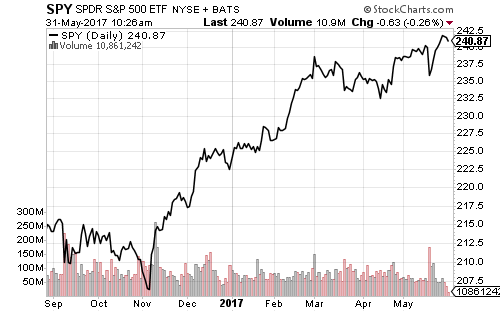

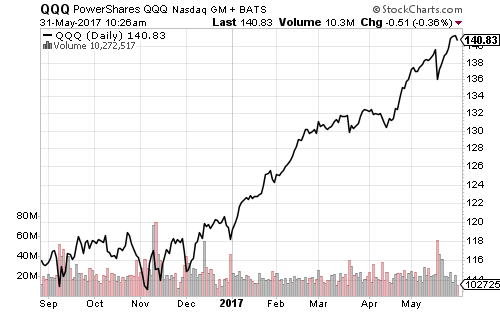

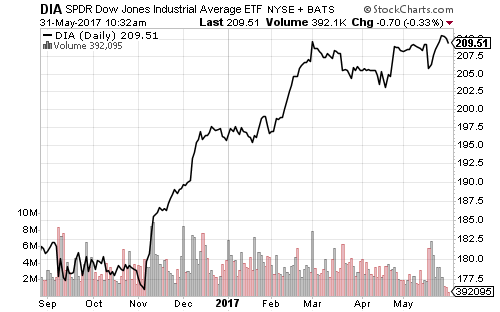

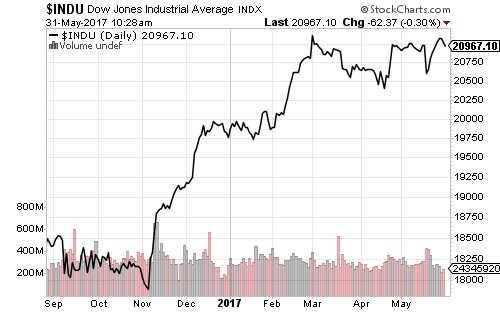

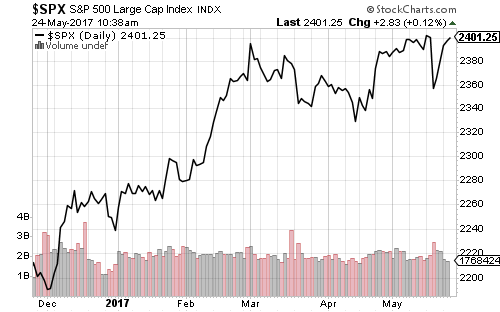

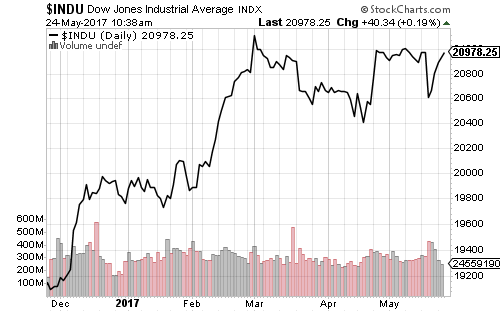

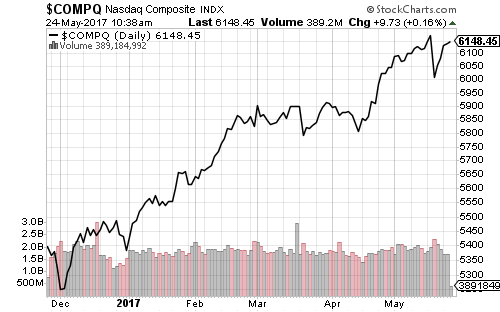

The S&P 500 Index and Nasdaq have continued to climb over the past week and although the Dow Jones has a little farther to go, the SPDR DJIA ETF (DIA) also hit a new all-time high.

