Stocks continued to grind sideways with Greece’s issues looming over the market, but strong economic data points to a growing economy and rate hikes later this year.

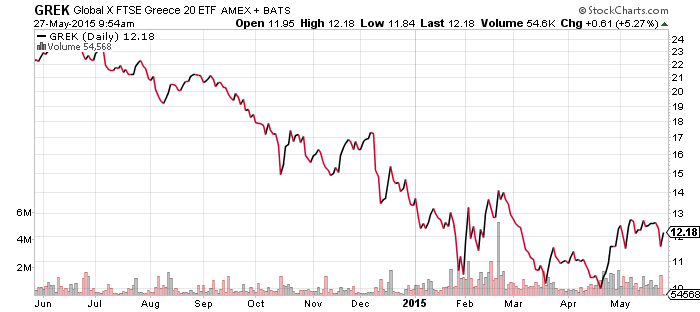

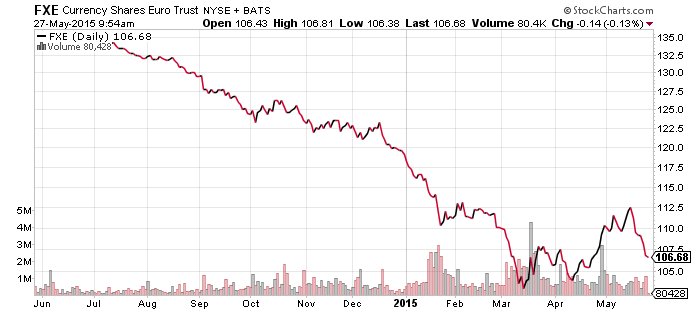

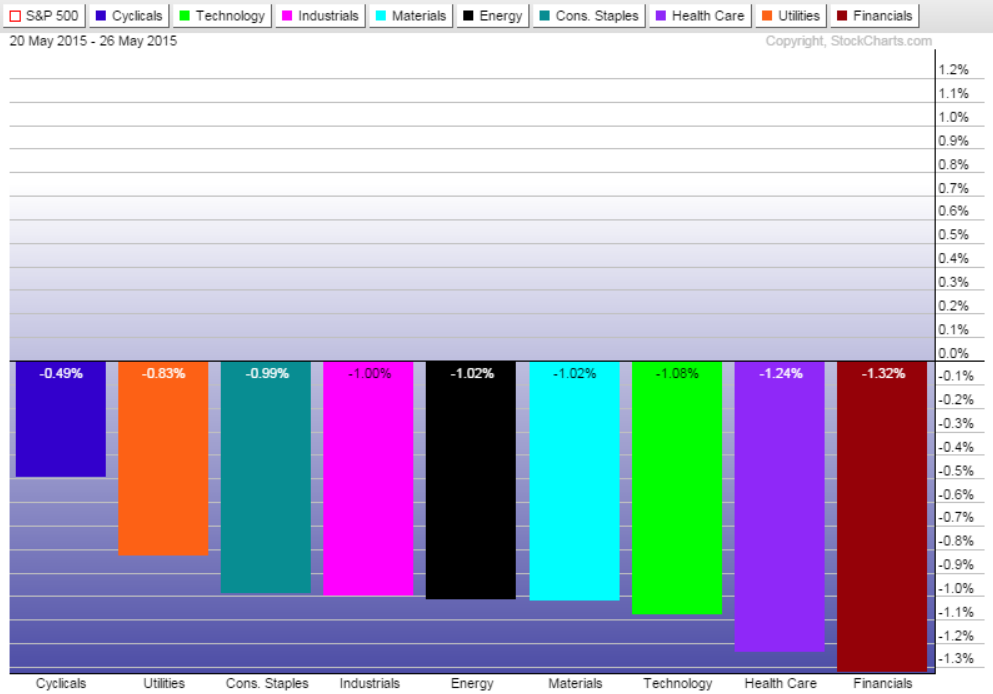

The S&P 500 Index was down slightly heading into Friday trading in a week when the potential for a Greek default increased substantially. The country is facing several large payments to the IMF in June and there’s a question if it will be able to make the first payment next week. The euro fell versus the U.S. dollar during the week, but remained above its lows. The evidence from the financial markets shows investors have priced in a Greek default, which might even be viewed positively since it will force the ordeal to a final endgame. Whether positive or negative for the markets, however, investors often wait on the sidelines until the outcome of major events are clear. Stocks may continue to move sideways until the deadline for the IMF payment on June 6, assuming no deal is announced.

