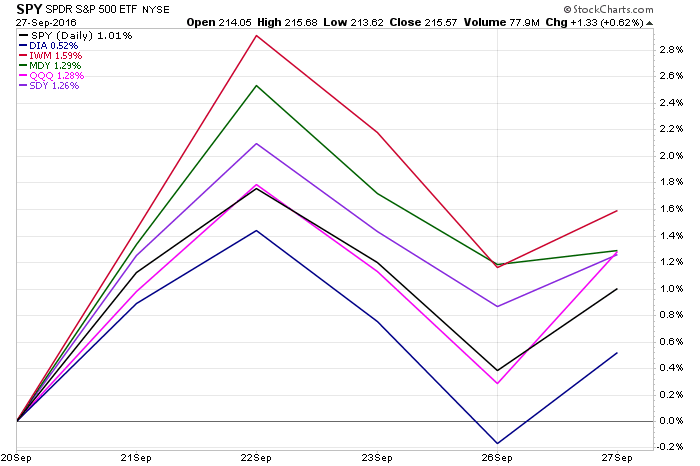

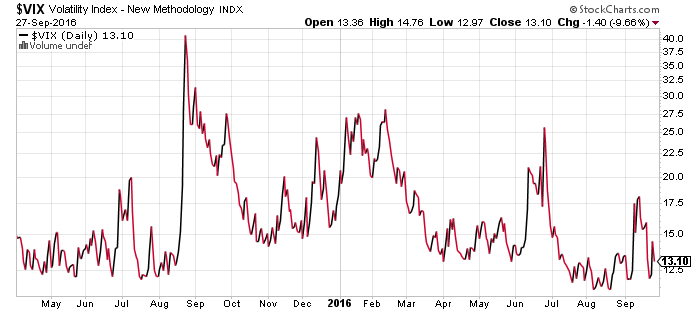

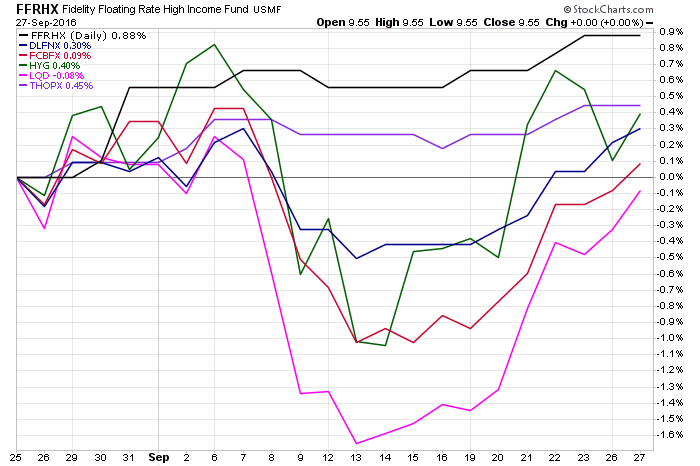

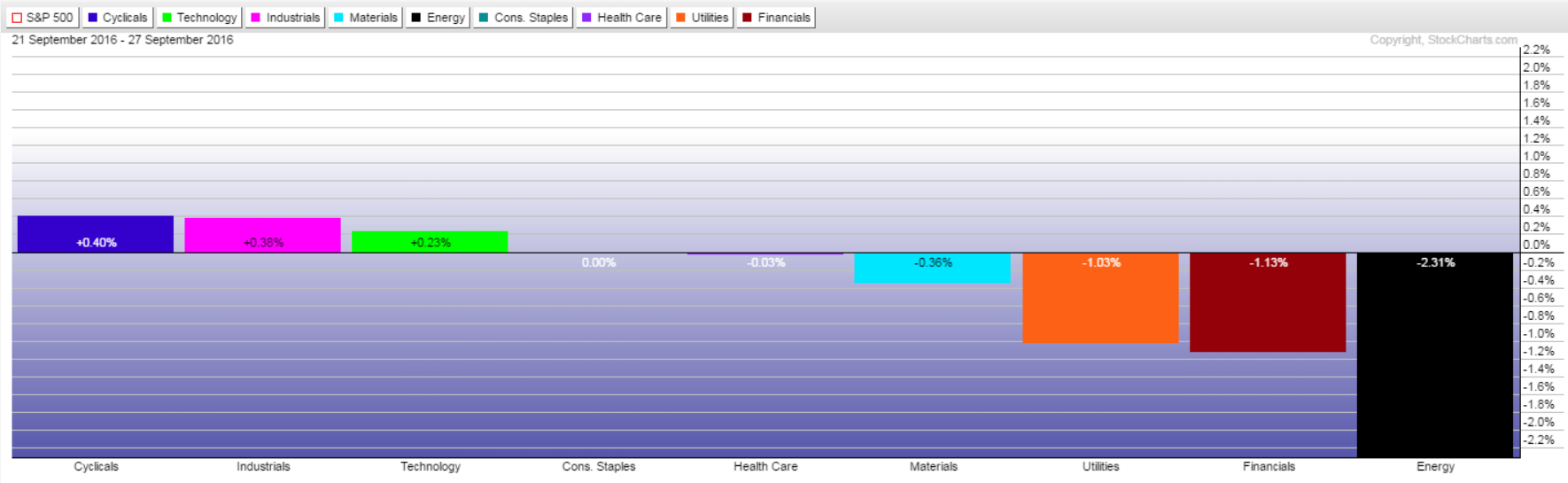

Volatility returned to the markets this week in response to the dispute between Deutsche Bank (DB) and the Department of Justice. Nevertheless, stocks pushed higher for the third consecutive straight week.

