The major stock indexes are sitting near their all-time highs to begin the week, including for the first time in 15 years, the Nasdaq. Earnings season is all but finished and investors will begin shifting their focus away from 2014 and focus on first quarter 2015 results.

This year is starting off much like last year, when first quarter data disappointed before recovering strongly later in the year. Current estimates for first quarter GDP growth have been coming down based on the data out thus far and this week’s data will go a long way to confirming or refuting the trend. Personal income, consumer spending, factory orders, construction spending and the trade deficit for January will be released. Vehicle sales and unemployment for February will also come out.

Over the weekend, China cut interest rates, joining more than a dozen other central banks that have cut interest rates this year. The cut comes ahead of two weeks of national meetings that will serve to announce the next phase of economic reforms. Another easing by the central bank is possible after the meetings finish in two weeks.

The immediate impact from the Chinese rate cut was a weaker yuan, which pulled emerging market currencies lower versus the U.S. dollar. The key currency for the dollar remains the euro though, and it bounced on Monday after falling near its 52-week lows last week. A rebound in the euro is long overdue, as it has been unable rally for nearly five weeks now.

Only 15 S&P 500 companies haven’t reported earnings yet, and several of them are in the retail sector. Best Buy (BBY), Costco (COST), Kroger (KR), Staples (SPLS) and Abercrombie (ANF) are among the big retail names reporting this week. 3D printing firm Stratasys (SSYS) also reports.

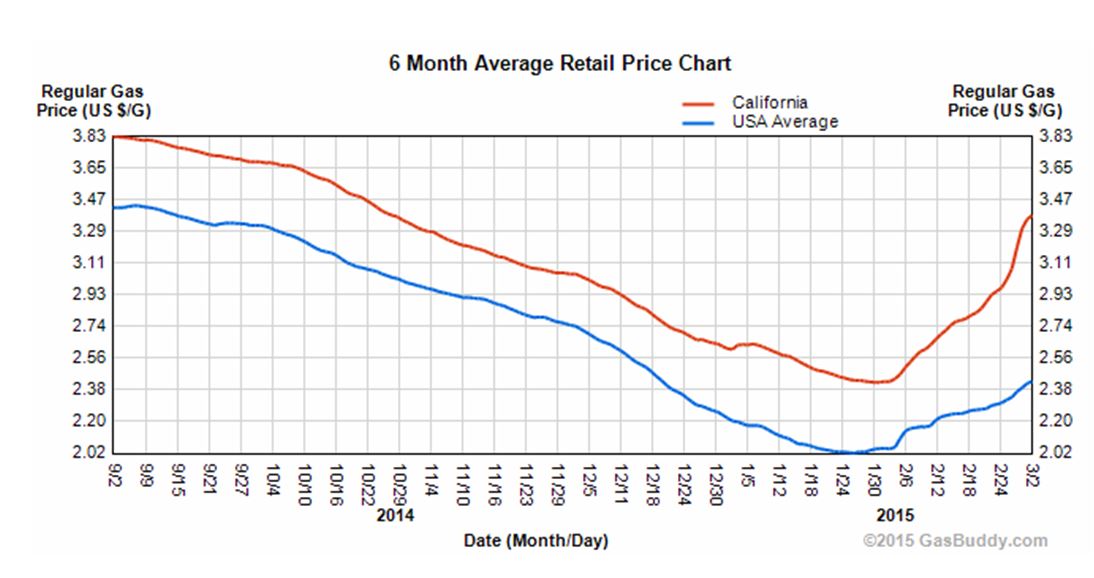

One area we’ll be keeping an eye on this week is the price of gas. Due to a confluence of events, including a strike, explosion and maintenance repairs, more than 20 percent of U.S. refinery capacity is currently offline. The result is rocketing gas prices, particularly in California. That state has stricter environmental standards and cannot import gasoline from other states, which makes the drop in supply more acute. In California, gas prices are back at levels last seen in October, when we first started seeing serious change in consumer behavior, with truck and SUV sales jumping. We will be watching to see if the price spike causes behavior to shift back to cheaper and more efficient economy cars.