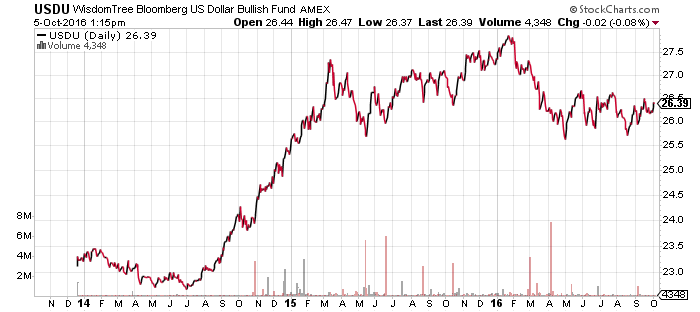

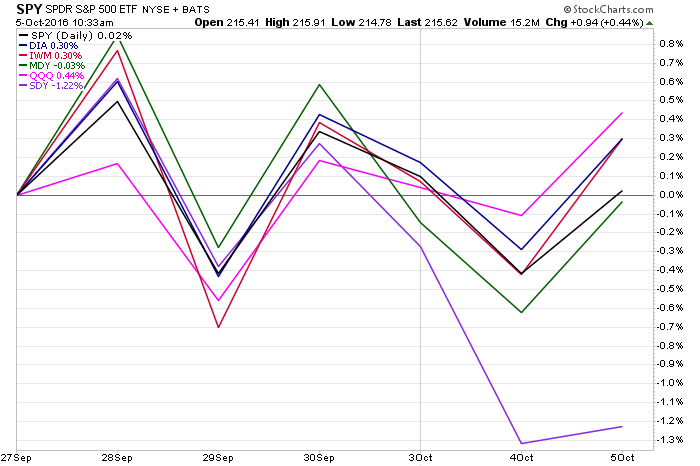

SPDR S&P 500 (SPY)

SPDR DJIA (DIA)

PowerShares QQQ (QQQ)

SPDR S&P MidCap 400 (MDY)

iShares Russell 2000 (IWM)

