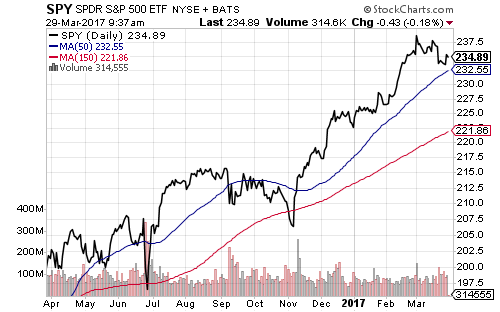

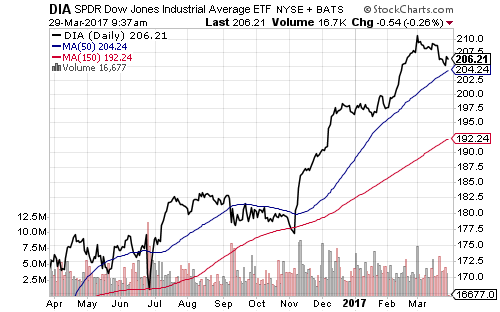

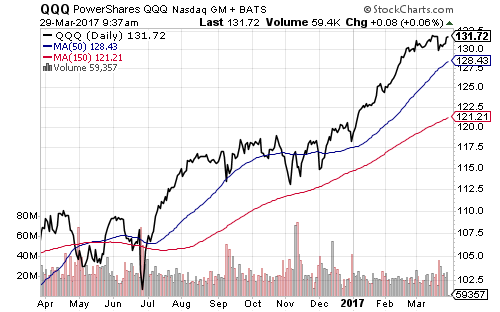

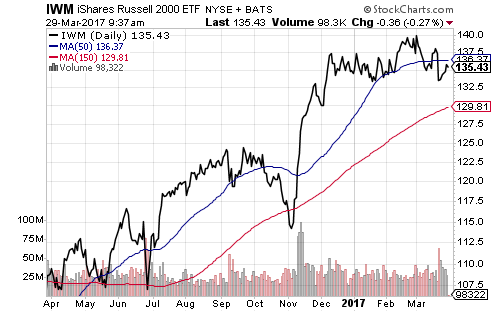

The Dow Jones Industrial Average and S&P 500 Index both bounced off 50-day moving averages over the past week, while the Nasdaq’s 50-day MA continues to climb. The Russell 2000 has remained in a trading range since December and has slipped below its 50-day MA.

