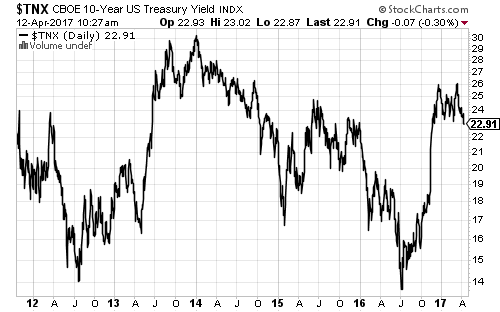

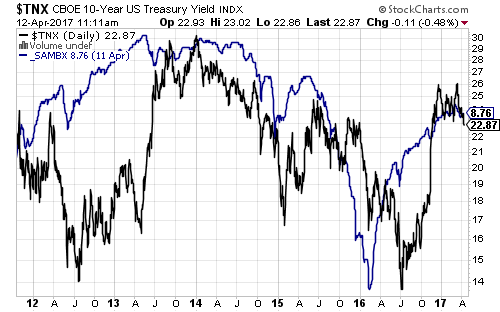

The 10-year Treasury yield slipped slightly below 2.3 percent.

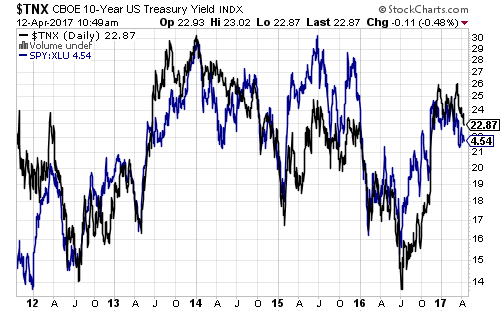

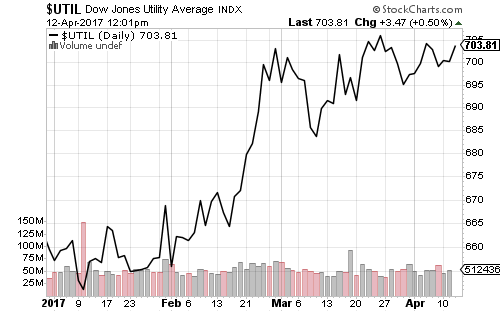

Longer-term, if bonds slide back into a trading range, it will have important implications for rate-sensitive sectors, such as utilities. The relative performance of SPDR S&P 500 (SPY) versus SPDR Utilities (XLU) matches up closely with the 10-year Treasury yield.

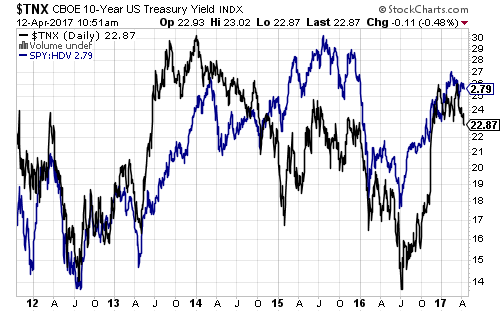

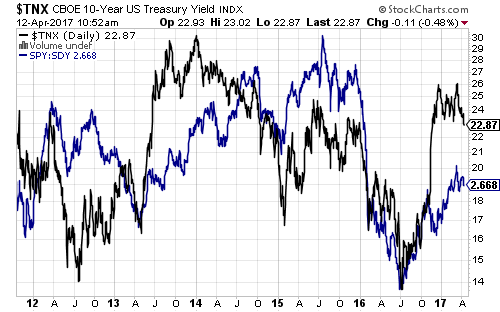

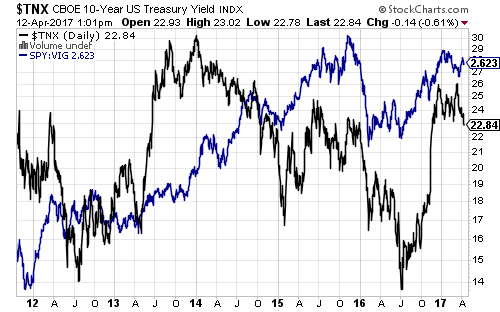

The implication for dividend funds is less clear. Higher yielding dividend funds, such as iShares Core High Dividend (HDV) and SPDR S&P Dividend (SDY), have tended to outperform the S&P 500 when rates fall, but the signal is not as strong as it is with utilities and real estate. Dividend growth funds such as Vanguard Dividend Appreciation (VIG) show even less correlation.

