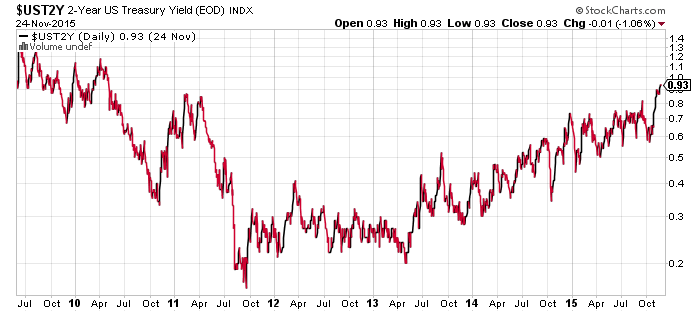

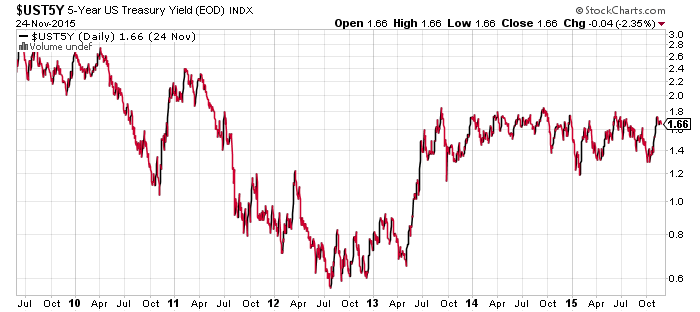

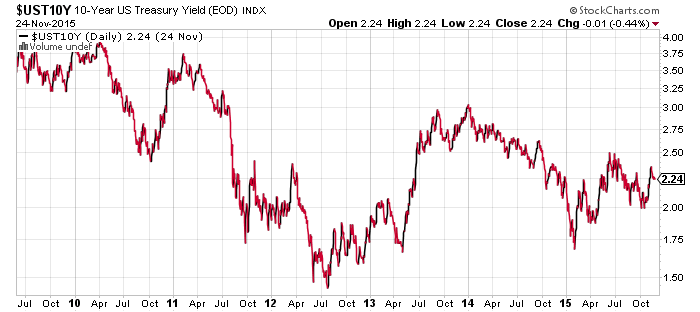

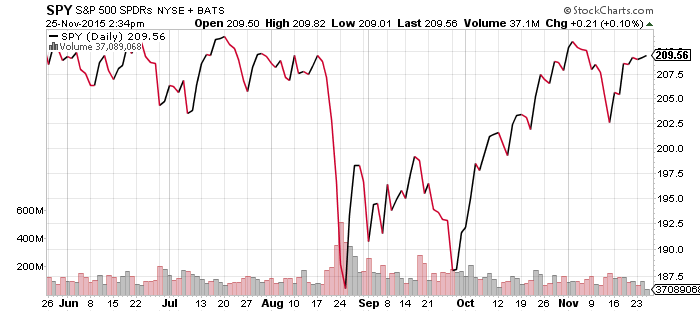

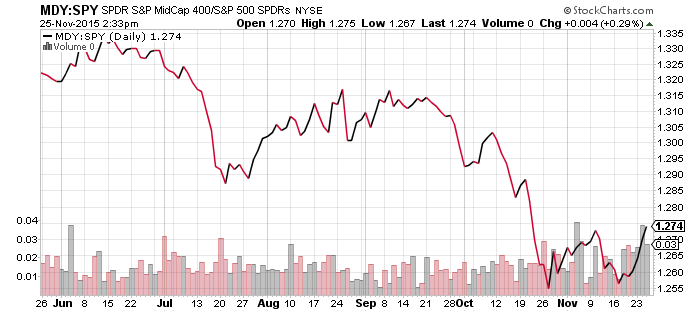

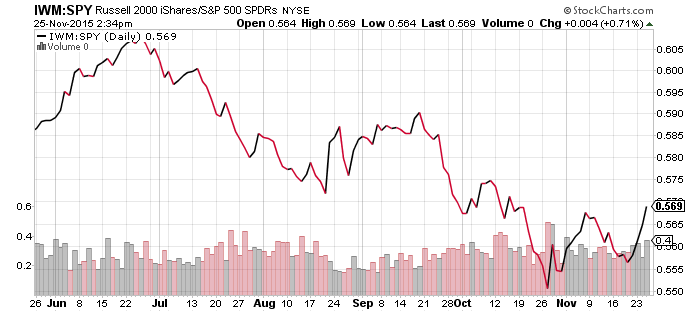

Investors will be paying close attention to a wide range of economic reports and news from key officials this week. Fed Chair Janet Yellen will speak at the Economic Club in Washington on Wednesday and will testify before a joint committee on Capitol Hill on Thursday. Other Fed officials are also scheduled to speak throughout the next two weeks leading up to the Fed’s much anticipated December meeting. The futures market odds of a December rate hike stood at 78 percent coming into this week.

Several important economic data points affecting interest rate policy will also be released over the coming days. Things got off to a weak start on Monday when the Chicago PMI came in at 48.7 for November, below the 56.2 reading in October. A number over 50 signals manufacturing expansion, below signals contraction. The dip in the reading came as new orders fell to levels last seen in March. Pending homes sales in October rose 0.2 percent, which could improve the PMI with a delayed boost in manufacturing sales.