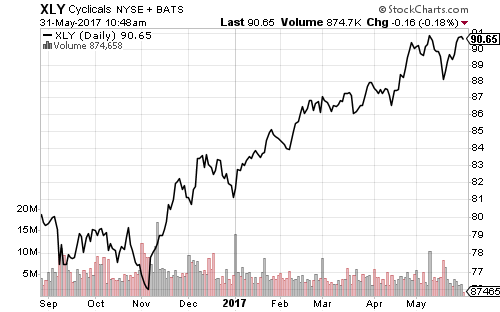

Technology and consumer discretionary have powered recent Nasdaq gains. Amazon (AMZN) beat Google (GOOGL) to $1000 a share intraday, but has yet to close above the psychological mark. Consumer discretionary also advanced on the week.

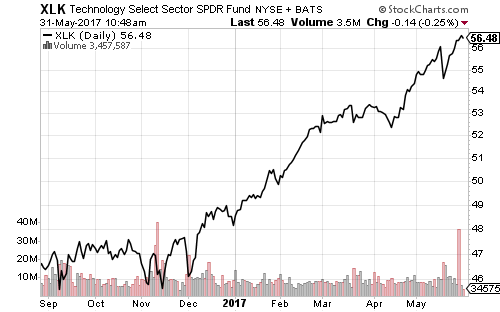

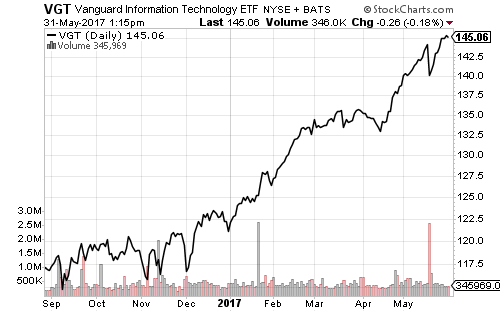

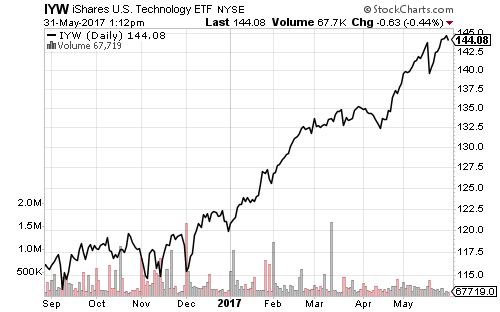

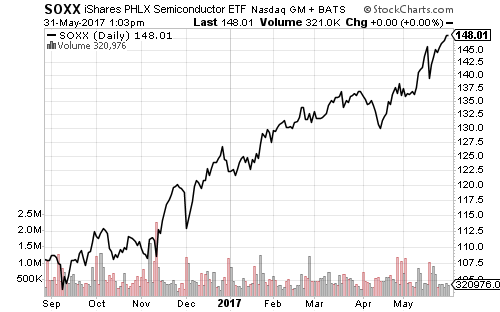

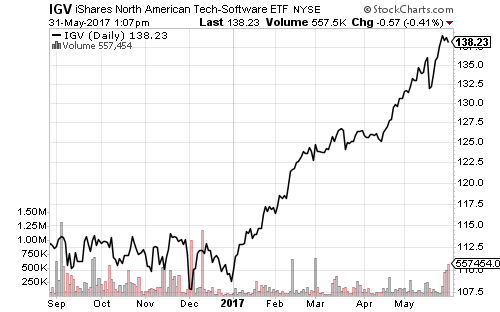

SPDR Technology (XLK) saw some selling on Friday, followed by the iShares North American Tech Software ETF (IGV) this week. Both are reflected in corresponding volume spikes on the charts below. Vanguard Technology (VGT), iShares US Technology (IYW) and iShares Semiconductors (SOXX), however, have not seen elevated volume, and SOXX was trading at all-time highs on Wednesday.