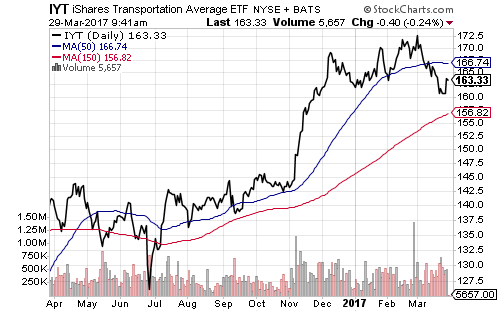

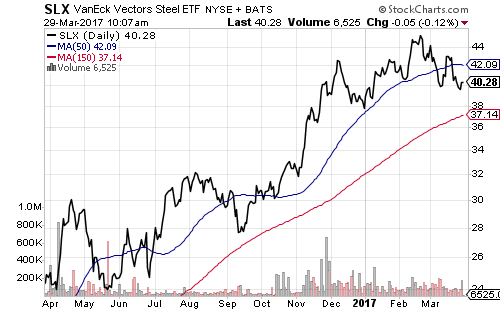

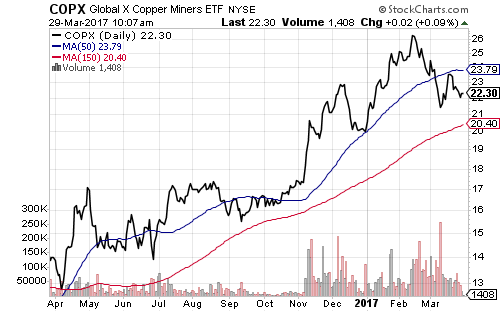

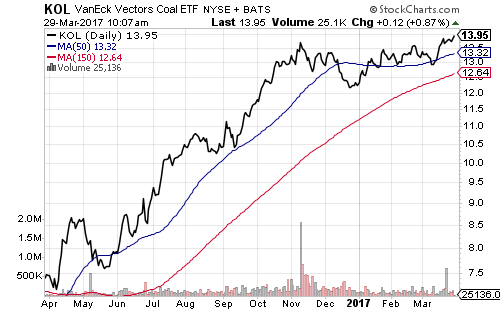

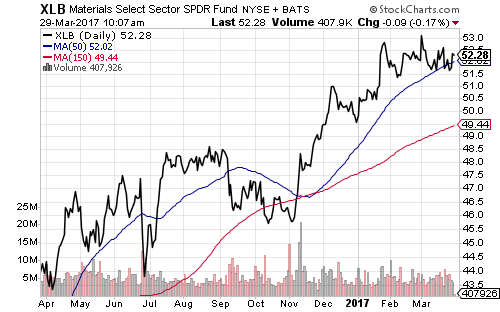

There are pockets of weakness in some commodity and related sectors. iShares U.S. Transportation (IYT) dipped below its 50-day MA. Steel producers and copper miners also slipped below support levels. VanEck Coal (KOL) broke out to a new 52-week high following President Trump’s rollback of anti-coal regulations. The broader materials sector tracked by SPDR Materials (XLB) shows the sector remains in a general uptrend.

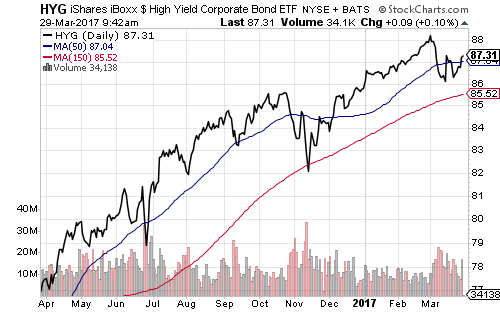

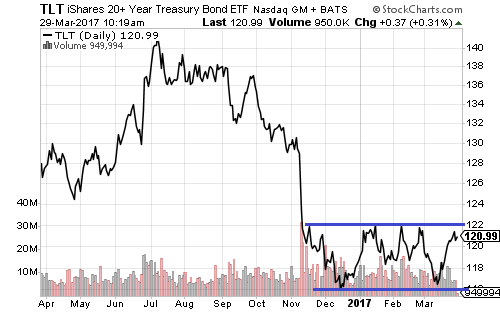

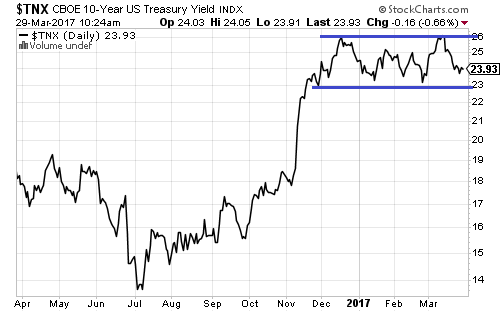

High-yield bonds foreshadowed the recent dip in stocks in early March, but iShares iBoxx High Yield Corporate Bond (HYG) has regained its 50-day MA. Rising interest rates weighed on iShares iBoxx Investment Grade Corporate Bond (LQD). iShares 20+ Year Treasury (TLT) remains in a range between $116 and $122, mirroring the 10-year Treasury yield, which is bouncing between 2.3 and 2.6 percent.

