Several major central banks are scheduled to comment on monetary policy this week, though economic news will likely be overshadowed by politics in the final days of the U.S. presidential race. Monthly non-farm payroll and unemployment reports will be out later in the week. A new FBI probe into the on-going Clinton email scandal led to a market dip last Friday and may continue to impact markets throughout the week.

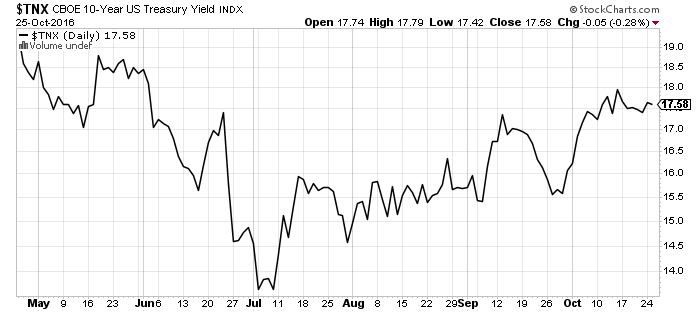

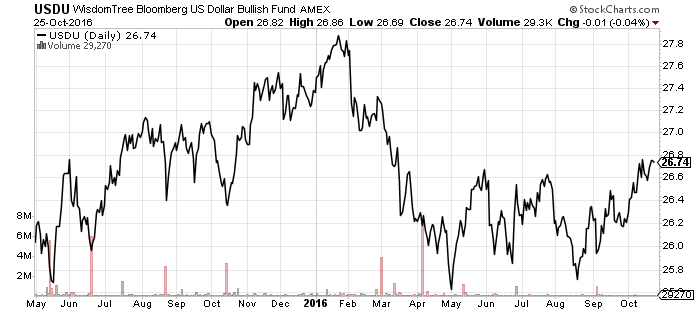

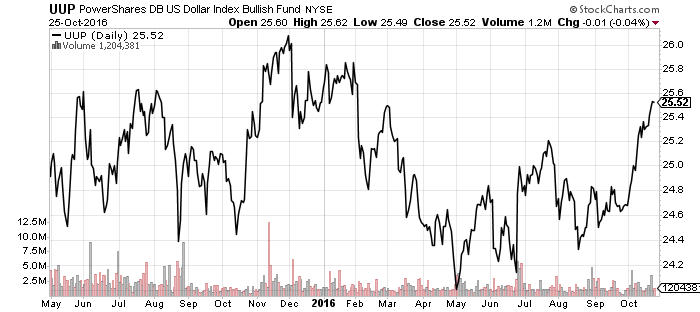

The U.S. Federal Reserve will meet on Tuesday and Wednesday. While analysts do not expect any significant changes before the election, the Fed’s accompanying policy statement may increase the odds of an interest rate hike in December. The Bank of Japan, the Bank of England and the Royal Bank of Australia will also report on current monetary policy this week.

Weekly unemployment claims are expected to decrease slightly from the prior week and Friday’s monthly jobs report calls for an increase in the number of jobs created compared to last month. The unemployment rate is expected to drop back to 4.9 percent after ticking up slightly last month.

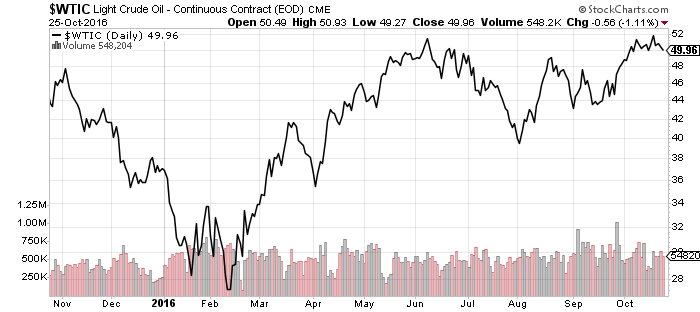

Eurozone gross domestic product (GDP), reported on Monday, was in line with analysts’ expectations of slow, steady growth at 0.3 percent. Economists forecast a slight increase in September’s U.S. Personal Income and Outlays, the Chicago Purchasing Managers Index (PMI) and the Dallas Fed manufacturing survey. Tuesday’s ISM manufacturing report and Construction Spending data are forecast to show slight increases, while Light Vehicle Sales are expected to decrease. The weekly mortgage purchasing index and oil inventory reports will be available on Wednesday and Thursday’s ISM nonmanufacturing number is expected to show a slight decrease.

Pfizer (PFE), Alibaba Group(BABA), Facebook (FB) Qualcomm (QCOM), Whole Foods (WFM) and Duke Energy (DUK) are among the widely-held names scheduled to share earnings reports this week. Pharmaceutical giant Pfizer (PFE) is expected to meet expectations on Tuesday, while the others are slated to report on Wednesday. Analysts will pay close attention to QCOM considering Apple’s (AAPL) report citing increased smartphone competition.