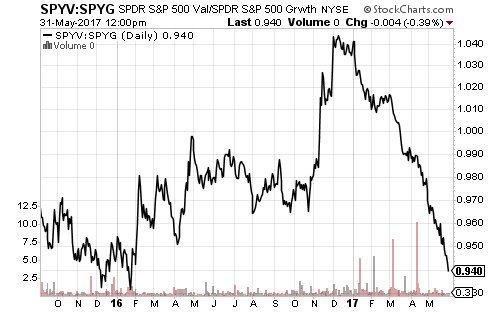

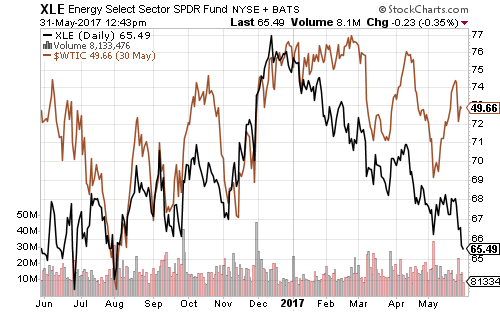

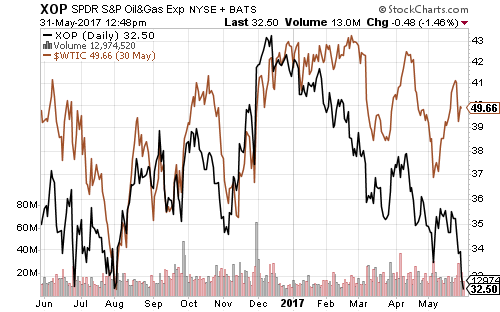

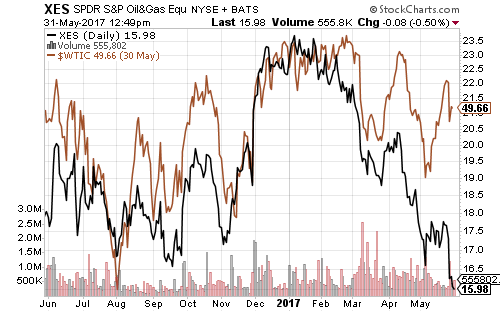

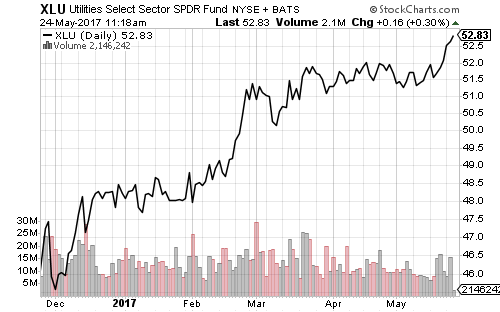

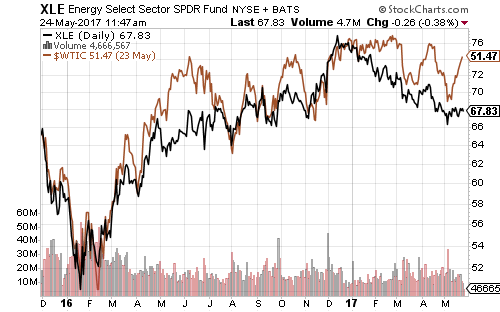

Weakness in energy, sideways action in financials and the surge in technology and consumer discretionary show up as growth outperforming value in 2017. The move has almost completely reversed the outperformance by value that started in early 2016, as hopes of a “reflation” fade.

However, an important test of this move is coming up. Investors are betting heavily on technology, and traders are short energy. A short-term reversal is increasingly likely as these positions grow in size.

