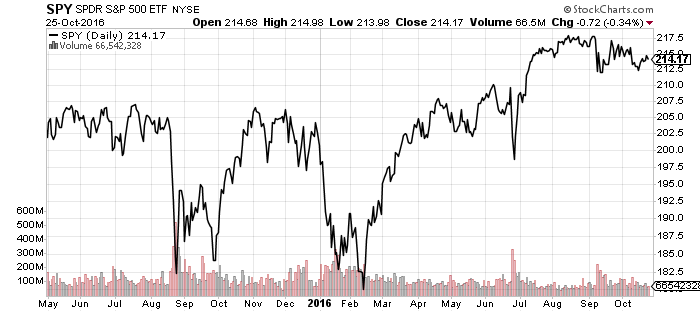

SPDR S&P 500 (SPY)

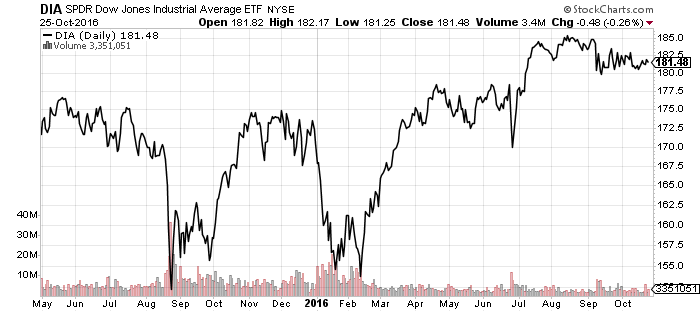

SPDR DJIA (DIA)

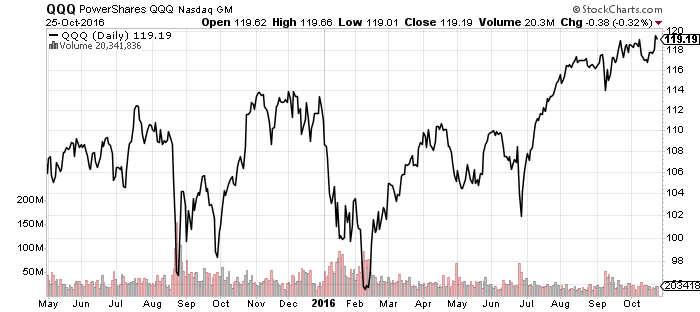

PowerShares QQQ (QQQ)

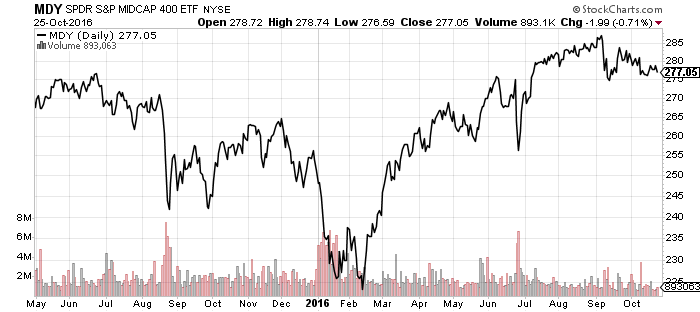

SPDR S&P MidCap 400 (MDY)

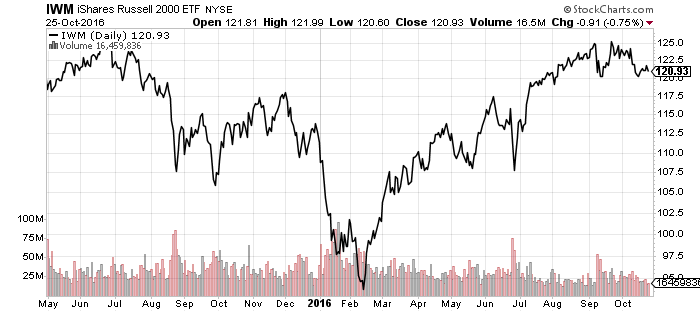

iShares Russell 2000 (IWM)

