Equity markets rallied this week, led by the financial sector’s 2 percent advance. SPDR S&P Regional Banking (KRE), performed particularly well, climbing more than 3 percent. The S&P 500 Index gained 0.79 percent, while the Nasdaq increased 1.42 percent. The Dow Jones Industrial Average advanced 0.32 percent.

The S&P 500 Index was flat in March though it increased 5.5 percent in the first quarter. The Nasdaq returned 1.49 percent in March and 9.81 percent in the first quarter to lead index performance.

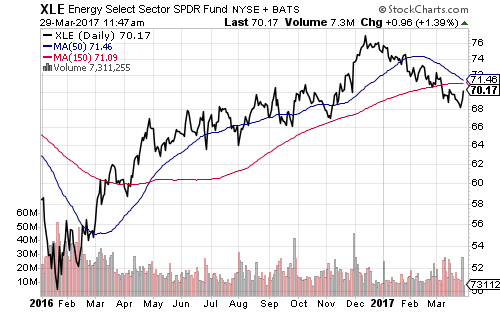

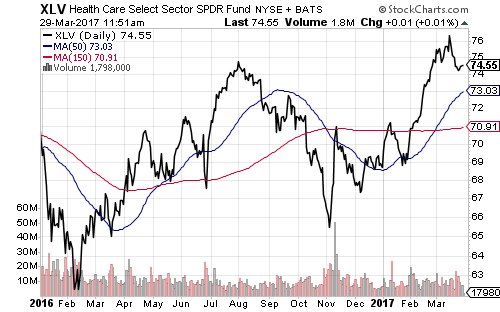

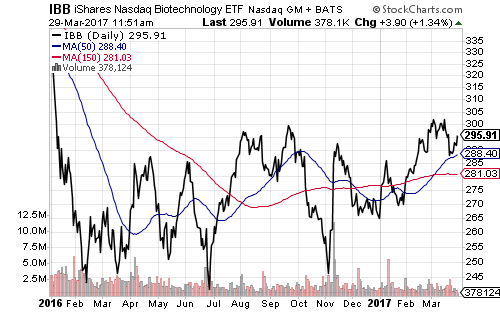

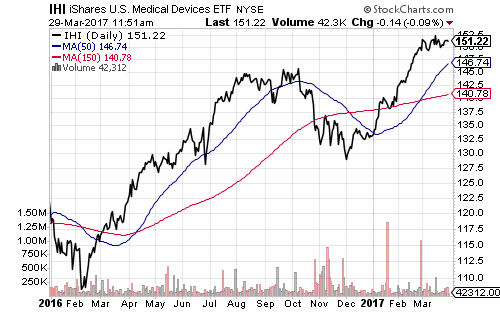

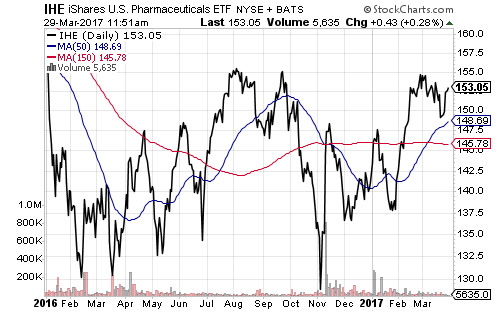

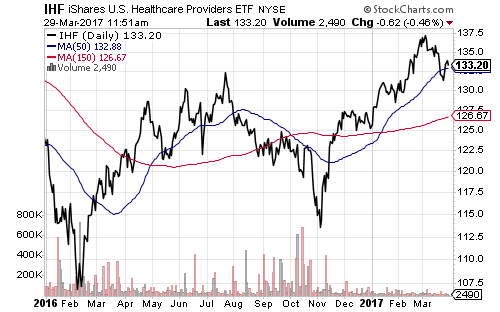

Technology and healthcare were the best performing sectors in the first quarter. Technology outperformed the broader S&P 500 Index by 5 percent and healthcare by nearly 3 percent. The S&P 500 energy sector underperformed the broader index by 12 percent.

Fourth quarter GDP was revised higher to 2.1 percent. Strong consumer spending offset a worsening trade deficit. Corporate profits rose 9.3 percent in 2016. GDP growth for the full year was 1.6 percent. These numbers are third and final estimates.

Conference Board Consumer Confidence surged to 125.6 in March, well above 116.1 from a month ago and estimates of 114.1. On Friday, the University of Michigan Consumer Confidence survey dipped slightly to 96.9.

Pending home sales increased 5.5 percent in February. Analysts believe home sales could grow even faster, but low inventory is limiting sales growth. Home prices are rising as a result, and new home construction remains robust. The Case-Schiller home price index climbed 5.9 percent year-on-year in January.

The personal consumption expenditures (PCE) report showed personal income in the United States grew 0.4 percent in February, in line with expectations. Consumer spending increased 0.1 percent, below forecasts. Economists blamed a delay in tax refunds. Core PCE inflation increased 0.2 percent in February and 1.8 percent year-on-year.

The Chicago PMI climbed to 57.7 in March, the highest reading since January 2015. Any number above 50 signals expansion in the upper Midwest’s manufacturing sector.

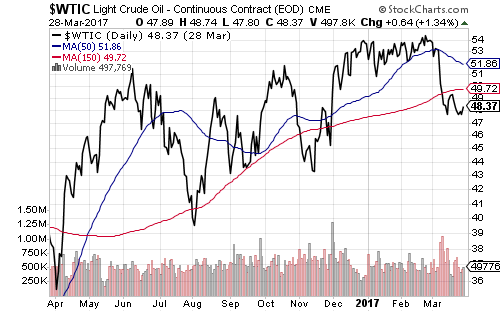

West Texas Intermediate crude oil rallied past $50 a barrel on Thursday after weaker-than-expected inventory. Rising U.S. production didn’t faze the market this week, nor did the news that U.S. shale producers may be able to quickly add 300,000 bpd in new production.

