Click here for the February 23 issue of the Global Momentum Tracker Weekly Sector Perspective Stocks closed the week on a high note after Greece and its European creditors agreed to a […]

Month: February 2015

Market Perspective for February 20, 2015

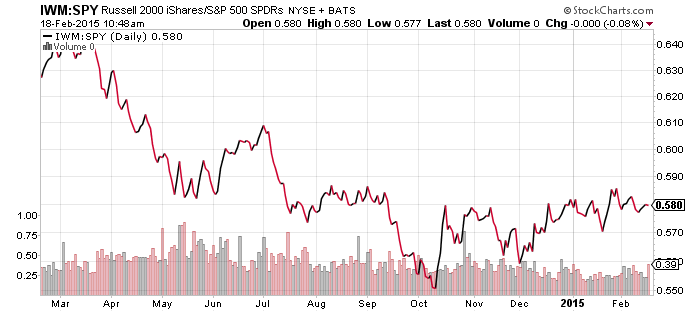

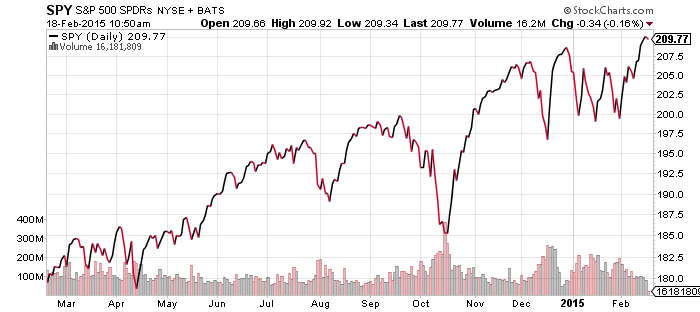

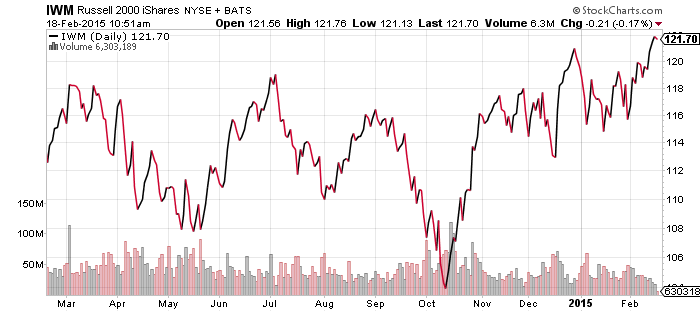

Although major indexes pushed into record territory this week, performance was a bit more subdued. The S&P 500 Index and Russell 2000 Index briefly reached new highs, while the Nasdaq reached a new post-2000 record with a 0.6 percent advance through four days of trading. With the markets still under the cloud of European debt negotiations, investors should be pleased with these modest results.

Domestically, one of the most significant news releases came from the minutes of the prior Federal Open Market Committee (FOMC) meeting. Fed officials discussed whether or not they should drop the word “patient” from the Fed statement. Some FOMC members worried that the removal of this word would cause investors to expect a rate hike much sooner than anticipated, since the Fed is basing its decision on the incoming data. This is an excerpt rom the Fed statement:

“When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.”

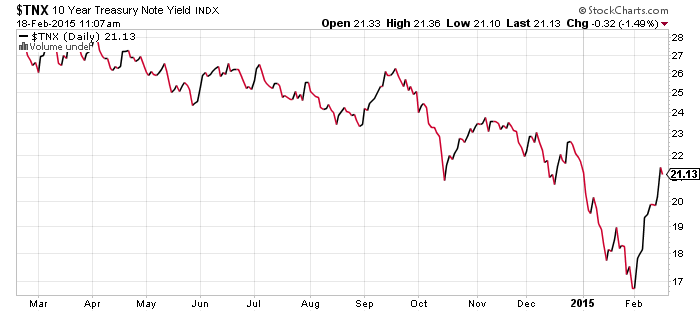

In other words, unless there’s a change in the data, the Fed is signaling rate hikes will occur later rather than sooner. Traders had been betting on a June rate hike, but those expectations were tempered after the release of the minutes. Bond yields slumped and the financial sector declined, which is why the S&P 500 and Dow Jones Industrial Average have underperformed the Nasdaq on the week.