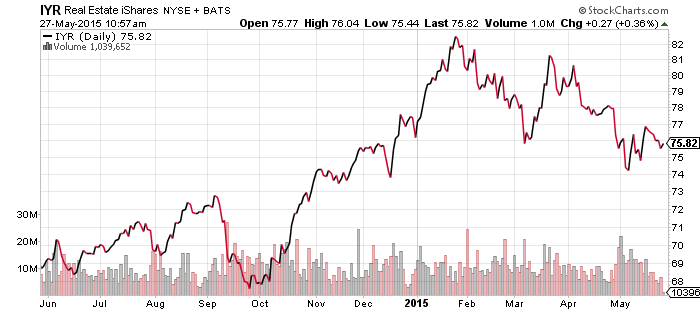

Looking forward over the coming months, the outlook for the economy and the equity market continues to improve. Housing data was very strong this week, with April pending home sales climbing to the highest level since the financial crisis. Economists were looking for a 1 percent increase, but they were way off as pending sales increased 14 percent. Recently, median home prices have also climbed to near the peak of the housing bubble, a sign that the economy may be finally returning to higher levels of growth. New homes sales in April were also higher than expected. Demographic trends are favorable here, as the larger Millennial generation moves into a period of family formation and home buying.

The second estimate of first quarter GDP was released on Friday and growth fell from 0.2 percent to negative 0.7 percent. While cold weather is often to blame, it wasn’t responsible for the weak first quarter. In fact, the first quarter result probably wasn’t as weak as reported. The government is using historical patterns of economic activity to seasonally adjust data and these methods are increasingly out of date. Revisions to past GDP, including first quarter 2015, is due in July. Second quarter GDP will be calculated using a new method. As for the current estimate of first quarter growth, the main reason for the decline was the higher than expected trade deficit in March, which subtracts from GDP.