Tomorrow will bring the more important Markit and ISM PMIs for November, which unlike the Chicago PMI, covers the entire nation. Both numbers are expected to show expansion. PMIs for other nations, such as China, will also be a factor for markets.

On Friday, we will see the release of the last monthly unemployment report before the Federal Reserve meeting. The unemployment number, along with average hourly earnings, may have a significant impact on the Fed’s expected decision to raise short-term interest rates. Economists expect employers to have added 200,000 jobs in November. The unemployment rate is projected to remain unchanged at 5 percent, and average hourly earnings are expected to have increased 0.2 percent.

Other reports that can either support or chip away at the consensus opinion include the Federal Reserve Beige Book, which is expected to show an increase in economic growth. October’s trade deficit is projected to have fallen slightly, to $40.6 billion.

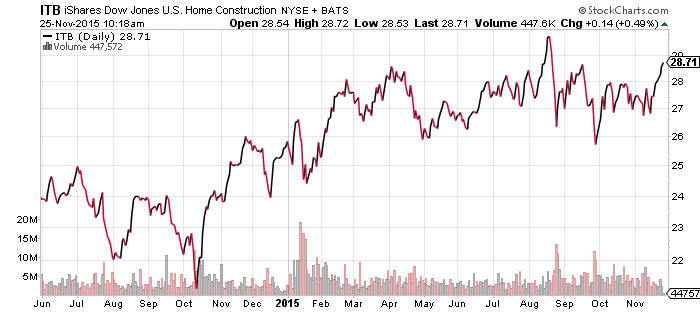

Key earnings announcements late in the week include Sears Holdings (SHLD) and new homebuilder Hovnanian Enterprises (HOV). Homebuilders have been on a winning streak the past couple of weeks and this earnings report will be an important data point for the sector in the short-term.

