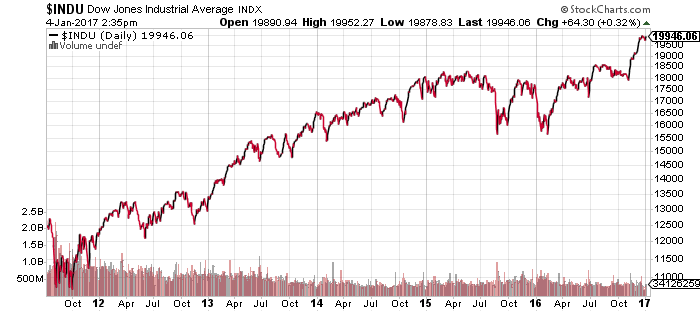

The Dow Jones Industrial Average climbed to 19,942 on Wednesday, edging to within 0.3 percent of the important 20,000 level. All the major indexes are in record territory.

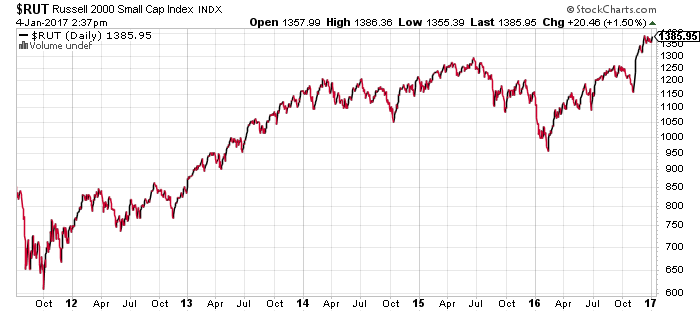

The Dow hit 18,000 in late 2014 and spent nearly 2 years in a trading range before a powerful post-election upside breakout. The Russell 2000 spent almost 3 years in a trading range prior to Election Day and has since rallied more than 20 percent.

