The Investor Guide to Fidelity Funds will be NOW AVAILABLE ! Links to monthly data have been posted below. Market Perspective: Wage Growth & Consumer Spending Increase October was historic for […]

Month: November 2016

Market Perspective for November 4, 2016

Election week uncertainty and odds favoring a December interest rate hike took a toll on markets. Analysts currently estimate the likelihood of a rate increase at 80 percent based on Fed statements released Wednesday. This week’s mixed economic reports and corporate earnings statements also reinforced bearish sentiment. The S&P 500 Index was lower for eight straight sessions over the past two weeks. The U.S. dollar index was down approximately 1 percent, while the 30-year Treasury experienced a slight uptick. The SPDR S&P 500 Exchange-traded Fund (SPY) was lower by almost 2 percent.

The Bank of Japan (BoJ), the Bank of England (BoE) and the Royal Bank of Australia (RBA) all left interest rates unchanged as expected. The BoJ extended the timeline for its inflation targets. The BoE hinted that further rate cuts were not on the table and that U.K. households should brace for an increase in inflation. Uncertainty grew further when the British High Court ruled that the Brexit referendum vote was insufficient and may require the approval of Parliament to enact the measure. The decision is under appeal. Analysts also believe that the RBA will not cut rates in the future and may instead be positioning for a rate increase.

U.S. Personal Income and Outlays for September rose by 0.3 percent and spending increased slightly by 0.5 percent. While spending met forecast targets, incomes were marginally lower than expectations. The Chicago Purchasing Managers Index (PMI) fell more than expected to its lowest level in five months. Although higher than the previous month, the Dallas Fed manufacturing survey was also negative. While the ISM manufacturing report rose Tuesday, the nonmanufacturing index fell. Construction Spending data indicated a decline versus forecasts for a slight increase. Private nonresidential construction hit its lowest level in nine months. While it was anticipated that light vehicle sales would decrease, the figures rose to their highest seasonally adjusted rate in 2016.

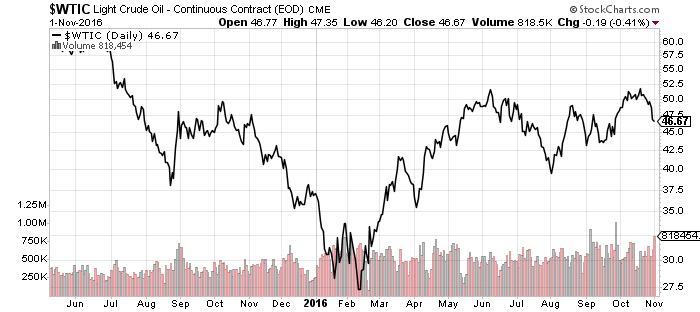

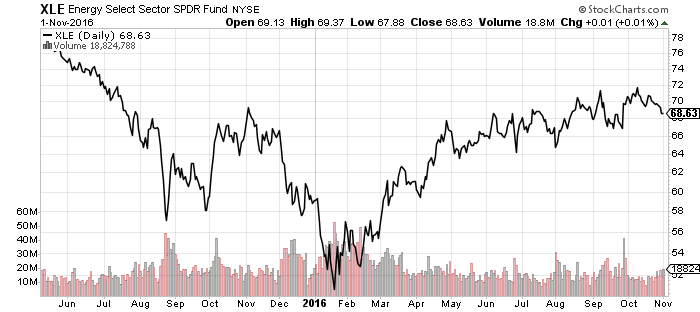

On Wednesday, the weekly oil inventory report showed a large build, which sent oil prices lower by almost 8 percent. Shares of the Energy Select Sector SPDR ETF (XLE) were down approximately 2 percent. Initial unemployment claims numbers were slightly higher than forecast but remain at levels indicating full employment. 161,000 new jobs were created in October and the unemployment rate dropped to 4.9 percent as anticipated.

Shares of leading pharmaceutical company Pfizer (PFE) fell over 6 percent on earnings that fell short of expectations. Online retailer Alibaba Group (BABA) and share prices declined, despite earnings and revenues that exceeded expectations. While Facebook (FB) also beat estimates, shares dropped in response to lowered forward guidance. Shares of chipset manufacturer Qualcomm (QCOM) were relatively unchanged despite strong sales and better-than-expected earnings.

