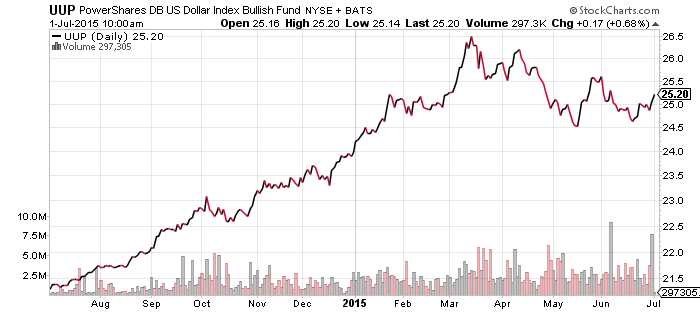

PowerShares U.S. Dollar Index Bullish Fund (UUP)

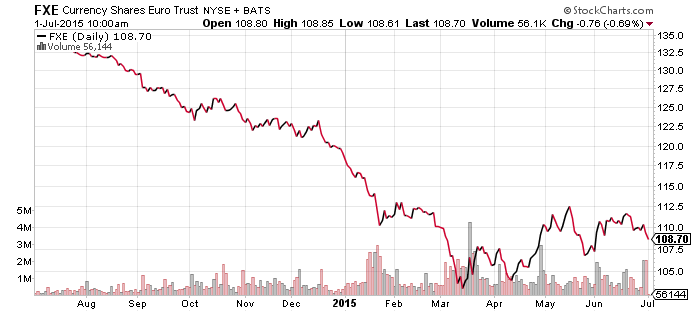

CurrencyShares Euro Trust (FXE)

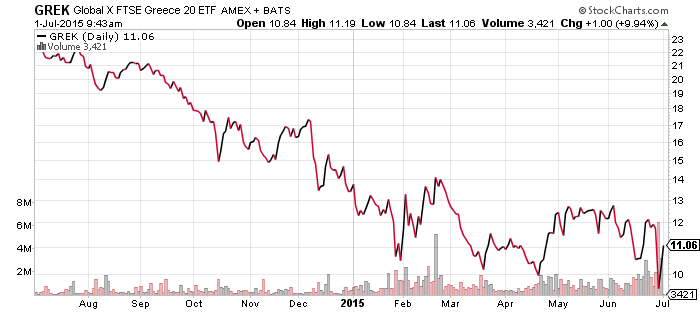

Global X FTSE Greece 20 (GREK)

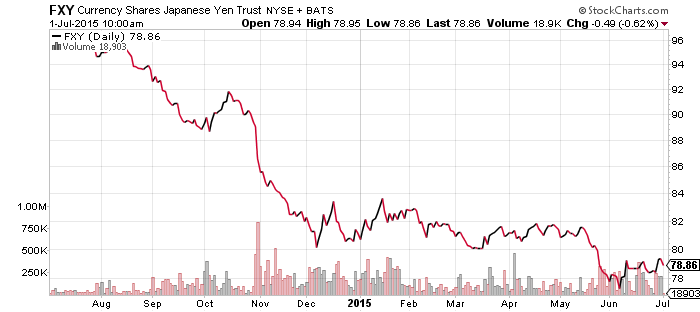

CurrencyShares Japanese Yen (FXY)

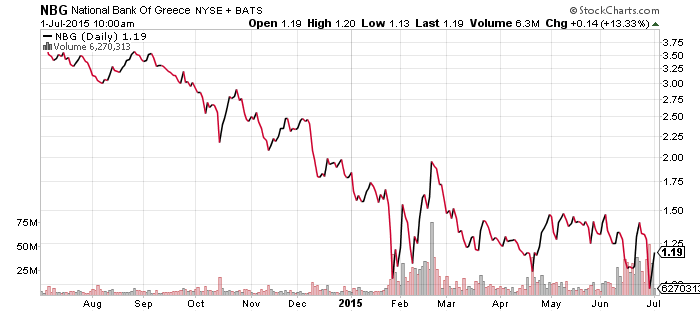

Greece has dominated the news as expected over the past week but markets took the news of a default to the IMF in stride. Shares dipped around the globe on Monday, but they bounced back on Tuesday and were sharply higher on Wednesday following a Greek request for more aid. However, Greece’s prime minister told the nation on Wednesday night that he wants them to vote no on the upcoming referendum. The referendum will decide whether the Greek people accept or reject the last offer made by European creditors, which is now off the table. The prime minister also told the people that the aid offers have improved since the government decided to hold an up or down vote on the European aid offer.