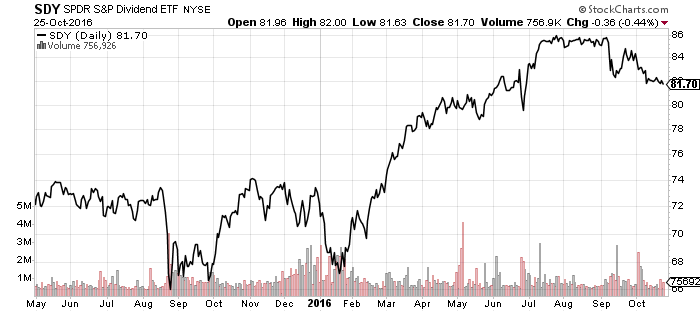

SPDR S&P Dividend (SDY)

The Nasdaq broke the market’s trading range to the upside last week with strong earnings from Microsoft (MSFT), Alphabet (GOOG) and Netflix (NFLX). With the presidential election looming, investors seem to be in a holding pattern, but the move higher signals a positive long-term trajectory.

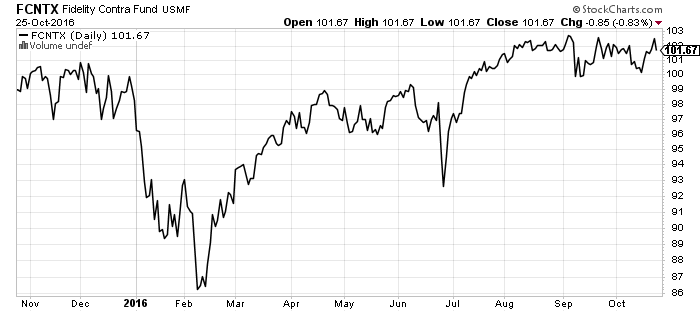

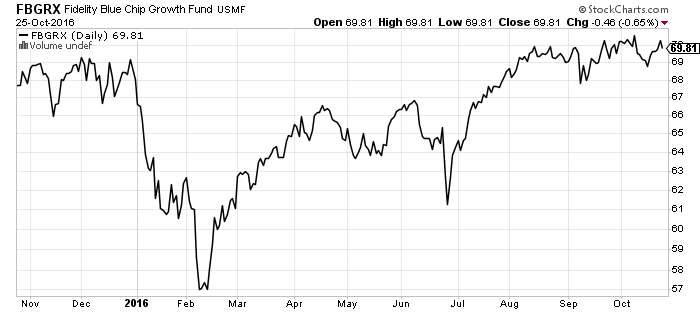

Both Fidelity Contrafund and Blue Chip Growth are benefiting from Nasdaq strength.

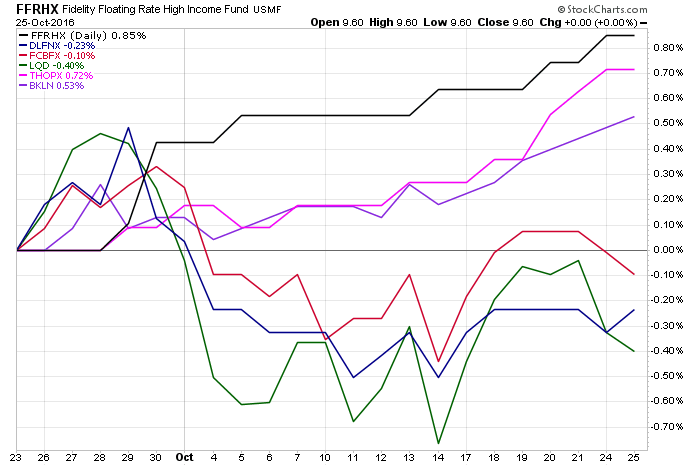

Fidelity Floating Rate High Income (FFRHX)

DoubleLine Core Fixed Income (DLFNX)

