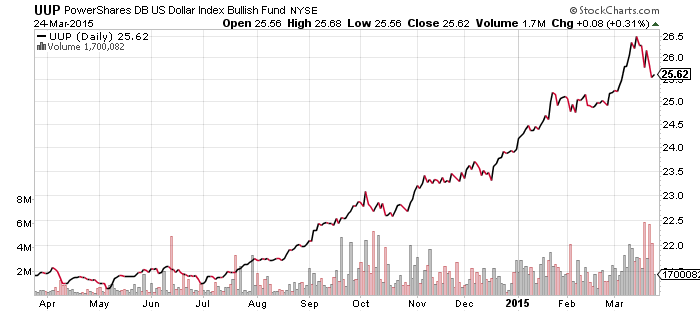

PowerShares U.S. Dollar Index Bullish Fund (UUP)

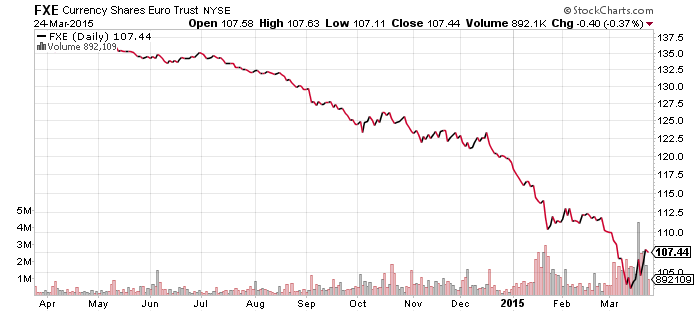

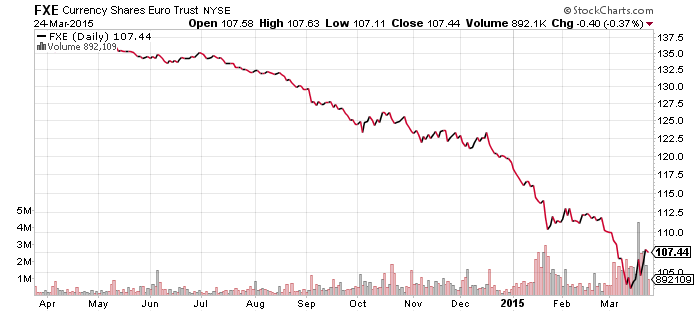

CurrencyShares Euro Trust (FXE)

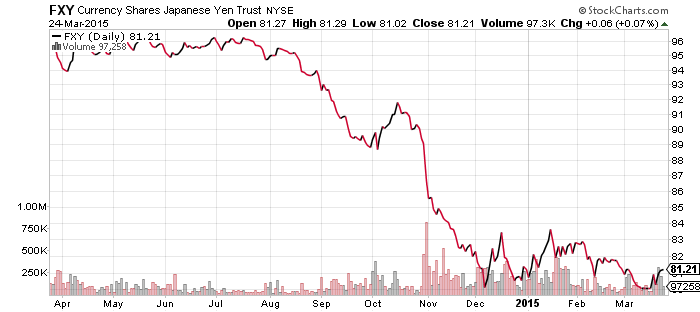

CurrencyShares Japanese Yen (FXY)

WisdomTree Dreyfus Emerging Currency (CEW)

The Federal Reserve’s dovish comments last week pushed back rate hike expectations. Speculators closed their dollar long positions and covered their foreign currency shorts, resulting in a sharp reversal across the currency markets. The largest rebound occurred in emerging market currencies, where even the Chinese yuan rallied sharply despite being a relatively strong currency over the past year. The euro rebound was meaningful, but it has not yet broken out of its long-term downtrend. The bounce in the yen is the smallest of all. FXY has been in a trading range between $80 and $83 since December. A broad reversal in the U.S. dollar is unlikely unless FXY climbs above $83.

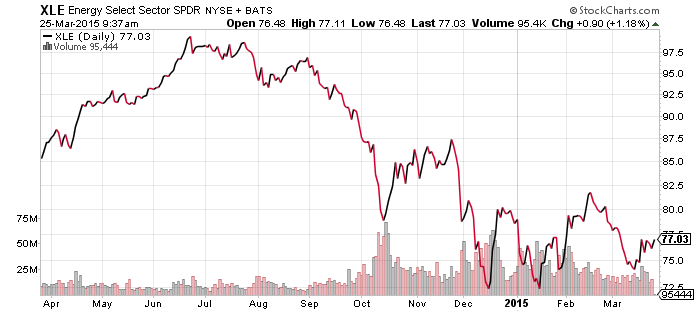

SPDR Energy (XLE)