The Fed minutes are a small story next to the situation in Europe though. Greece and Germany are still on opposite sides after Germany rejected Greece’s request for a loan not tied to the bailout agreement. Greece needs capital to fund itself and was seeking a loan to keep the government running for six months while negotiations continued. Without cash, Greece will be forced to choose a collapse in its financial system as banks run out of euros, or print a new currency.

Even if German politicians would like to make a deal with Greece, they still have to pass it through the national parliament. The German public is hard set against giving Greece any deals and the media is already discussing how Greece leaving the euro may be positive for the challenged country. An online poll on the website of center-right newspaper Frankfurter Allgemeine shows 53 percent of the more than 93,000 respondents say “end the horror” and let Greece leave the euro, while another 31 percent say Germany should not be blackmailed by Greece. Germany’s Chancellor Merkel is unlikely to force an unpopular agreement through parliament with that level of opposition.

Today is the deadline with Greece, though Europe is unlikely to stop negotiating if an agreement cannot be finalized. Spain has already said a deal can come as late as Monday. The current bailout agreement runs until February 28 and negotiations will probably run up until the last minute if need be.

Global stock markets are waiting for the results in Europe and this situation looks as though it’s going down to the wire. In the short-term, markets are extremely unpredictable. The euro and even U.S. stocks are trading based on leaked comments and rumors. As always, investors should remain focused on the long-term and not make trades based on speculation.

Fidelity Strategic Dividend & Income Fund Gets Results

Fidelity Strategic Dividend & Income Fund Gets Results

A Seeking Alpha Contribution

Summary

- FSDIX is a multi-asset fund that has held up very well versus newer multi-asset ETFs.

- FSDIX aims for capital appreciation in addition to income, so yield is relatively low at 2.34 percent.

- FSDIX is less volatile than the competition.

The Fidelity Strategic Dividend & Income Fund (MUTF:FSDIX) was established in December 2003. The fund offers investors a multi-asset approach to income, with five major asset classes included in the portfolio. A 2.34 percent yield puts the fund’s yield not far above that of the broader market, but it comes with wider diversification and lower volatility….To Continue Reading Please, Click Here.

ETF Watchlist for February 18, 2015

SPDR Energy (XLE)

United States Natural Gas (UNG)

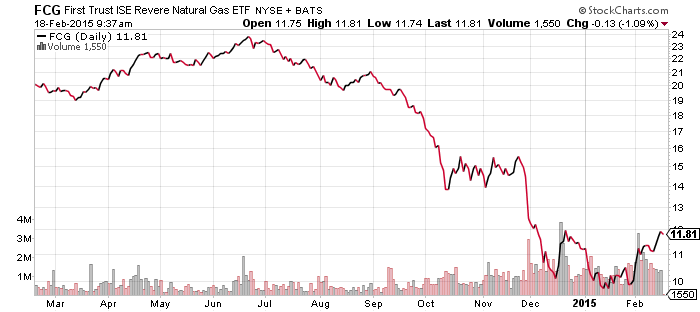

First Trust ISE Revere Natural Gas (FCG)

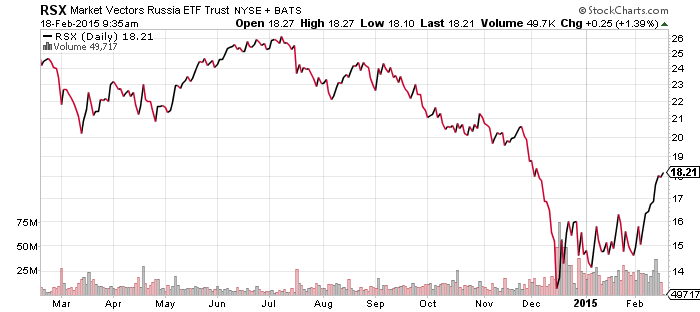

Market Vectors Russia (RSX)

