Click Here to view today’s Global Momentum Guide WEEKLY SECTOR PERSPECTIVE Fidelity Select Wireless (FWRLX) gained the most significant relative momentum among Fidelity Select Sector funds. Computers (FDCPX), Chemicals (FSCHX) […]

Month: February 2017

Market Perspective for February 27, 2017

Markets edged higher on Monday, continuing their longest winning streak since 1992. Several key economic reports will be released this week, in addition to President Trump’s first address to a joint session of Congress.

Domestic durable goods orders increased 1.8 percent in January, exceeding estimates of 1.6 percent. Pending home sales fell 2.8 percent as prices increased 7.1 percent. Tuesday’s Chicago Purchasing Managers’ Index (PMI) is forecast to show steady growth in the U.S. economy. Chinese manufacturing and non-manufacturing PMI reports, UK manufacturing PMI figures and U.S. crude inventory levels will be available on Wednesday. Chinese figures are expected to show a slower, but still expanding rate of growth. The British report is forecast to reflect a slight decline.

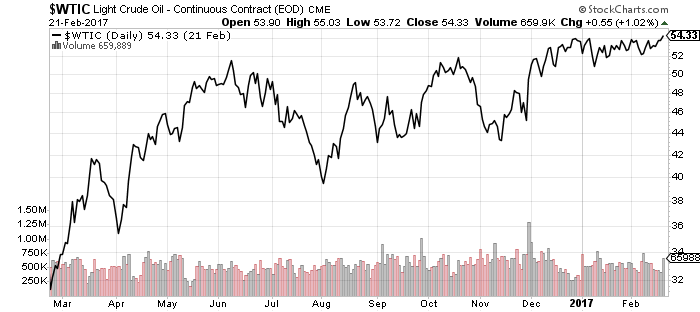

Despite OPEC production cuts, crude inventory levels are expected to increase more than 2 million barrels. Economists are forecasting a slight uptick in wages and consumer spending. Auto sales are expected to strengthen from January’s pace of 17.5 million annual sales to 17.7 million. Economists expect Initial claims for unemployment will remain at four-decade lows.

92 percent of the S&P 500 has reported thus far. Two-thirds of companies have beaten their earnings per share forecasts. The earnings growth rate has risen to 4.9 percent. Eight of 11 sectors have recorded higher growth rates due to upside earnings surprises. Widely held companies reporting this week will include retailers Target and Dollar Tree. Target (TGT) has previously reported lackluster holiday sales. Although sales lagged last quarter, analysts are expecting significant growth from Dollar Tree (DLTR).

Lowe’s (LOWS) will report earnings on Wednesday. Like Home Depot (HD), which reported last week, the company is expected to benefit from the strong housing market and surging consumer confidence. The same day, electronics retailer Best Buy is also scheduled to report. The company has beat earnings estimates the last four quarters. Analysts are expecting continued growth in sales when warehouse club Costco (COST) reports Thursday. The parent of social media company Snapchat is expected to release its initial public offering Wednesday after the bell with a stock price between $14 and $16 per share.