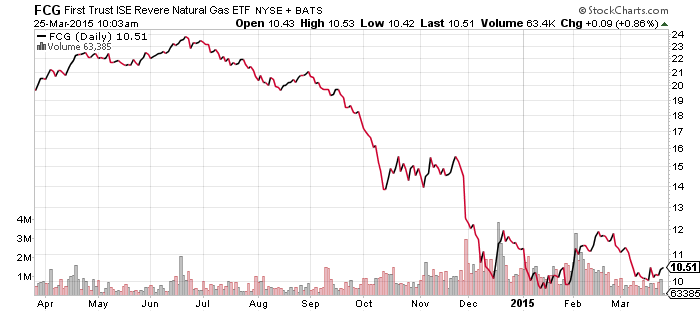

FirstTrust ISE Revere Natural Gas (FCG)

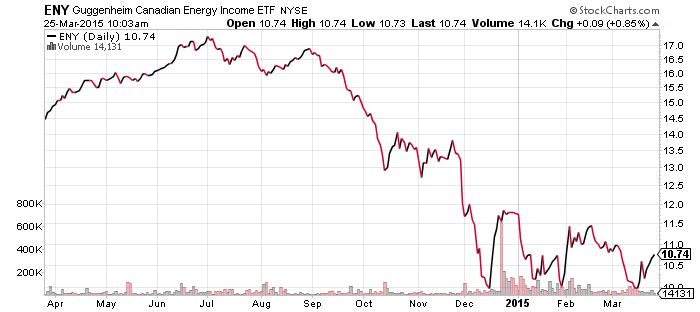

Guggenheim Canadian Energy Income (ENY)

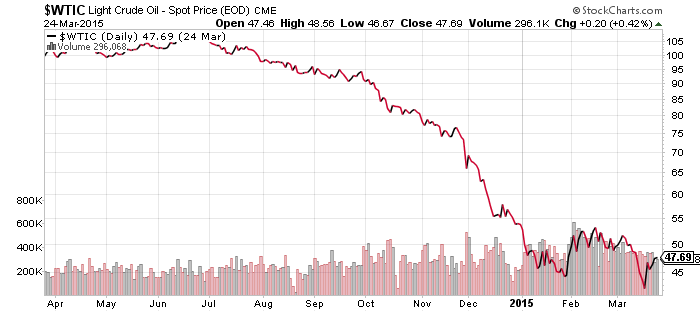

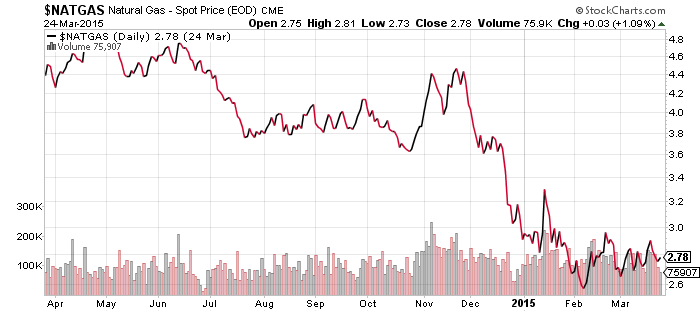

Oil prices rebounded along with foreign currencies, but the bounce has been muted by the continued climb in inventory and steady production. In the U.S., the American Petroleum Institute reported inventory growth of 4.8 million barrels last week. That’s down from the prior week’s increase of more than 10 million, but the pace of increase is still historically high. Even though rig counts are falling, the most productive rigs are still operating and it’s even possible that U.S. production will rise thanks to tax cuts in North Dakota that were triggered by low prices.

In China, low prices led to massive oil imports that filled existing strategic petroleum reserves. Construction of the reserve continues, but it may be several months before more inventory space is available, potentially ending the surge in Chinese imports. China may have also run out of space in January, since oil imports fell that month, and prices tumbled globally as a result.

Finally, the Saudis say they will not cut production unless non-OPEC countries do the same. However, Russia is in no condition to cut exports and the U.S. has almost no control over oil production in the short-term.

2016.

