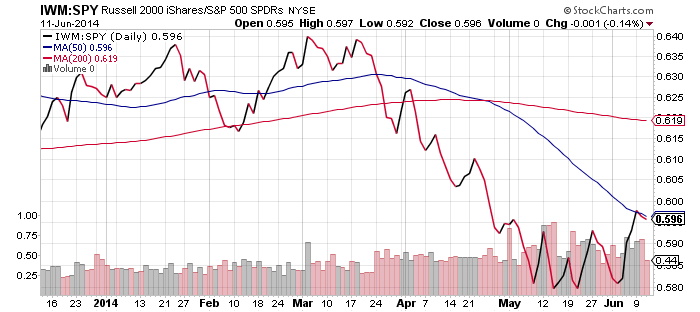

iShares Russell 2000 (IWM)

The iShares Russell 2000 Index has finally broken higher. The chart below is the price ratio of IWM to SPDR S&P 500 (SPY). When the line is rising, it means the Russell 2000 is outperforming the S&P 500; when it is declining it means the Russell 2000 is underperforming. Although the Russell 2000 bottomed in mid-May, it has only been over the past several trading days that the small-cap index has started to outperform the large-cap S&P 500.

There is still plenty of room for the Russell 2000 to rally. In order for this ratio to hit a new high for the year, the Russell 2000 would need to outperform the S&P 500 Index by 7 percent. Even if it cannot reach the earlier high from this year, solid gains are still likely.

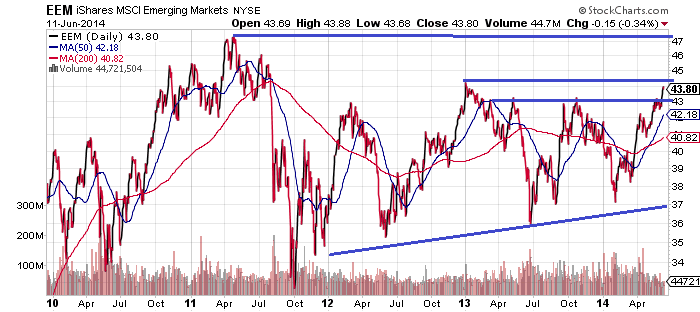

iShares MSCI Emerging Markets (EEM

Emerging markets have been staging a comeback of late. Although China remains stuck in a rut and concerns about the economy have not dissipated, India, Russia and Brazil have all experienced solid rallies. This has the emerging markets ETF trading at its highest level in over a year and on the verge of beating its high for 2013. Beyond that, a gain of approximately 10 percent would push it above its post-2008 high, and a bit more would push it to an all-time high. Emerging markets have spent a long time trending sideways, but economic growth has been solid in many countries. If a bull market does break out in emerging markets, it is likely to last for several years.

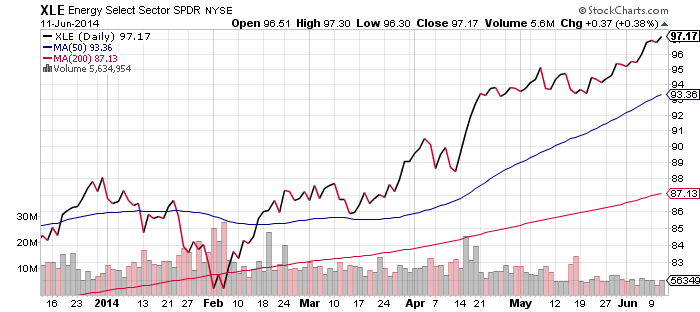

SPDR Energy (XLE)

We continue to keep an eye on the energy sector; it is one of the top three performing S&P 500 sectors in 2014 and it underlies some of the strength we are seeing in Brazilian and Russian shares. Energy shares pushed on to new all-time highs last week.

Oil prices spiked higher in overnight trading on news of the insurgent gains in Iraq. West Texas Intermediate Crude hit a new 2014 high above $105 a barrel. It still needs to climb above $115 to beat the post-2008 high though.

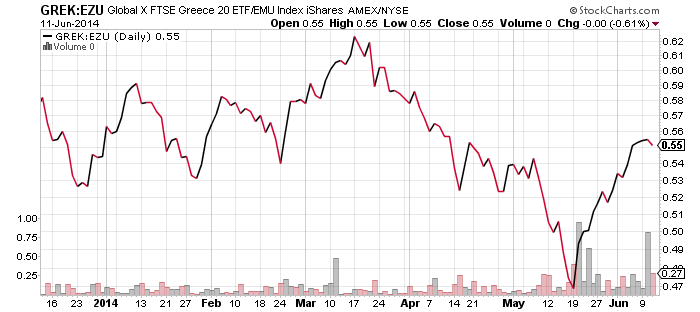

Global X Greece (GREK)