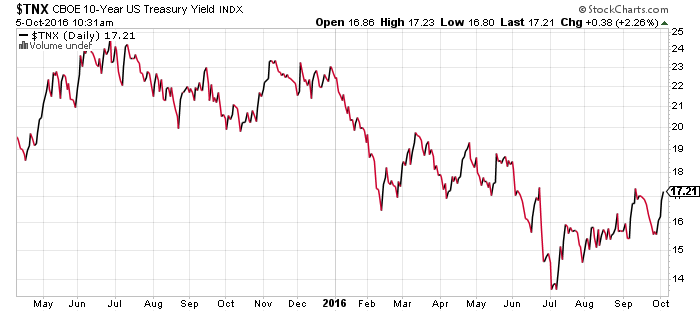

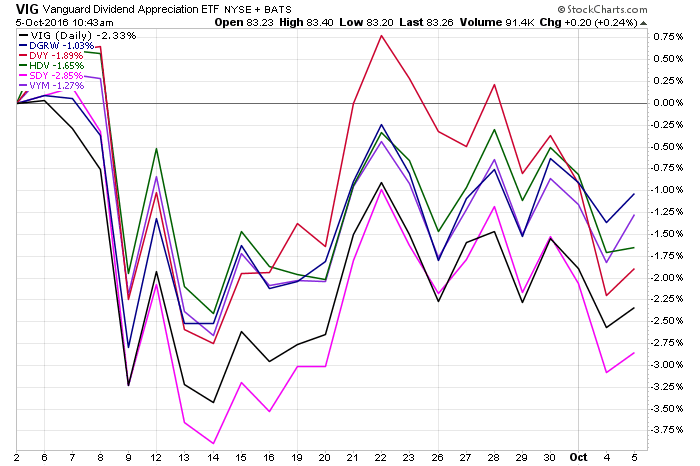

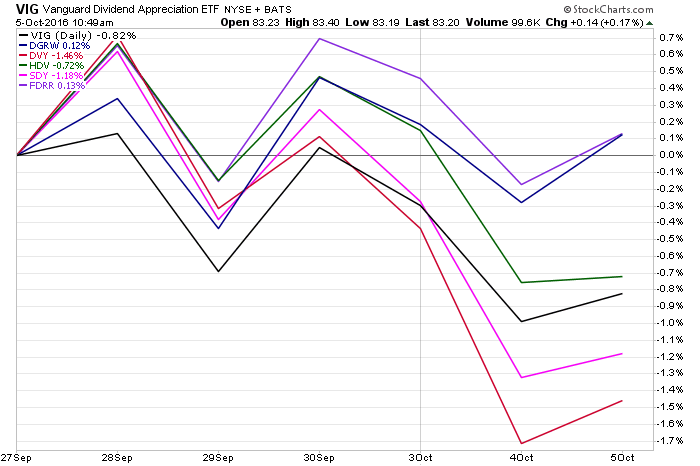

The indexes traded in lockstep over the past week, though a sharp rise in interest rates weighed on SPDR S&P Dividend (SDY) due to its large utilities exposure.

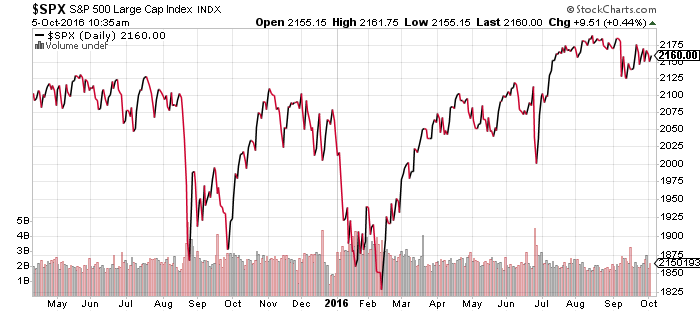

The S&P 500 Index is back in a trading range, with 2190 marking upside resistance and support near the 2100 level. Historically, the market has rallied 70 percent of the time following the presidential election.