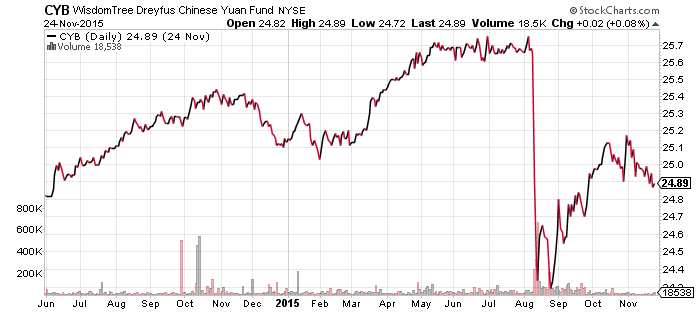

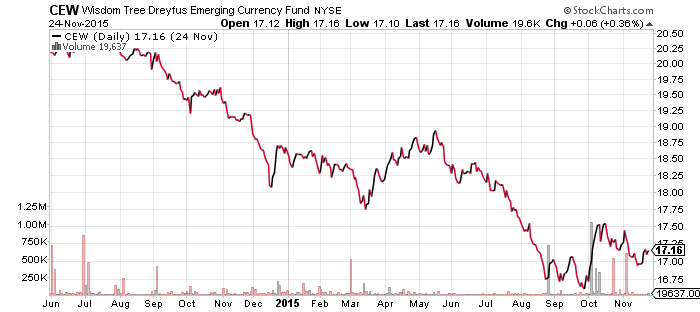

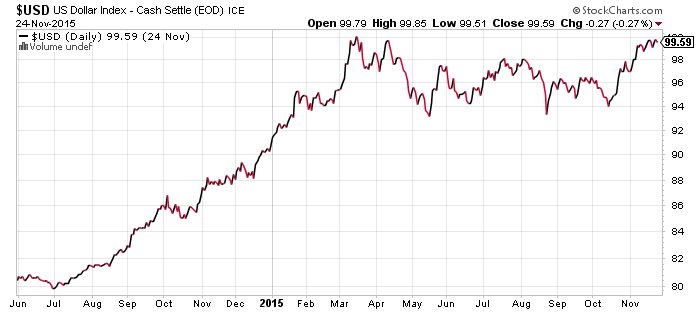

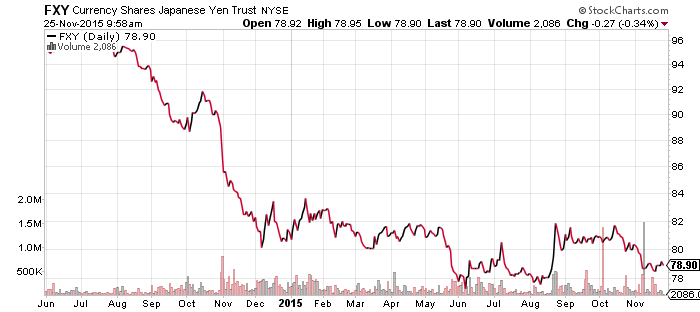

In overseas news, the International Monetary Fund is expected to announce on Monday that it will include the Chinese yuan in its basket of reserve currencies in 2016. The yuan will join a select group: the British pound, euro, yen and U.S. dollar. While a positive step forward for China, it will not be bullish for the currency. The yuan will not function as a reserve currency until China opens its capital account, making the addition to the SDR mainly symbolic for the next couple of years. Also, with the U.S. dollar rising to a new 52-week high and Chinese economic indicators yet to bottom, depreciation pressures are mounting.

