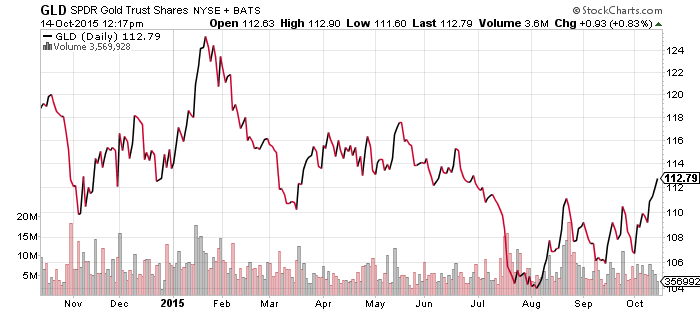

iShares MSCI Emerging Markets (EEM)

Emerging markets continue to warrant close attention. Shares enjoyed a strong rally over the first two weeks of October, with the momentum peaking on Friday. A pullback is likely as investors take profits. Chinese economic data was also weaker than expected, with imports down again in September, as well as both consumer and producer prices worse than anticipated.

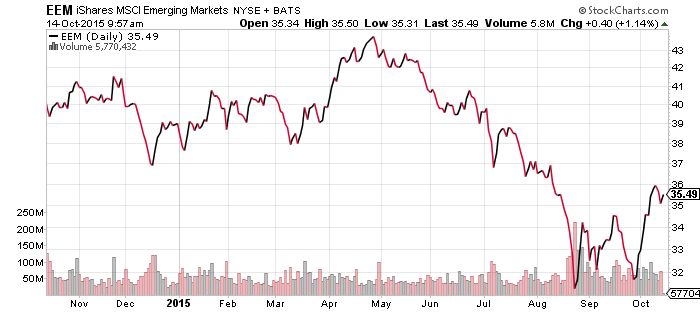

WisdomTree Chinese Yuan (CYB)

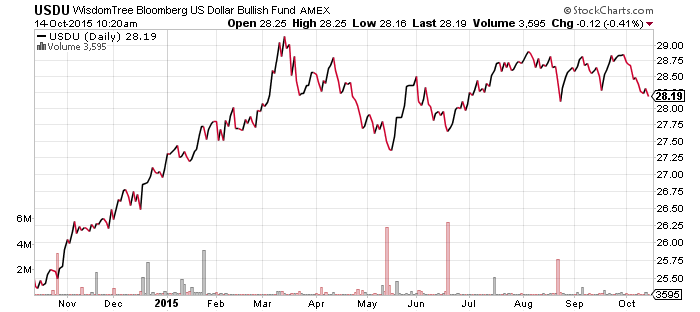

WisdomTree Bloomberg USD Bullish (USDU)

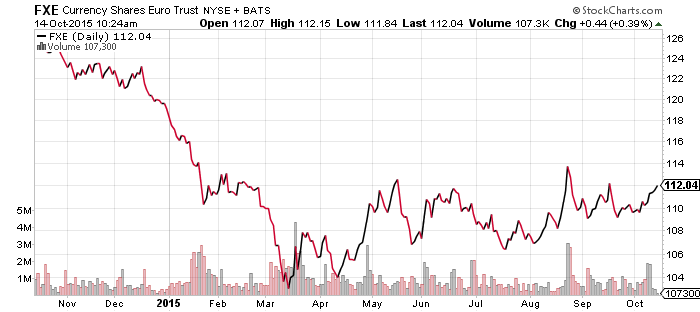

CurrencyShares Euro Trust (FXE)

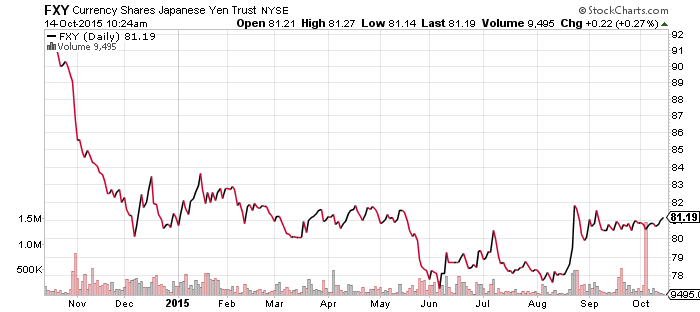

CurrencyShares Japanese Yen (FXY)