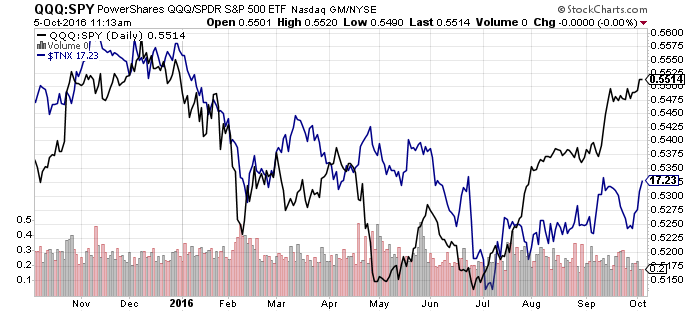

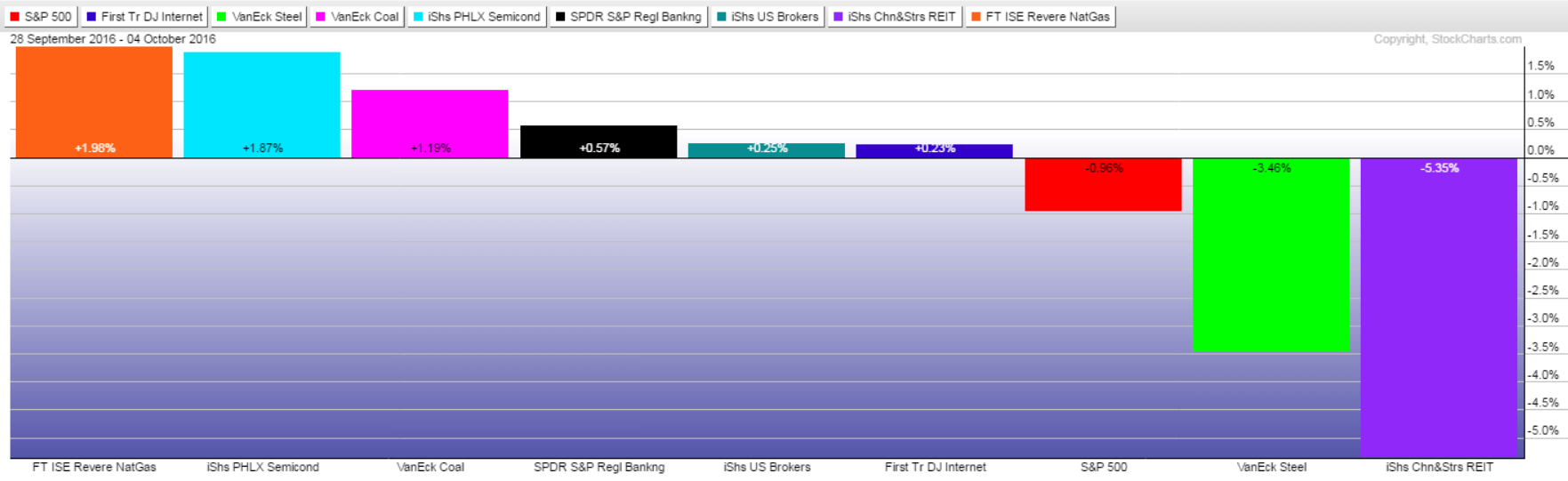

For now, rising interest rates may keep a lid on shares. While Financials are benefiting, investors are rotating out of utilities and REITs, as well as sectors held for dividend yield, such as consumer staples. This accounts for a relatively flat index since rates started rising in July. In contrast, the technology-laden QQQ has outperformed. The chart below shows QQQ underperforming SPY until early July, turning right about the same time as the 10-year yield begins to rise.

Fidelity Floating Rate High Income (FFRHX)

DoubleLine Core Fixed Income (DLFNX)

Thompson Bond (THOPX)

Fidelity Corporate Bond (FCBFX)

iShares iBoxx Investment Grade Bond (LQD)

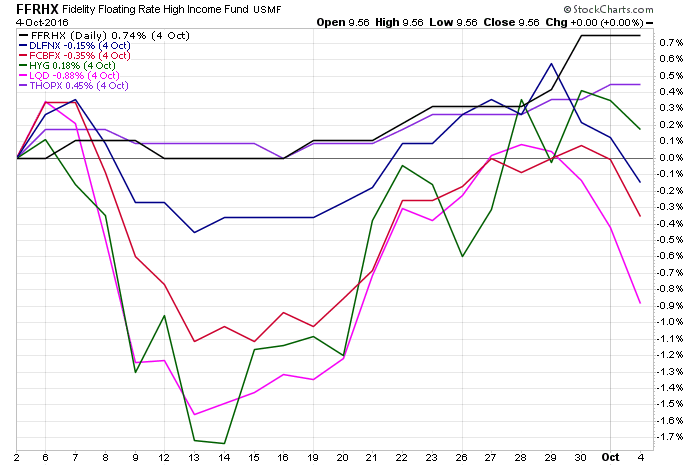

Interest rates rose sharply over the past week, leading to a sell-off in many bond funds, though a few funds bucked the trend. THOPX managers anticipated rising rates and positioned the portfolio to mitigate interest rate risk, while FFRHX holds securities specifically designed to perform well in a rising rate environment. If the rising rate trend stays intact, FFRHX will start seeing increased dividends by early 2017.

Vanguard Dividend Appreciation (VIG)

Vanguard High Dividend Yield (VYM)

iShares Core Dividend (HDV)

WisdomTree U.S. Quality Dividend Growth (DGRW)

SPDR S&P Dividend (SDY)

iShares Select Dividend (DVY)

Dividend funds with exposure to utilities, such as SDY and DVY, underperformed last week. The growth-oriented DGRW is overweight technology and has no assets in the utilities and telecom sectors. It was among the few dividend funds that outperformed the S&P 500 Index.

The new Fidelity Dividend ETF for Rising Rates (FDRR) also outperformed. One of the factors used to select stocks for FDRR is correlation with the 10-year Treasury yield, and is underweight sectors such as telecom and utilities. FDRR is also a relatively high-yield fund as compared to the lower yielding dividend growth DGRW.