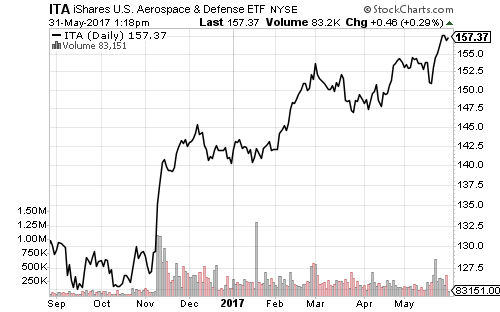

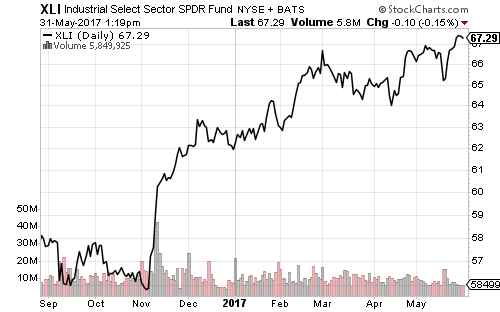

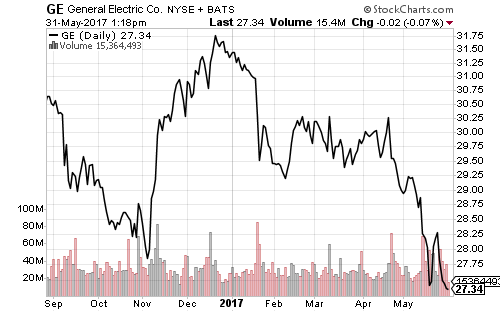

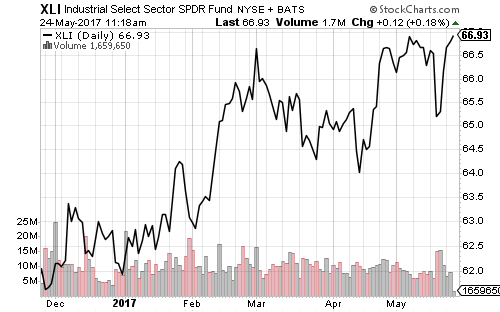

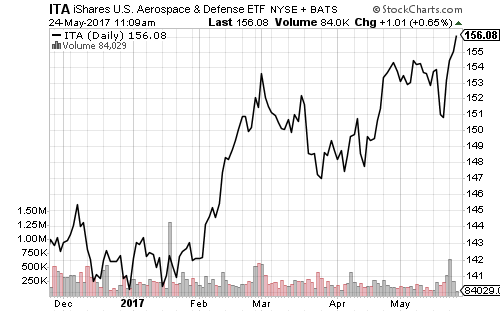

Industrials and the defense aerospace subsector traded at new all-time highs on Tuesday. General Electric (GE) is obscuring the strength in industrials though. It is the largest company in the sector at 8 percent of assets and it is trading at a 52-week low.

