Federal Reserve Chair Janet Yellen spoke in support of financial deregulation during this week’s Congressional briefing, which benefited the financial sector. Interest rate expectations also immediately shot higher, pushing up the odds of a June or July rate hike to 75 to 80 percent. The odds of a May hike are approaching 50 percent.

Inflation data was also positive for interest rates. Core consumer prices increased 0.3 percent in January, faster than the expected 0.2 percent. This helps cement core inflation above 2 percent, within the Fed’s target range of 2 to 3 percent. More importantly, producer prices climbed 0.6 percent in January, double the 0.3-percent forecast and the fastest monthly PPI jump since 2011.

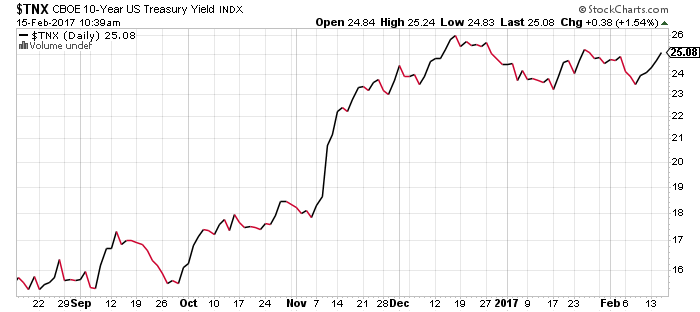

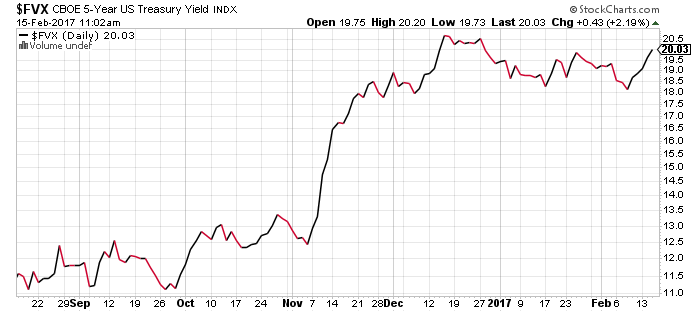

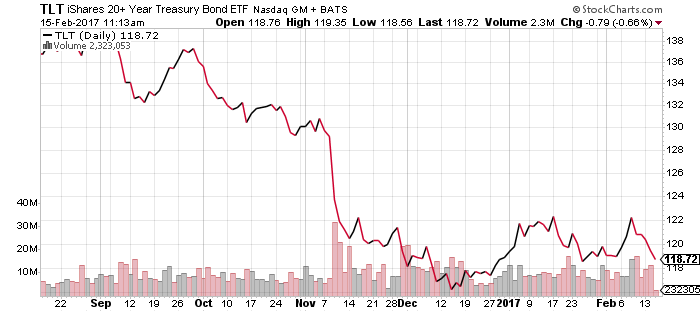

The 10-year Treasury yield bounced and the 5-year Treasury yield climbed to a 2017 high following Fed statements.

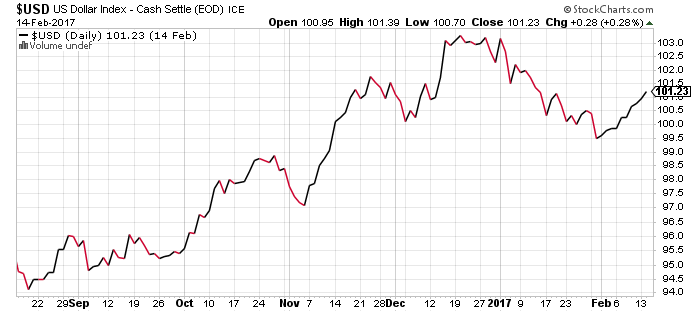

The U.S. dollar remains positively correlated with interest rates, and it too jumped on Yellen’s comments, extending a rebound that started at the end of January.

