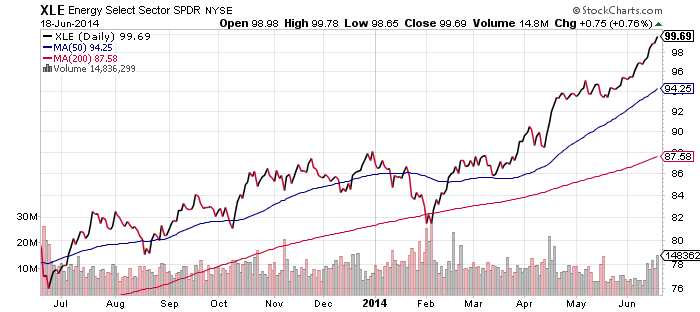

Below is the annual inflation rate as measured by MIT’s Billion Price Project which records the changes in billions of prices online. The chart shows that currently, BPP has inflation running at nearly 2.5 percent annually, above the government’s official Consumer Price Index (CPI) number. In 2010 there was a similar gap, which eventually closed in favor of the BPP number.

The BPP indicates more upward surprises like we saw this week, when the core CPI number came in higher than expected at 2 percent. The core number strips out energy and food, which are volatile month to month, but the increase in the CPI for May and BPP’s number are telling us inflation has spread from food and energy to the entire economy. General inflation may be coming back.

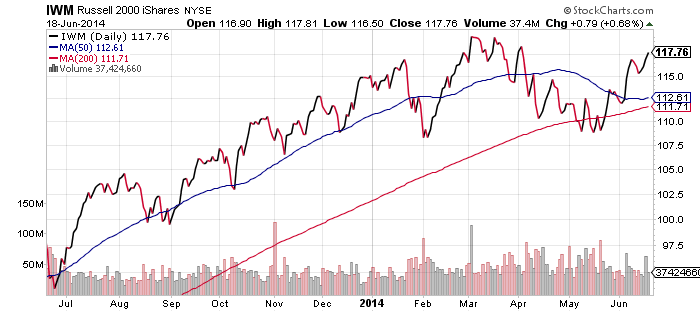

iShares Russell 2000 (IWM)

Should the Nasdaq achieve a small advance today, the Russell 2000 Index will be the only remaining major index below its all-time high. The index is likely to move higher, and if it gains a bit more than 2 percent, it will hit a new high and send bears scrambling. In other words, if the bullish action continues over the coming week, IWM could outperform the other indexes as shorts cover.

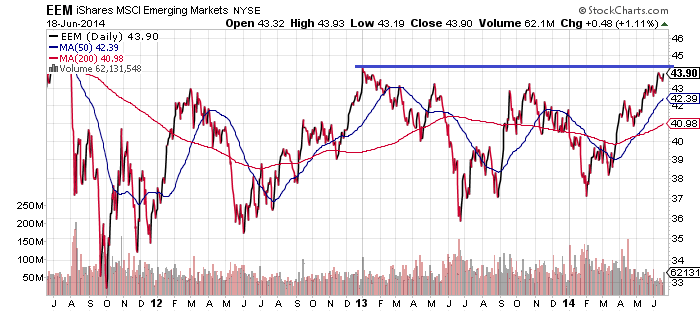

iShares MSCI Emerging Markets (EEM)

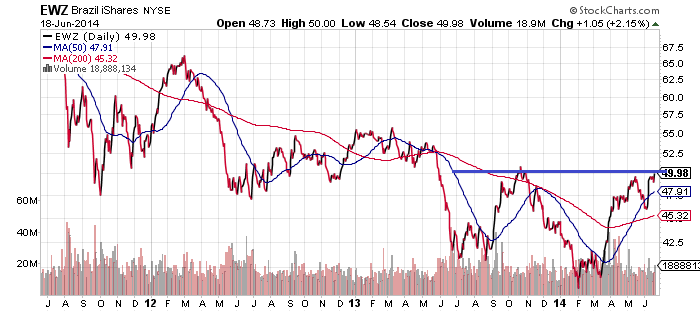

EEM is at a major resistance line and several individual country funds have similar charts. See Brazil (EWZ) below as an example. Yesterday’s Fed announcement caused a drop in the dollar and a rally in emerging markets, with EEM and EWZ both pushing up to their resistance lines again.

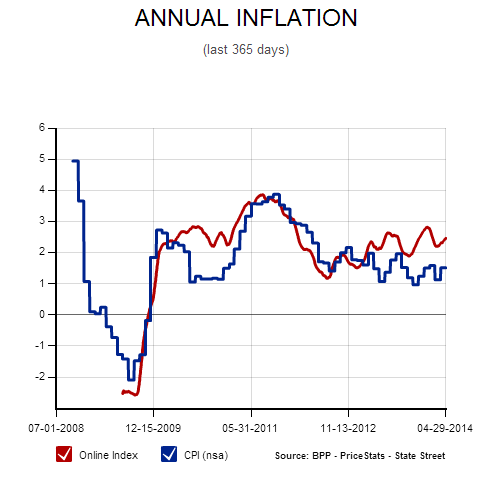

SPDR Energy (XLE)

Events in Iraq sent oil prices sharply higher at the end of last week. The S&P 500 Index is up slightly over the past 5 trading days, but energy ETFs have witnessed far larger gains. XLE added more than 2 percent, while SPDR Oil & Gas Exploration & Production (XOP) and First Trust ISE-Revere Natural Gas (FCG) both rallied more than 4 percent. We were looking for energy to be a potential market leader earlier this year. Thanks to inflation picking up, in addition to solid economic growth, it looks set to perform well going forward.