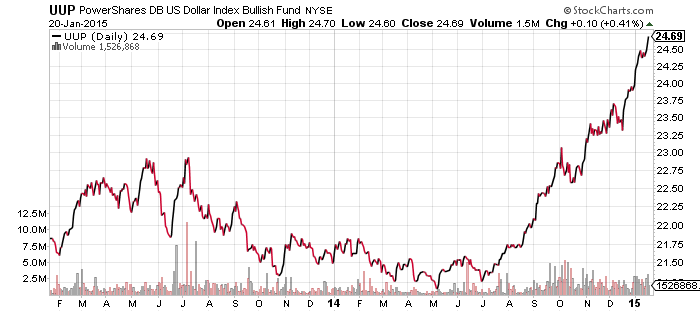

PowerShares U.S. Dollar Index Bullish Fund (UUP)

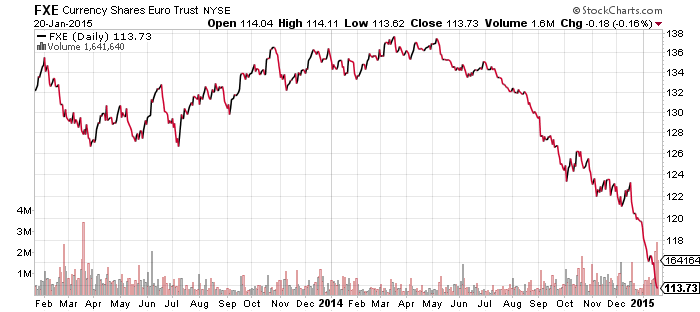

CurrencyShares Euro Trust (FXE)

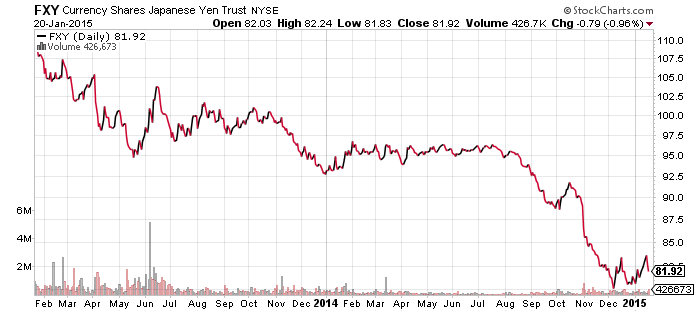

CurrencyShares Japanese Yen (FXY)

Currencies market will be watched closely ahead of the European Central Bank’s (ECB) decision on quantitative easing. The ECB leaked the size of the program today: 50 billion euros a month through 2016. This is in line with expectations and the euro initially rallied as a result.

Currencies have experienced historic volatility in the wake of the Swiss National Bank’s decision to end the euro peg, which sent the franc up as much as 30 percent versus the euro before settling at an approximately 20 percent advance. Traders were on edge ahead of the ECB’s announcement, but the leaked plan today appears to have calmed some nerves.

In the near-term, the euro is oversold and the U.S. dollar is overbought based on short-term technical signals. If the euro continues to strengthen, an extended move is possible as many traders who bet on a falling euro in the past few months may take profits.

As for the yen, it has been strengthening versus the U.S. dollar as currency traders start to ask if Japan might fail to follow through on its quantitative easing rhetoric.

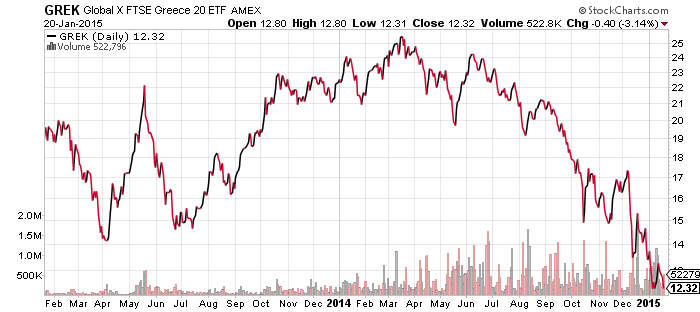

Global X FTSE Greece 20 (GREK)

Volatility in Europe may also be heightened when Greece votes on Sunday. The anti-austerity Syriza party has held on to a 2 to 3 percent lead for several weeks. Greek stocks have priced in a Syriza victory, selling off to their lowest point since the last round of the Greek debt crisis.