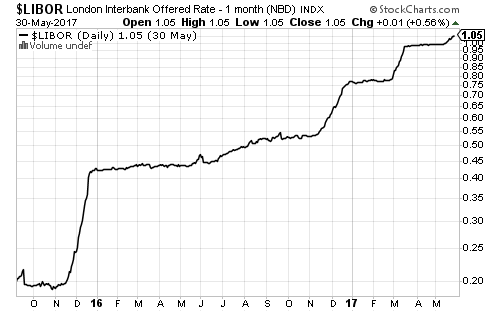

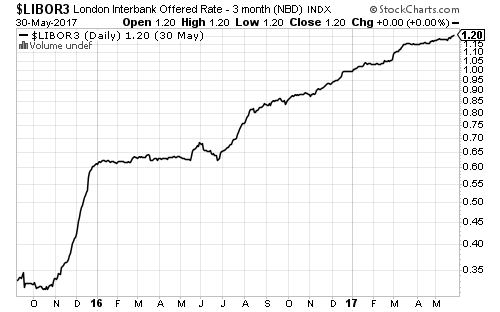

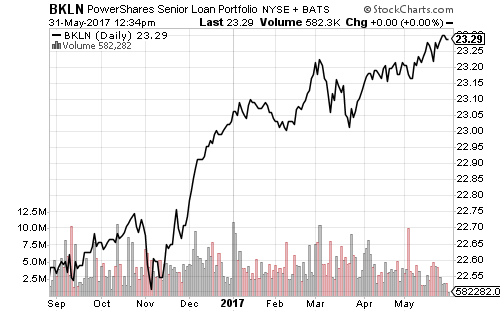

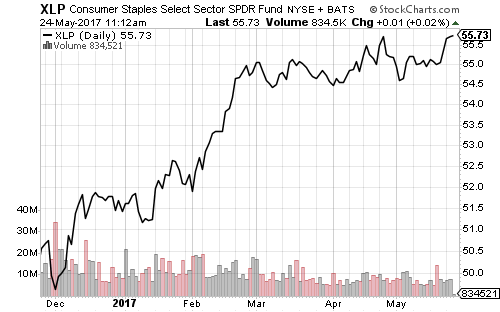

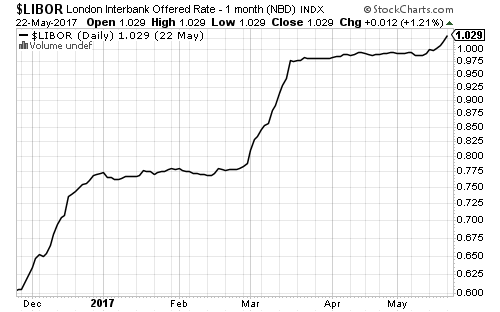

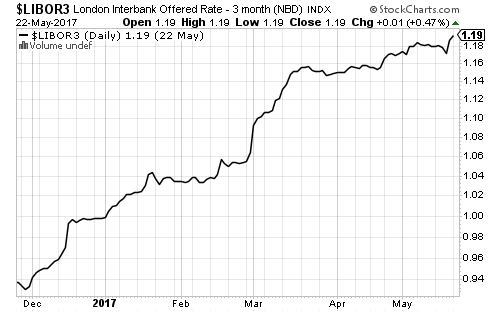

One- and 3-month Libor have started to price in a June rate increase. Floating-rate funds have climbed with Libor.

Energy equities, as measured by SPDR Energy (XLE), hit a new 2017 low on Wednesday, SPDR Oil & Gas Exploration & Production (XOP) is testing its 52-week low, and SPDR Oil & Gas Equipment (XES) has broken to a new 52-weeek low.