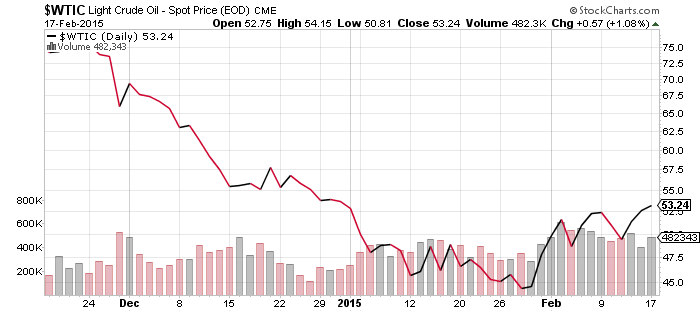

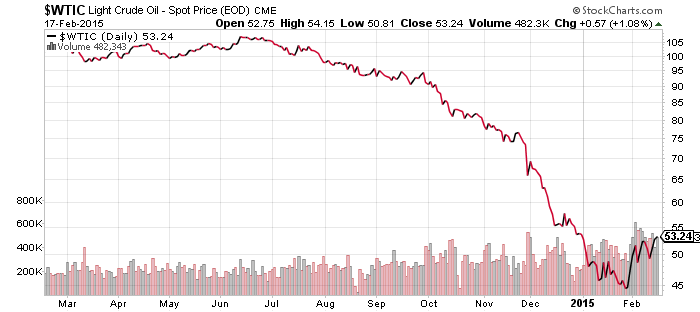

Oil prices continued to form a bottoming pattern over the past week, and in the short-term the trend has turned slightly bullish. However, when we look back at historical performance, it is still too early to say that the current bounce is not a correction within a larger bear market move.

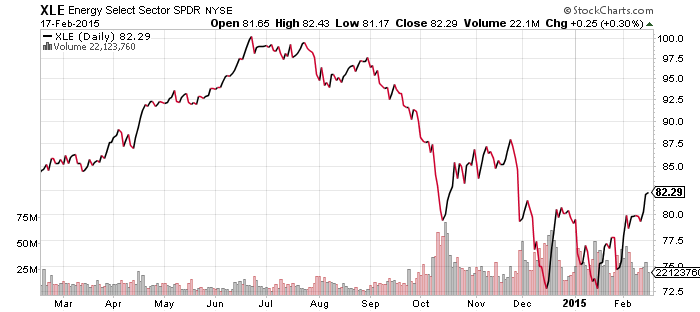

The outlook for energy related stocks is positive. XLE, for example, has erased its losses going back to October. Near term resistance is in the upper $80 range on that ETF, with room to run once it breaks through. This recovery signals that investors are bullish on the energy sector over the long-term and since the stock market is a forward looking market, it is forecasting higher prices over the months ahead.

The commodity spot market is a different story. Commodity prices are much more a function of supply and demand, and oil is not a product that is easily stored. Inventories continue to build while oil production is still rising. In January, China stopped importing extra oil to fill their strategic reserve. Citigroup has forecast oil could drop to $20 a barrel and that is not unreasonable, given rising production and rising inventories.

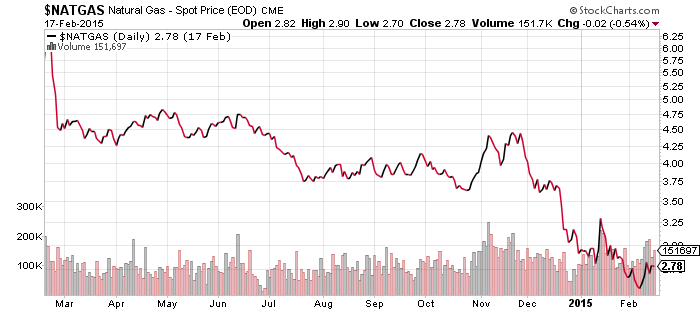

Natural gas is a good example of how rising production can crush prices. Even though much of the country is being frozen by wave after wave of Arctic air, natural gas prices refuse to budge. Luckily for FCG investors, the fund continues to move with energy equities, rather than the underlying commodity.