ETF & Mutual Fund Watchlist for November 2, 2016

SPDR S&P 500 (SPY)

SPDR DJIA (DIA)

PowerShares QQQ (QQQ)

SPDR S&P MidCap 400 (MDY)

iShares Russell 2000 (IWM)

SPDR S&P Dividend (SDY)

Speculators continue to pounce on political uncertainty to make quick short-term profits in the last few trading days before the election. Investors, however, should remain wary of these markets. Evidenced by this year’s Brexit, political market reactions can reverse swiftly.

The 15-minute S&P 500 Index chart below illustrates the impact of last week’s FBI statements regarding the Clinton email case.

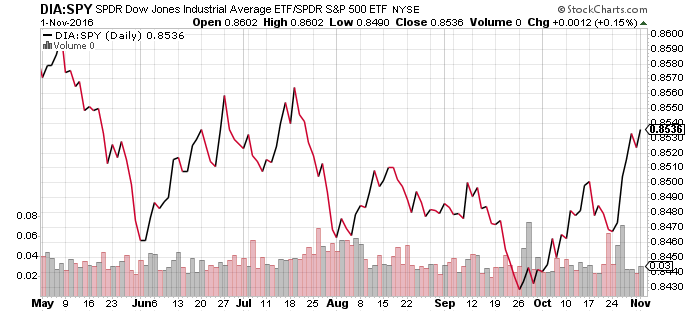

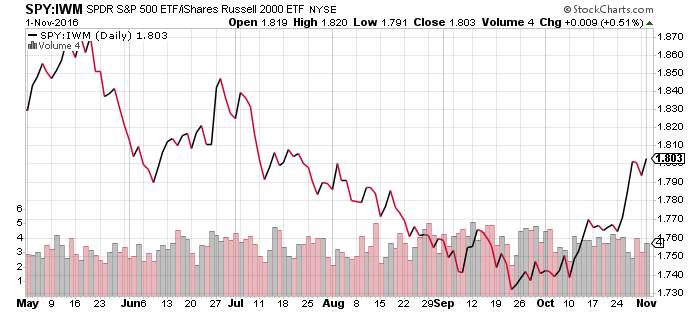

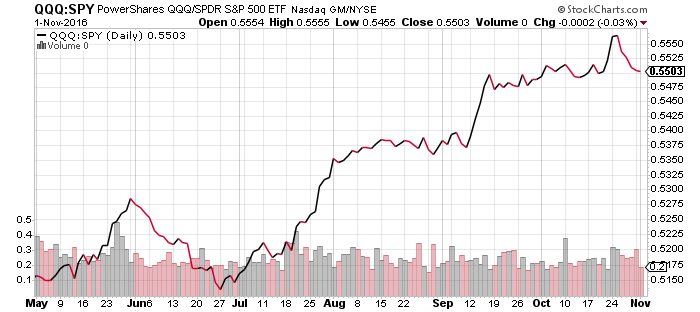

The following price ratio charts reflect the outperformance of mega- and large-caps in the current market. SPY has bested IWM over the past week and DIA has outperformed both.

Technology is holding its own, as illustrated in the price ratio comparison of QQQ to SPY.

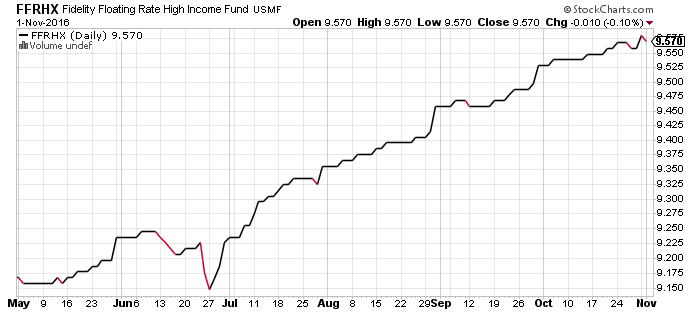

Fidelity Floating Rate High Income (FFRHX)

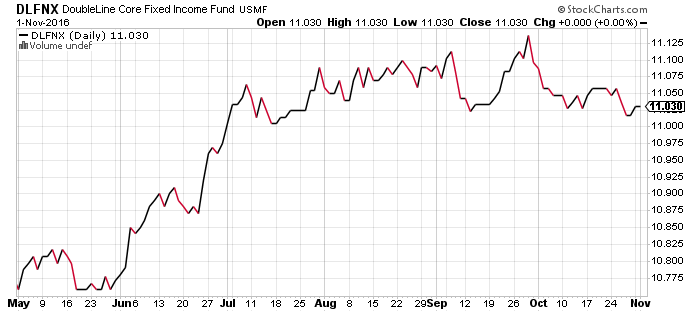

DoubleLine Core Fixed Income (DLFNX)