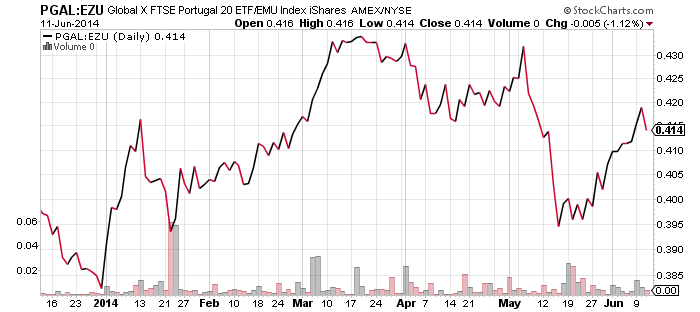

Global X Portugal (PGAL)

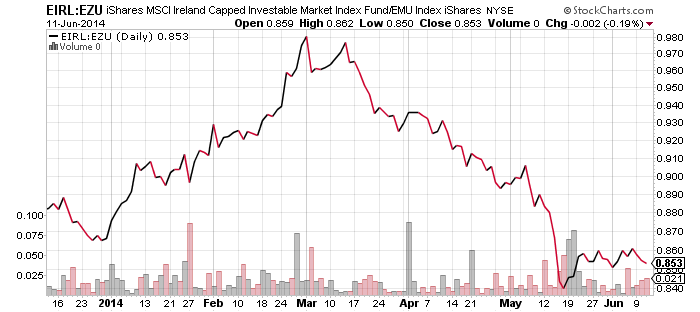

iShares Ireland (EIRL)

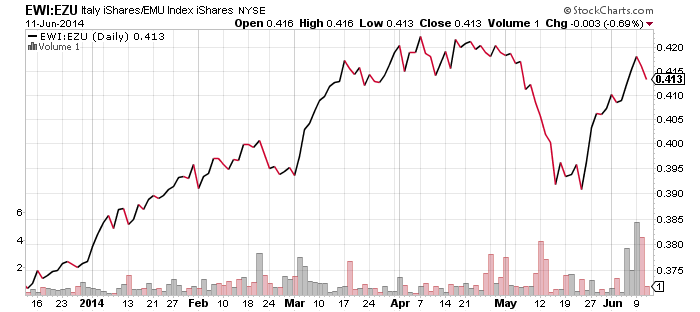

iShares Italy (EWI)

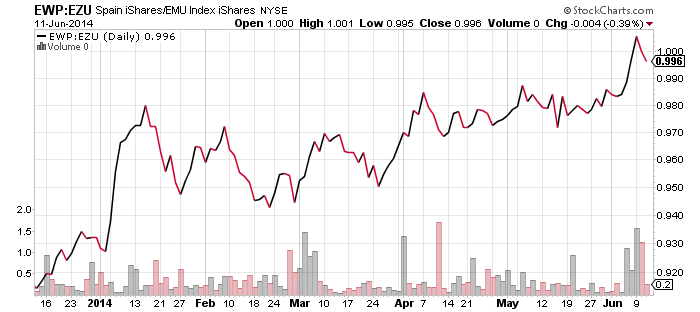

iShares Spain (EWP)

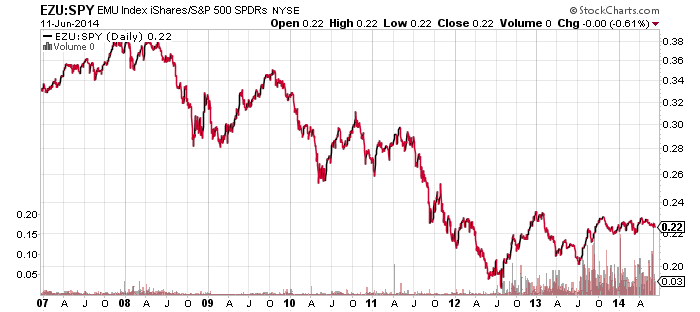

iShares EMU Index (EZU)

These five nations make up the PIIGS and are lumped together based on their large debt problems. Things have been improving though, and in our weekly Global Momentum Guide, four of these nation funds have spent time among the top 10 of the international funds we track. The fifth, PGAL, would also have been in the top 10, but since the fund has a short track record, it is not yet included in our rankings.

Among these five, Spain (EWP) has performed the best. This is not a surprise given that Spanish bond yields recently fell to their lowest level in more than 300 years, and currently yield less than U.S. Treasuries. It’s a remarkable turnaround for a nation that had struggled so mightily.

Finally, there is a chart of EZU versus the SPDR S&P 500 (SPY). It shows that the eurozone has underperformed the U.S. market continually since 2008. Last week, the European Central Bank cut the deposit rate at the ECB (for banks and governments that leave money with the central bank) to negative 0.10 percent. A quantitative easing policy is possible in the coming months as well. The U.S. markets outperformed since 2009, in part due to the U.S. policy of quantitative easing. With the U.S. winding down its easing and Europe potentially beginning a QE policy, perhaps the baton of stock market leadership is passing.