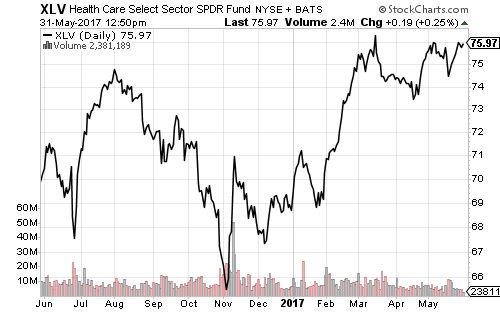

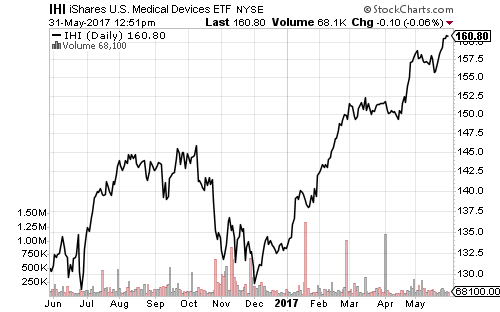

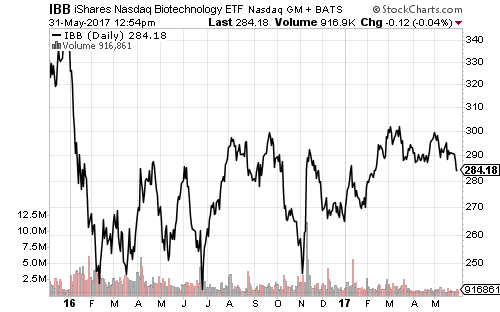

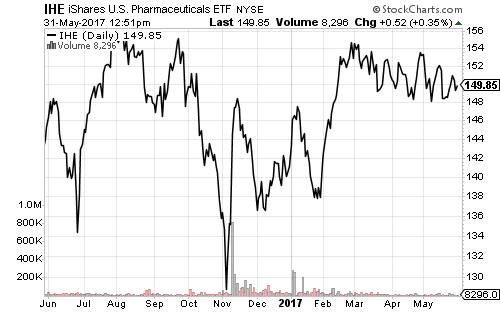

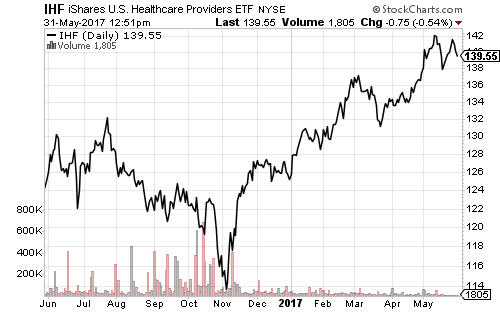

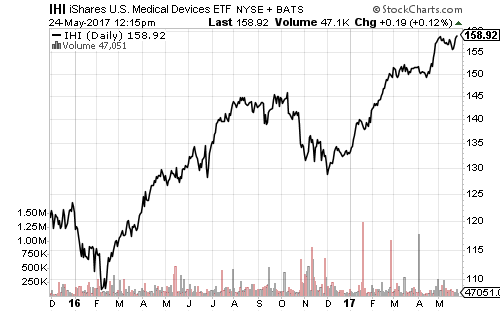

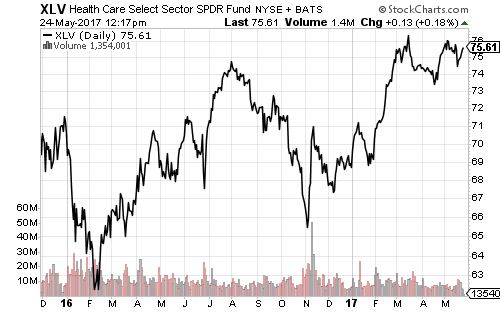

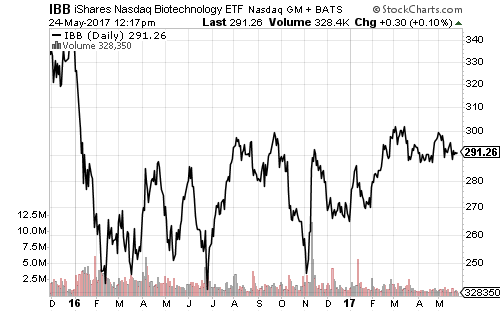

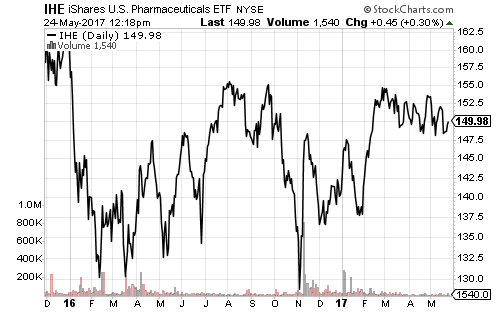

Healthcare stocks will likely move higher over the coming weeks.

