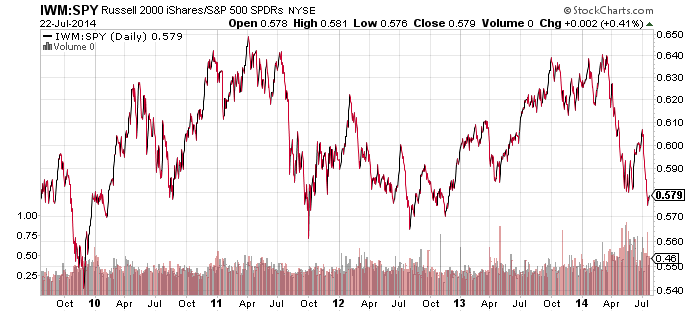

iShares Russell 2000 (IWM)

While the majority of indexes are at or near their all-time or 52-week highs, small-cap stocks have lagged. The Federal Reserve’s negative comments about valuation last week put even more downward pressure on the small-cap index, but it has since demonstrated some upward momentum. The chart below illustrates the price ratio of IWM to SPDR S&P 500 (SPY) and shows small-caps have underperformed large-caps since March, save only for a month-long rally in June. They are now near their lows in relation to the large cap index. Since the bull market in large-caps remains intact, the underperformance of small-caps may be nearly finished. However, that doesn’t mean they will outperform immediately.

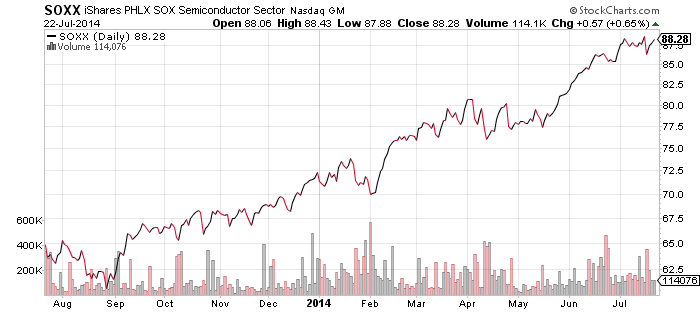

iShares PHLX SOX Semiconductor (SOXX)

iShares PHLX SOX Semiconductor (SOXX)

The semiconductor sector has taken the place of biotechnology as the bull market leader. The chart below shows that, even in its weakest period this year, semiconductor moved sideways, not down. When the broader market has been strong, semiconductors have pushed to new highs. Strong earnings from Intel (INTC) last week provided a further boost to the sector.

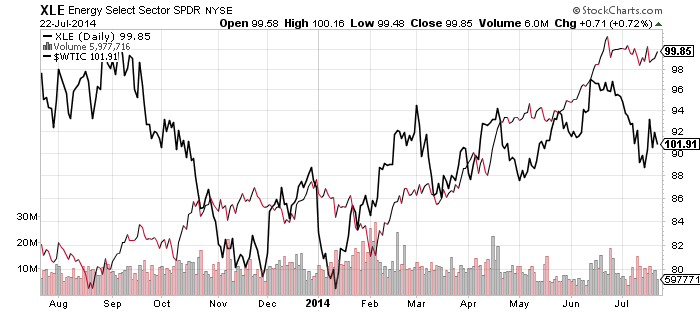

SPDR Energy (XLE)

The energy sector has remained strong even though oil prices have slipped. The chart below shows the price of XLE compared to the price of West Texas Intermediate Crude. Clearly, stock investors remain optimistic in regard to equities. Oil prices have trended upward this year and a stronger economy in the second half should keep demand steady.

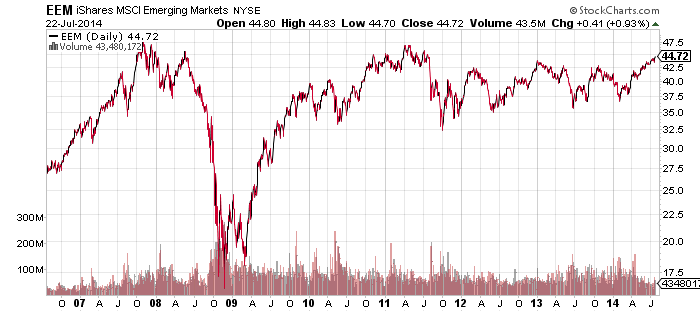

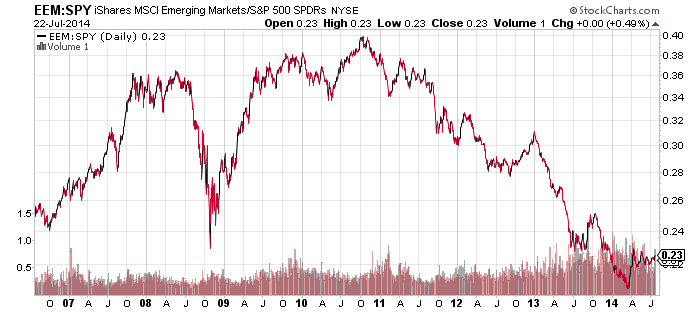

iShares MSCI Emerging Markets (EEM)

EEM cleanly broke above its 2013 high and has made a series of higher lows and higher highs. The major target and resistance area is now above $47.50 per share. A real breakout may not begin until the $50 level is breached as it is post-2008 unadjusted high. The all-time high for EEM, unadjusted for dividends, is closer to $55 per share. A breakout would signal a change in trend for emerging markets. As the bottom chart comparing the price of EEM to SPDR S&P 500 (SPY) shows, emerging markets have been lagging the wider market for years and have yet to make a decisive upward move. However, if the current trend continues to build, a turning point could be evident later this year.

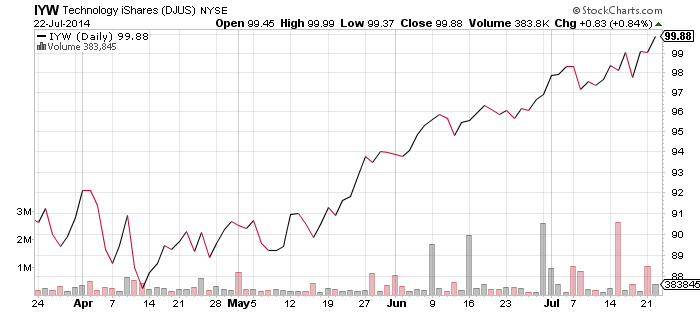

iShares US Technology (IYW)

iShares US Technology (IYW)

While energy and utilities sectors were the winners over the first half of 2014, the technology sector is making a strong upward push and could challenge for leadership soon.

Strong earnings reports have boosted shares of some technology firms recently. Google (GOOG), IBM, Microsoft (MSFT) and Intel (INTC) are a few of the names that have performed very well in July. Microsoft and Intel are also experiencing major breakouts from the decade-plus period of technology doldrums. This could be the beginning of a much longer bull market cycle for some of these stocks.