In other words, the game of chicken goes on. We do have a little more information after this week. We’ve learned that a Greek default threat is bad for equities, but good for the euro, as long as it is seen as not requiring more quantitative easing. When Greece suddenly agreed to the bailout offer on Wednesday, with a few changes, the euro slumped.

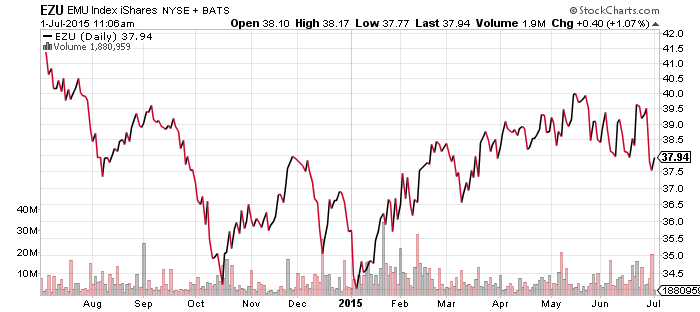

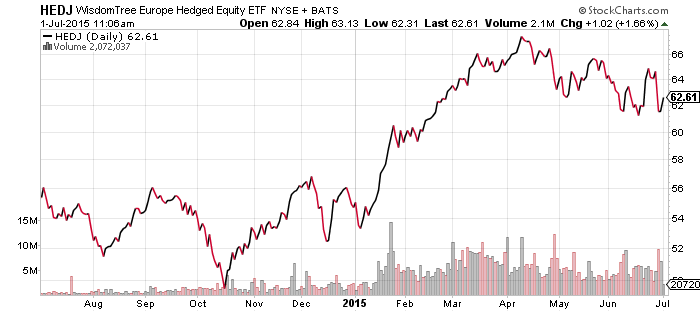

A deal is looking more likely today, but whatever the outcome, the central bank may need to increase quantitative easing. This expectation is reflected in the performance of EZU versus HEDJ. EZU is the unhedged European equity ETF, HEDJ hedges currency risk. EZU broke to a new low whereas HEDJ has held its lows from a few weeks ago.

Finally, the Greek prime minister also told the public that discussions with the rest of Europe will resume on Monday.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

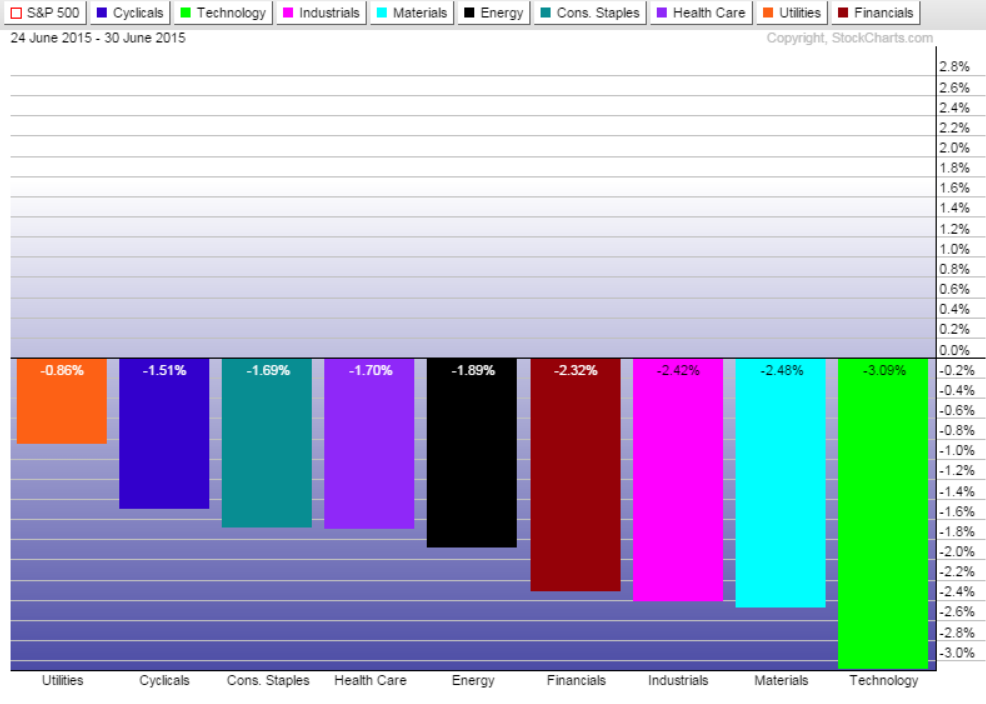

The down week for equities benefited the defensive utilities sector, which outperformed. Technology was the worst performing sector after shares of Intel (INTC) slipped.

