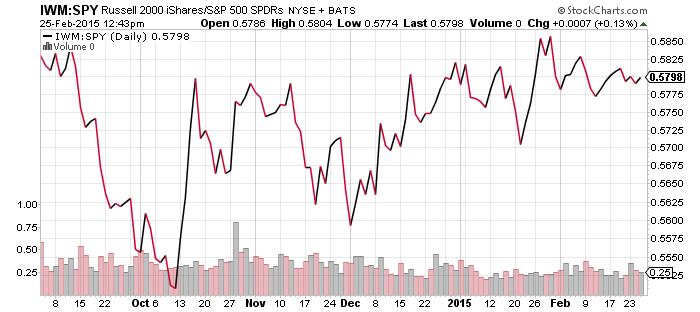

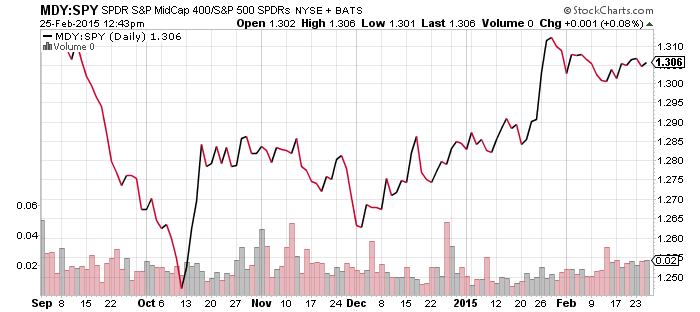

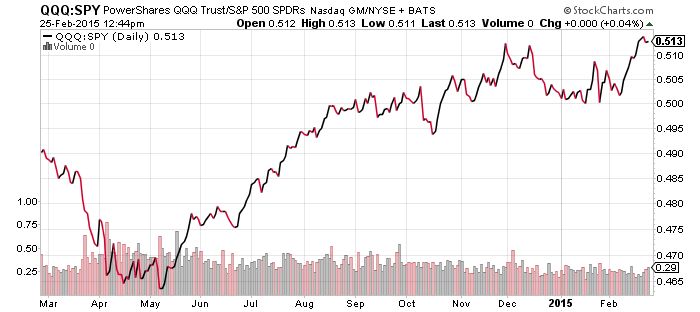

The major stock indexes pushed into record territory this week, led by gains in the Nasdaq and the Russell 2000. The Nasdaq is still below its all-time high, but it moved 0.6 percent closer as of Thursday. The S&P 500 Index was flat heading into Friday trading, while the DJIA was up about 0.4 percent. Additionally, the Japanese Nikkei Index climbed to a 15-year high on Thursday.

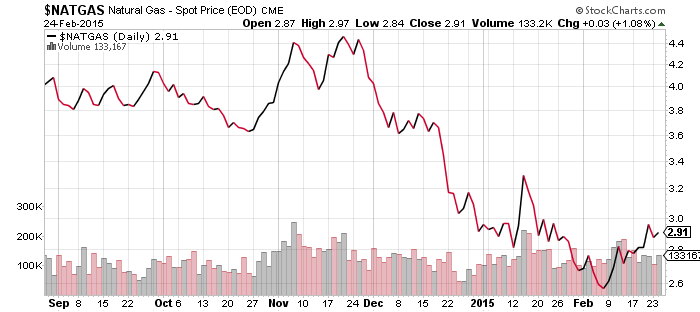

In contrast to the rising stock market, economic data was tepid this week. As expected, the Bureau of Economic Analysis revised fourth quarter GDP lower due to inventory and imports numbers. Growth was lowered from the initial 2.6 percent to 2.2 percent. The Consumer Price Index also came in as expected, down 0.7 percent from a year ago. The drop in oil prices was responsible for the slide into deflation as core CPI, which excludes food and energy, increased 0.2 percent. The Chicago PMI came in much lower than expected at 45.8 in February, down from 59.4 in January. It is the lowest reading on the index since July 2009. Durable goods from January were strong, up 2.8 percent and beat expectations. New home sales in January were well ahead of expectations and in line with the solid December number.