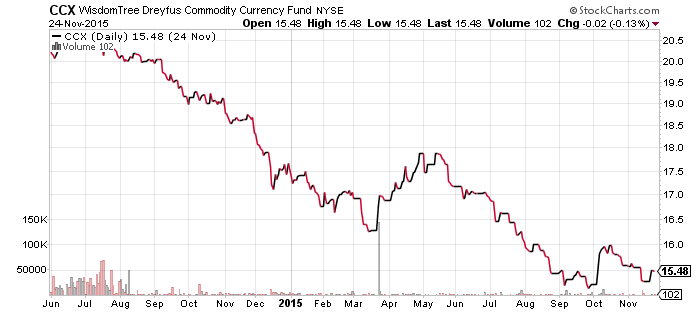

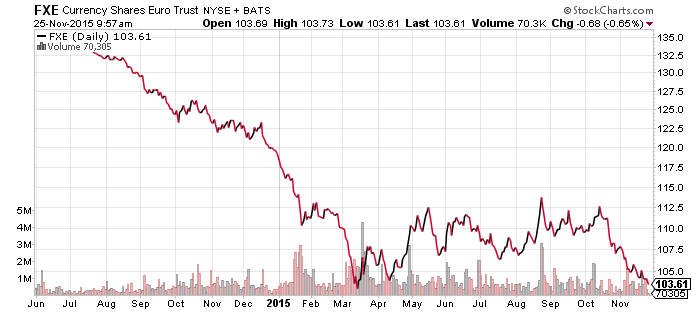

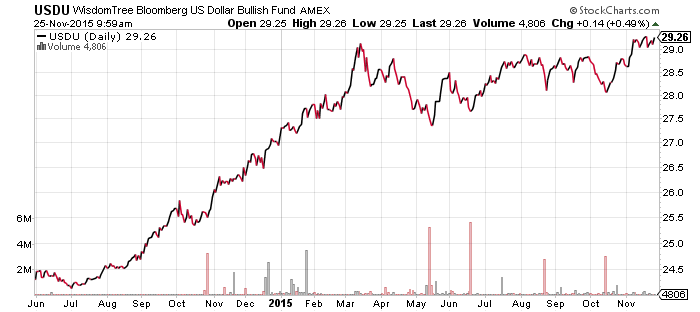

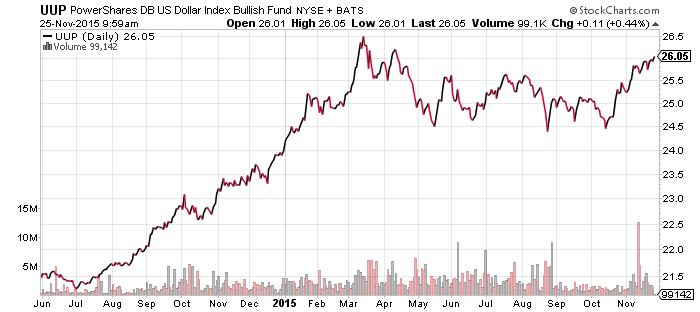

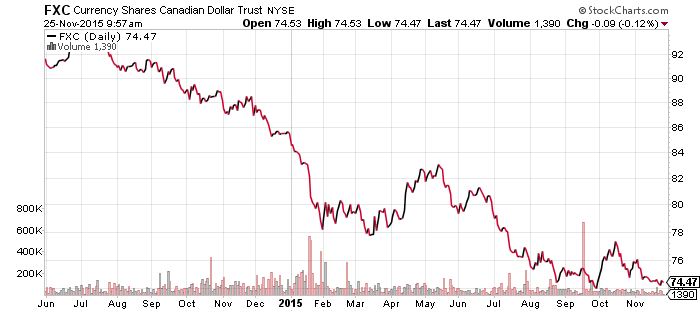

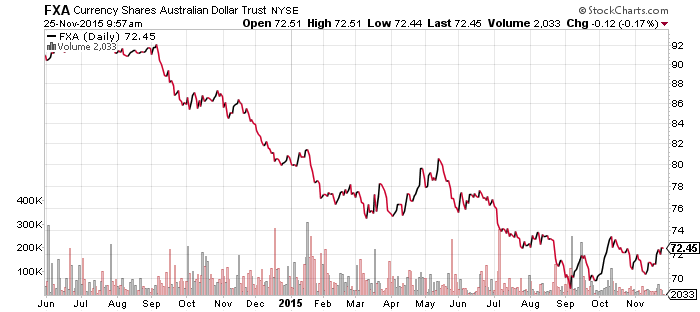

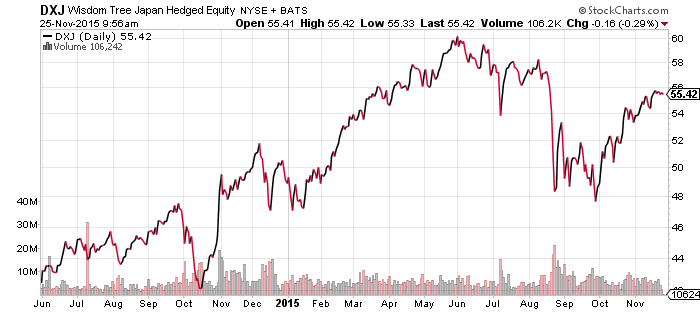

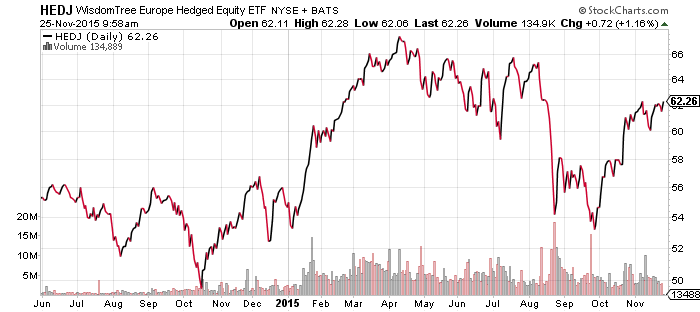

The European Central Bank will hold a key meeting on Thursday. Traders anticipate monetary easing of some sort: another round of quantitative easing, lower interest rates or other monetary tools designed to stimulate the stagnant Eurozone economy. This move has been priced in by the markets and is a big reason why the U.S. Dollar Index made a new 52-week closing high on Friday of last