Investors in equities remain more bullish than commodities traders as both XLE and FCG have maintained their uptrends. However, optimism at this point isn’t high for the sector, providing upside potential for aggressive investors.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

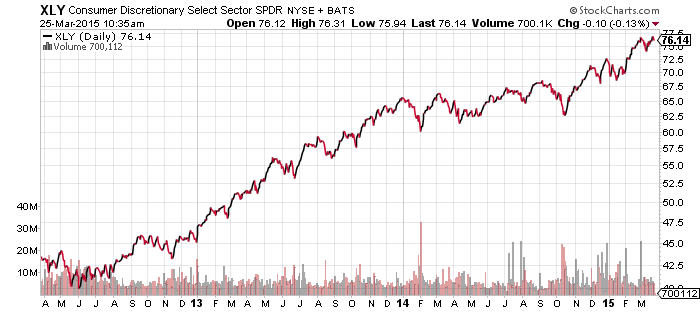

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

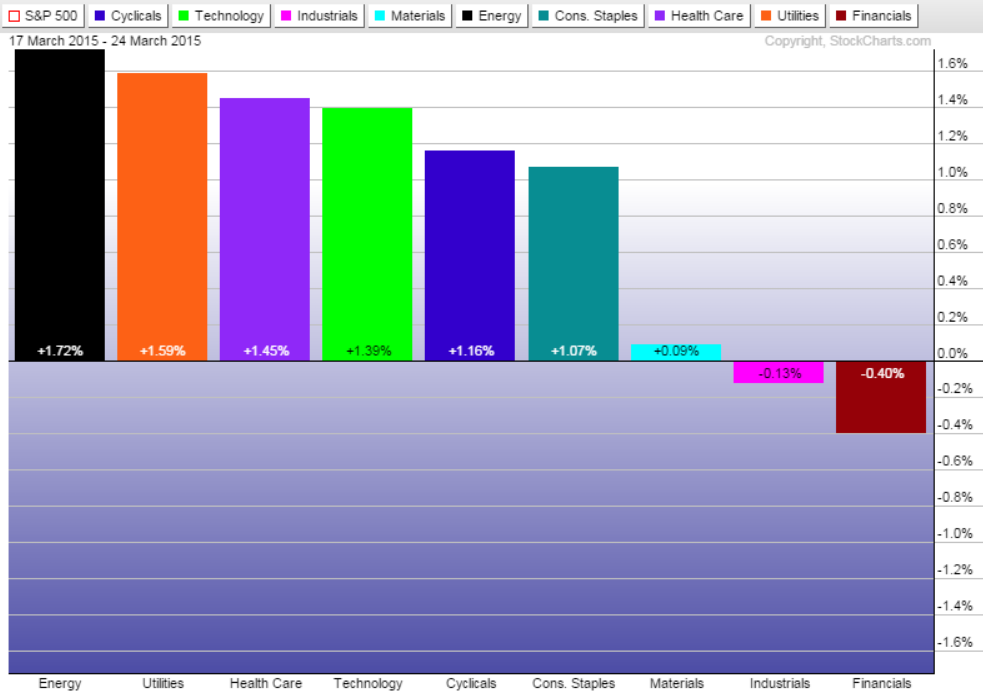

A number of equities rallied in the wake of the Fed’s policy statement, but the comments on the economy dinged the financial sector. Bank stocks climbed ahead of the Fed statement because higher interest rates are good news for banks who can lend at higher rates. In contrast to financials, the rate sensitive utilities sector rebounded after sliding ahead of the Fed’s meeting.