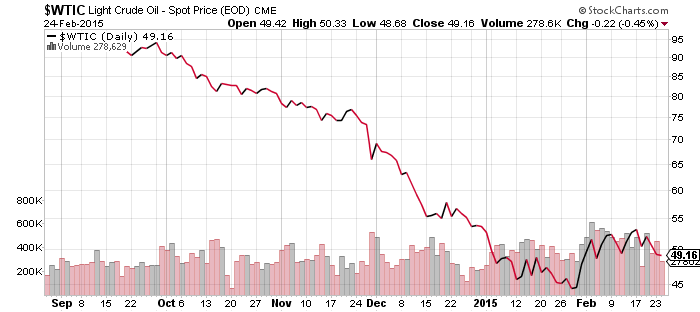

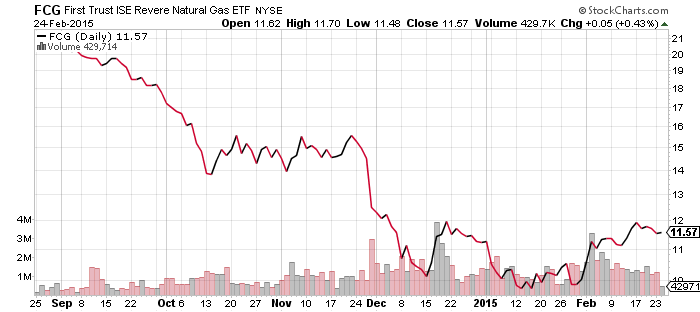

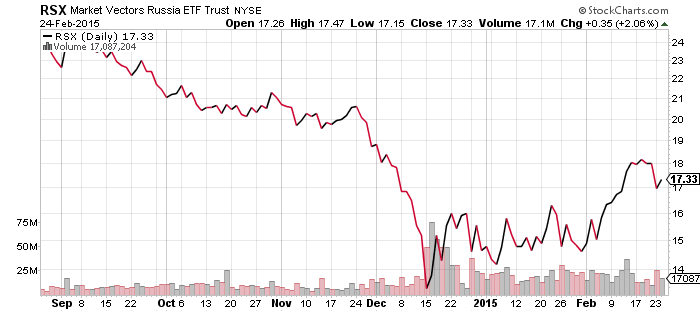

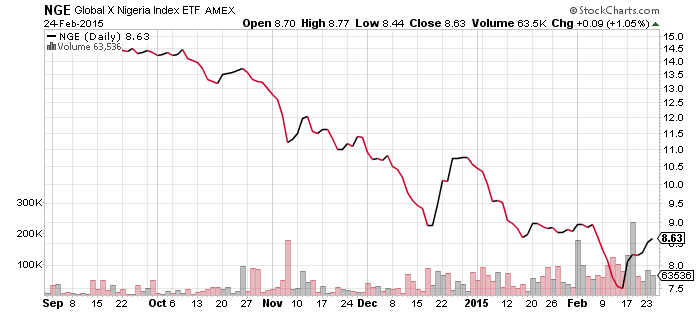

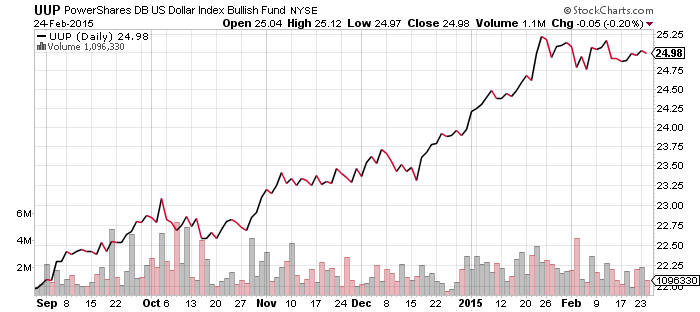

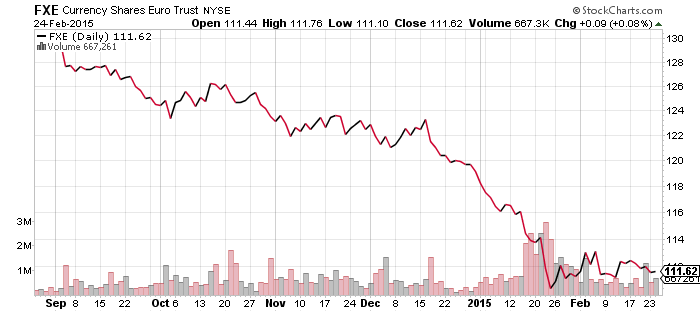

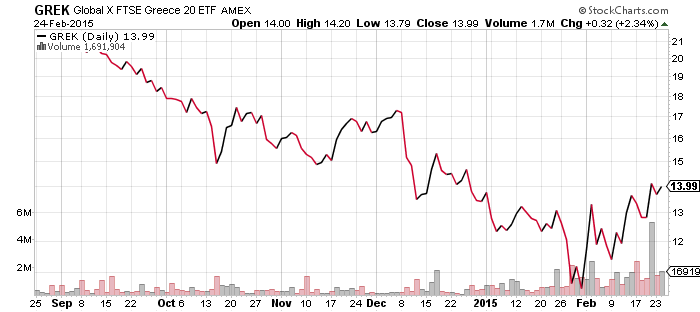

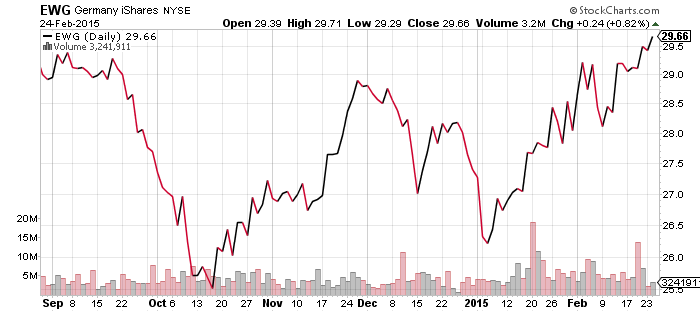

The U.S. dollar will finish the week on a strong note following a sharp drop in the euro on Thursday. The euro is not far from its lows for the year and with Germany approving Greece’s four month bailout extension, short-term pressures on the euro are lifted. Odds still favor a rally in the currency, but the primary trend in the euro is still bearish. A strong dollar has weighed on foreign markets and commodities. Case in point, oil prices followed the euro lower and sank below $50 a barrel on Thursday.

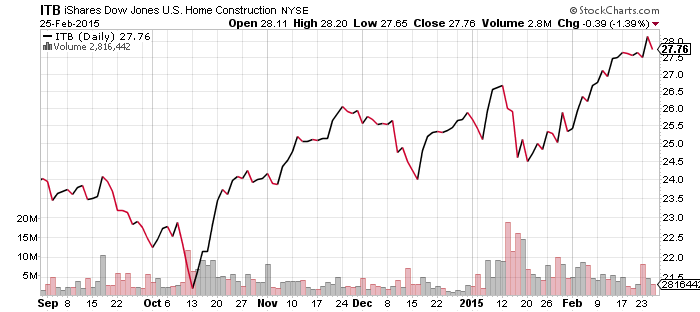