Finally, last week we noted Russia broke out from its trading range. Over the past week it continued on an upward trajectory. That trading range now serves as support, while the $20 to $21 level provides some resistance.

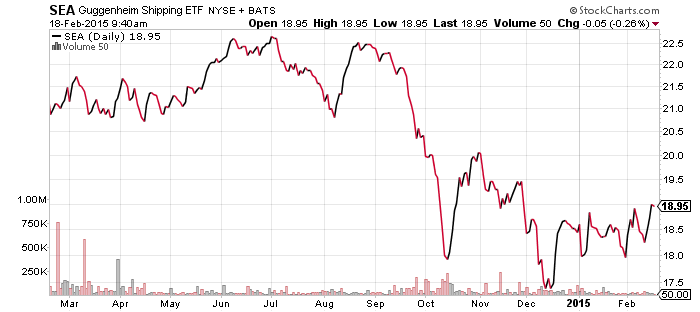

Guggenheim Shipping (SEA)

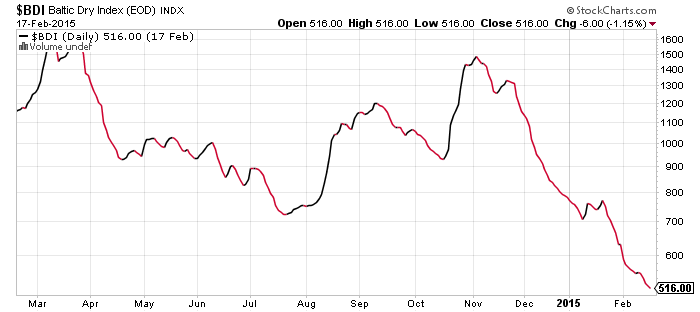

Although the Baltic Dry Index set a new all-time low last week, SEA moved higher as shipping companies started reducing supply. China COSCO, for instance, mothballed 8 ships in January due to the collapse in prices. As with energy, investors in the shipping companies are pricing in a recovery before the spot market, measured by the Baltic Dry Index, has hit bottom.

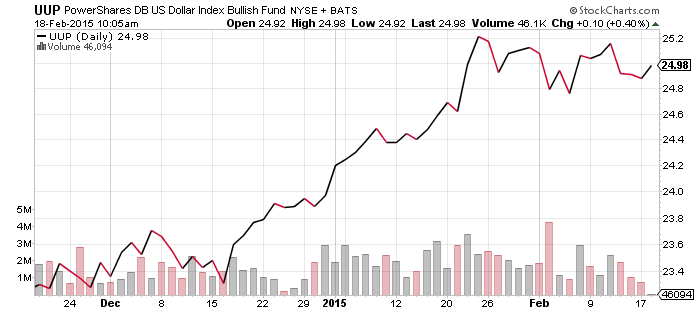

PowerShares U.S. Dollar Index Bullish Fund (UUP)

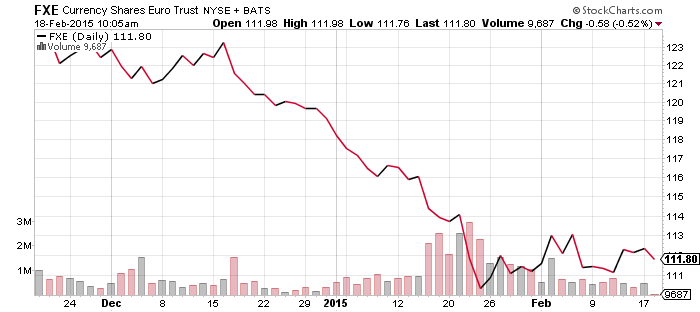

CurrencyShares Euro Trust (FXE)