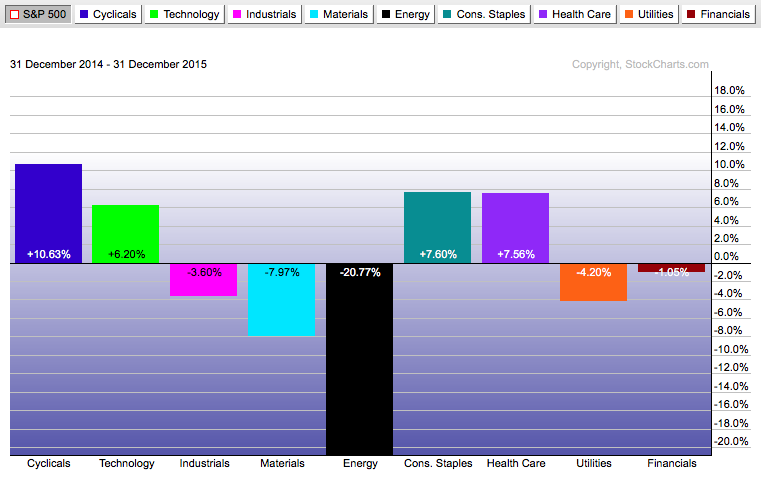

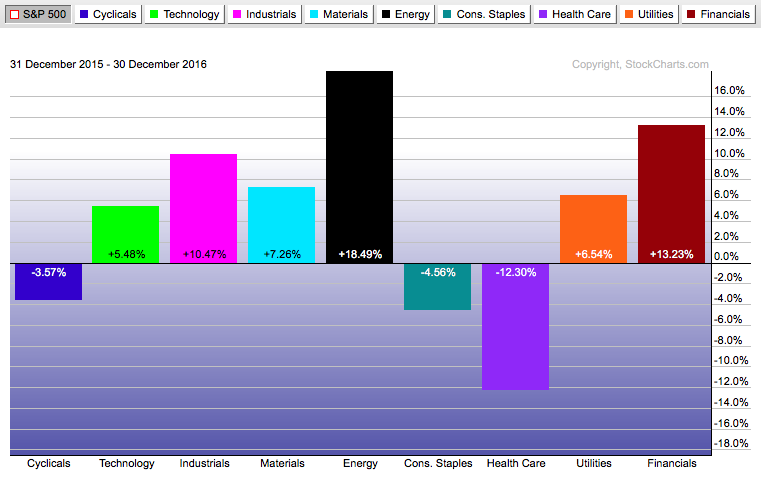

The two charts below compare sector performance in 2015 and 2016 relative to the S&P 500 Index. Energy, materials, financials, utilities, and industrials were the worst performers in 2015. In 2016, they were the best performers. Looking ahead to 2017, healthcare, consumer staples and consumer discretionary (cyclicals) are all candidates for outperformance.

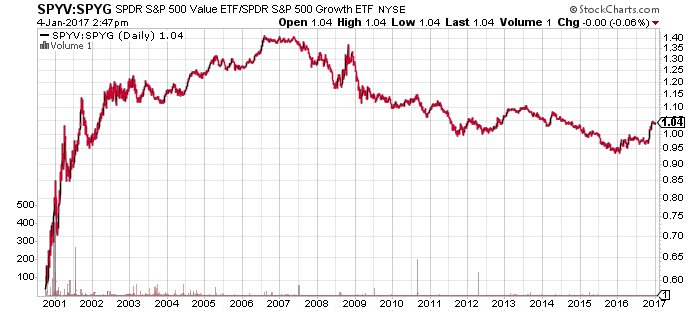

The SPDR S&P 500 Value (SPYV) and Growth (SPYG) price ratio chart reflects value’s dominance from 2000 to 2007 during a period of strength in utilities, financials, and industrials. Led by the decline in financials, value underperformed growth all the way until early 2016, when growth started showing signs of weakness. Value started outperforming, but didn’t really break out until after Election Day, when financials and industrials led the market higher.