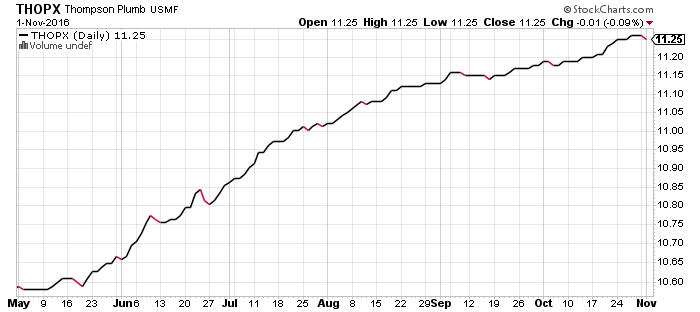

Thompson Bond (THOPX)

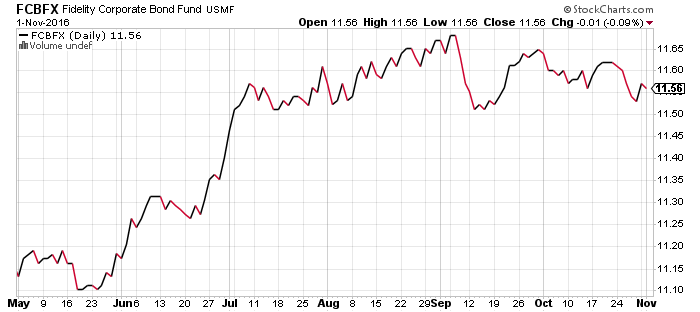

Fidelity Corporate Bond (FCBFX)

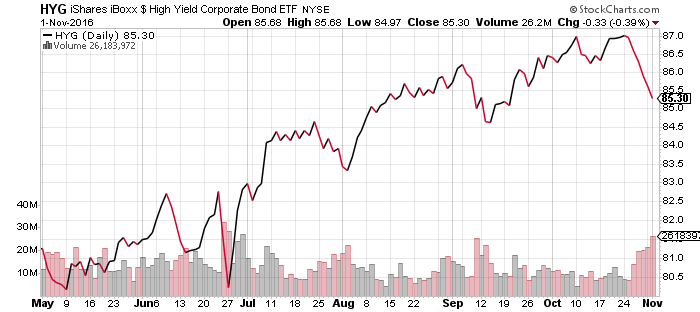

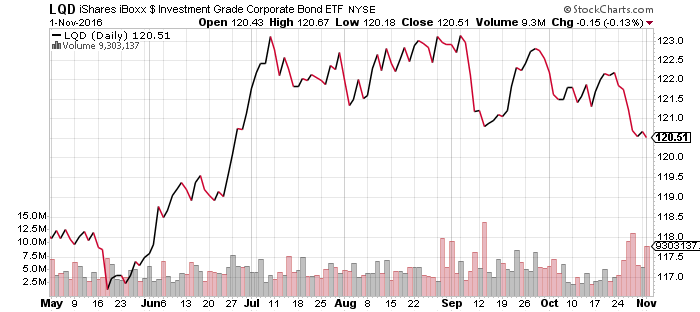

The bond market could rally following the election, as it did on Tuesday, if speculators expect a selloff to delay interest rate hikes.

The Federal Reserve is likely to hike rates in December regardless of the election outcome considering consistently strong economic data.

High-yield bonds, conversely, are trending similarly to the stock market.