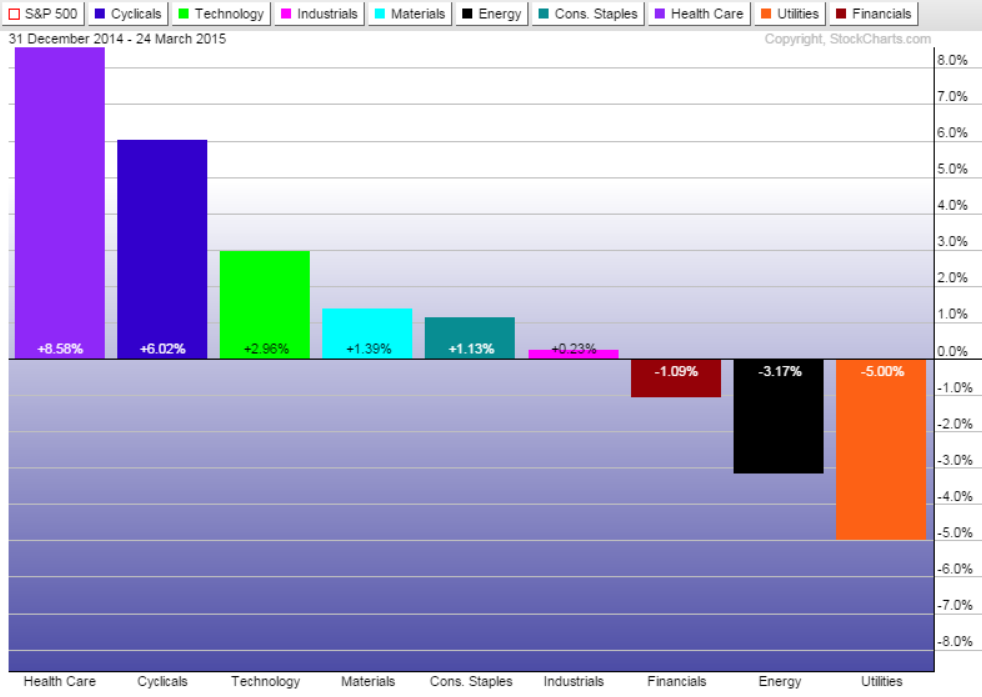

Year to date, healthcare is the best performing sector, with consumer cyclicals close behind. These two are largely responsible for the gains in the broader market indexes this year.

SPDR S&P 500 (SPY)

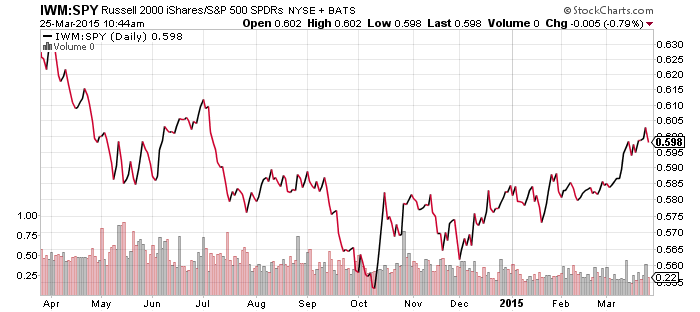

iShares Russell 2000 (IWM)

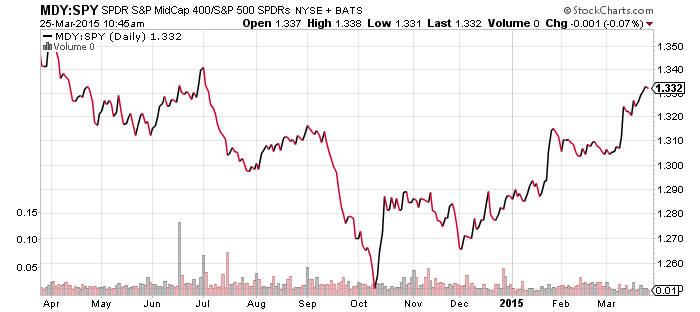

S&P Midcap 400 (MDY)

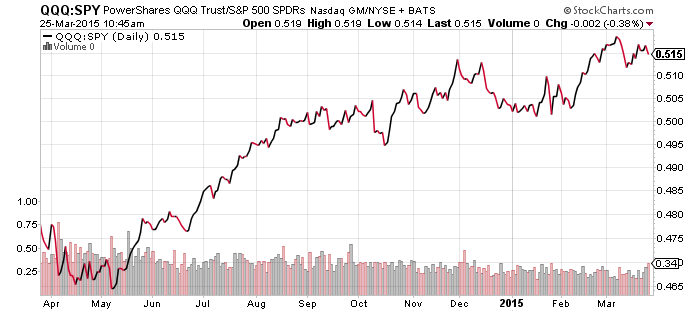

PowerShares QQQ (QQQ)

SPDR DJIA (DIA)

SPDR S&P 500 Large Cap Value (SPYV)

SPDR S&P 500 Large Cap Growth (SPYG)

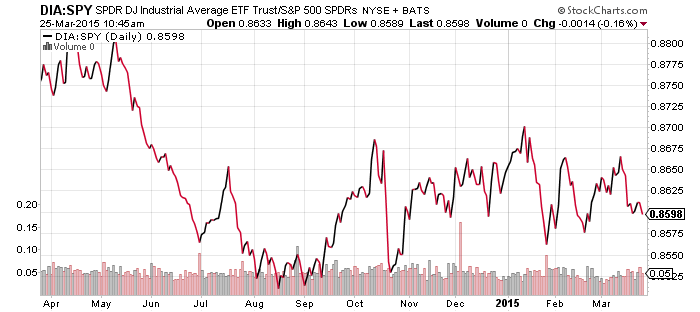

Small-caps continue to lead the market in 2015 which is a bullish sign for stocks. One explanation for small-cap strength is the strong U.S. dollar, but last week the dollar dropped and small caps continued to lead the market. Mid-caps continue to lead large caps as well.