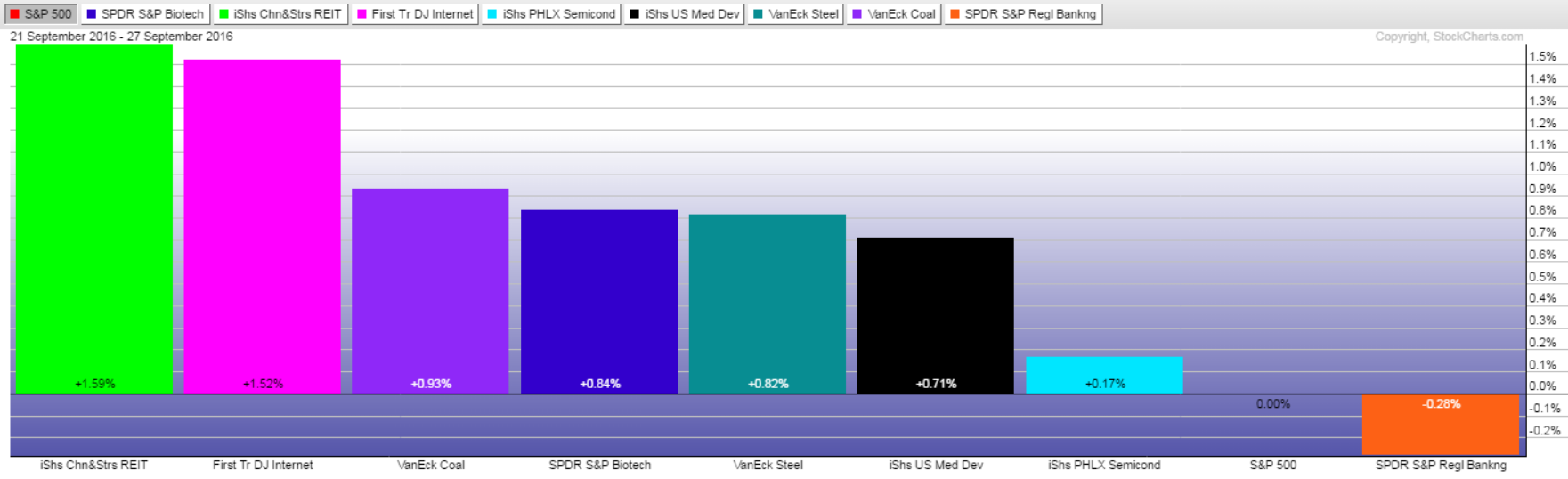

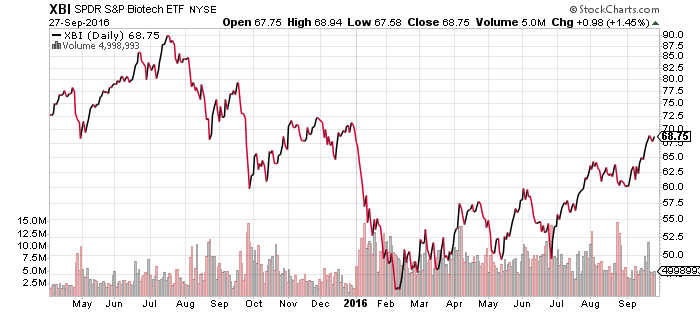

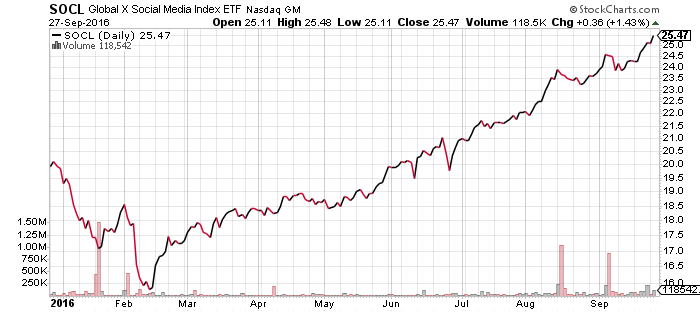

The S&P 500 Index gained 0.17 percent on the week, finishing the third quarter up 3.31 percent. The S&P 500 technology sector climbed 10 percent over the past three months, while Utilities fell 5 percent and consumer staples slid nearly 4 percent. Healthcare was flat, although funds with biotechnology exposure such as Fidelity Healthcare (FSPHX) performed better. The remaining sectors were up 2 to 4 percent.

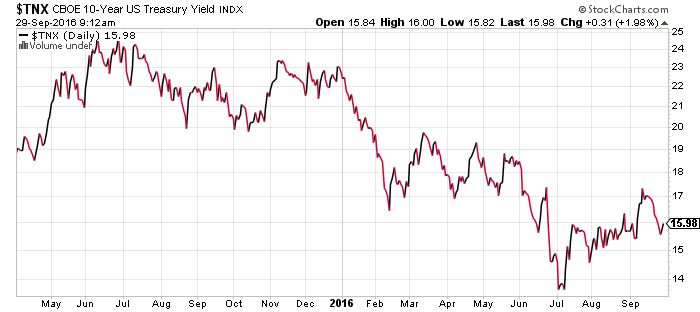

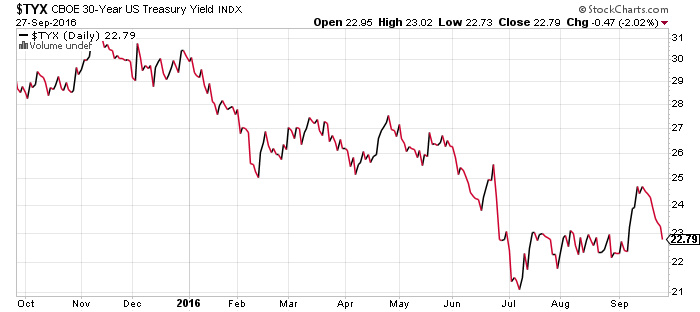

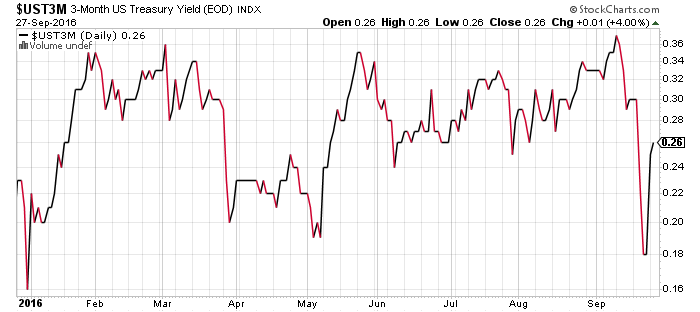

On Tuesday, San Francisco Federal Reserve President John Williams claimed the economy could sustain higher interest rates and that Fed inaction was a threat to the recovery. Esther George, president of the Kansas City Fed, believes it is time for the central bank to tighten monetary policy. These reports were offset Wednesday when Federal Reserve Chair Janet Yellen hinted that, with the right authority, the U.S. central bank could directly purchase stocks like the Bank of Japan. Still, the odds of a December hike finished the week above 60 percent.