Market Perspective for February 24, 2017

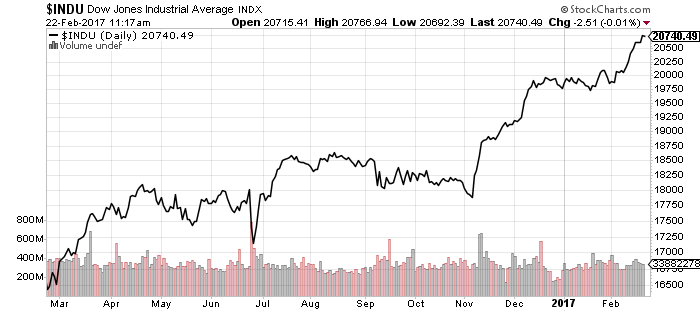

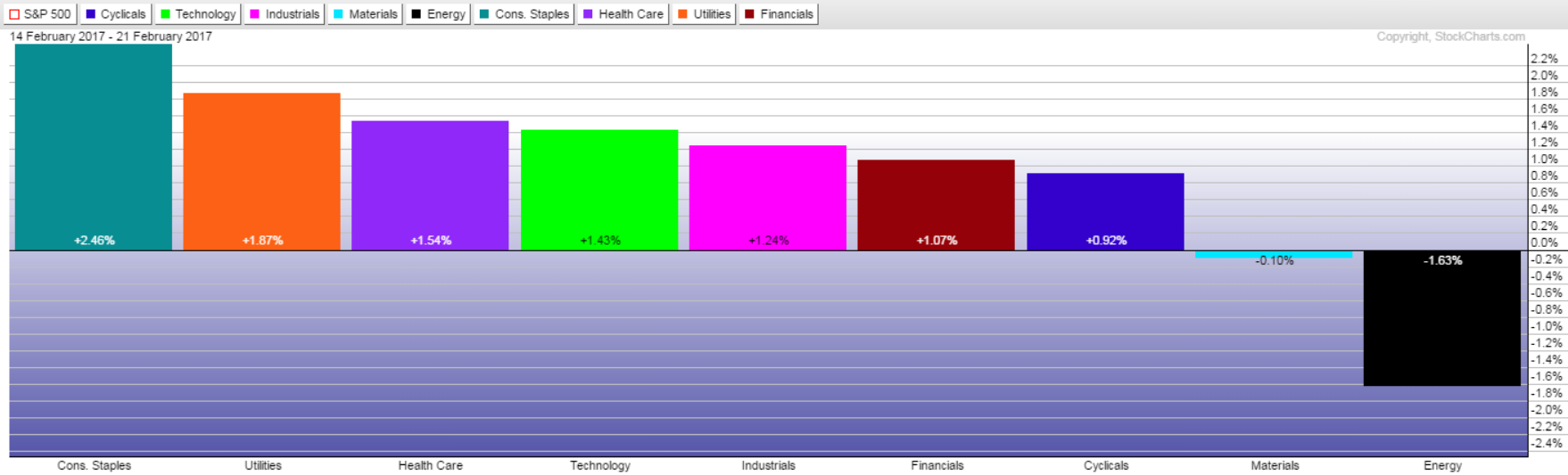

The markets hit new all-time highs earlier in the week before a small Friday pullback. The Dow Jones Industrial Average enjoyed its longest record-setting streak since 1987. Consumer staples, financials, healthcare, and technology led performance.

The minutes of the last Federal Open Market Committee meeting suggest another rate hike may be on the horizon. With market expectations of a March hike below 25 percent, a June or July increase is more likely.

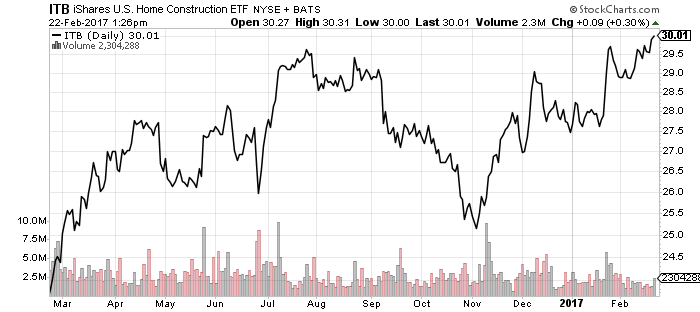

Eurozone flash manufacturing and services PMIs were the strongest in six years. In the United States, January existing home sales reached their highest point in more than a decade, handily beating forecast estimates. Average home prices are up 7.1 percent versus a year ago, while new home sales came in below estimates, but above December levels. Weekly unemployment data remains at 43-year lows and the 4-week rolling average dipped again last week. The Kansas City Fed Manufacturing Survey also reinforced sentiment with a five-year high, indicating a steady pace of U.S. economic expansion.

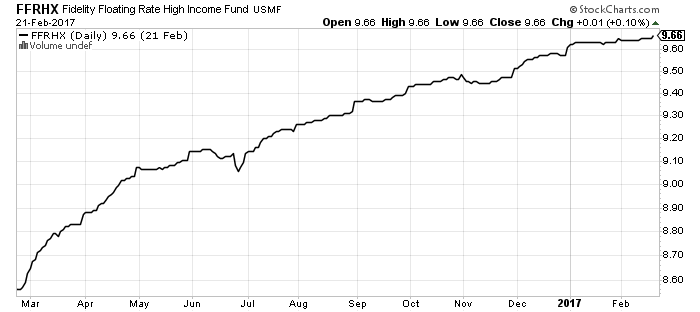

Gold was higher by 1 percent while the U.S. dollar index remained unchanged. The yield on the benchmark 10-year Treasury fell to 2.3 percent and slightly steepened the yield curve. Although markets are looking for short-term rate increases, the 10-year Treasury is near its 2017 lows. Floating-rate bond funds rallied on hardening rate hike expectations, with Fidelity Floating Rate High Income (FFRHX) and RidgeWorth Seix Floating Rate High Income (SAMBX) climbing on the week. Corporate and investment- grade bonds rallied as treasury rates came down.