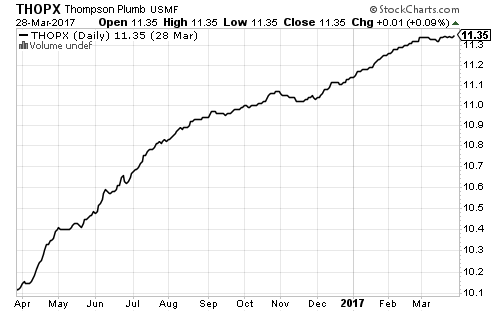

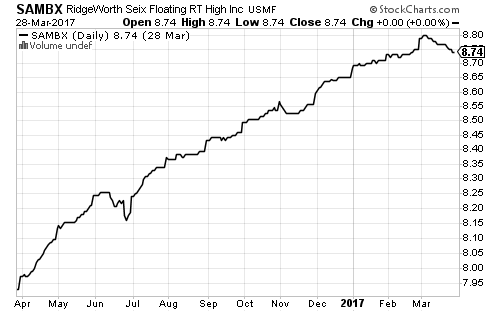

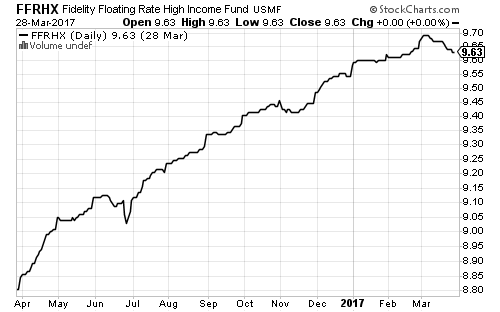

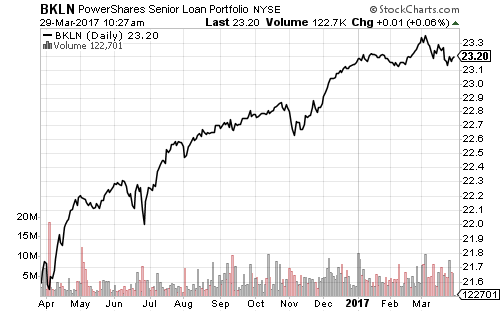

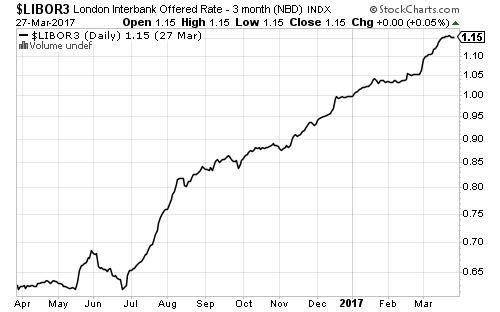

Thompson Bond (THOPX) continues to hold steady despite fluctuations in the bond market. Floating-rate funds eased following the Fed’s rate hike. Market interest rates have steadied over the past few weeks.

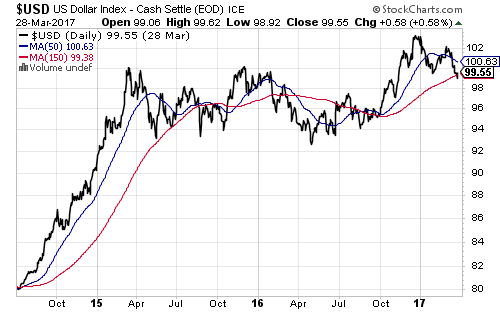

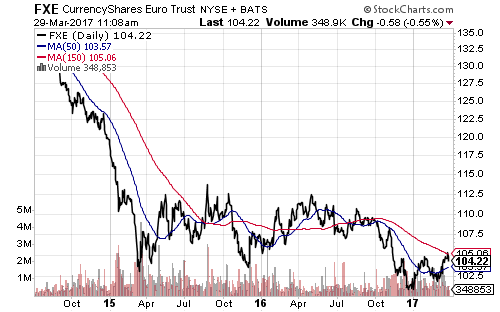

The U.S. Dollar Index fell sharply before quickly recovering. It spent several months below its support line in 2015 and 2016, so a further dip doesn’t threaten the long-term bull market. The euro bumped against its 200-day MA and turned down on Wednesday.

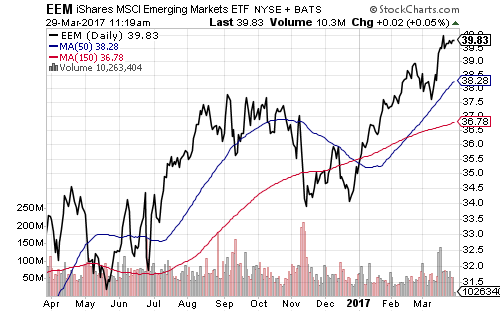

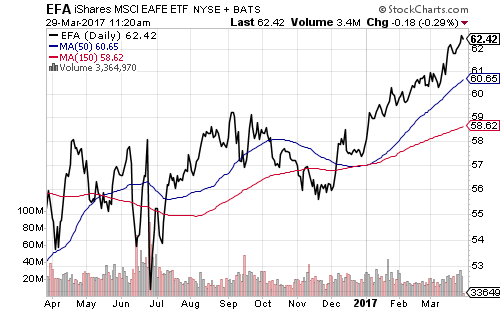

Both emerging and developed markets are well above their moving averages thanks to the weaker dollar this year.

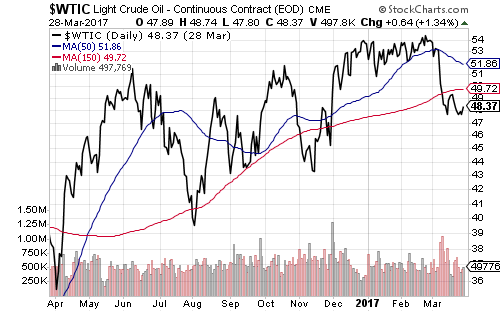

West Texas Intermediate crude oil retook the $49 level today following subdued weekly inventory reports.