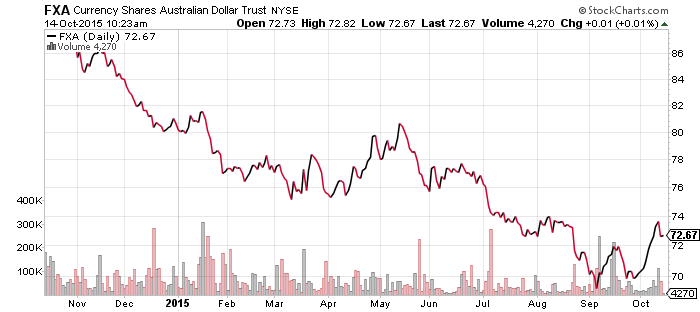

CurrencyShares Australian Dollar (FXA)

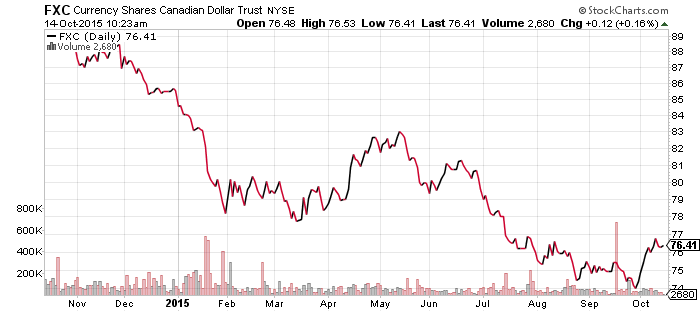

CurrencyShares Canadian Dollar (FXC)

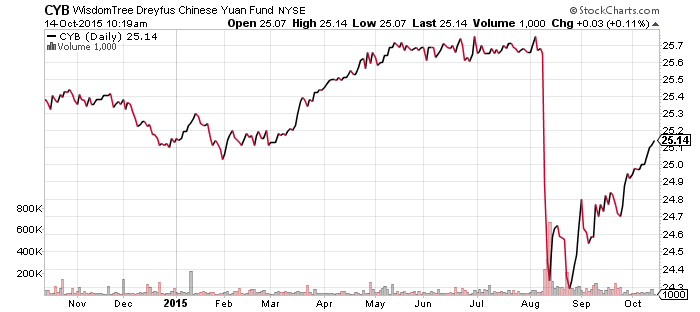

WisdomTree Emerging Market Currency (CEW)

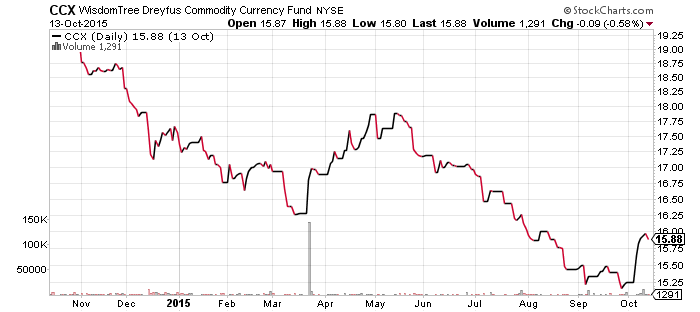

WisdomTree Commodity Currency (CCX)

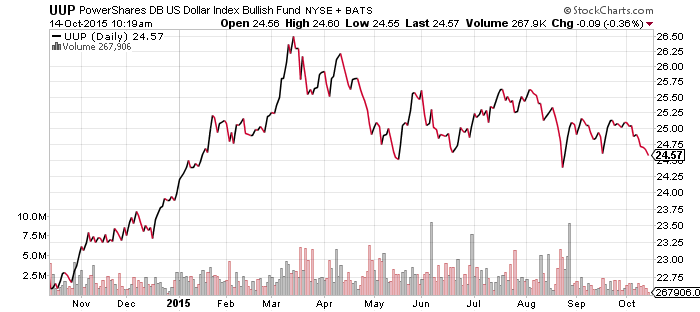

PowerShares DB U.S. Dollar Bullish Index (UUP)

Emerging market currency strength was behind the rally in equities, which was partially fueled by the rally in commodities. The Australian and Canadian dollars also benefited from the move in commodities.