Thompson Bond (THOPX)

Fidelity Corporate Bond (FCBFX)

iShares iBoxx Investment Grade Bond (LQD)

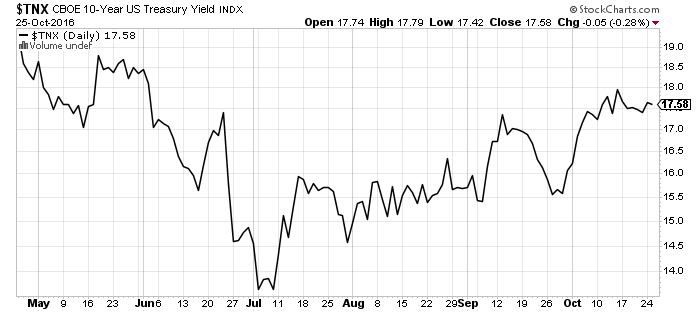

Floating rate bond funds and funds geared towards rising rates, such as THOPX, extended their gains over the past week. The odds of a December rate hike reached 78 percent on Tuesday.

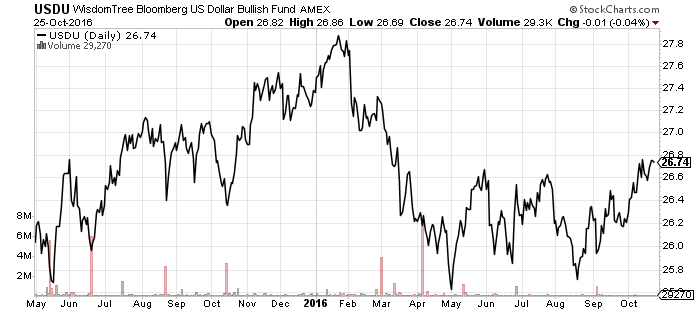

WisdomTree US Dollar Bullish (USDU)

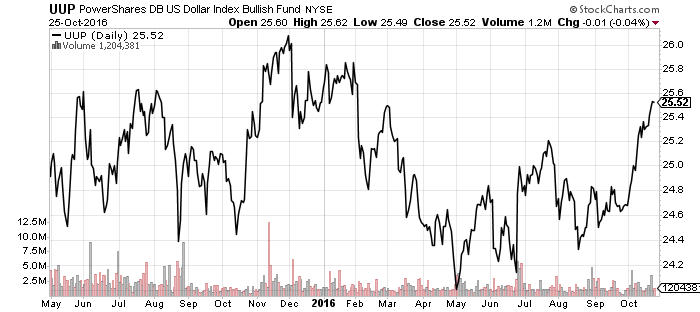

PowerShares DB US Dollar Bullish (UUP)

The U.S. dollar rallied to its highest level since February this month and key currencies such as the British pound, euro, yen and Chinese yuan have all weakened.

Third quarter GDP will be released on Friday. The Atlanta Federal Reserve’s GDP Now model predicts growth of 2.0 percent, with one final adjustment on Thursday. The New York Fed is predicting slightly higher 2.2 percent growth in the prior quarter.