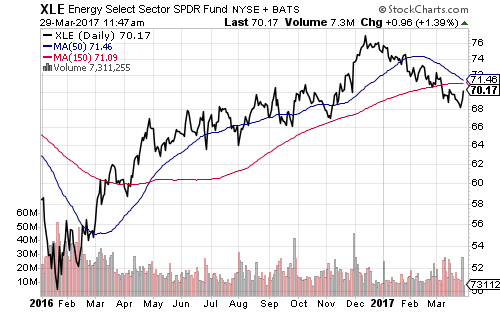

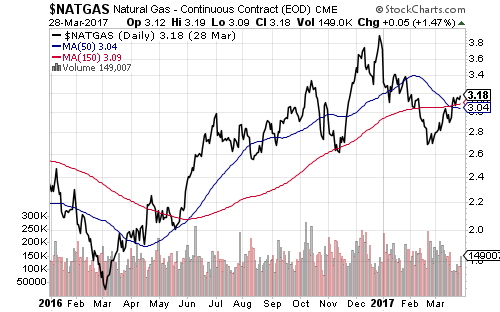

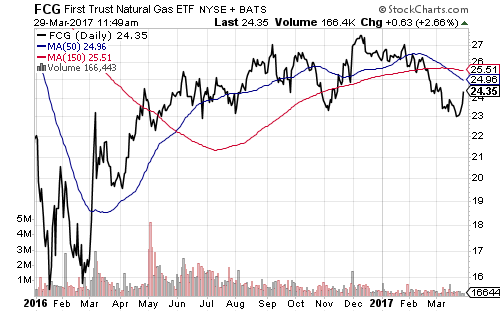

Natural gas continues to perform better than oil, but natural gas equities have underperformed the broader energy sector in 2017.

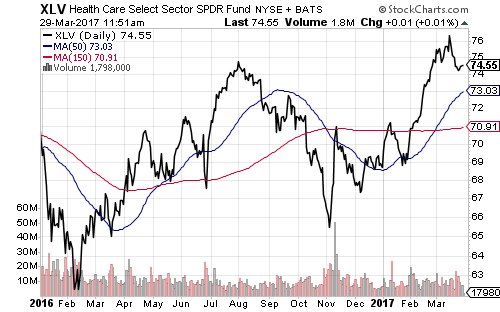

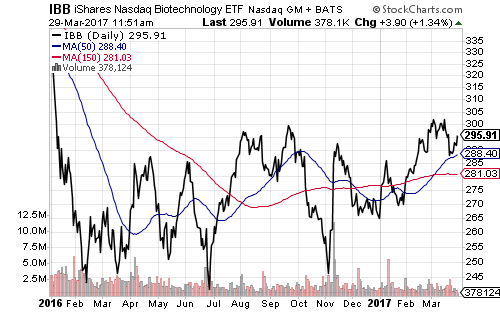

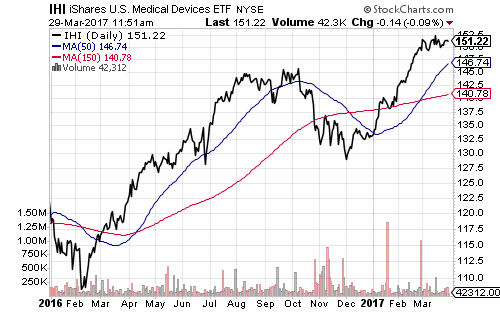

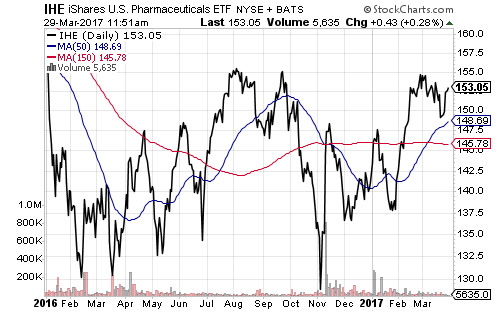

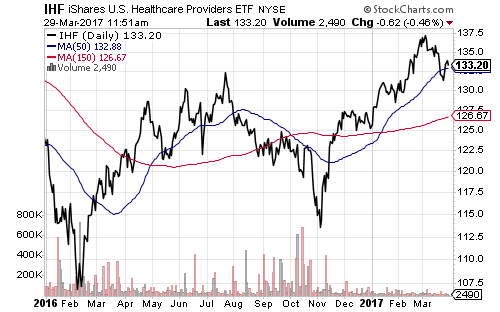

Healthcare was a strong performer over the past week, due to the failure to repeal the Affordable Care Act.

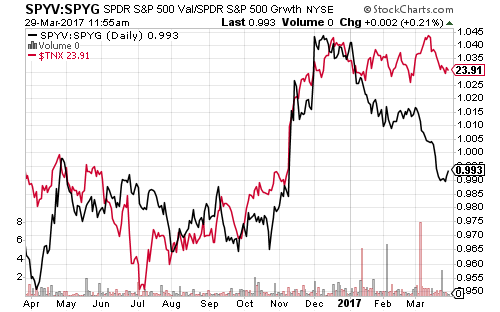

Value stocks outperformed growth by a solid margin in 2016. At the start of 2017, the trend towards higher rates paused as investors rotated out of value and back into growth.