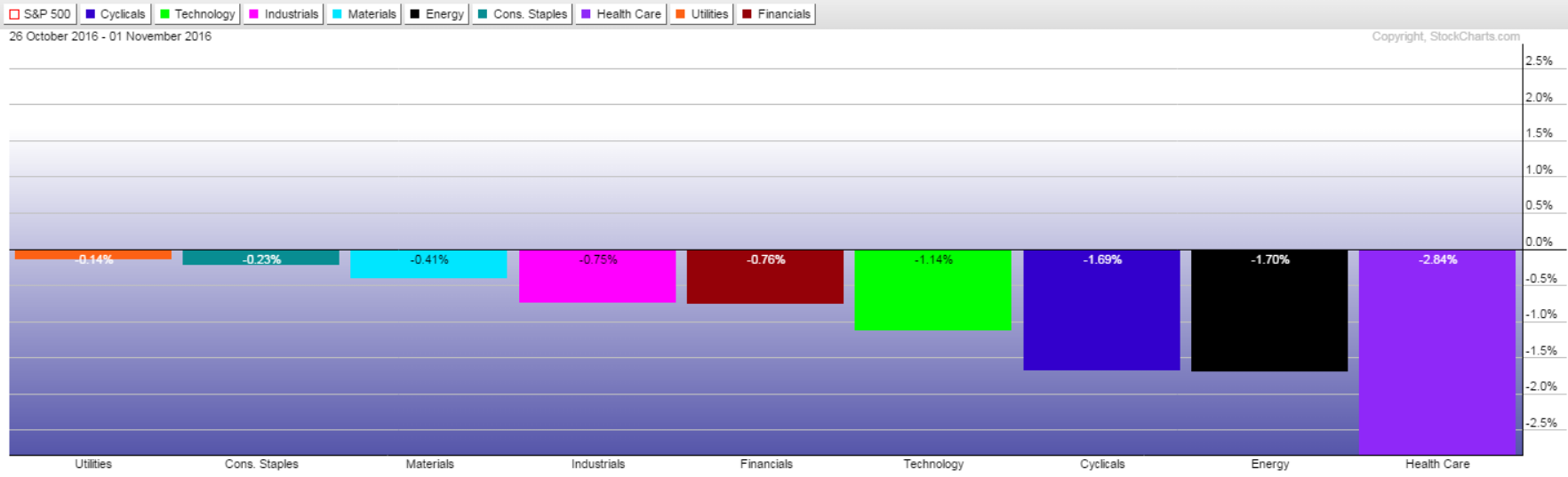

Sector Performance

Utilities and consumer staples held up well over the past week as investors stuck with defensive sectors, while biotech weighed on Healthcare.

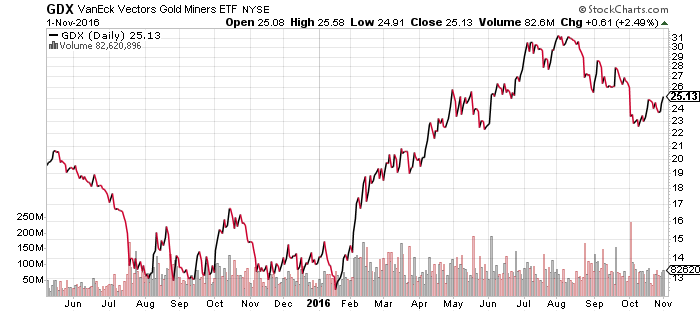

Gold and gold miners are benefiting from increased volatility in the market, but this looks like a bear market rally amid a larger correction for precious metals. This rally is likely to abort, regardless of election outcomes, though it may gain a few more percentage points before downside action resumes. The downside target for GDX is around $20 per share.

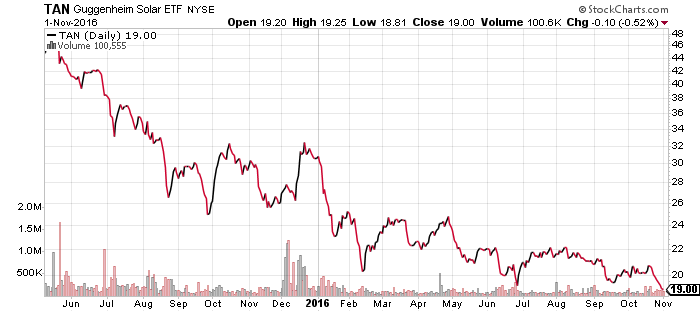

Shares of TAN are down from a high near $50 per share in early 2015 as both energy and interest rates fell. The latest dip is a blip on the long-term chart.

SPDR Energy (XLE)

Over the past week, higher- than-expected inventory and OPEC infighting sent oil prices down to $46. West Texas Intermediate Crude made a short-term peak around $50 a barrel in October 2015 before falling. In June 2016, it peaked near $52 a barrel before sliding just below $40 a barrel. Now in October 2016, it again peaked near $52 a barrel. A repeat of the summer swoon in oil still leaves more than 10 percent potential downside.

XLE remains in an uptrend that stretches back to January 2016 nonetheless.