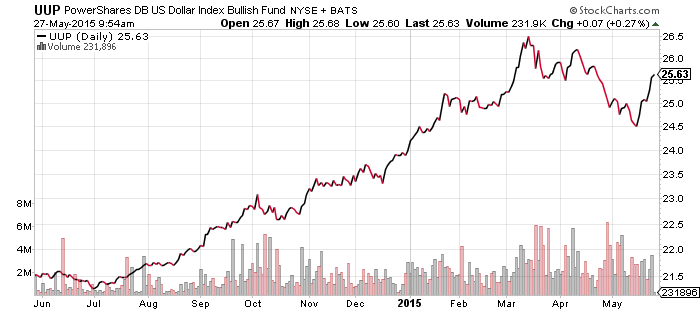

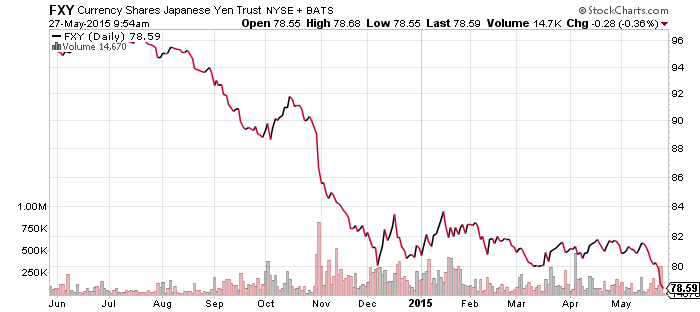

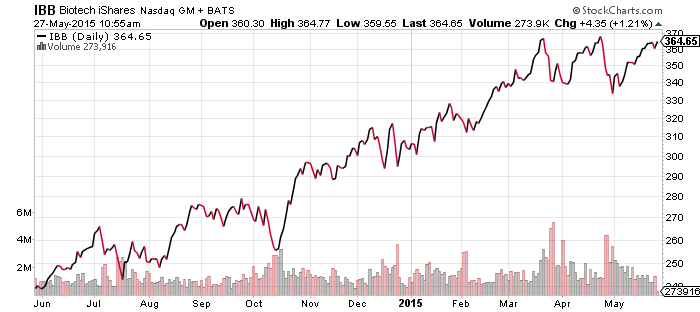

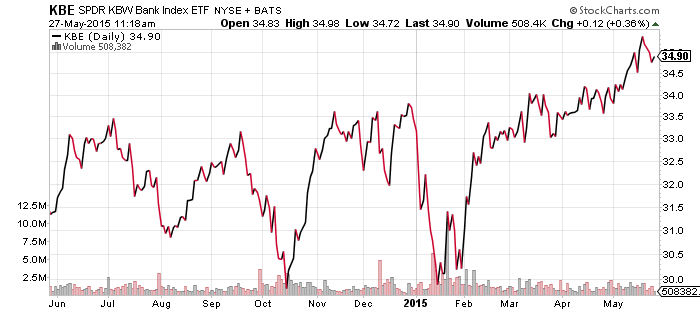

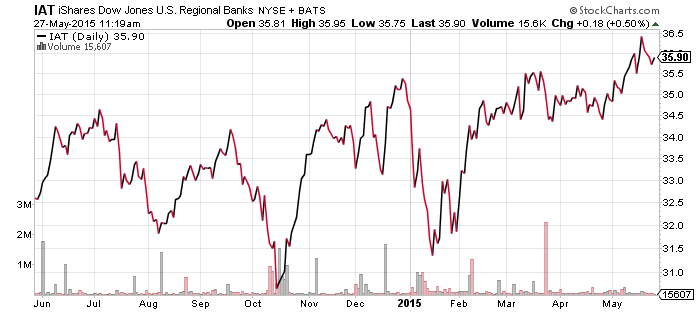

Finally, the U.S. dollar hit a new multi-year high versus the yen this week. The breakout hasn’t been confirmed yet, but a push higher would be bullish for the dollar moving forward. A stronger dollar attracts capital to the United States and the domestic financial sector is the leader in global finance. The United States has the largest bond and equity markets, and many innovative companies around the globe choose to list on the U.S. stock exchanges. With automation picking up speed and rising wages causing companies such as even McDonald’s to begin replacing workers with robots, a major wave of capital investment could fuel a technology revival. The biotechnology sector is already in the middle of a boom, fueled by aging demographics, government spending on healthcare and breakthroughs in technology.

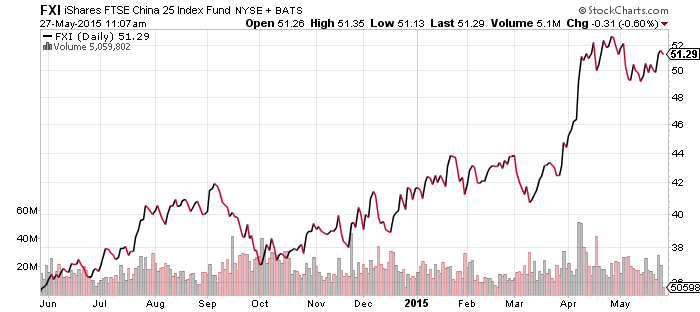

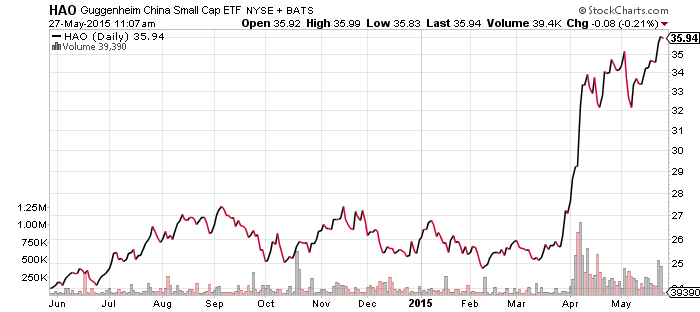

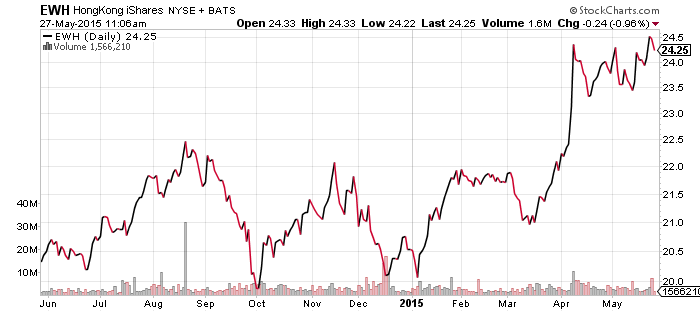

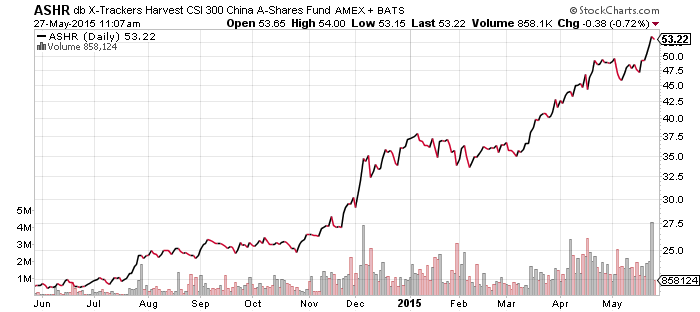

China has intentionally supported its stock market with the goal of reforming the economy and launching a wave of investment in technology companies, but the United States already has the most efficient capital markets in the world. A stronger U.S. dollar will draw more capital here, as it did in the 1990s.