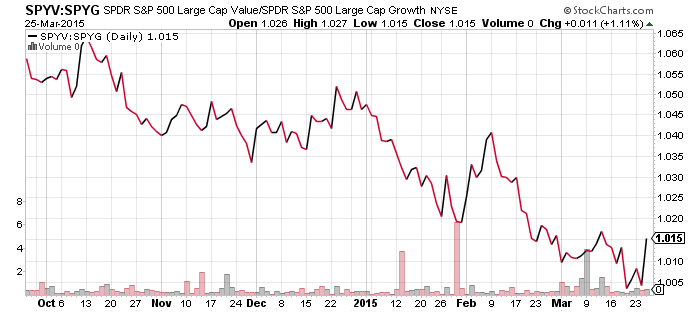

The technology and biotech heavy Nasdaq is starting to lose some steam relative to the S&P 500 Index. Technology lost ground in March and while biotech has been strong, it doesn’t carry enough weight in the index to drive performance. Relative performance since late August has been weak and it would not be surprising to see a change of leadership over the coming weeks and months as the market digests the possibility of higher interest rates.

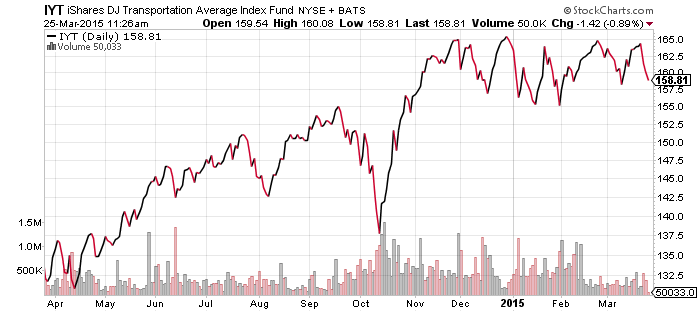

iShares Transportation Average (IYT)

IYT tumbled last week after Kansas Southern (KSU) said its earnings would be hit by falling oil prices. Transportation stocks often trend with oil prices because demand for transportation rises with economic activity. The drop in oil prices to date has not coincided with a plunge in economic activity, but IYT has traded sideways since oil prices began tumbling in November. Resistance is at $165 and a move above that level would be bullish. To the downside, a break of the $155 level would start a bearish move to below $150.

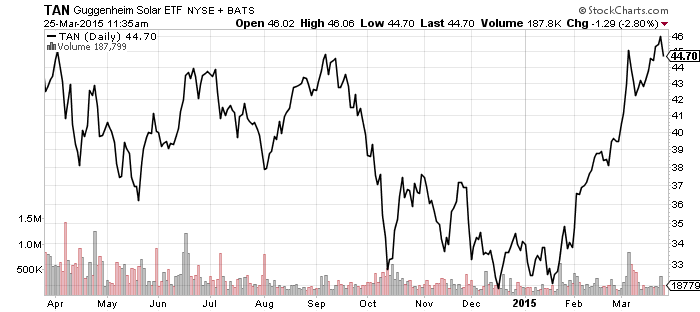

Guggenheim Solar (TAN)

Solar stocks have been on a tear since January, but a correction should begin over the coming days. Solar stocks are one of the riskiest market sectors. When spirits are running strong, solar stocks catch a bid and climb, and when investors turn cautious, solar stocks are dumped. Another asset that rises and falls with sentiment is bonds, with yields rising as investors turn more optimistic. Solar rallied along with interest rates since January, but over the past few weeks, a gap between interest rates and solar stocks has opened. Odds are solar stocks will take a breather following a nearly two-month uninterrupted rally.

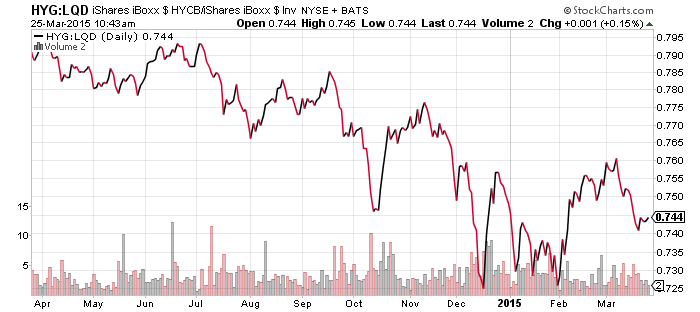

iShares iBoxx Investment Grade Corporate Bond (LQD)

iShares iBoxx High Yield Corporate Bond (HYG)

Finally, there hasn’t been shift in the trend between high yield and investment grade corporate bonds. Both HYG and LQD rallied thanks to falling interest rates.