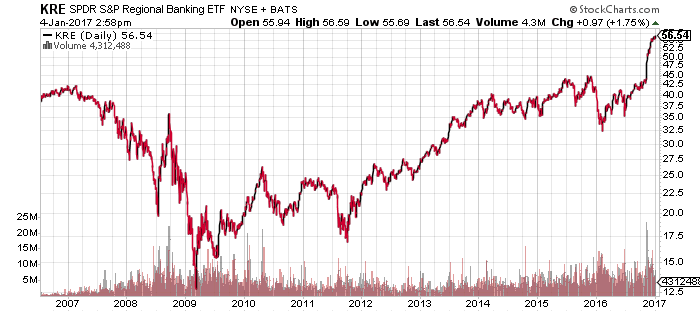

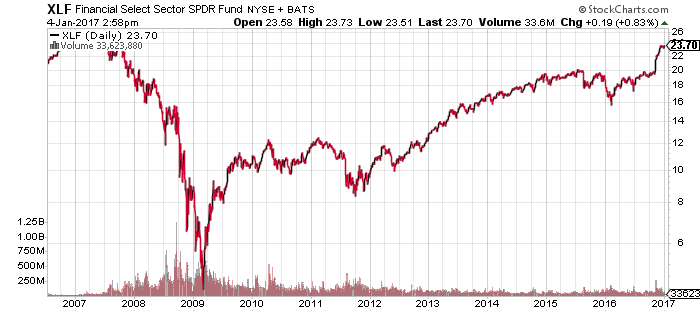

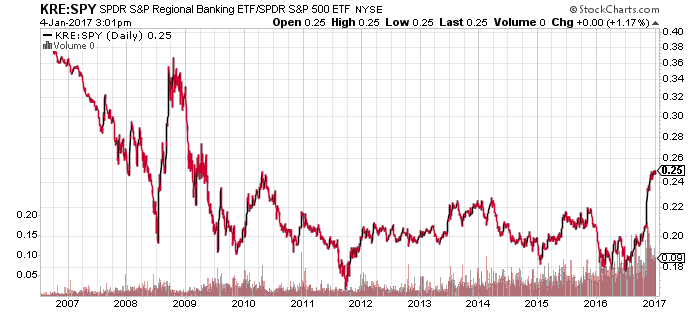

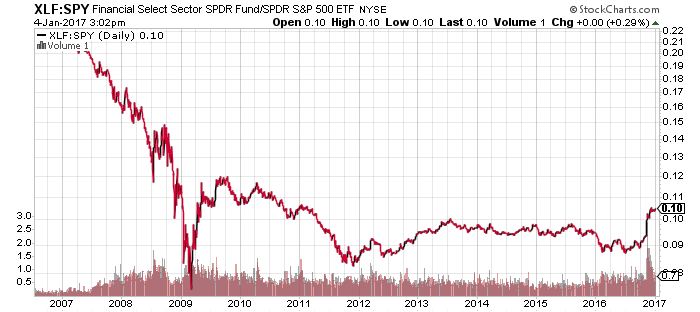

The long-term financials chart, as measured by SPDR Financials (XLF), has yet to break out to a new high. A comparison with the S&P 500 Index also shows that from 2008 through 2016, financials were in a trading range relative to the S&P 500 Index. Even after the recent spike, financials are far from being over-valued

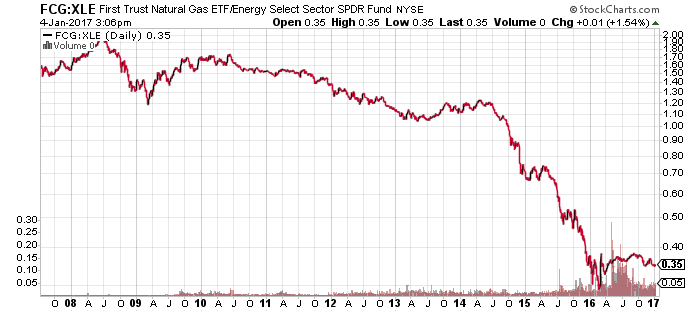

Other sectors that could benefit from a shift in 2017 include natural gas and solar. The first chart shows the relative performance of First Trust Natural Gas (FCG) against SPDR Energy (XLE).

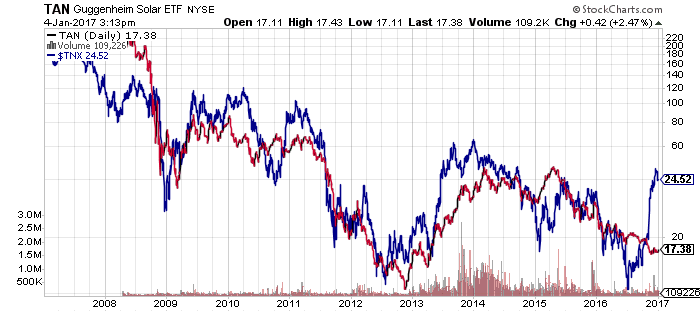

Solar suffered amid falling interest rates and low energy prices. If rates remain elevated, or climb higher still in 2017, odds are solar will eventually follow.