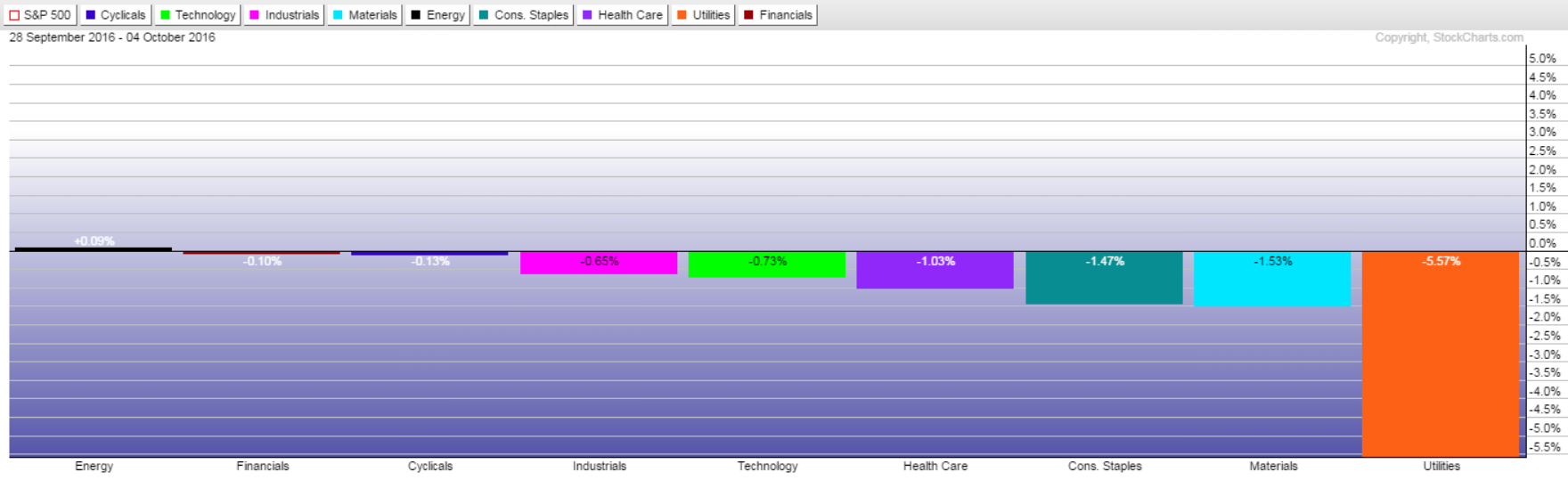

Sector Performance

Utilities was by far the worst performing S&P 500 sector last week, falling 5.6 percent, while materials fell just 1.5 percent.

