Healthcare stocks had an excellent run in 2013 and they could be in for another solid advance in 2014. There has been widespread speculation the Affordable Care Act would damage the healthcare sector, for now, the law hasn’t had the negative impact many expected. While there is still a fair amount of uncertainty surrounding the law, thus far the industry has proved resilient and investments in the healthcare sector have generally performed well.

Healthcare providers, expected to take a big hit under the law, have thrived. In 2013, pharmaceuticals and biotechnology have seen their best performance in years. Medical devices had been expected to lag due to the increased taxes imposed by the ACA; instead they have also performed well, with Fidelity Select Medical Equipment and Systems (FSMEX) returning 41.30 percent last year. Overall, most every subsector in the healthcare space has been a good investment and in the year when the ACA began taking effect, the returns were their best since its passage.

When legislation substantially impacts such a large portion of our economy, politics will continue to play a substantial role, with our elected officials having the ability to alter the law on an ongoing basis. This being the case, it is more challenging for investors to find clarity. With 2014 being a midterm election year, Republicans are likely to push for changes, including the modification of the insurer bailout, which safeguards those companies from losing money under the ACA. They certainly will use the law against red state Democrats who face uphill reelection battles.

While Republicans will continue to be vocal in their disapproval, the likelihood of repealing the law or making significant changes is remote. Republicans may win the Senate, but they will not have a veto proof majority. Democrats are deeply invested in the success of the law; if issues arise over the next several years, they will likely use executive or regulatory action to mitigate the impact of any issues. Over the short-term, the greatest challenge is ensuring there are enough people enrolling (especially young people) to make the law viable. The March enrollment deadline is looming and if numbers don’t meet expectations, it could prove to be damaging politically.

We have been a long-time proponent of investing in the historically defensive healthcare sector. With an increasing number of people aging and requiring medical services, there is strong demand which should last for years to come. Plus, the ACA’s goal is to increase the number of individuals purchasing health insurance. The net effect of the law then is to increase spending and demand, which is good for the healthcare industry because it drives up prices and ultimately profits. Even with all of the political bloviating, the industry is not likely to die anytime soon.

There are numerous ways to invest in healthcare with mutual funds, a few of which we will discuss below.

Broad Base Funds

For investors wanting diversification, Fidelity Select Healthcare (FSPHX), Vanguard Health Care (VGHCX), Janus Global Life Sciences and ICON Healthcare (ICHCX) all offer broad based funds that cover the entire sector. ICON and Vanguard both delivered similar 40 percent plus returns in 2013. Both funds maintained a heavy weighting in pharmaceuticals: nearly 50 percent in the case of Vanguard and over 50 percent for ICON.

The Fidelity and Janus funds outperformed ICON and Vanguard by more than 10 percent. In Fidelity’s case, the difference came down to over-weighting of the biotechnology sector, which had an excellent year. Janus was more balanced, with less than 40 percent in biotechnology and 31 percent in pharmaceuticalsFor investors wanting diversification, these broader funds can provide an easy and often best option. If you are a bit more aggressive, the biotech heavy funds have greater upside opportunity, but greater risk. ICON and Vanguard are a bit more defensive and should provide some downside protection relative to their peers.

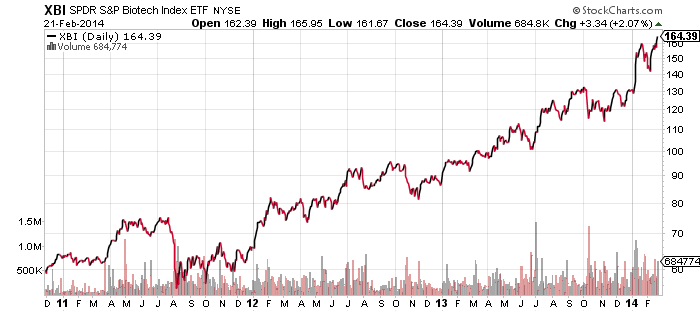

Biotechnology

As for the red hot biotechnology sector, among the offerings are, Fidelity Select Biotechnology (FBIOX) and Rydex Biotechnology (RYOIX). Fidelity was the big winner in 2013 as FBIOX climbed more than 60 percent, while RYOIX was up 56 percent. The biggest difference between the funds is their market cap exposure. FBIOX’s average market cap is $12 billion, about 50 percent greater than RYOIX’s $8 billion, due to a 40 percent exposure to mega cap stocks. The Rydex fund has only 25 percent in mega caps, with a heavier leaning towards midcaps at 32 percent of assets.

On valuation measures, Fidelity’s portfolio is aimed at growth companies with higher valuations, but with faster growth prospects. The performance gap makes sense given these fundamentals, but investors looking to be conservative aren’t getting a value portfolio from Rydex. This is still an aggressive growth sector and if you’re bullish enough to want to stay in biotechnology, then sticking with FBIOX makes sense. Ultimately, biotechnology has been a market leader for two years; conservative investors may want to take some profits and look towards more defensive alternatives.

Pharmaceuticals

Fidelity Select Pharmaceuticals (FPHAX) turned in a 41 percent return in 2013. Pharma had been a laggard for years going back to the 2000 bubble, with prices for many stocks bottoming in 2008, so some amount of catch-up is warranted. The big worry in recent years was the expiring of patents on blockbuster drugs and investors succumbed to fear and priced in poor performance; when the companies performed better than expected, valuations increased.

The move in pharma also bucked the trend of rising yields hurting dividend paying shares as investors didn’t lose interest in the relatively high yielding sector. Between pharma and bitoech, the former has the better odds of extending its streak for another year. We continue to maintain a position in FPHAX as we believe it still has upside potential.

Medical Delivery

Fidelity Select Medical Delivery (FSHCX) returned just over 35 percent in 2013. While this sector will be heavily impacted by the ACA, over the long-term these companies should benefit from an increase in demand for services from millions of additional people having coverage. With Medicaid expansion in many states, this coverage should reduce bad debt for hospitals (those people that do not pay for services) as they will likely now have access. For now, the greatest risk facing providers are the reimbursement payments they will receive and the number of enrollees that are reported.

While FSHCX only has 47 holdings, approximately 60 percent of the assets in the fund are allocated to large and mega cap stocks. By and large, those stocks are well positioned to capitalize on industry changes. Over the short-term, the fund may be a bit volatile but we continue to believe it has the opportunity to outperform over the long-term.

Medical Equiptment

Finally, there’s Fidelity Select Medical Equipment & Systems (FSMEX). Even though the fund was up last year, the ACA tax on medical devices may take a toll on the sector. This sales tax is reducing profits by roughly 25 percent, which is worrisome. With the repeal of the ACA unlikely, this sector could face some headwinds moving forward. Sentiment is negative on the sector and performance may be driven by political forces rather than business fundamentals. This makes us uncomfortable as the moves in these stocks may be rationally based, increasing volatility and risk.

For most investors, having diversified healthcare exposure makes the most sense. For more aggressive investors, placing small bets in individual sectors such as pharmaceuticals and medical delivery can provide some additional upside opportunities.