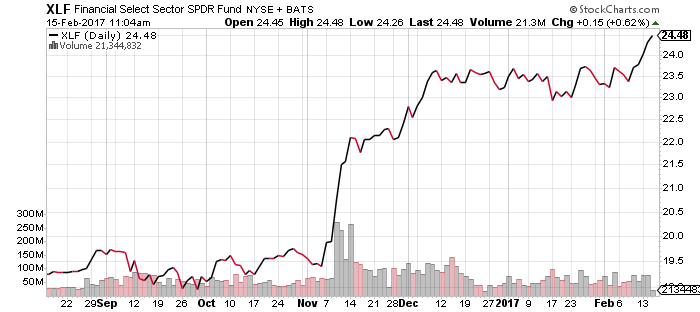

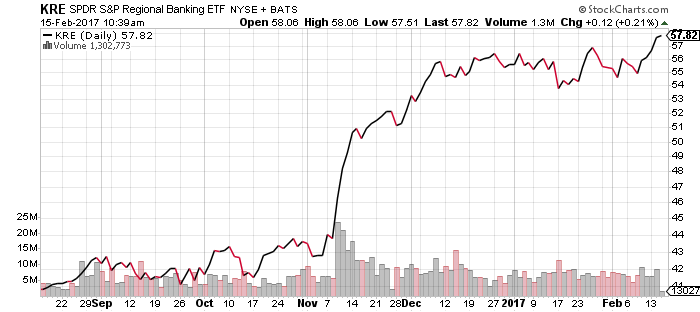

Financial stocks climbed to a new 52-week high. The trading range is broken and a new bullish advance appears to be underway.

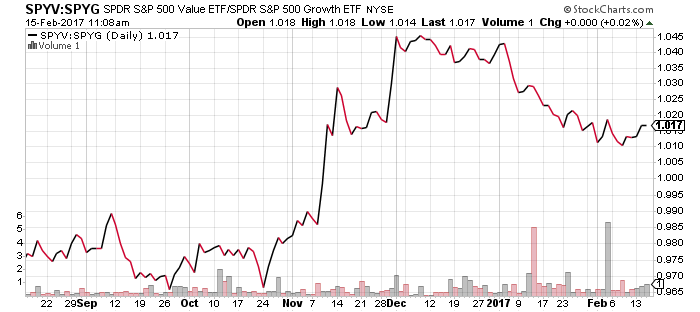

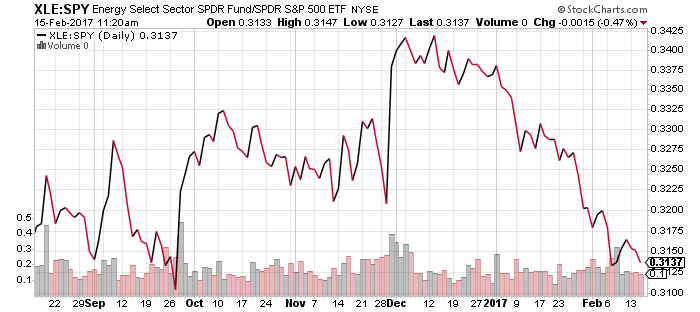

The rebound in interest rates and the dollar lifted value relative to growth. Weakness in energy limited value’s outperformance over the past week.