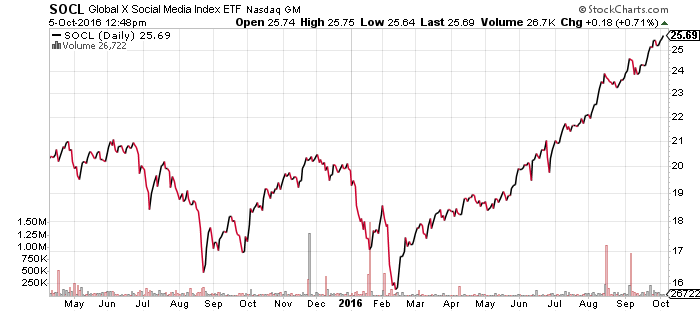

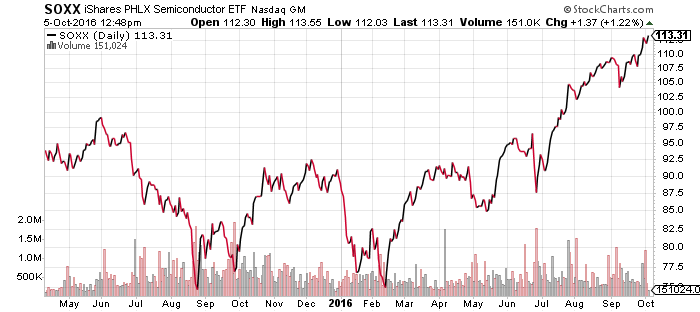

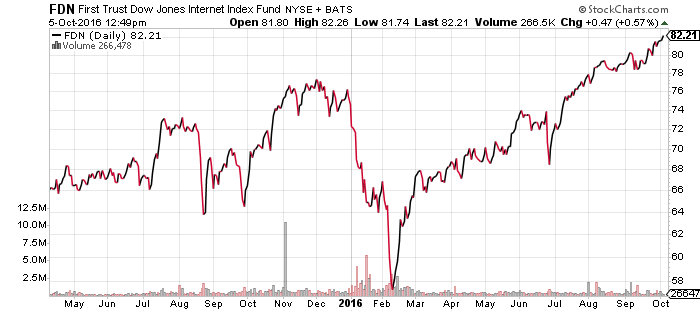

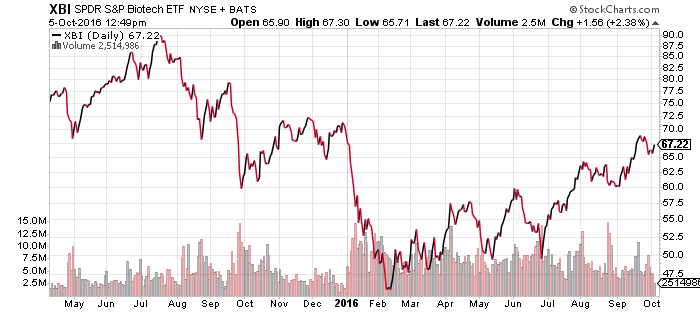

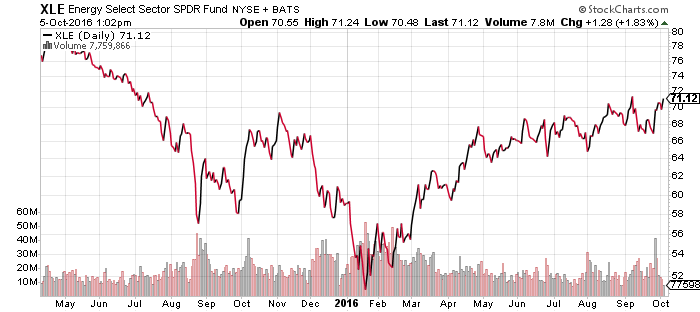

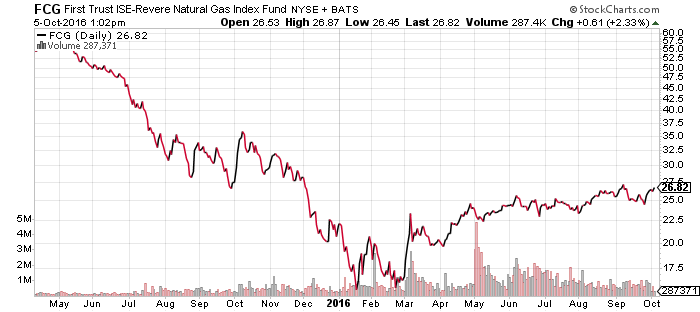

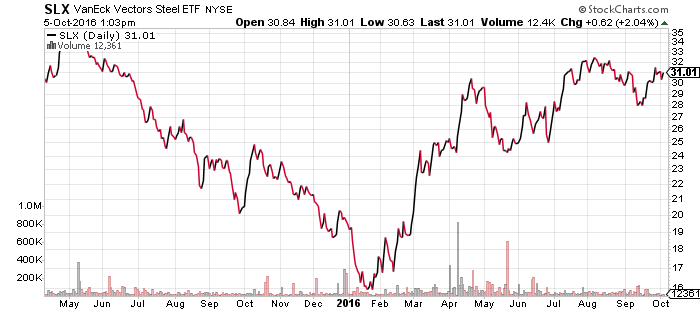

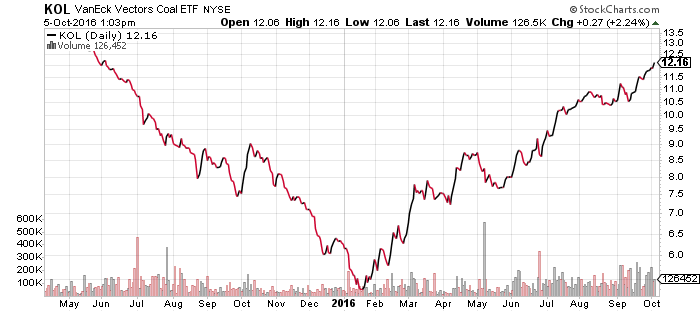

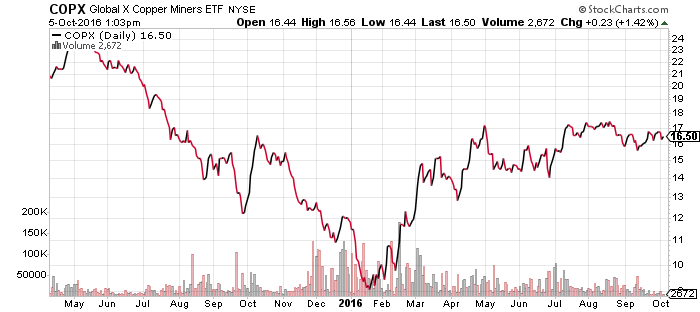

Subsectors reflect the same breakdown in performance. iShares Cohen & Steers Realty Majors (ICF) fell 5.4 percent. VanEck Steel (SLX) fell 3.5 percent as the stronger U.S. dollar also bit the commodity sectors. VanEck Coal (KOL) and FirstTrust ISE Reverse Natural Gas (FCG) both followed oil prices higher. SPDR S&P Regional Banking (KRE) rallied, as did First Trust Dow Jones Internet (FDN) and iShares PHLX Semiconductor (SOXX). Internet and technology shares are among the strongest in the market right now. Biotechnology is also rising, with SPDR Biotech (XBI) the strongest of the ETFs.