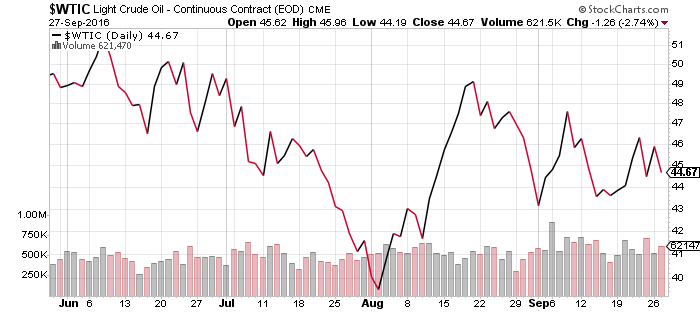

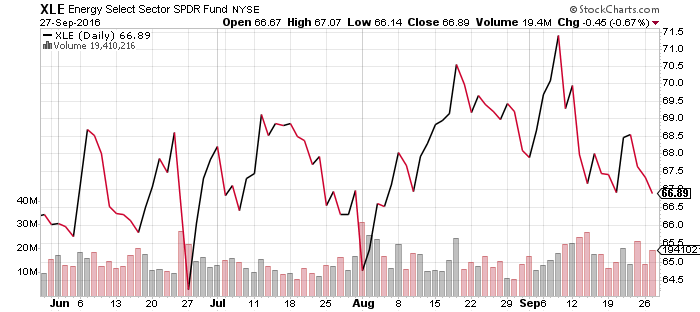

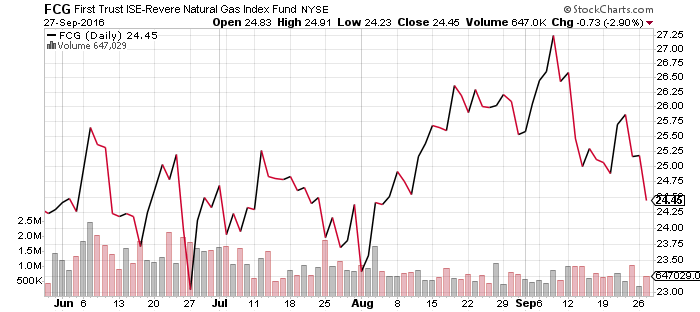

There was potential progress at the recent OPEC meeting with a deal to cut oil production. Oil prices and energy stocks rallied on the news. We still don’t know if production will actually fall though. The cut itself only reduces production to early 2016 levels, Iran is exempt from the deal and OPEC countries are notorious for cheating.

New home sales fell less than expected while price gains slowed. Although the interest on fixed rate mortgages fell to yearly lows, the pace of new purchase applications decreased about 1 percent last week. The flash manufacturing Purchasing Managers Index (PMI) indicated slower growth in September. While the 51.8 reading was higher than expected, survey respondents indicated a slowdown in future hiring and new orders. Thursday’s weekly unemployment claims figures came in lower than expected, showing continued strength in the labor market. Finally, the Bureau of Economic Analysis increased its estimate of second quarter GDP growth to 1.4 percent thanks to a bump in business investment.

On the earnings front, shares of Nike (NKE) fell after the company reported fiscal first-quarter earnings. Although earnings per share (EPS) and revenues beat expectations, the athletic footwear and apparel maker forecast weaker sales growth. Shares of PepsiCo (PEP) rallied after it reported EPS and revenue numbers that beat analysts’ expectations on continued strength in its snack food operations.

BlackBerry (BBRY) reported an 89 percent year-over-year growth in software and service revenue, beating earnings and revenue expectations. Shares advanced strongly before giving up some of the gains on Thursday. Warehouse club retailer Costco (COST) announced better-than-expected earnings, but revenue growth was not as strong. Shares rebounded on the news, reversing five consecutive days of declines.