Shares of Home Depot (HD) rallied after reporting earnings and profits that blew past analyst estimates. Strong housing market data is also buoying the firm’s shares. Wal-Mart (WMT) announced strong holiday sales and shares rose more than 3.5 percent. Tesla (TSLA) shares fell almost 9 percent on Thursday after it reported weaker-than-expected earnings. Investors are concerned the automaker will need a fresh infusion of capital as it rolls out the mass-market Model 3.

While retailer Kohl’s (KSS) beat analysts’ expectations with higher profit margins, their shares were relatively unchanged after weak holiday sales. Nordstrom’s (JWN) shares were also unchanged on the week despite beating Wall Street forecasts. Earlier in the week, Macy’s (M) and Dillard’s (DDS) reported disappointing sales and earnings indicating continued weakness in brick-and-mortar retail.

Mutual Fund & ETF Watchlist for February 22, 2017

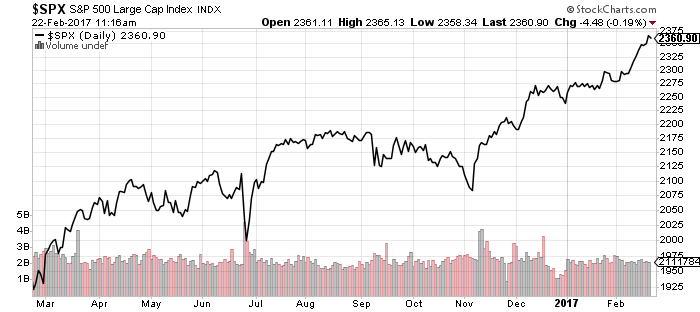