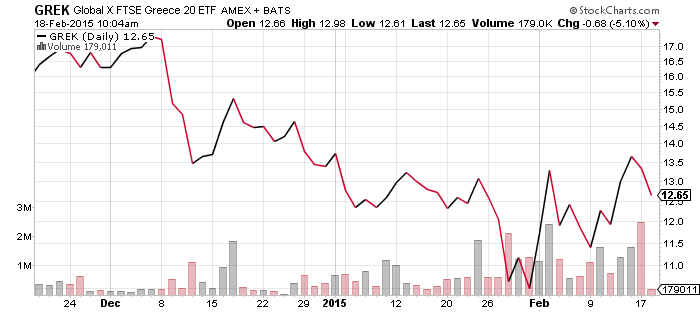

Global X FTSE Greece 20 (GREK)

Attempts at making a deal continue in Europe. Eurozone finance ministers failed to reach an agreement on Monday, but investors are optimistic that a deal will come on Friday. Rhetoric has been turned up in Greece and Germany though, as the two sides remain far apart publicly. The Greeks want a loan extension now and they want to negotiate the terms later, since the current funding runs out in a little over a week. The Germans want the terms settled first. The latest news is that Greece will ask for a bridge loan to keep it from going broke. The Greeks do not want this loan to fall under the bailout terms, while the Germans do.

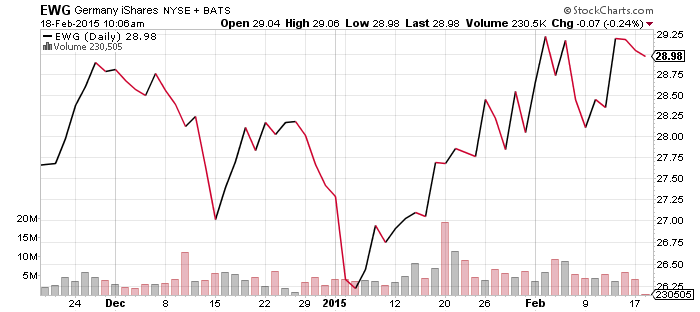

Stock prices in Greece have bounced off their lows and German stocks have climbed to a new all-time high measured in euros. However, EWG is still trading below its high set in 2014 as losses from the euro have weighed on the ETF. Both of these stock markets can rally domestically even if there’s bad news for the euro. GREK will likely rally once a deal is completed. German stocks priced in euros are likely to rally as well, but depending on how the euro behaves, foreign investors may or may not benefit. For this reason, WisdomTree Europe Hedged Equity (HEDJ) remains attractive.

As can be seen in the chart of the FXE and UUP, since the European Central Bank launched quantitative easing in January and the focus shifted to Greece, the market for euros has gone into a holding pattern.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

iShares US Home Construction (ITB)