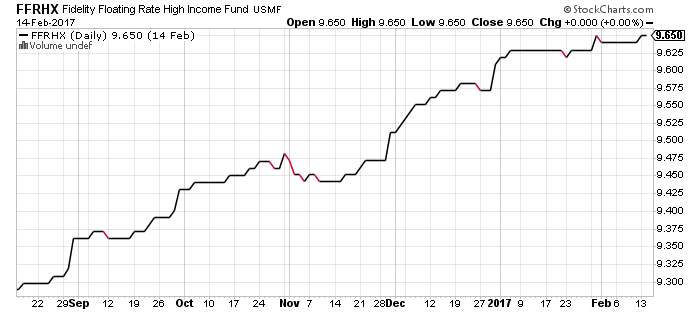

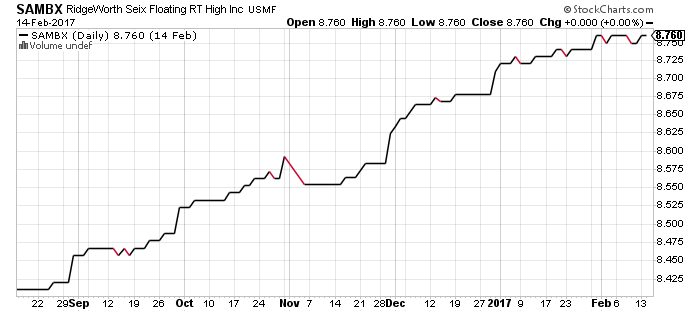

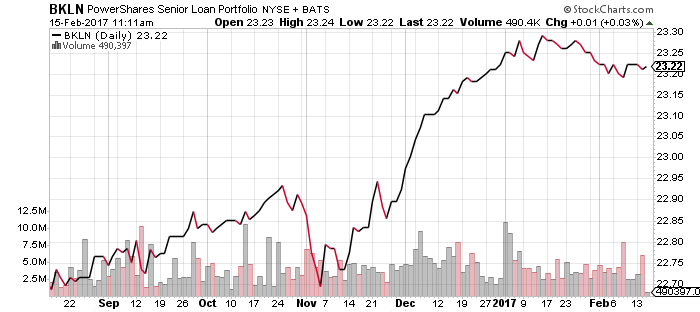

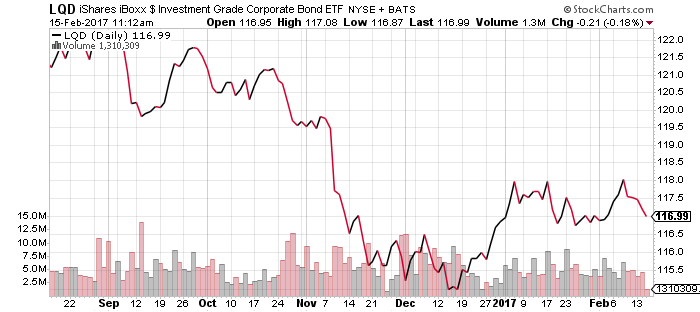

Floating-rate funds also held their value. Investment-grade bonds and long-term Treasury bonds took a hit.

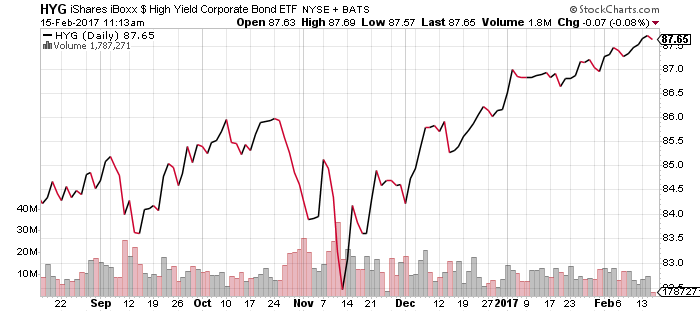

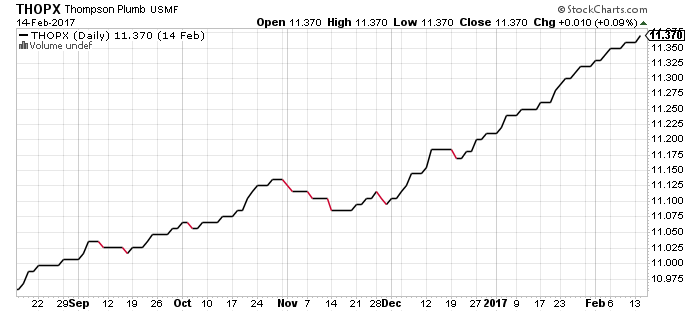

High-yield funds pushed higher on economic optimism. The low-duration, higher yield Thompson Bond (THOPX) continues to steadily advance.