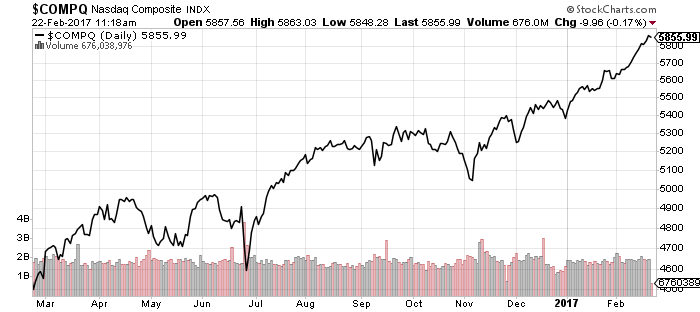

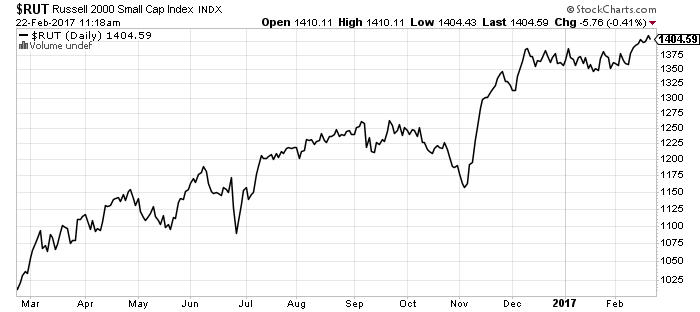

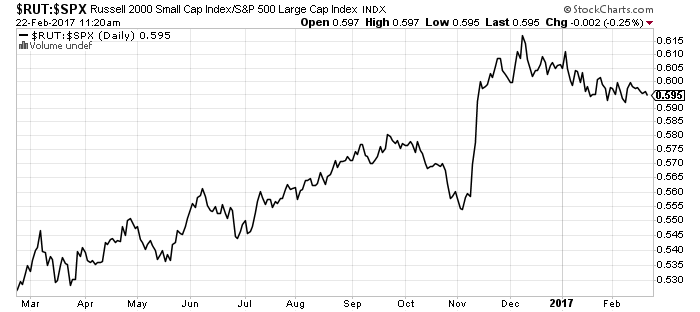

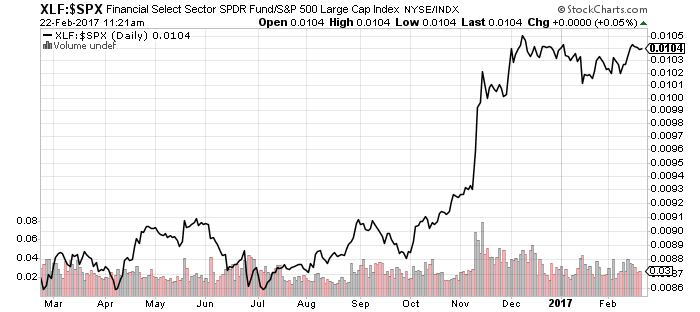

Equities climbed to new all-time highs again last week. The Russell 2000 broke out of its trading range to a new high, though it continues to underperform the S&P 500 Index. Acceleration in the financial sector, however, could eventually boost the index back into leadership.

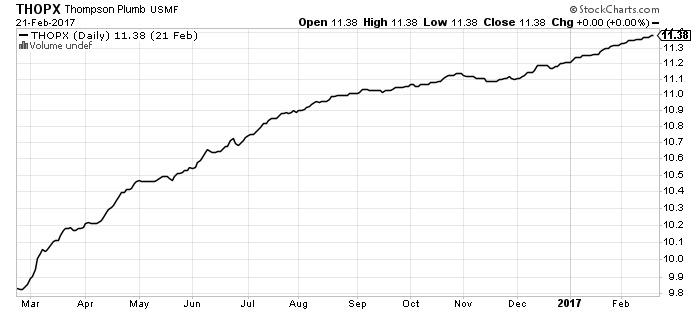

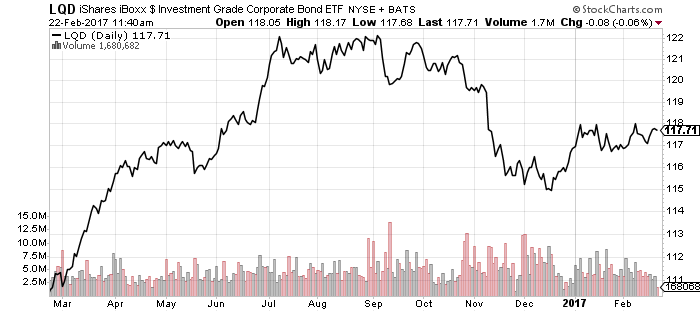

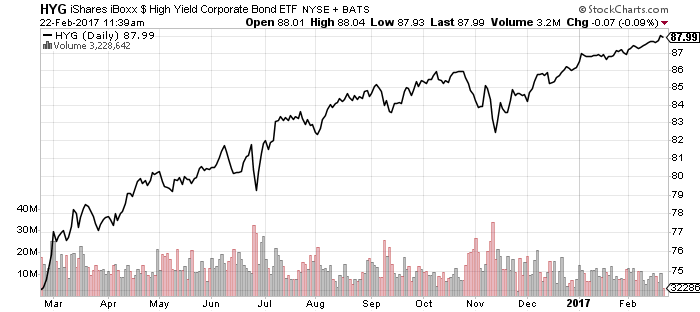

Thompson Bond (THOPX) has marched upwards since December, in contrast to the choppier patterns in high-yield funds, such as iShares iBoxx High Yield Corporate Bond (HYG). Investment-grade bond funds like iShares iBoxx Investment Grade Corporate Bond (LQD) have seen even greater volatility due to much longer duration. THOPX’s very low duration of 1.15 years reduces interest rate risk.