A surprise victory by the ruling party would spark a rally in Greek shares. A victory by Syriza would open a new set of questions about Greece and its status in the eurozone. France’s finance minister this week said, “it is absolutely fair and legitimate that discussions should take place between the EU and the new Greek government.” In contrast, the Germans are starting to wonder if a Greek exit isn’t for the best.

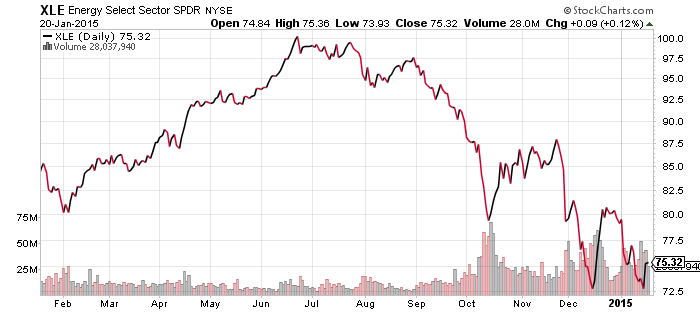

SPDR Energy (XLE)

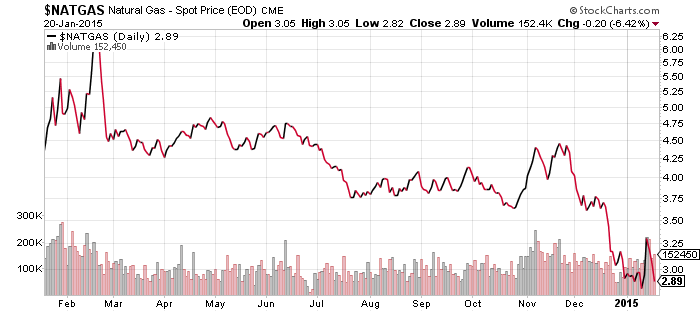

United States Natural Gas (UNG)

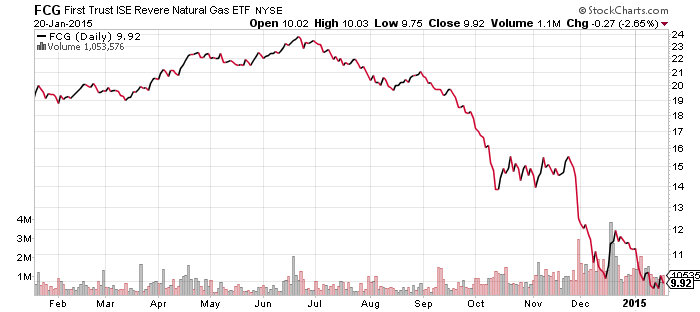

First Trust ISE Revere Natural Gas (FCG)

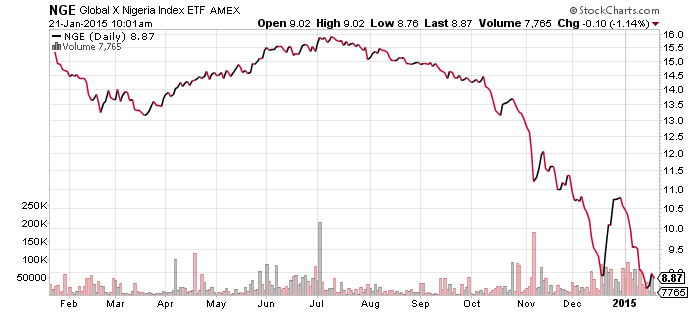

Global X Nigeria (NGE)

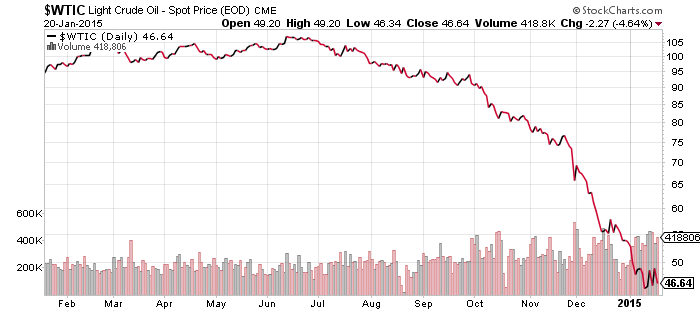

West Texas Intermediate Crude stabilized above the $45 level last week. This is one of the strongest weeks for oil since it started falling in July. Oil stocks have done better, as SPDR Energy hasn’t fallen under its December low. Investors have been proven right thus far, but a few weeks of stabilization is not a bottom.