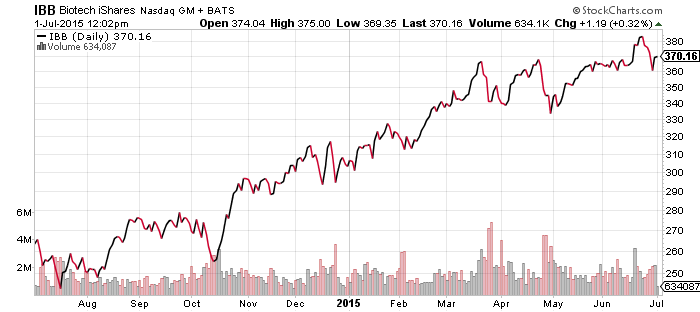

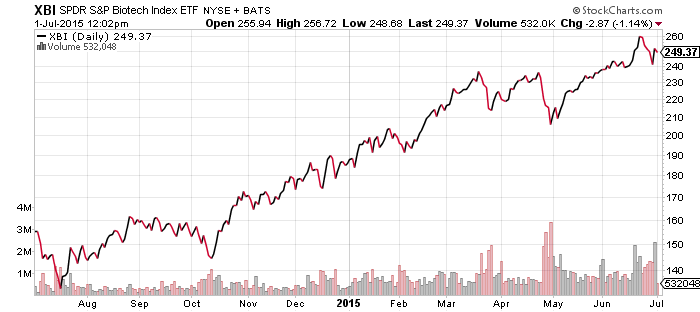

Large cap biotechnology fell back during the week. As can be seen in the chart, the $370 level was a resistance line for IBB and now it is a support line. A move below $370 could result in a test of the lows around $340. XBI shows a more bullish pattern, which is good news for the sector here.

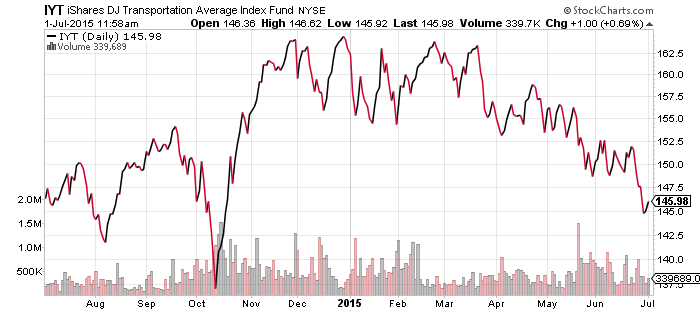

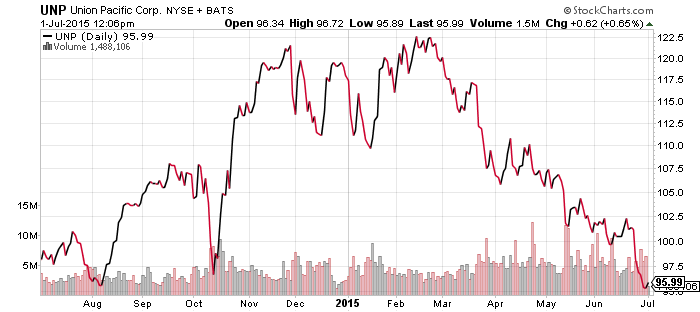

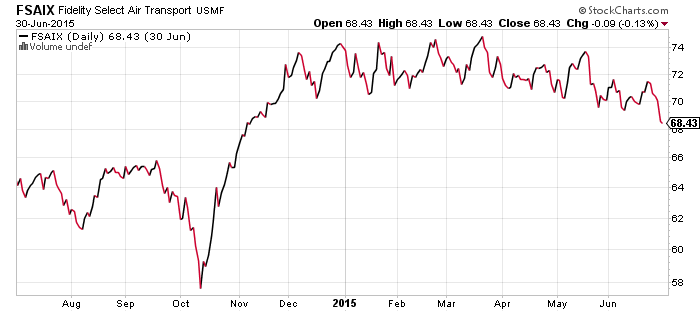

The Dow Transports broke lower over the past week. It remains the most bearish of the major indexes. Railroads are in a steep downtrend and airlines are in a slow and steady decline.