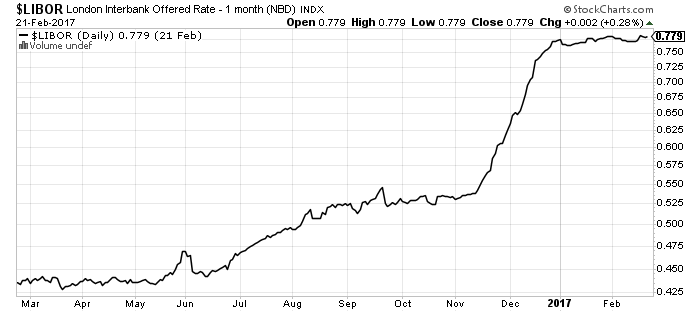

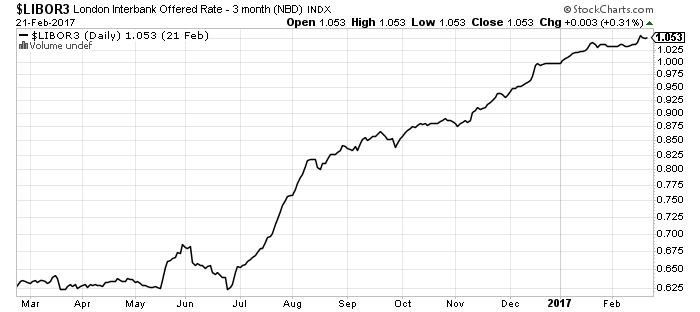

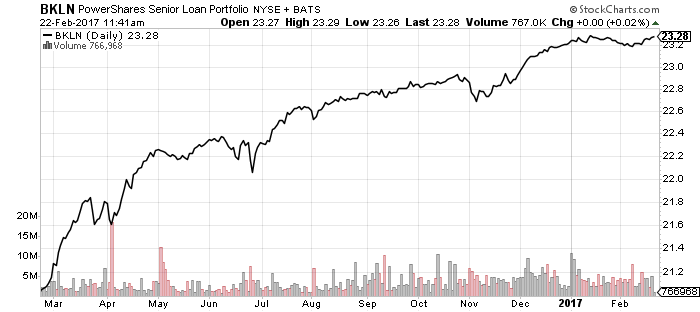

Floating-rate funds, which have durations close to zero, remain in an uptrend as well. An uptick in LIBOR following Federal Reserve Chair Janet Yellen’s Congressional testimony lifted shares.

In contrast to LIBOR, Treasury yields pulled back following the Yellen spike. Both remain in consolidating trading ranges following late-2016 breakouts.

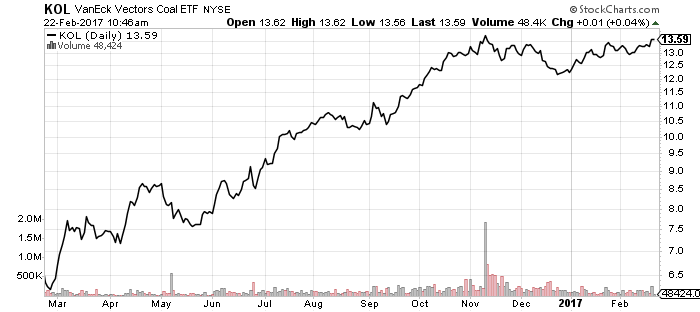

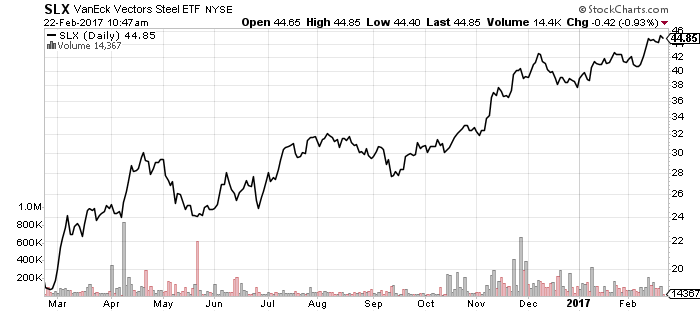

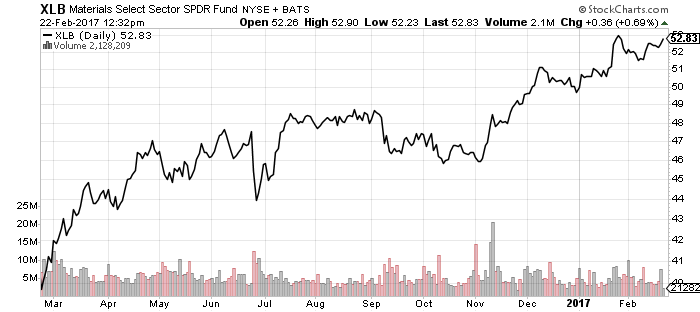

Some natural resource funds have formed bullish consolidation patterns. VanEck Steel (SLX) has already broken out of its consolidation pattern and moved higher, but VanEck Coal (KOL) has yet to break out of its larger pattern. SPDR Materials (XLB) has a similar smaller pattern.

Utilities were a surprisingly strong performer as rate hike expectations rose over the past week.

Healthcare and technology have been strong performers this year and both turned in solid gains for the week.