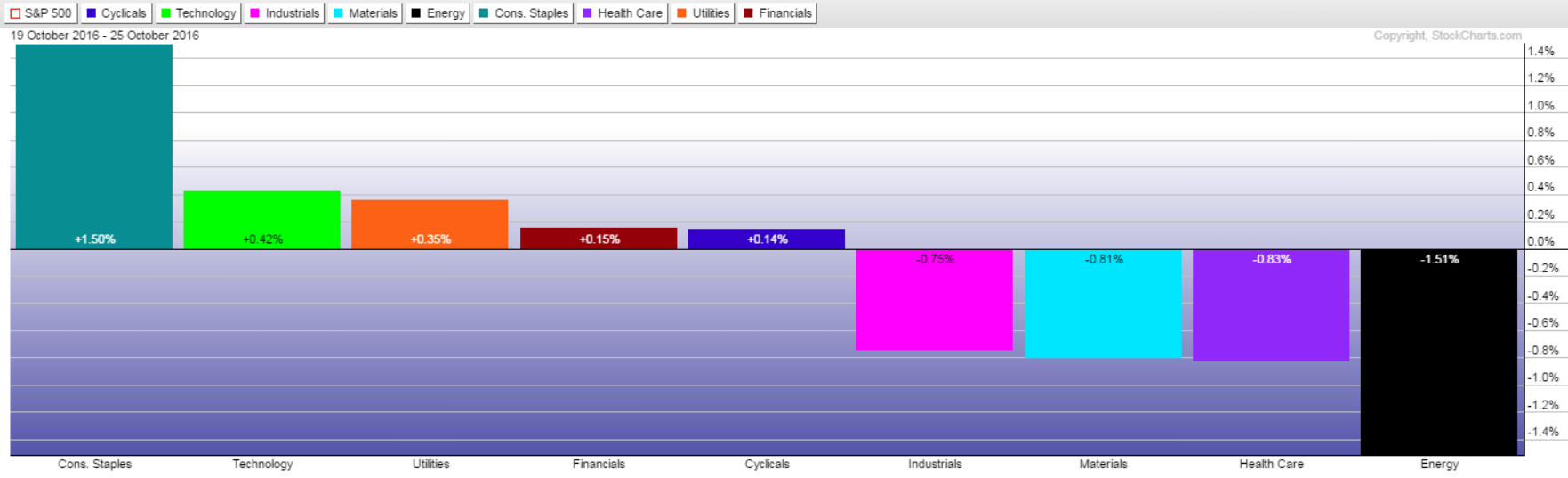

Sector Performance

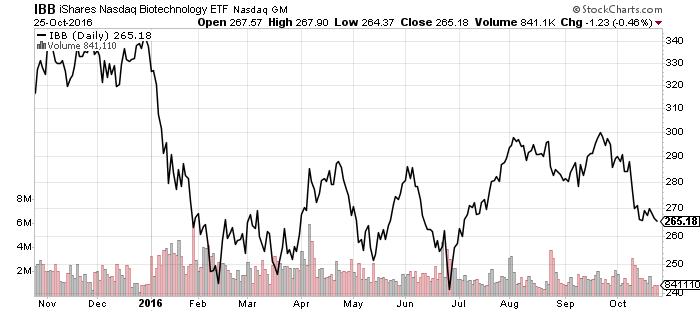

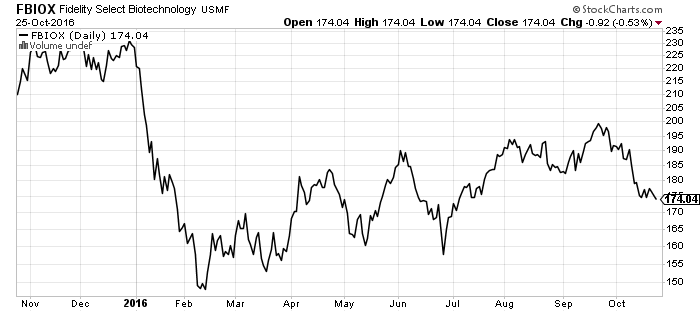

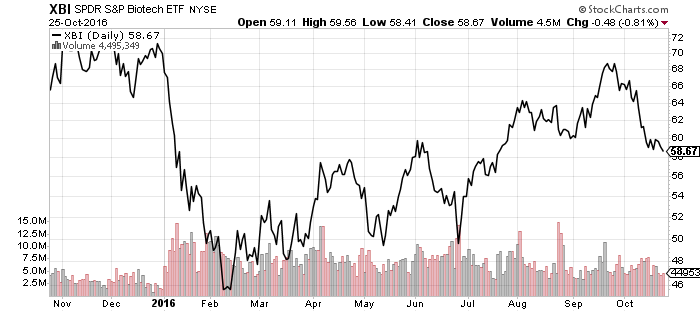

Consumer staples rose 1.50 percent last week while Technology rallied 0.42 percent. Oil prices sent Energy down 1.51 percent, while a pullback in biotechnology pulled Healthcare down 0.83 percent.