U.S. dollar and euro will be of particular interest in the near-term. FXE and UUP are nearly mirror images of one another. The first few weeks of January notwithstanding, UUP is trading near its lowest levels in 2015, while FXE is near its highs. A break to the upside in the euro would be significant for global markets and likely spark further gains in commodities if the U.S. dollar weakens.

USDU, which has much less euro exposure than UUP, shows the dollar is still in an uptrend, but the series of higher lows since May was broken last week. USDU is approximately 3 percent above its May low, and about 3.5 percent below its March high.

USDU is the broader U.S. dollar index and the better signal as emerging markets rise as a share of the global economy. A break to a new low in UUP would not immediately signal a bearish turn for the dollar, but it would raise a red flag.

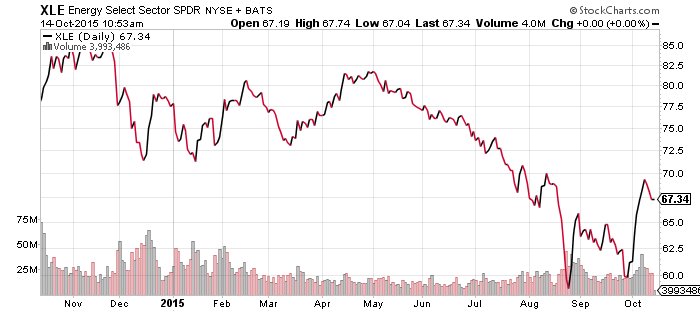

SPDR Energy (XLE)

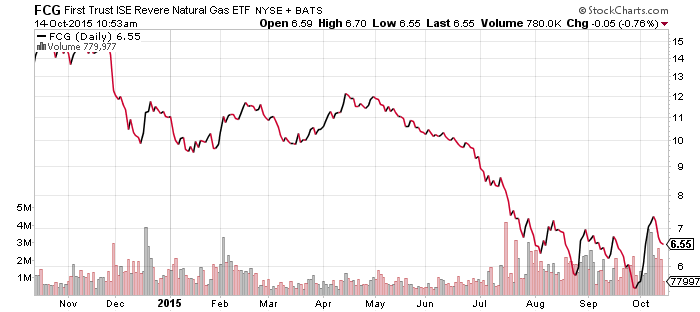

FirstTrust ISE Revere Natural Gas (FCG)

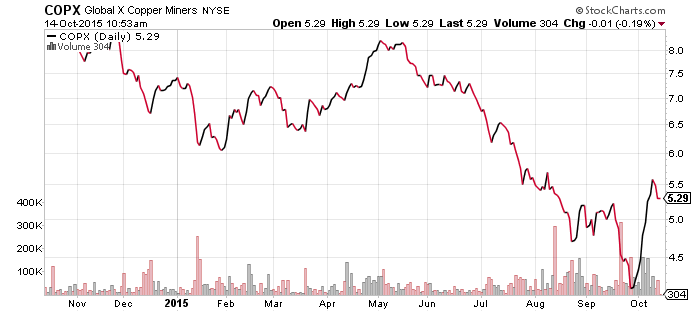

Global X Copper Miners (COPX)

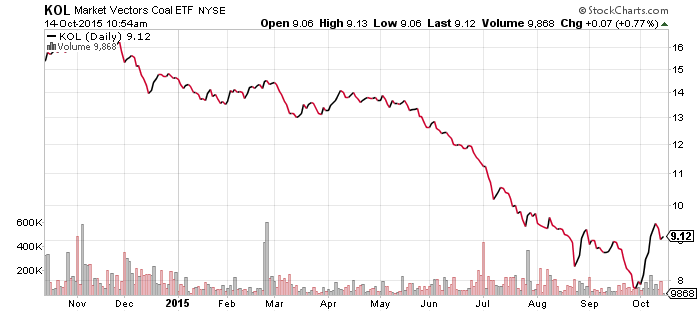

Market Vectors Coal (KOL)

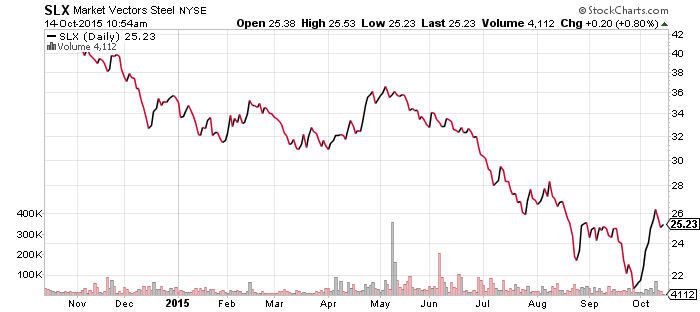

Market Vectors Steel (SLX)