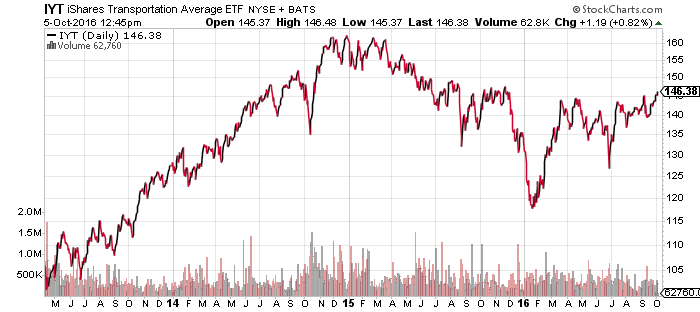

iShares Transports (IYT) was still in a trading range last week, but a consistent rally has it potentially forming an inverse head-and-shoulders pattern. If this pattern completes, it would have an upside target above $170 per share, a new all-time high. Commodities and energy would likely accompany IYT in an upside breakout.

SPDR Energy (XLE)

First Trust ISE-Revere Natural Gas (FCG)

VanEck Steel (SLX)

VanEck Coal (KOL)

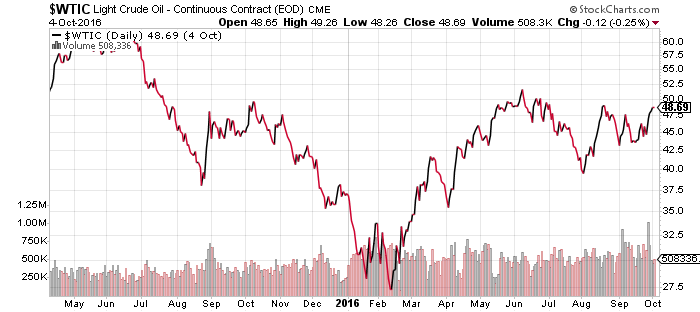

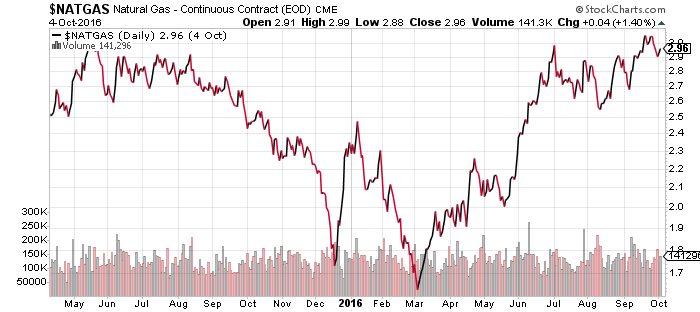

A potential deal between Saudi Arabia and Iran could lead to OPEC production cuts later this year. Oil prices rallied on the news, and are now testing the $50 level following large inventory drawdowns in the United States. Natural gas and coal stocks benefited from rising oil prices, as did oil shares, but other commodities were weighed by the strong U.S. dollar.