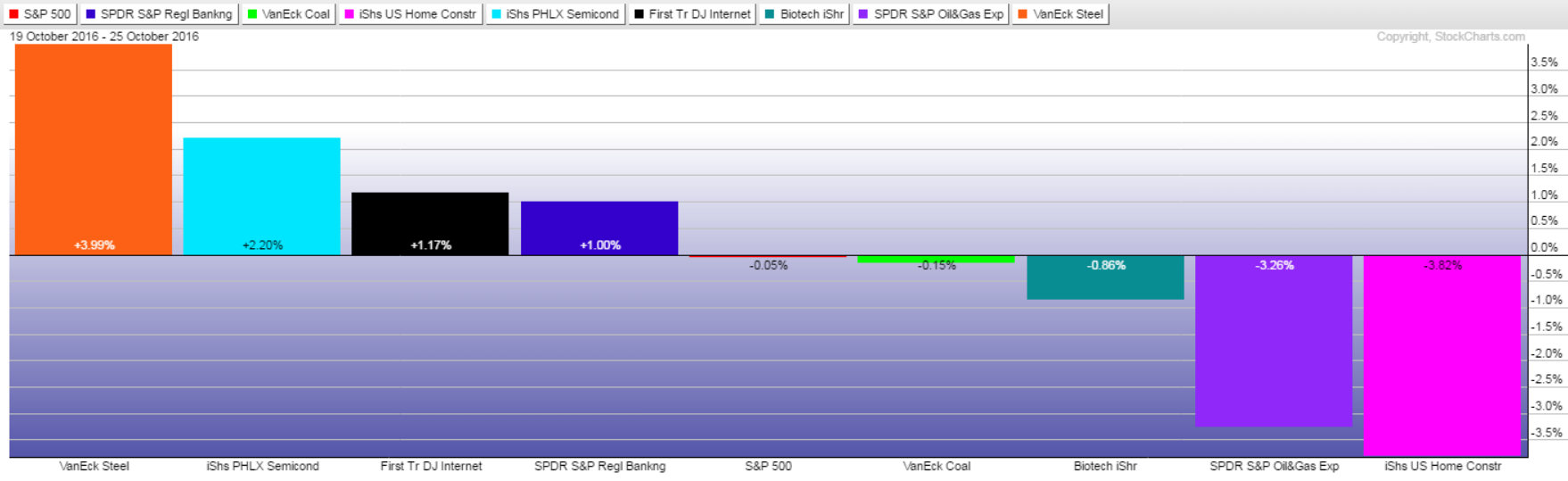

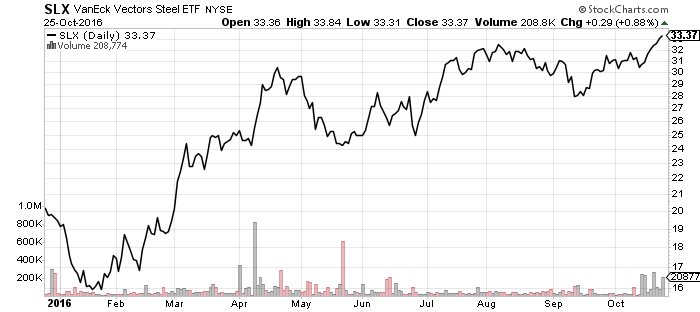

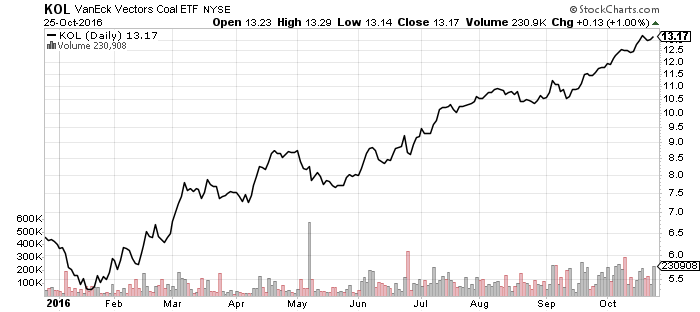

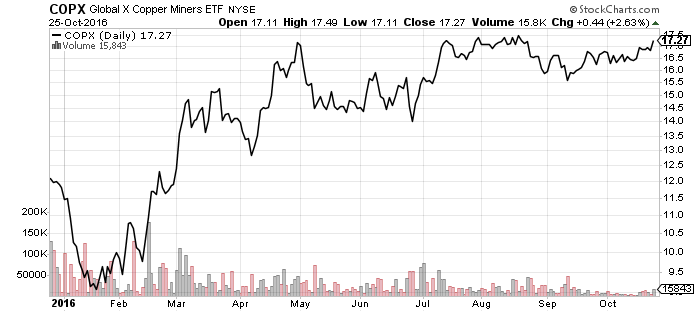

VanEck Steel (SLX) jumped 3.99 and VanEck Coal (KOL) extended its rally. Global X Copper Miners (COPX) also looks poised to break out amid U.S. dollar strength.

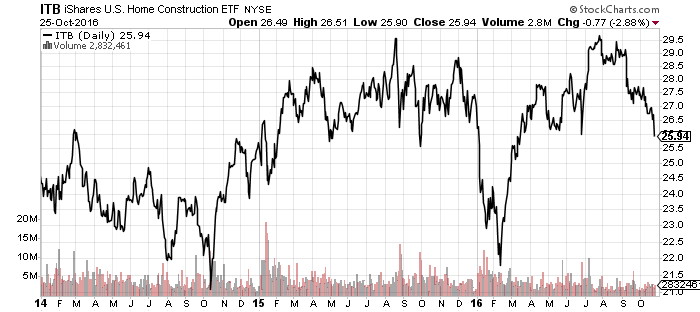

Higher interest rates cut into homebuilders over the past month and iShares US Home Construction (ITB) is sitting near the bottom of its 2-year trading range. If ITB is going to bounce, it will do it soon, or it risks sliding as much as 10 percent as it heads back towards the 2016 lows.