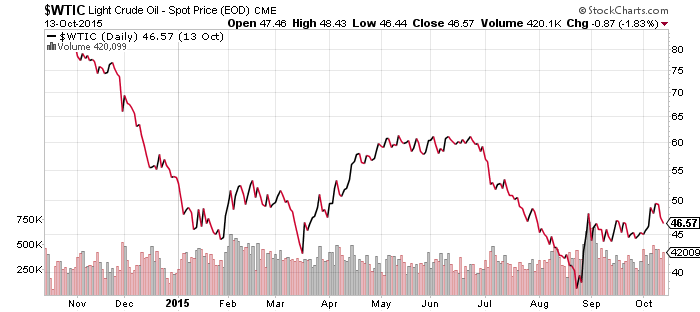

Last week’s rally in oil ran out of steam after hitting the $50 level, pulling back into the high $40s. The $45 level remains the key to watch because it held as a level of support throughout September. As the previous two sections show, whichever direction oil takes is also likely to be the direction of emerging market and natural resource exporter currencies, as well as emerging market equities.

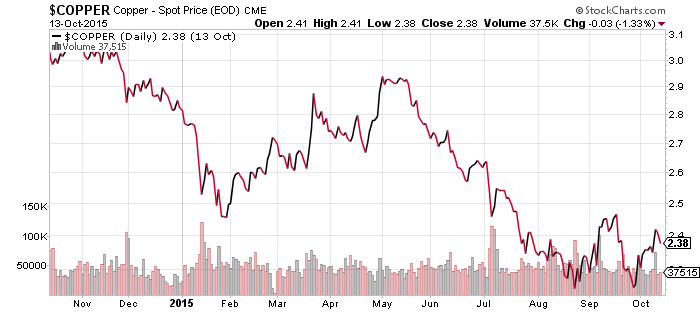

Copper, coal and steel producers saw a smaller pullback, but these sectors have all been performing worse than energy. An upturn in oil could pull these commodities higher, in which case they could rebound more sharply due to prior underperformance. China, however, continues to cloud these sectors and has a far larger impact on the markets for copper, steel and coal coke than it does on the oil market.

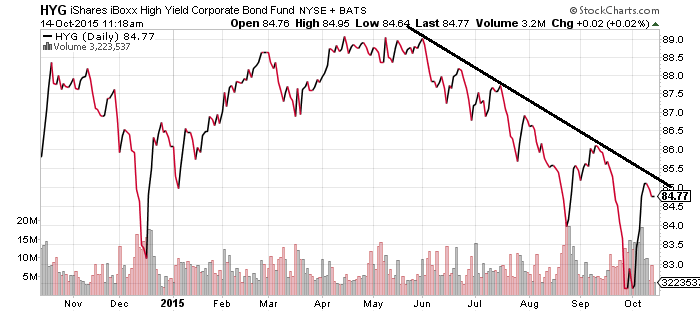

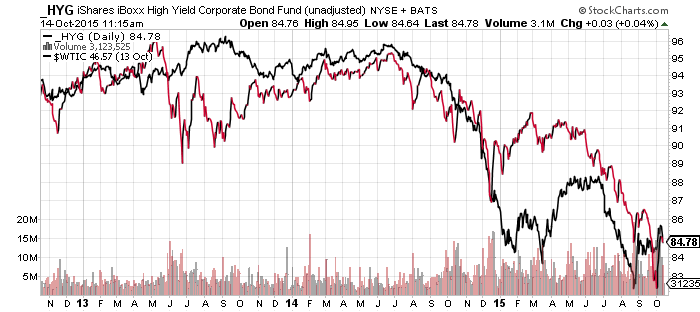

iShares iBoxx High Yield Corporate Bond (HYG)

