iShares Russell 2000 Index (IWM)

The Russell 2000 Index comes into Wednesday trading at an important technical convergence. When the sell-off began there was a big loss early, on January 24. This left a gap in the chart—when the open on the candlestick chart is far above or below the prior day’s trading range, there is a large open space. Technical traders believe that gaps are often filled, such as when a stock that surges on good news, but will eventually test that level before rising again.

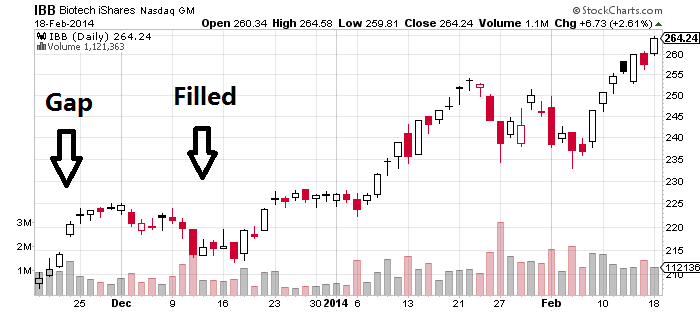

We used this method to call for an expected drop in biotechnology back in December, suggesting that it would dip before rising again, providing bulls a better entry point. It behaved as expected, filling the gap before again moving higher.

The gap in IWM is not as impressive, but it is also below the upper trendline from the market peak in 2000. The Russell 2000 approached this peak in 2007, but subsequently turned lower with the rest of the global equity markets. Recently, the Russell 2000 broke this trendline to the upside on its way to new all-time highs, but it is now fallen off. Bearish traders expect this to provide a great amount of resistance, considering it marked the past two major tops for the stock market.

In conclusion, the behavior of IWM this week will be very important to watch. A break higher would be very bullish for the index as bears are forced to cover; however, this line could prove very difficult to break. A few more weeks of sideways action makes more sense, or even a renewed sell-off, before the index breaks higher.

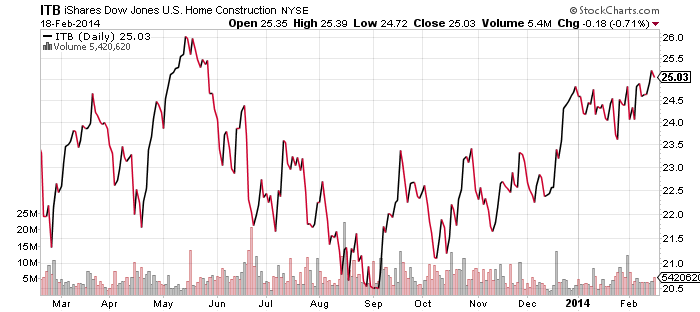

iShares U.S. Home Construction (ITB)

Home builder sentiment plunged in February, the worst one-month drop ever recorded since the index started in 1985. It’s also the first time the index has slipped below 50, which is the dividing line between positive and negative sentiment, since May 2013. Despite the report, the homebuilder ETF looks ready to challenge its 52-week high. Ironically, as the chart below shows, that high was set in May 2013, the last time homebuilder sentiment was negative. More important for the sector is interest rates, which have been coming down in 2014.

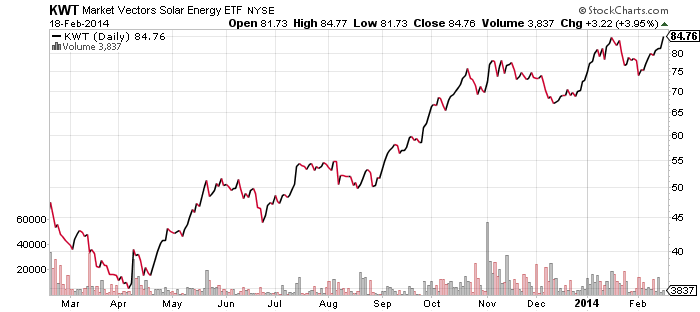

Market Vectors Solar (KWT)

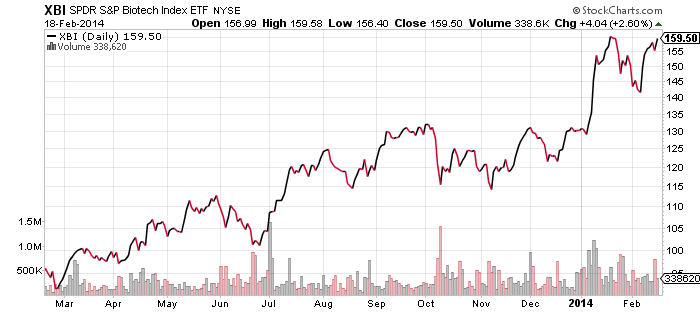

SPDR S&P Biotechnology (XBI)

Let’s take a quick look at a solar and biotechnology ETF that are underperforming relative to their peers. Both iShares Nasdaq Biotechnology (IBB) and Guggenheim Solar (TAN) have broken out to new highs, but Market Vectors Solar (KWT) and SPDR S&P Biotechnology (XBI) have yet to follow. How these two funds perform over the near future may signal the strength of these new sectors. If KWT and XBI fail to follow, it could imply IBB and TAN are overextended, or that the broader market will indeed turn lower again.

We have often discussed biotechnology and solar as pockets of bullishness in bearish periods this year. Also in that category are Global X Social Media (SOCL) and First Trust DJ Internet (FDN), two funds also at new all-time highs.

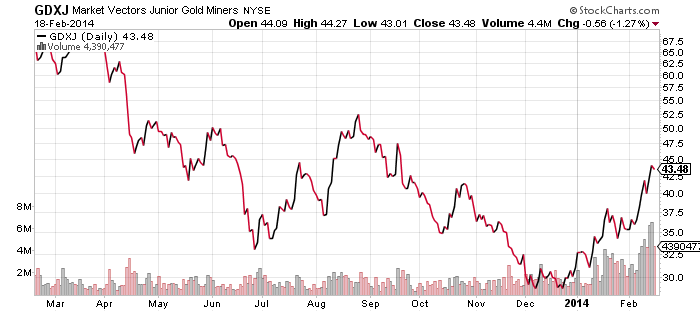

Market Vectors Junior Gold Miners (GDXJ)

Is the bear market in gold mining shares over? Maybe. GDXJ is up almost 45 percent in 2014 and still the sentiment on gold mining shares remains negative. There has been some takeover activity which is good news, and many firms have gone through share issuance, asset divestitures and write downs. In other words, there’s some reason to believe the bad news is priced in. Most importantly, the price of gold appears to have found firm support above the $1200 level. Gold miners were priced for disaster at the end of 2013 (relative to the price of gold, mining shares traded below their 2008 lows), and unless gold prices tumble again, disaster will be avoided.

That doesn’t mean a pullback isn’t coming given the rapid run-up in prices. For that reason, we would not chase performance. Investors who are long-term bullish on gold should remember GDXJ was a split-adjusted $150 stock in April 2011, when gold was at $1500 an ounce. The high of $1900 looms in investors’ minds, but that price was achieved in a $400, three month run-up from July to September. Today, gold miners are in a better position financially, thanks to the three year bear market. In sum, investors who are bullish on gold and looking to buy mining shares may use any dips as a buying opportunity.