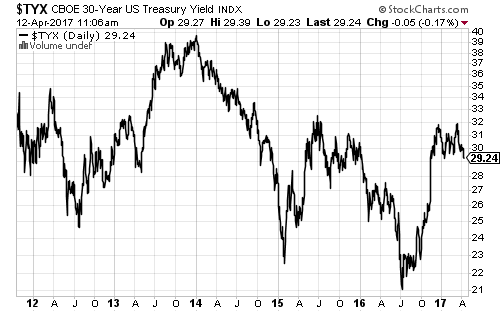

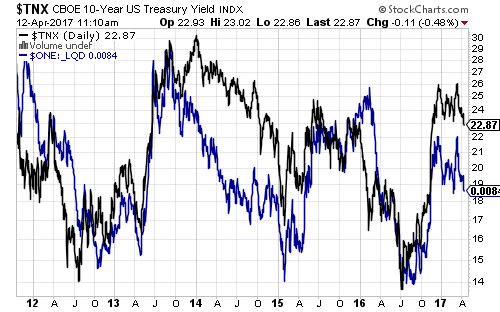

Falling yields will boost prices on longer-term bond funds. The first chart below shows the 10-year Treasury yield versus iShares iBoxx Investment Grade Bond (LQD) inverted. Also, dividends are stripped out to show only the fluctuation in the underlying bond portfolio.

In contrast, floating-rate funds follow interest rates higher and tend to be relatively immune from long-term interest rates. From 2014-2016, falling oil prices increased credit risk in the market, pulling many higher-yielding bonds with it, regardless of energy exposure. Given the lack of credit risk in the market today, floating-rate funds should hold steady even if long-term interest rates continue dipping.

Thompson Bond (THOPX) also performs well through rate fluctuations.