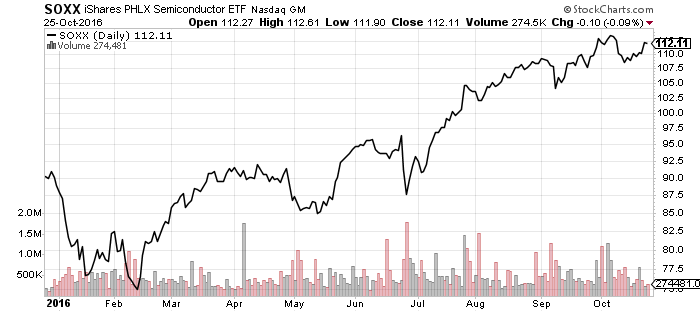

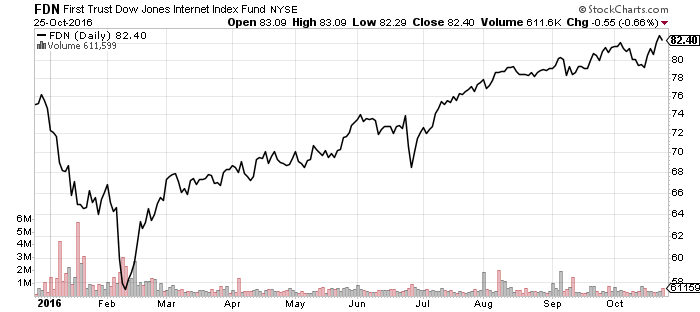

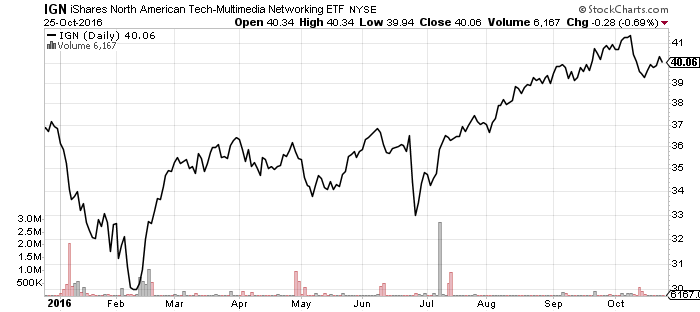

Internet stocks lifted the Technology sector last week with a new 52-week high. Semiconductors look to challenge their old high, while social media and networking shares have a little further to go.

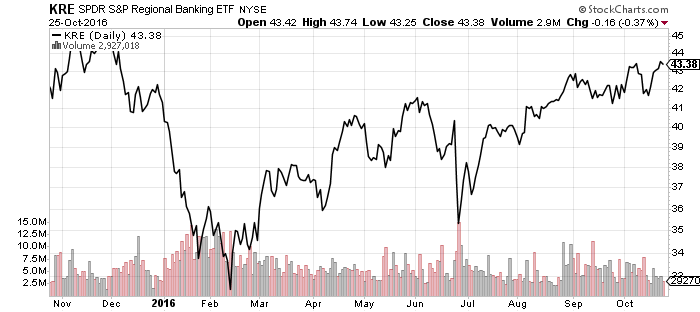

Regional bank shares set a new 2016 high over the past week as December rate hike odds also climb to their highest levels this year.

Biotech remains in an uptrend despite the recent pullback. Note the relative strength in the more volatile XBI, which is trading at June levels, as it compares to FBIOX and IBB in April. This reflects the bullish recovery in the sector as XBI leads the large cap funds higher.

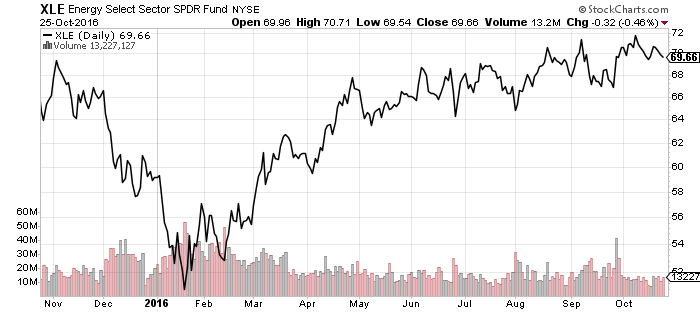

SPDR Energy (XLE)

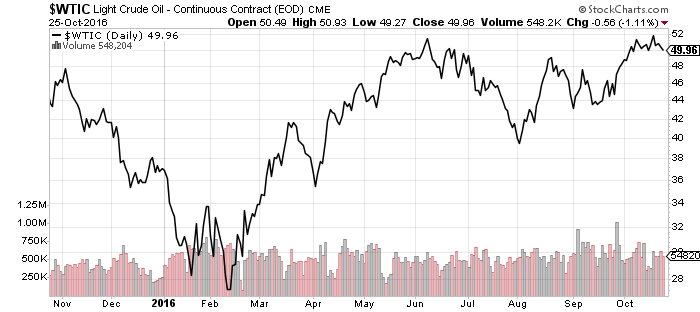

Crude oil topped out right near its 52-week high and bears pounced on the failure at resistance, sending West Texas Intermediate Crude back below $50 a barrel. Although oil inventory at Cushing, OK is at its lowest level of 2016 and near early-2015 levels, prices are coming under pressure as inventory hits the market. The expectation that American frackers will ramp up production if oil rallies to $60 a barrel and skepticism over OPEC cuts are also weighing on the market.