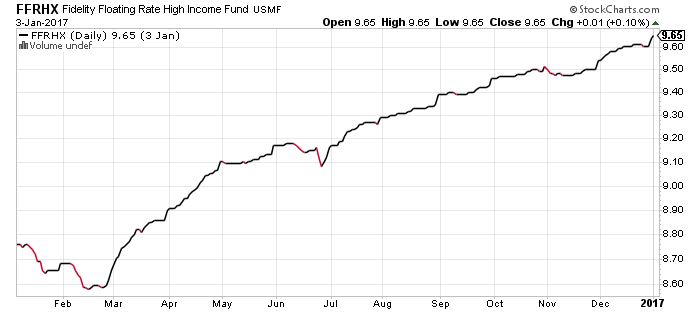

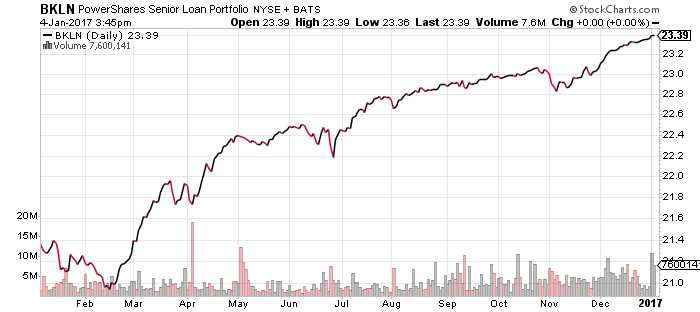

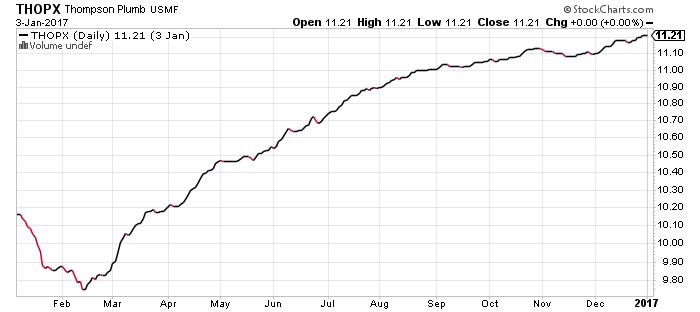

If the Fed follows through on rate hikes, floating rate funds will perform well in 2017. Fidelity Floating Rate High Income (FFRHX), PowerShares Senior Loan Portfolio (BKLN) and RidgeWorth Seix Floating Rate High Income (SAMBX) remain among the best options. If economic growth picks up as well, high-yield bonds will benefit from falling credit risk. Thompson Bond (THOPX), Fidelity High Yield (SPHIX) and iShares iBoxx High Yield Corporate Bond (HYG) should also provide investors with solid gains.

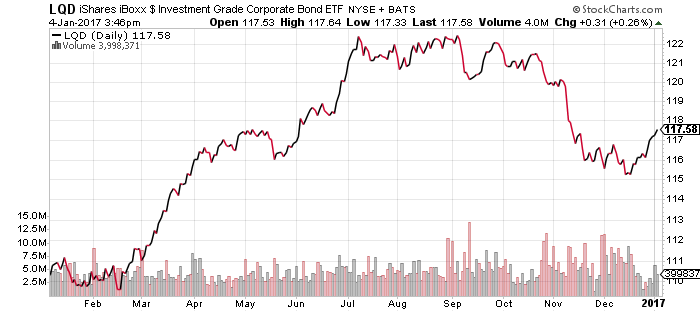

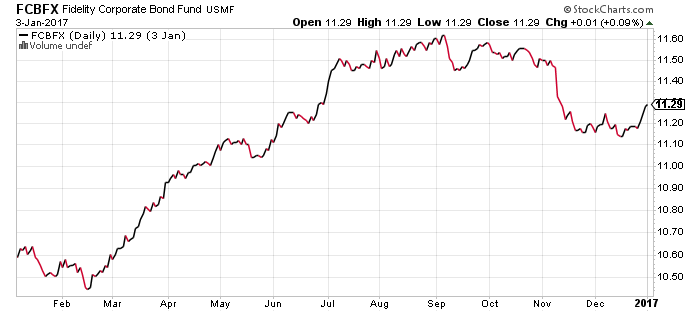

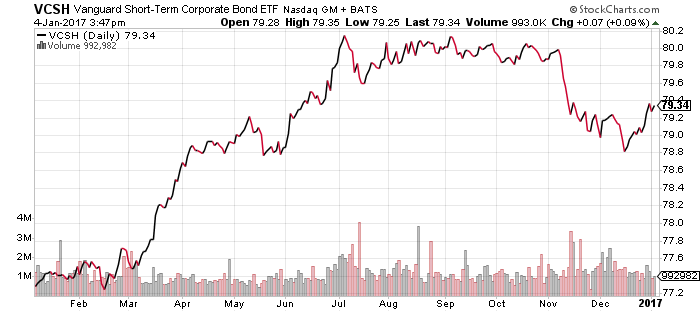

Corporate and investment grade bond funds are less certain. Short-term interest rates are likely to rise, but it doesn’t follow that long-term rates will continue their rapid ascent. If they do rise, it will be a headwind for corporate and investment-grade bonds, and an even larger headwind for long-term Treasuries.