Natural gas has been stabilizing as well, though natural gas producers in FCG have performed worse than the energy majors found in XLE. A cold January hasn’t helped prices.

The fallout from the drop in oil continues to hit oil exporting nations. Nigeria’s currency fell below 200 to $1 today, more than 25 percent below the central bank’s peg rate.

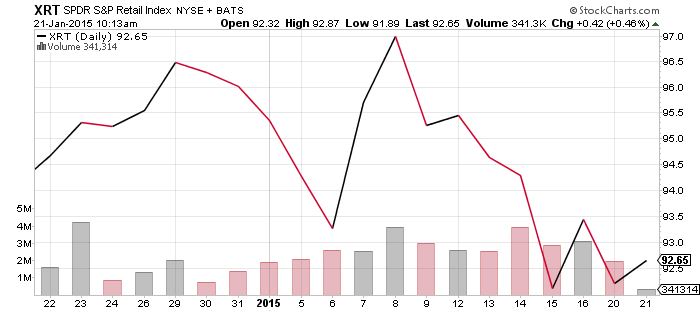

SPDR Retail (XRT)

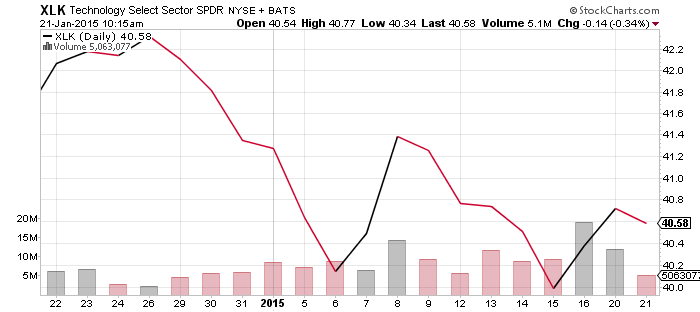

SPDR Technology (XLK)

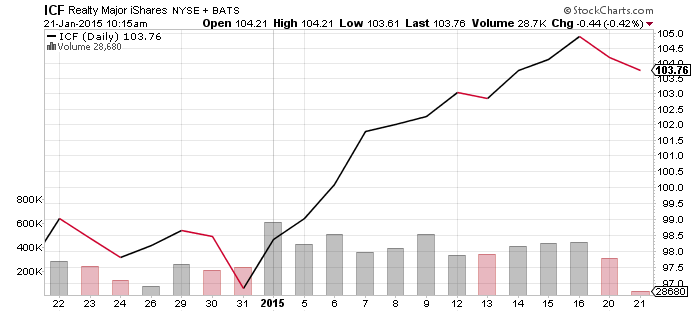

iShares Cohen & Steers Realty Majors (ICF)

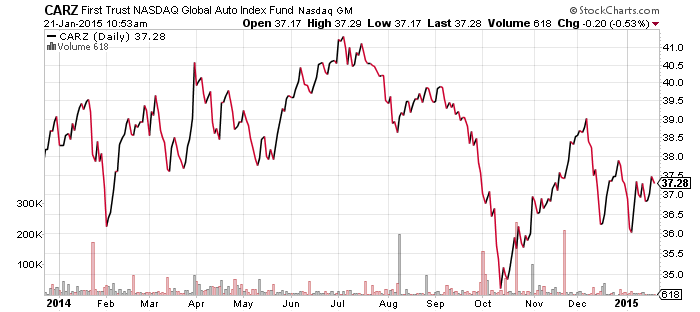

FirstTrust Nasdaq Global Auto (CARZ)