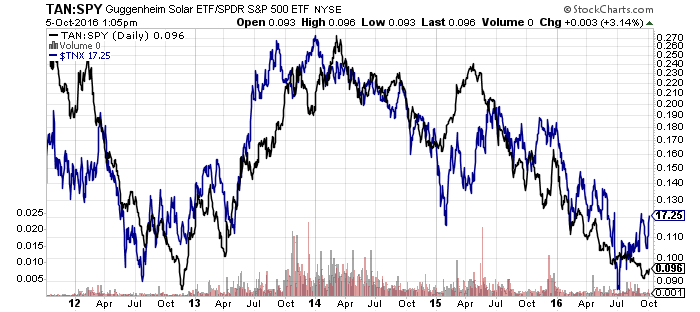

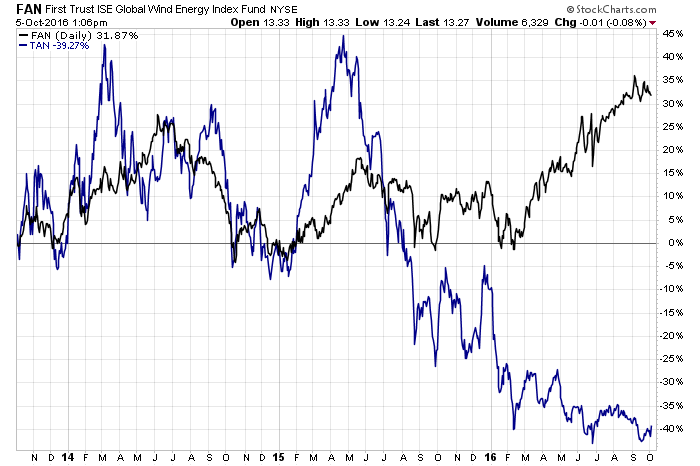

The solar energy subsector tends to be positively correlated with interest rates. If the rally in interest rates continues into the fourth quarter, solar should play catch up with wind. First Trust ISE Global Wind (FAN) and Guggenheim Solar (TAN) used to trade together along with the alternative energy complex, but the two funds diverged in 2016. Currently FAN is one of the strongest funds in 2016 in terms of momentum, while TAN is one of the weakest.

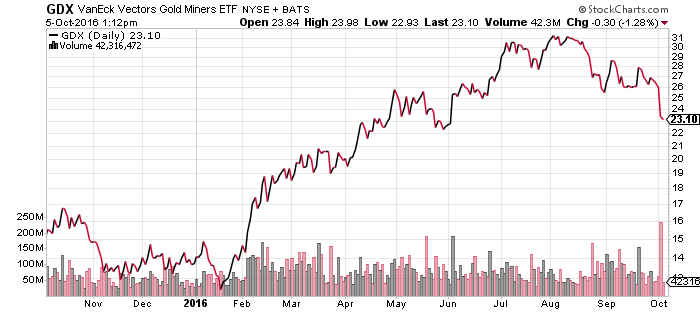

VanEck Gold Miners (GDX)

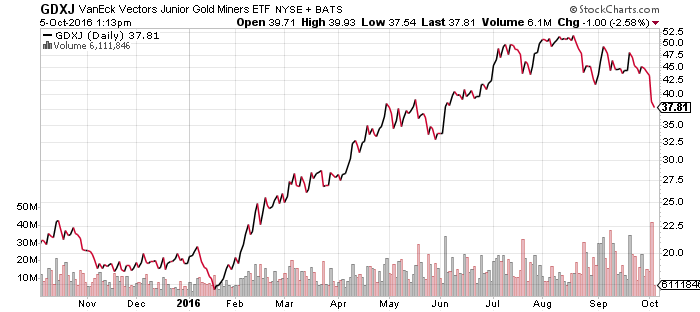

VanEck Junior Gold Miners (GDXJ)

Last week the yen weakened and gold was hit hard, sliding double digits. GDX and GDXJ could have another 25 percent downside.

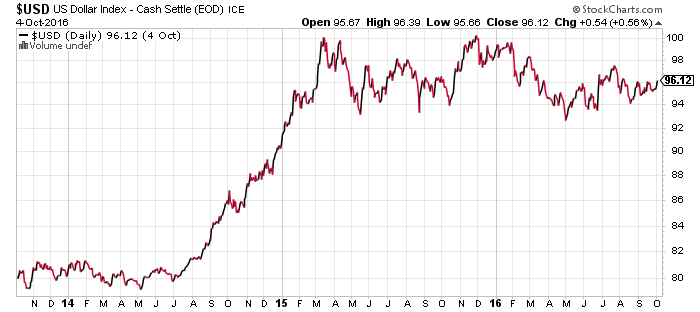

WisdomTree US Dollar Bullish (USDU)

A big question mark hanging over the markets right now is the U.S. dollar. Rising interest rates lifted the exchange rate of the dollar, while concerns about Deutsche Bank (DB) weakened the euro. At the same time, the European Central Bank may be ready to taper its quantitative easing policy, an act which would raise European interest rates and strengthen the euro at the expense of the dollar. A stronger dollar is bearish for commodities and assets denominated in foreign currency. Whether this is a short-term rally or the start of a new long-term bull market will be evident once the U.S. Dollar Index breaks out of its trading range.