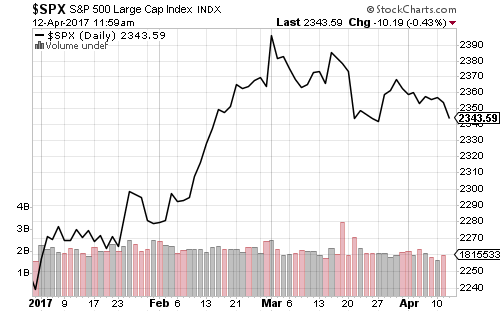

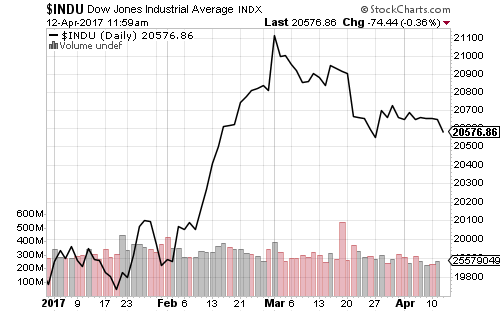

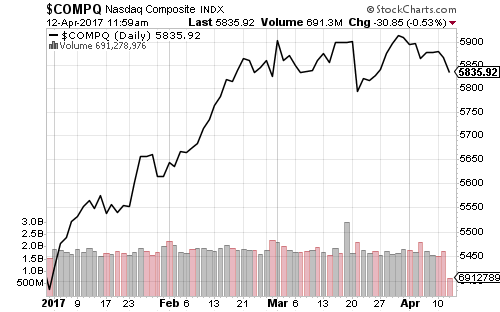

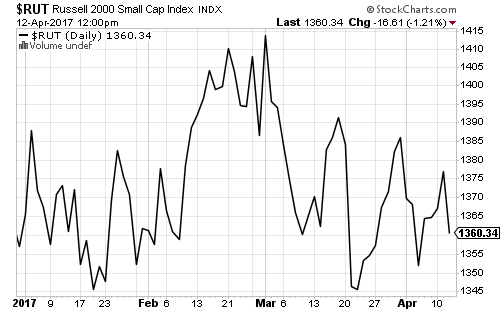

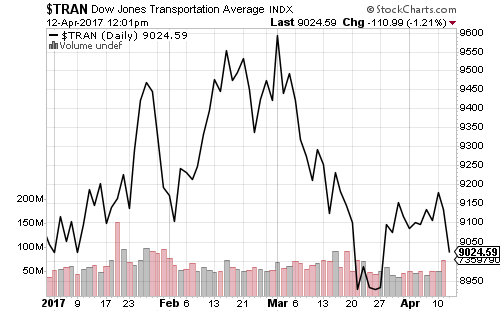

The year-to-date index charts reflect consolidating gains from February’s big run-up. The Russell 2000 is the only exception with flat YTD performance. The Dow Jones Utilities Index is pushing towards a new high, consistent with the dip in interest rates. The Dow Transports are down slightly for the year, hurt by UPS and trucking shares.

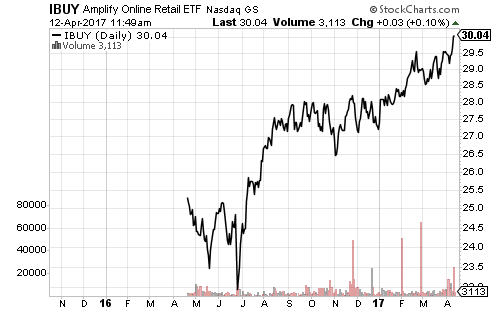

Brick-and-mortar retailers have been closing stores at a healthy clip over the past year, but the SPDR S&P Retail (XRT) fund managed to rally for most of 2016. The fund recently broke its uptrend and shares hit the underside of this trendline, however, which has now become resistance.

Retailers with physical locations are losing business to online competition. An ETF launched in 2016, Amplify Online Retail (IBUY) shows the contrast. Shares of this fund are at a new all-time high.

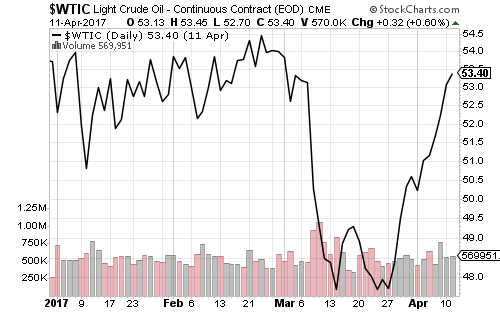

West Texas Intermediate crude oil stormed back to $53 a barrel in the past week, completely reversing its losses from early March.

The U.S. Dollar Index climbed above 101 in the past week before slipping. It remains in a clear short-term downtrend.

A weaker euro lifted the dollar last week.