Homebuilders are trading at a new 52-week high and their highest level since 2007. Since late 2016, investors have wondered if economic optimism would trump rising interest rates in the housing market. Right now, investors are betting on growth and data backs them: existing home sales for January were 5.69 million, higher than December’s 5.51 million and the forecast of 5.57 million. January new home sales are out on Friday. Forecasts call for 586,000 new homes, up from December’s 536,000.

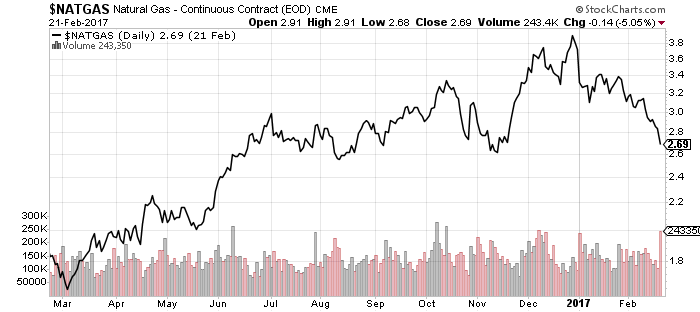

Oil prices have been steady since December, with the $54 area serving as a hard resistance. Natural gas prices have declined; $2.60 area is an important zone of near-term support.

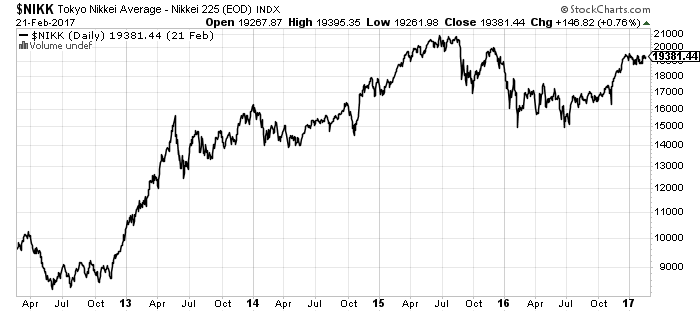

The Japanese economy hit an important milestone this past quarter when its nominal GDP exceeded the old high set in 1997. The Japanese economy has done well in recent years, performing similarly to the United States and Europe when measured by real per-capita GDP.

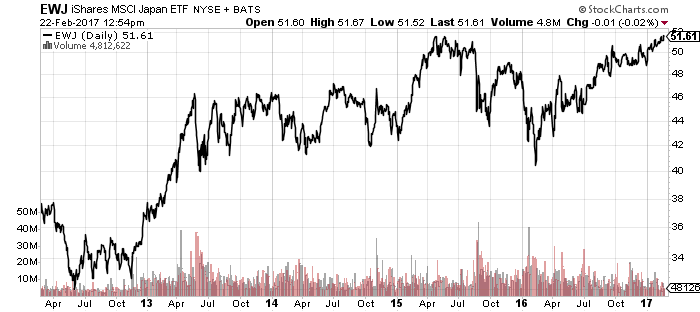

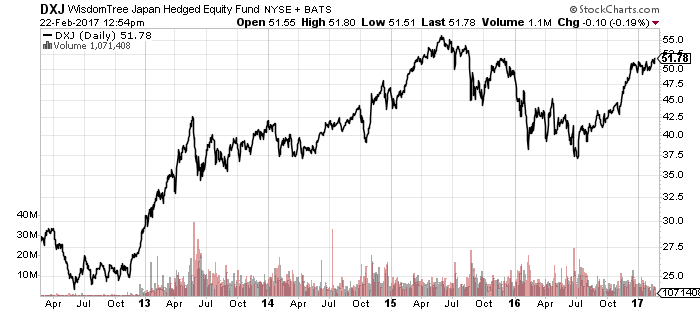

The Japanese stock market is hovering about 9 percent below its 52-week high, but iShares MSCI Japan (EWJ) is nearing its 52-week high thanks to a stronger yen. WisdomTree Japan Hedged (DXJ) hedges out yen exposure and behaves more similarly to the Nikkei. Japan will need a weaker yen if it wants to keep nominal GDP growing.

ETF Investor Guide for February 2017

The February Issue of the ETF Investor Guide is NOW AVAILABLE! Links to the February Data Files have been posted below. Market Perspective: Ongoing Optimism Continues to Boost Stocks Major […]