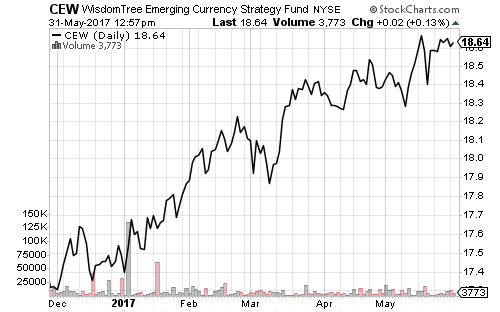

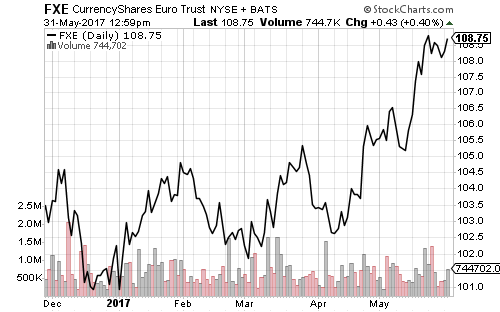

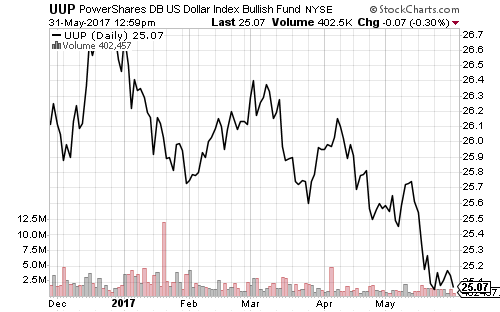

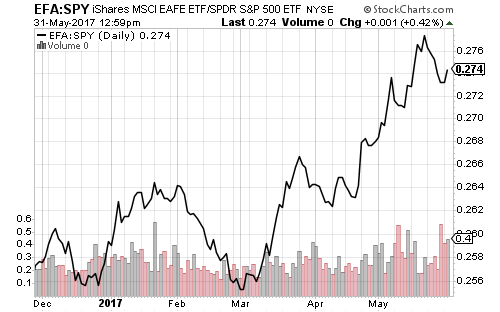

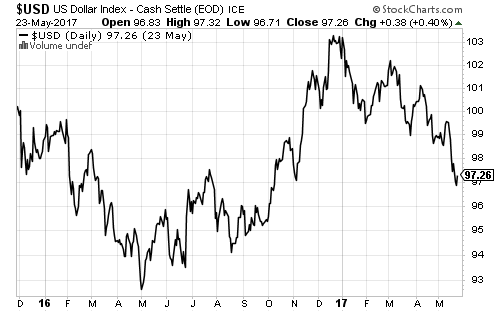

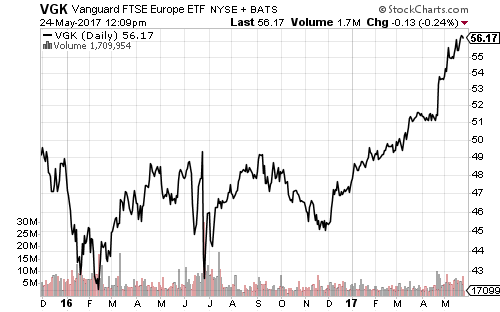

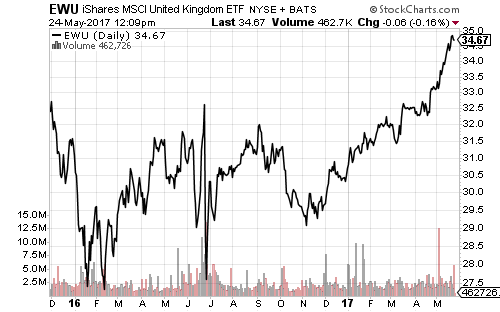

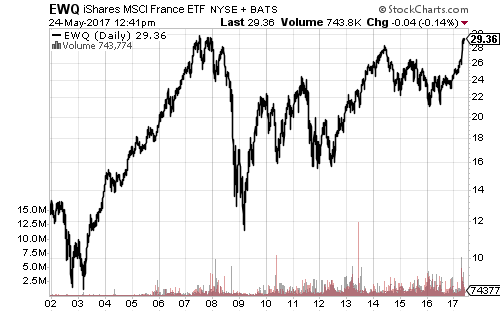

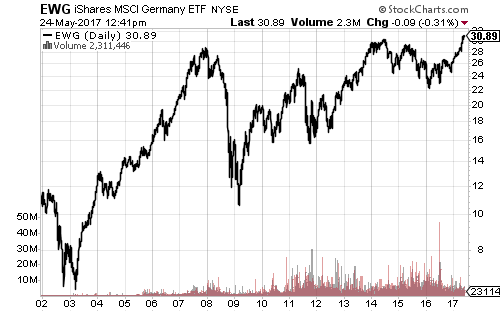

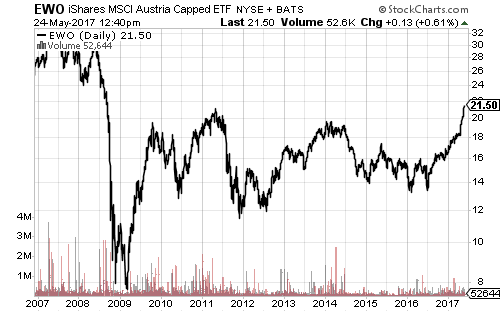

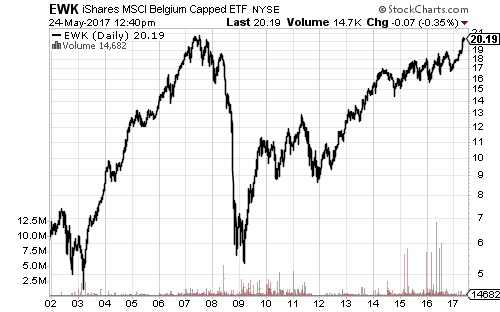

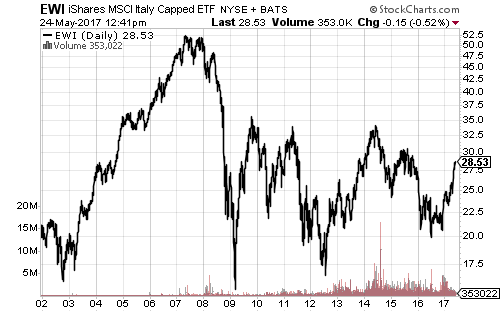