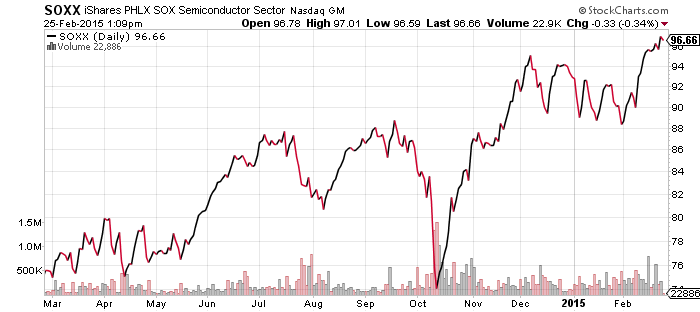

Earnings helped the market this week. Home Depot (HD) pleased investors with a rise in earnings, sales, a dividend increase and increased stock buybacks. The homebuilder sector remains a bright spot in this market as home sales remain near their post-2008 highs. The still hot solar sector lifted the Nasdaq following decent earnings from First Solar (FSLR) and SunPower (SPWR). The two firms sent their stocks sharply higher with a deal to spin off power generation projects into a new company, what the market dubs a yieldco. These types of deals are popular in the market right now because investors are hungry for yield and solar firms need capital to invest. Whether it turns out to be a good deal for yieldco shareholders remains to be seen, but the solar firms will benefit. The capital generated from the spinoff will be used on new projects.