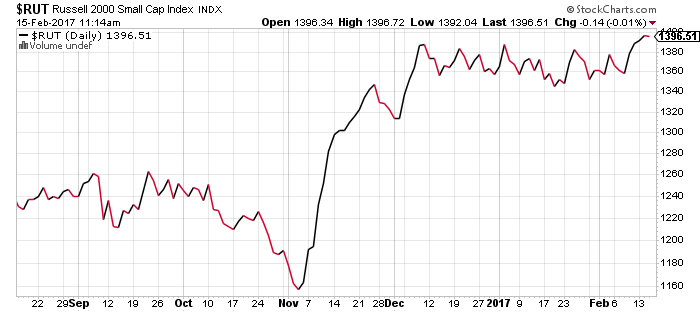

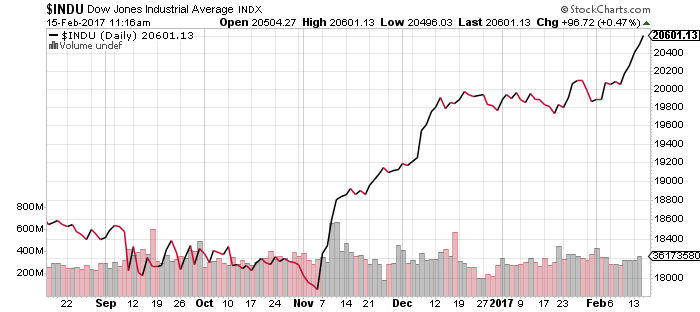

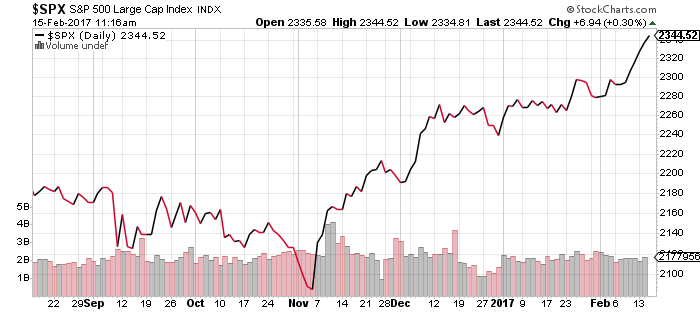

Yellen sent the Russell 2000 to a new all-time high. The Dow Jones Industrial Average and S&P 500 Index had already broken out of their trading ranges and swiftly advanced. A similar move in the Russell 2000 should follow if the bulls stay in control.

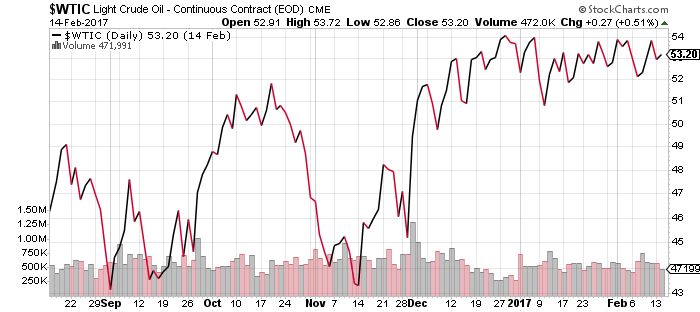

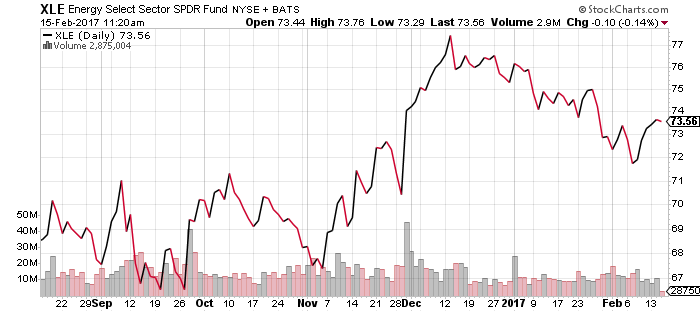

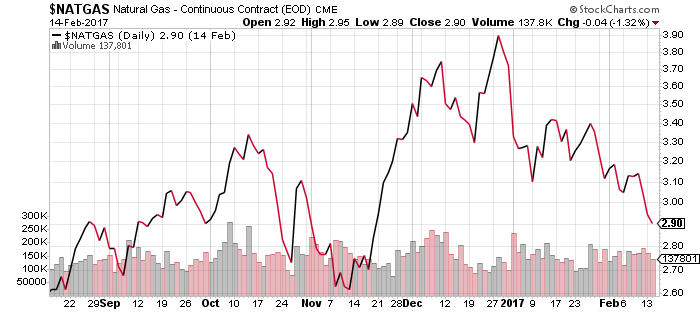

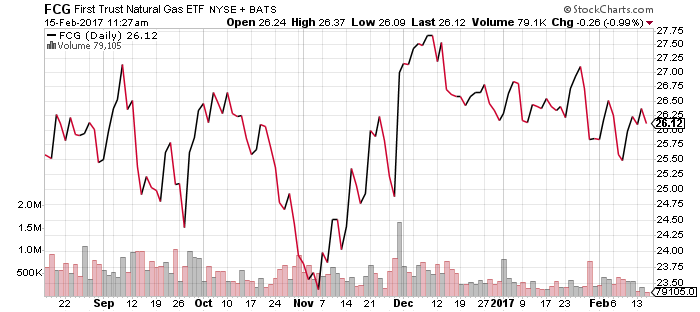

Crude prices remain in a trading range, drifting lower over the past week on larger-than-expected inventory builds. While funds such as XLE advanced on the week, they underperformed the broader stock market. Natural gas prices are also correcting from their late-2016 rally.