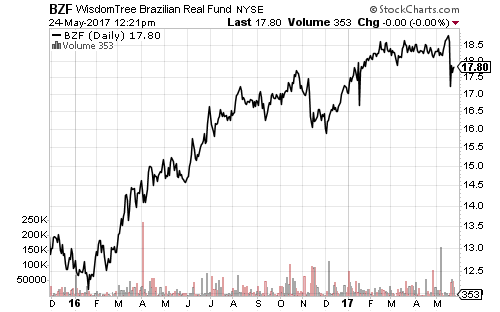

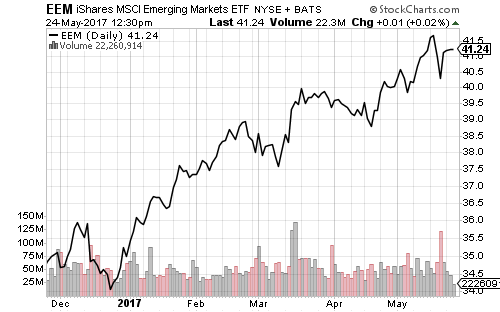

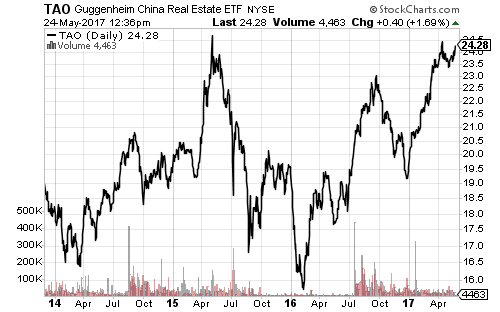

China manipulated the yuan higher on Wednesday by driving up funding costs. Emerging-market currencies followed it higher. Investors also shrugged off a potential early Italian election, bidding the euro back near its 2017 high. Although currency markets were favorable for foreign shares, U.S. markets have outperformed the MSCI EAFE over the past week.