week. The U.S. dollar could sell off if policymakers disappoint, and the euro could fall to a new 52-week low if they follow through. Odds are favoring the U.S. dollar bulls to start the week, but anything is possible given the amount of central bank activity this week.

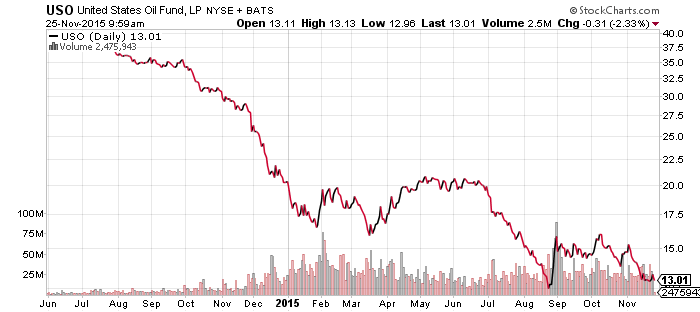

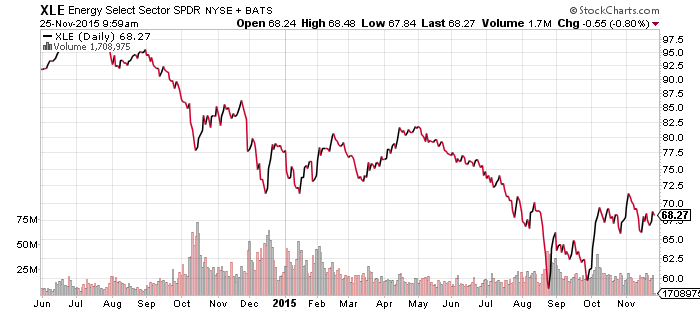

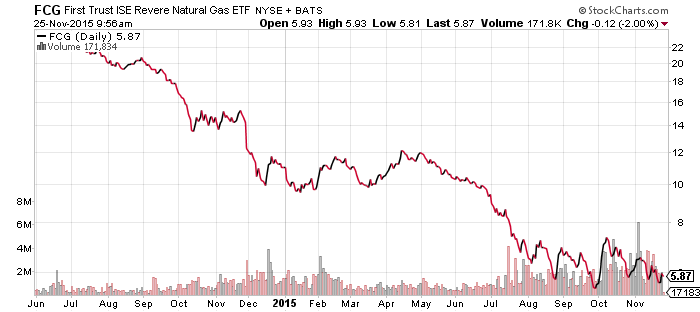

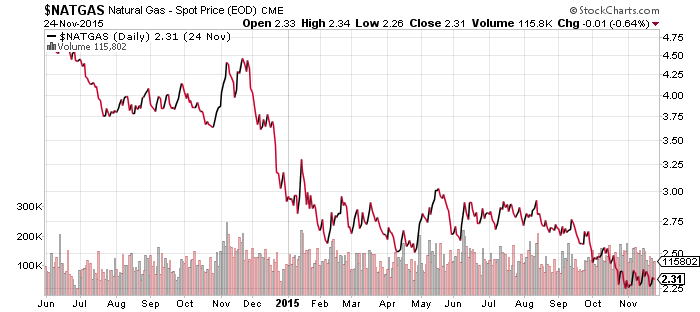

Finally, on Friday OPEC will gather in Vienna as crude oil continues to face a prolonged slump in prices. Iranian production is set to hit the world market soon and several nations need prices to rise in order to protect their currencies or national budgets, including Saudi Arabia.