Due to the Independence Day holiday in the United States, this will be a shortened trading week. Even more, traders often take off early on Thursday, making for even lighter volume. Sometimes this can lead to volatility, especially if there’s a surprise in any forthcoming economic data.

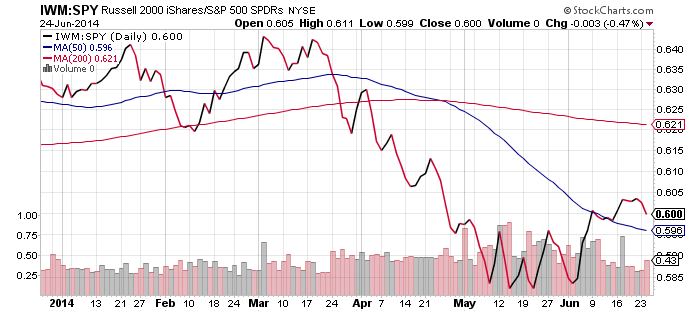

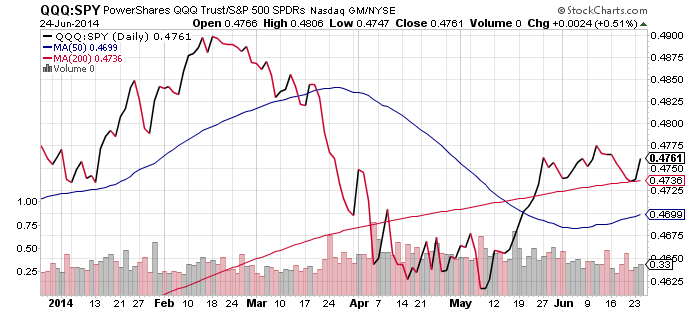

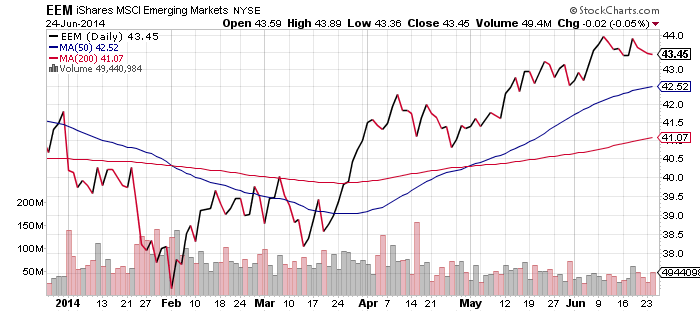

Over the coming days, attention will be focused on the S&P 500 Index, Dow Jones Industrial Average and Dow Jones Transports, all of which are close to new all-time highs. The Russell 2000 has a bit further to go, but could also hit a new record if this week is strongly bullish. Emerging markets are also on the cusp of a larger breakout to the upside, though they still remain in a technical bear market. In other positive news, the Nasdaq has rallied to a new 52-week high last week.

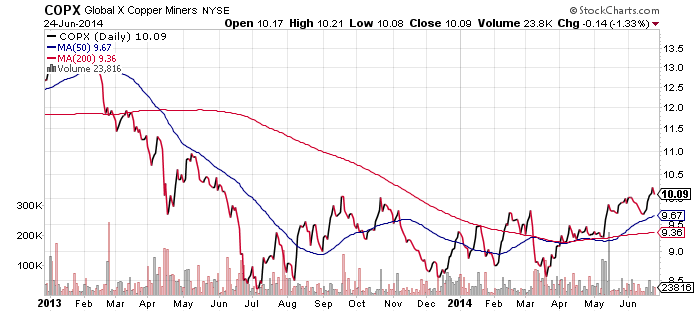

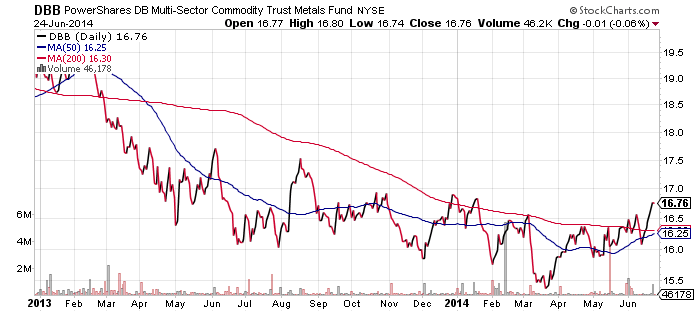

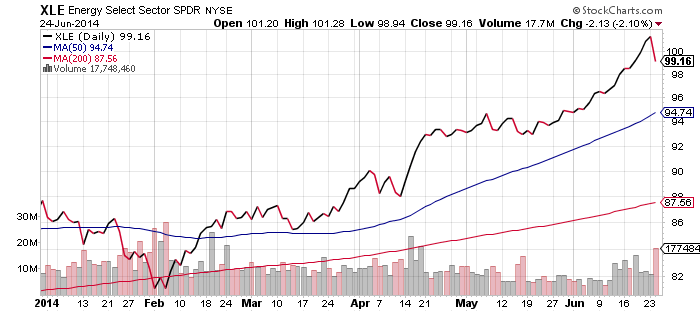

Halfway through the year, the predominant story has been the strong rally in energy and materials prices. Energy and utilities were the top performing S&P 500 sectors over the past 6 months. Rising commodity prices also benefited emerging markets, which is why the broad emerging market funds are on the cusp of multi-year highs. Brazil was one of the strong performers, helped by rising oil prices, as Petrobras is a dominant stock in their stock market. Should emerging markets push higher in the next few weeks, this could mark a major turning point for the asset class. Emerging market funds have been in a bear market since about 2011.

Higher energy prices are also benefiting the United States, as it has become expensive to import foreign made goods. While this may not seem positive, both foreign and domestic manufacturers are beginning to relocate production back to the United States. This is a big component of the rising manufacturing data and a reason why the outlook for the economy remains strong over the rest of the year.

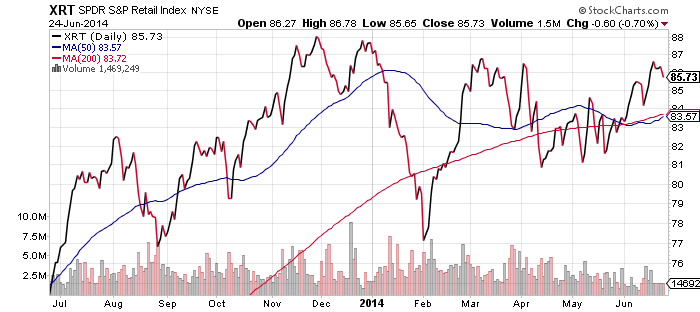

Economic Reports: This week we’ll see June manufacturing PMIs for a number of nations. The two most important reports are those of the United States and China, which are both expected to show increases over May’s numbers. On Tuesday, motor vehicle sales for June will be released; this has been a bright spot recently and it will be interesting to see if the trend continues. On Thursday, the trade balance for May is released, along with the ISM services number. Finally, Federal Reserve Chairman Janet Yellen is making a speech to the IMF on Wednesday.

Earnings: Extremely light week for earnings, one week ahead of the Q2 earnings season kickoff. This week the headliner is Constellation Brands (STZ).