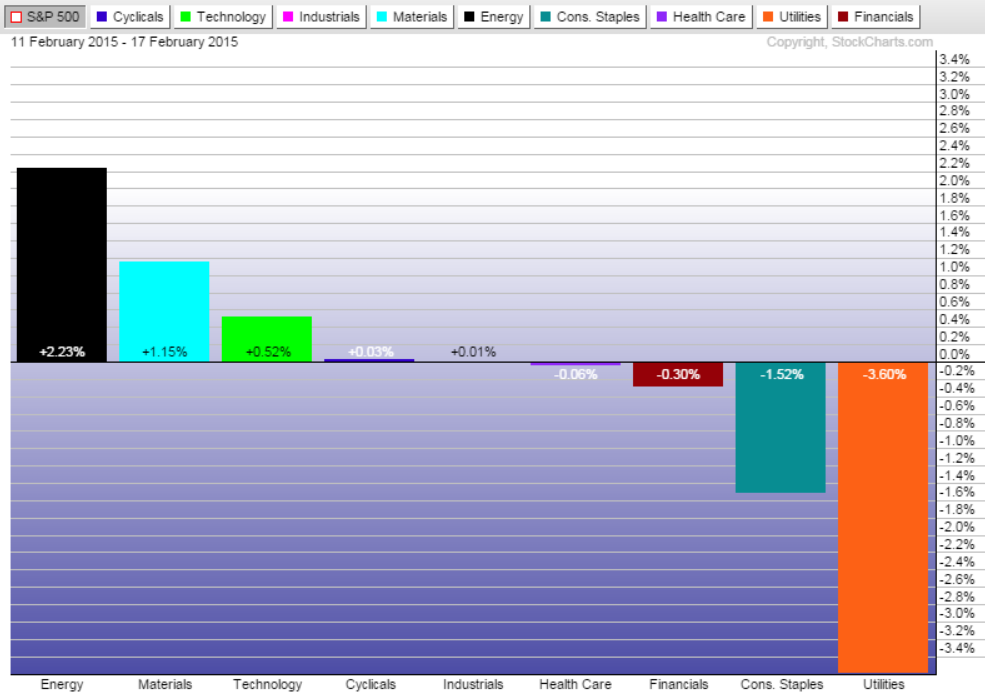

The relative performance chart of the major sector ETFs shows that energy and technology has pushed the market higher in the past week, while the utilities sector lagged again. Interest rates continued to march higher, which weighed on the rate sensitive sectors.

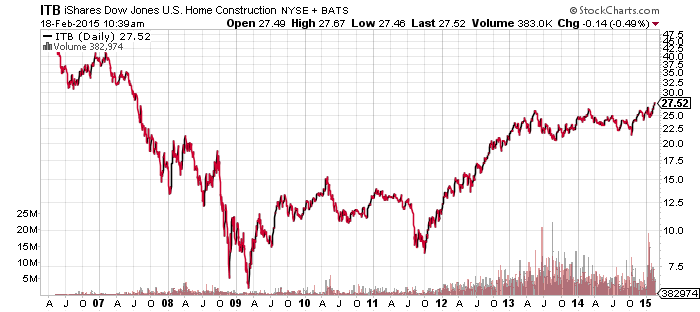

One sector that hasn’t been hurt by higher rates is home construction. It climbed to a new 52-week high and appears to be breaking out of a trading range it has been caught in for two years. Since the Fed announced the taper in May 2013, ITB had been trading sideways, consolidating gains from its first real rally since the housing crisis. Putting fundamentals aside, which remains a mixed bag, the market is turning bullish.

SPDR S&P 500 (SPY)

iShares Russell 2000 (IWM)

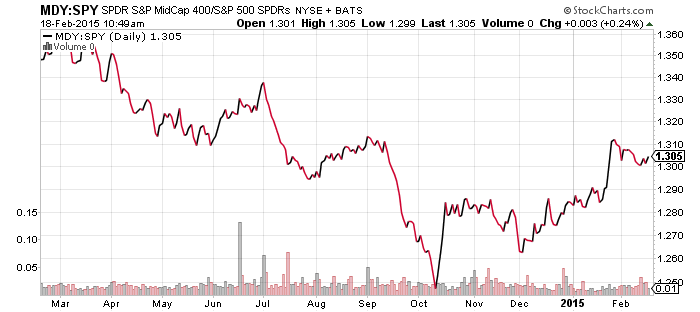

S&P Midcap 400 (MDY)

Small caps continue to hold up well versus large caps, as the S&P 500 Index and Russell 2000 closed at new all-time highs last week. Mid caps remain the stronger performing sector in early 2015 though, as they improve their performance after a lackluster 2014.

Our special reports for 2015 have been released and several mid cap funds are in the mix. If you’re not yet a subscriber, call (888) 252-5372 to begin your membership and receive immediate access.

ETF Investor Guide for February 2015

Click here to view the February ETF Investor Guide Market Perspective: S&P 500 Rallies to New High on Strong Earnings and Economic Data The S&P 500 Index and Russell 2000 […]