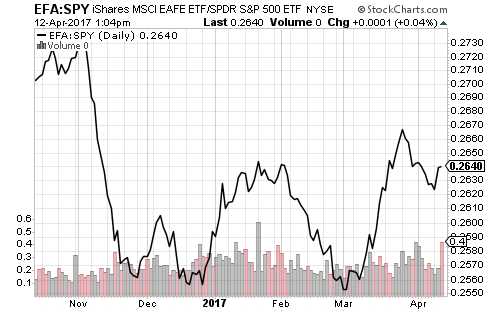

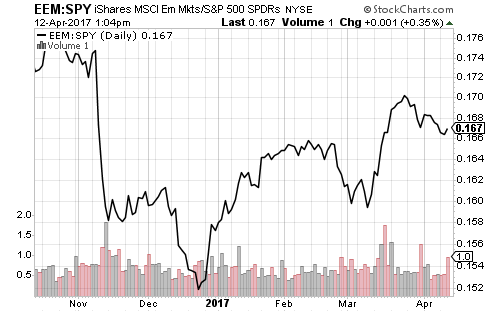

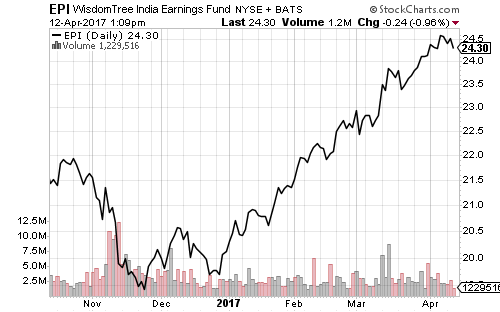

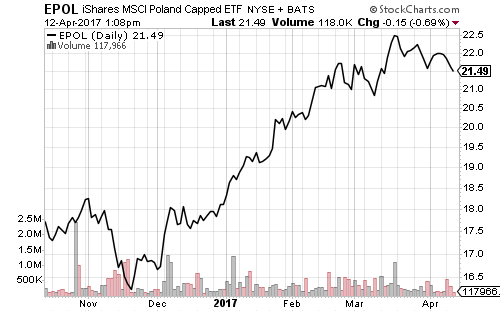

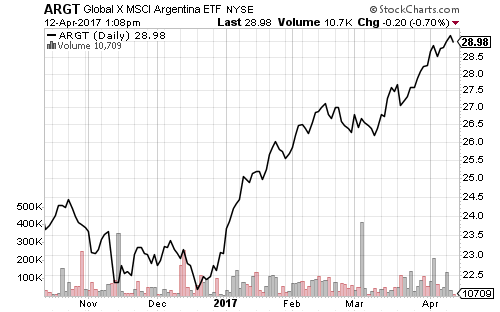

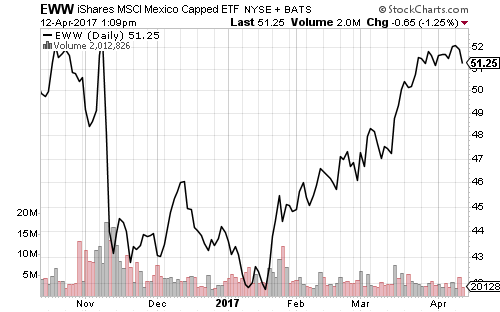

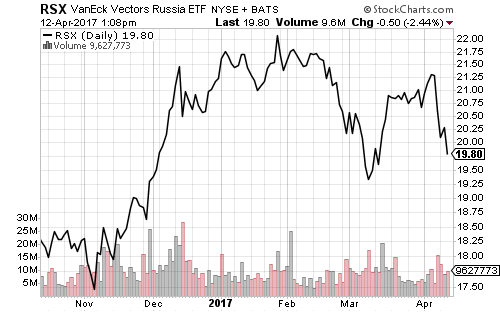

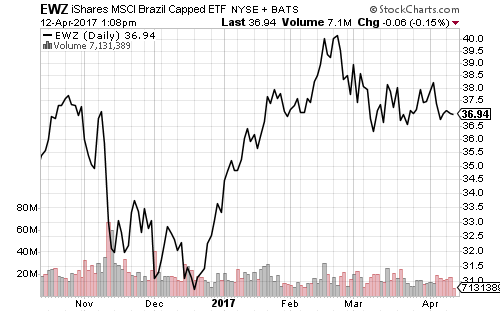

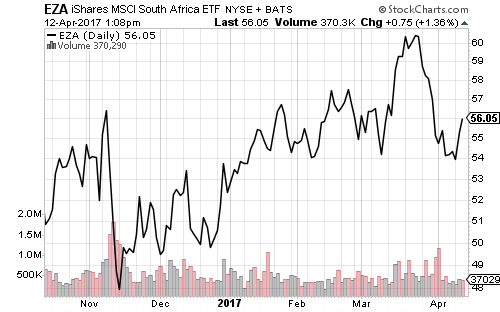

Foreign stock markets outperformed the domestic market in the first quarter, aided by the weaker U.S. dollar. Emerging markets are performing better than developed markets, with individual countries such as Poland, India, Argentina and Mexico among the best performers. Emerging markets linked to commodity exports, such as Russia and Brazil, lag.