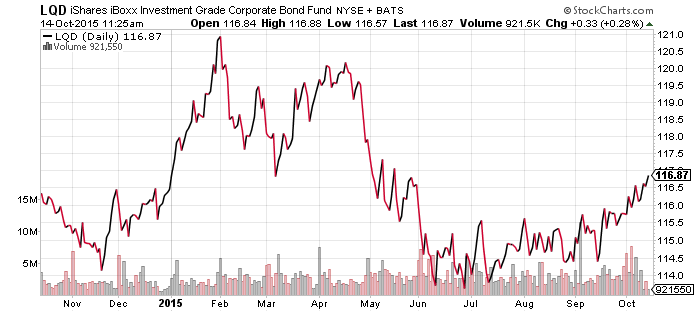

iShares iBoxx Investment Grade Corporate Bond (LQD)

Many of the emerging market, commodity and currency charts indicate healthy rebounds, but aside from UUP and a few others, most could rise or fall a few percentage points without significant repercussions. This is not the case with high-yield bonds, which rallied back to their resistance lines that marked the latest decline.

Weak oil prices that caused high-yield to weaken and many shale oil drillers are taking advantage of low interest rates. They issued high-yield bonds to fund operations, but did not expect oil prices to fall to multi-year lows.

Altogether, the outlook is quite good for the commodity markets from high-yield bonds. If commodity prices rebound, high-yield will quickly break its downtrend and start rallying back as bankruptcy fears fade.

Investment-grade bond prices continue to increase, in part due to credit quality, but mainly due to falling interest rates.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

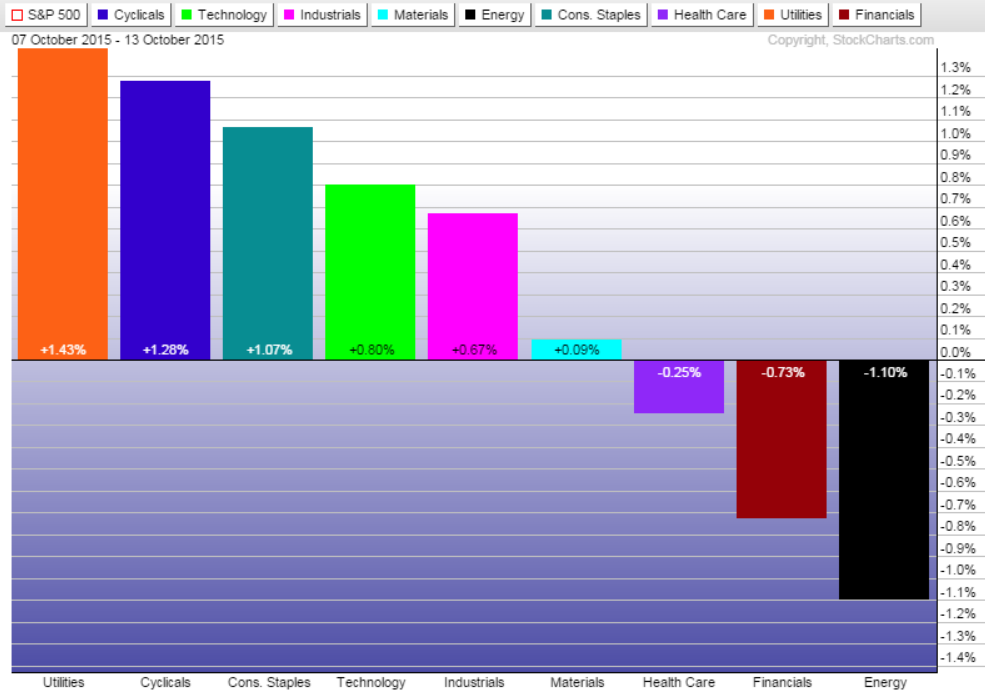

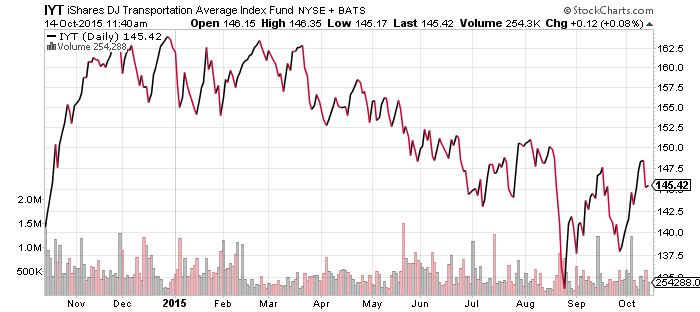

The S&P 500 Index gained ground over the past week, lifted by consumer staples, consumer discretionary and technology, though defensive utilities sector was the best performer due to lower interest rates. Those falling rates weighed on financials, while biotechnology continued to drag on healthcare. Transportation stocks are still in a downtrend, but the pace of decline has slowed as a result of a rebound in some railroad stocks.