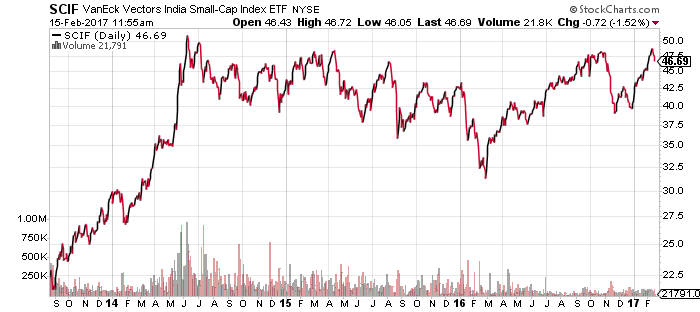

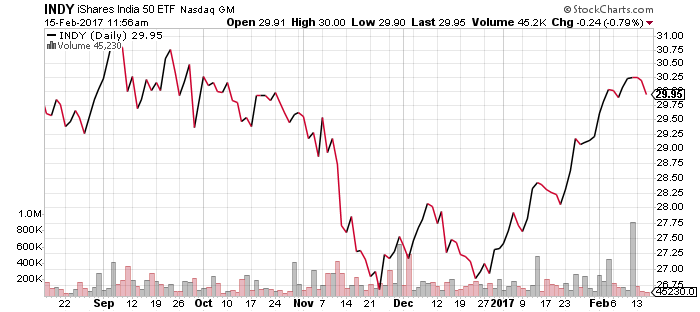

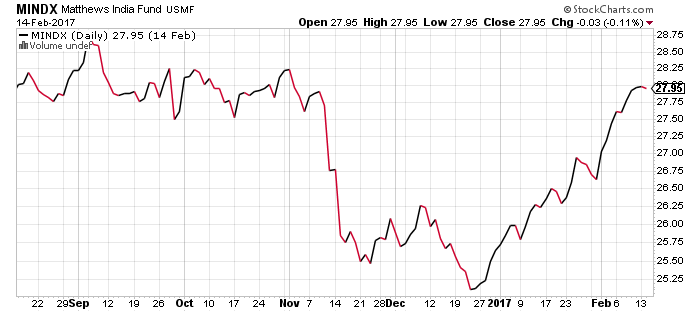

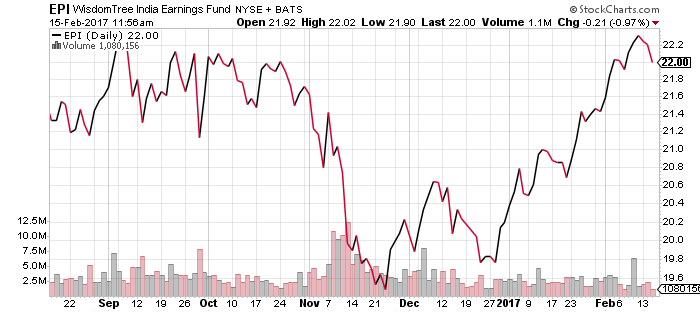

The small-cap SCIF hit a new multi-year high this past week, but subsequently pulled back. A long-term bullish breakout will occur when it exceeds the 2014 high. WisdomTree’s India fund EPI has finally recovered from the cash ban losses, while iShares fund INDY and Matthews India fund MINDX both have further to go.

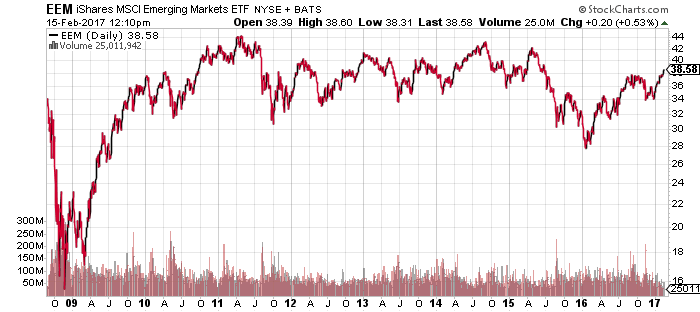

India funds are benefiting from general strength in emerging markets. iShares MSCI Emerging Markets (EEM) has been in a trading range since 2009, spending most of the time between $32 and $44. It currently sits at just over $38. The fund has remained in an intermediate-term bull market since the start of 2016.

\