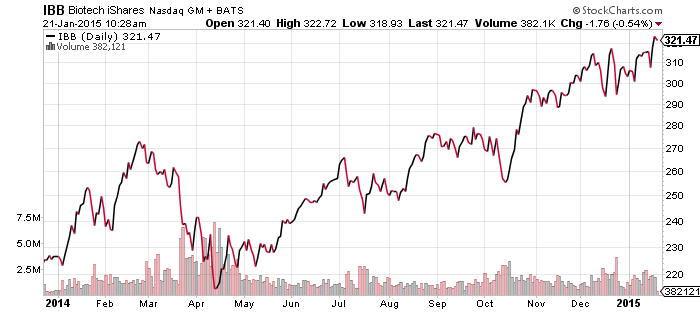

iShares Nasdaq Biotechnology (IBB)

Defensive stocks held on to their lead last week, while falling bond yields helped rate sensitive sectors, particularly the higher yielding REIT sector. With the launch of quantitative easing in Europe, global investors are anticipating even lower bond yields and looking for income wherever they can find it. For that reason, dividend stocks have been outperforming the broader market since the autumn.

Weak retail numbers from December continue to weigh on retail stocks, but the big wave of earnings reports is still a couple of weeks away.

Technology stocks have seen a couple of big reports, as both Intel (INTC) and IBM (IBM) disappointed investors, and declines in their shares weighed on technology ETFs. Strong earnings from Netflix (NFLX) resulted in a double-digit gain for its shares.

Low gasoline prices continue to work in favor of truck sales in the U.S., boosting the bottom line for automakers. CARZ has been in a downtrend since July though, due in part to slowing global growth.

Biotechnology remains the bull market’s leader, with no weakness in 2015. Shares hit a new all-time high last week. This strength reveals the bullish sentiment just below the surface of the market. Defensive sectors are doing well as the markets get off to a choppy start this year, but the momentum leaders are confidently pushing to new highs.

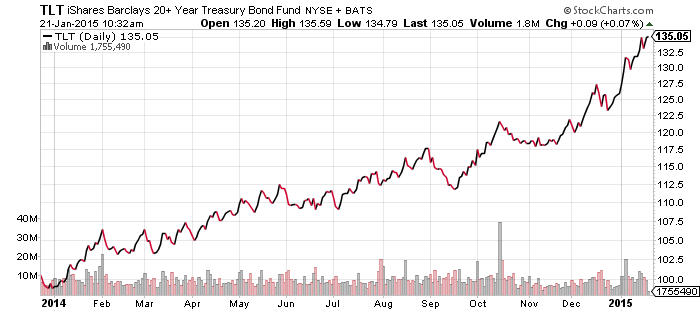

iShares Barclays 20+ Year Treasury (TLT)

Bonds are overdue for a pullback. The long-bond has rallied non-stop in 2015, but with the ECB making its quantitative easing announcement this week, traders may finally take profits in currency and bond markets. Longer-dated Treasury bonds have been rallying in part because U.S. yields are above European yields. The 30-year Treasury yields 2.39 percent, versus about 0.30 percent for the Swiss 30-year bond.

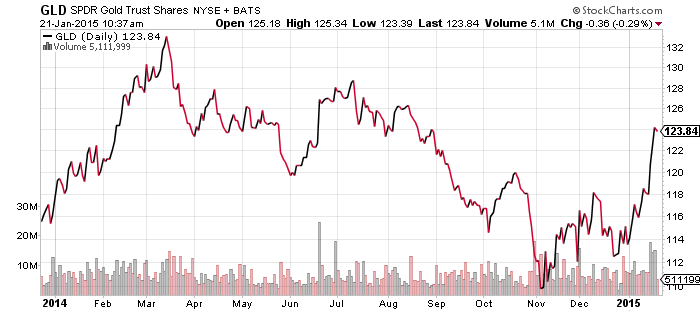

SPDR Gold Shares (GLD)

Following the Swiss National Bank’s move last week, gold has seen renewed interest as a monetary asset. Gold dropped when the ECB leaked its plan to buy 50 billion euros in assets each month though, as a quantitative easing plan was already priced into the gold market. After advancing $100 in the first three weeks of January, a further pullback is possible, but trouble with Greece could help the metal move higher and delay a correction.