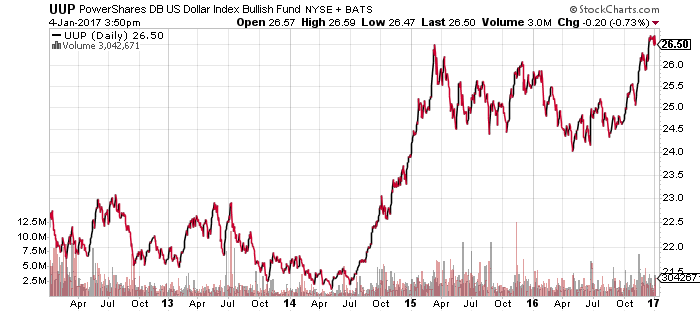

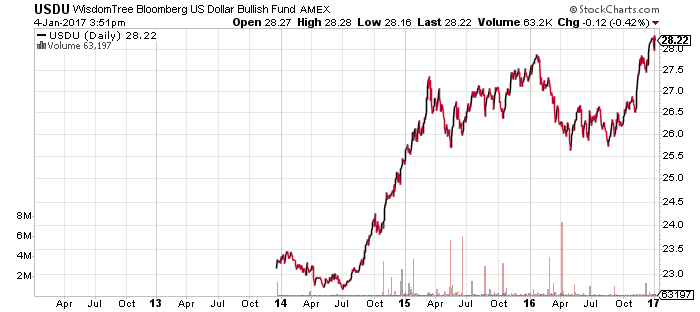

WisdomTree US Dollar Bullish (USDU)

PowerShares DB US Dollar Bullish (UUP)

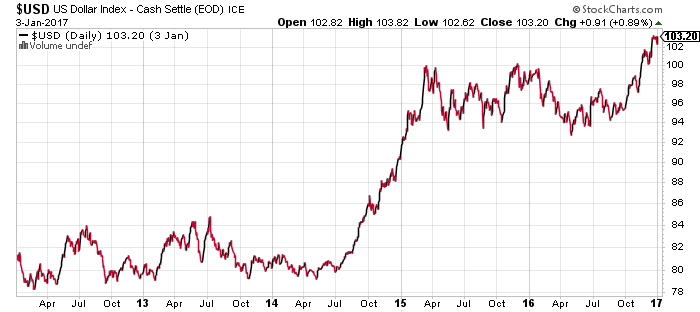

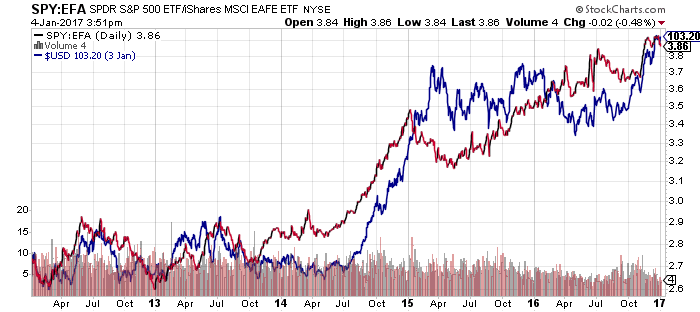

International funds generally underperformed U.S. markets in 2016. There were pockets of strength in commodity-exporting economies such as Brazil and Russia, but overall international lagged in the face of a stronger dollar. As the chart comparing SPDR S&P 500 (SPY) to iShares MSCI EAFE (EFA) shows, relative performance matches up very closely with the U.S. dollar. Higher interest rates, stronger economic growth and potential renegotiation of trade deals are all positives for the dollar if they materialize in 2017.