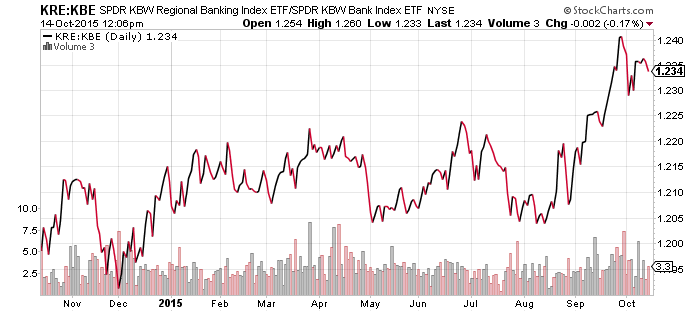

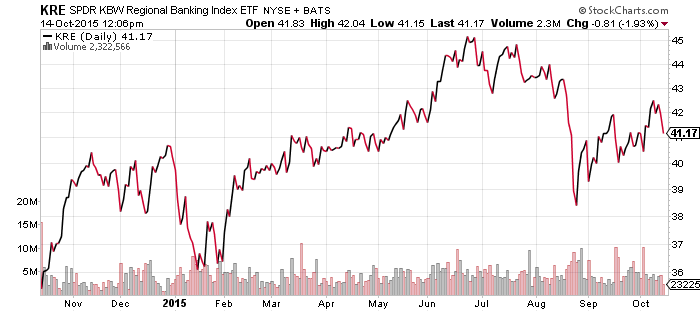

Banking shares slipped with last week’s falling interest rates. The Federal Reserve minutes were interpreted as dovish and comments made by other Fed officials have caused speculators to push back the timing of a Fed rate hike. Odds of a hike are not expected to exceed 50 percent until April 2016. Speculators could change their minds quickly, but this is related to the bounce in commodity prices, particularly gold. The market is beginning to believe monetary policy will be much softer for longer than expected, due mainly to foreign central banks easing policies. Investors are still shifting towards financials, but delayed rate hikes will postpone a bullish breakout for the sector.

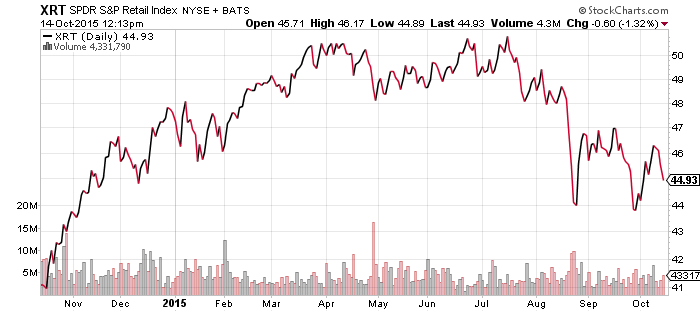

Retail came under pressure on Wednesday after Wal-Mart (WMT) warned earnings that would decline as much as 12 percent over the coming year. The strong U.S. dollar is having an impact, but the big hit came from wage hikes.

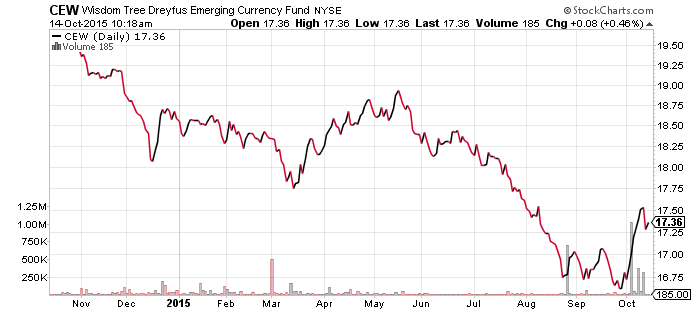

SPDR Gold Shares (GLD)

While commodities pulled back in the past few days, gold has moved higher and made a short-term bullish breakout. Weakness in China’s economy has investors expecting more stimulus there, including easier monetary policy that would add depreciation pressure to the Chinese yuan. The rise in gold reflects firming sentiment about the impact of China’s slowdown in China on the Fed to delay in rate hikes well into 2016.