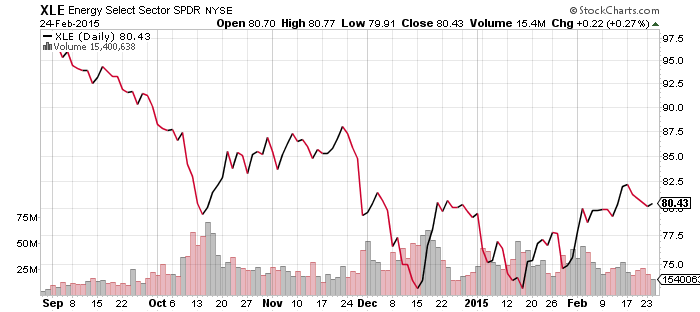

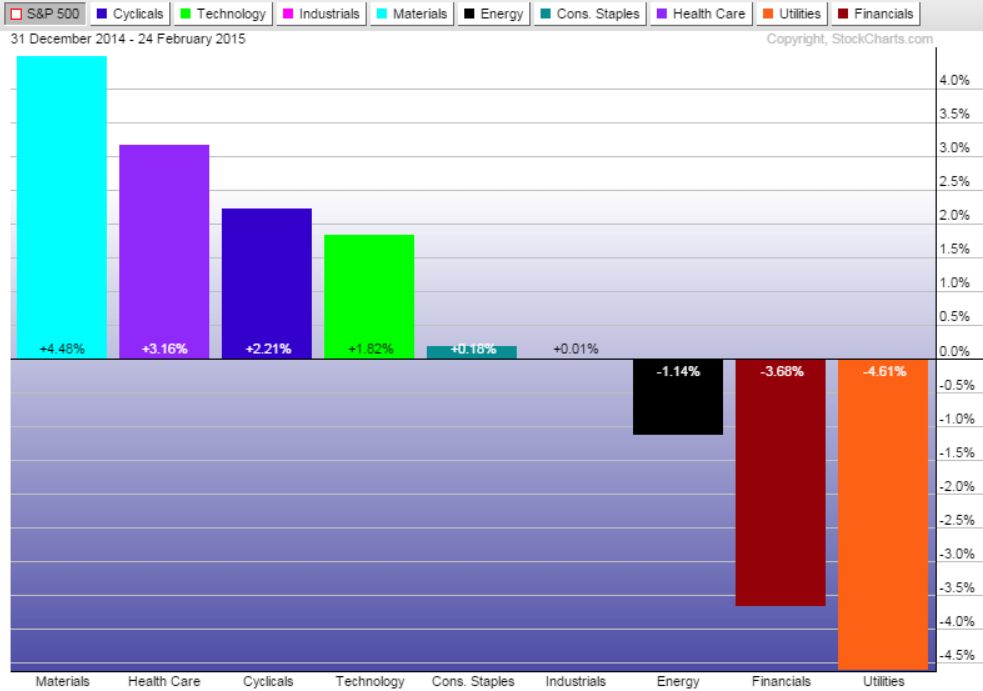

For the week, the best performing sectors were consumer cyclicals, healthcare, consumer staples and technology, which were all up heading into Friday trading. Energy, utilities, industrials and materials were all down and are unlikely to turn positive without a significant rally on Friday. Financials were flat for the week, but opened lower on Friday.

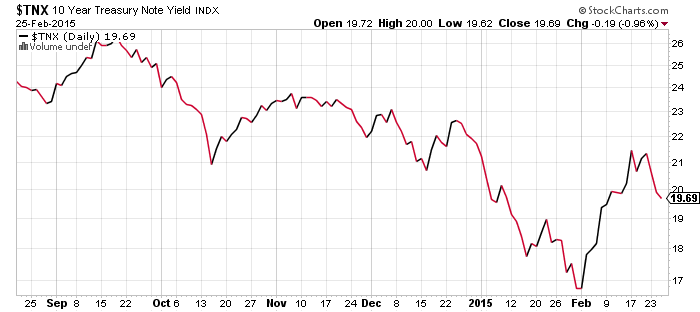

Bonds were up on the week as interest rates declined. Janet Yellen’s testimony before Congress confirmed what the Fed minutes seemed to indicate: a rate increase will come later than the market had been expecting. Yellen was optimistic on the economy though and expects that labor market improvements will lift inflation into the Fed’s target range over the next two years.