Initial claims for unemployment were 258,000 last week, down slightly from the prior week’s number. Initial claims remain near four-decade lows and well below the 300,000 associated with full employment.

In earnings news, Carnival (CCL) beat estimates by 3 cents at $0.38 per share. Revenues were in line with forecasts. Shares hit a new all-time high following the results. Lululemon (LULU) earned $1.00 per share, missing earnings estimates by a penny. Shares tumbled 23 percent after executives said the year was off to a “slow start.” Paychex (PAYX) beat earnings estimates and missed on revenues, sending shares down 3 percent. On Friday, Blackberry (BBRY) reported a loss of $0.10 per share, missing expectations, but much better than the year-ago quarter loss of $0.45 per share. BBRY rallied in Friday trading.

Month: March 2017

Mutual Fund & ETF Watchlist for March 29, 2017

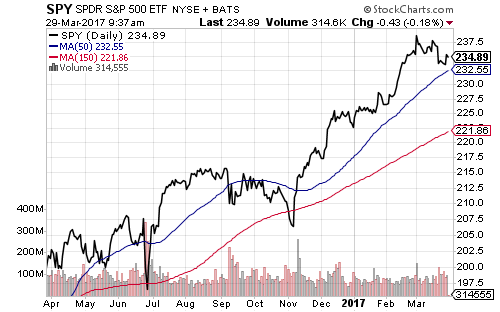

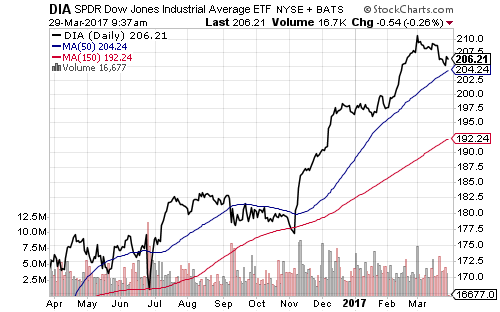

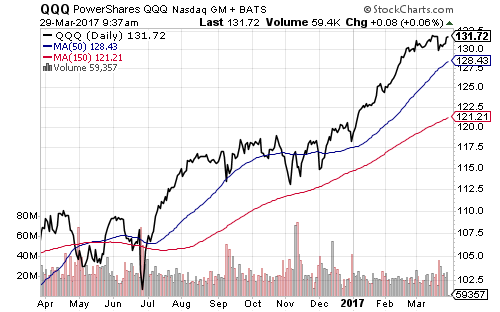

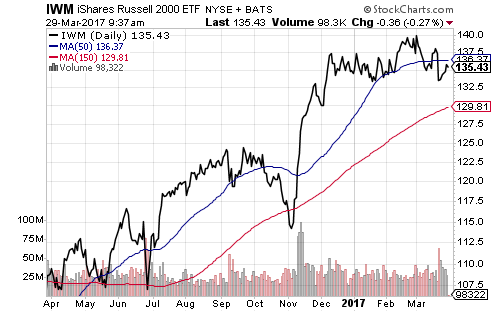

The Dow Jones Industrial Average and S&P 500 Index both bounced off 50-day moving averages over the past week, while the Nasdaq’s 50-day MA continues to climb. The Russell 2000 has remained in a trading range since December and has slipped below its 50-day MA.

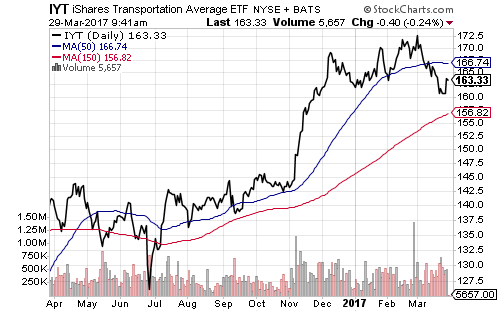

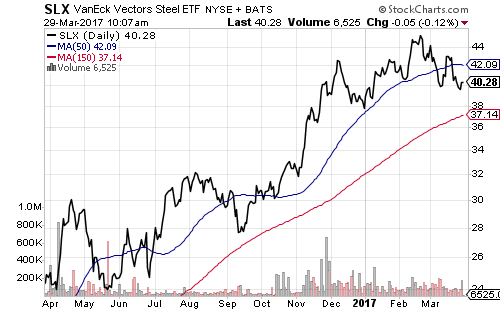

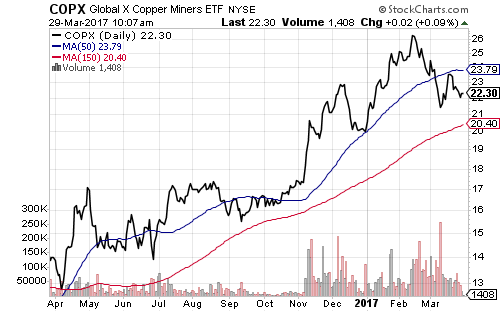

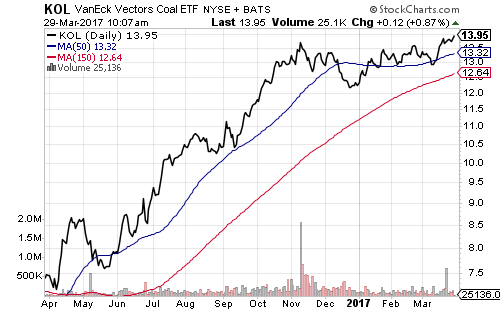

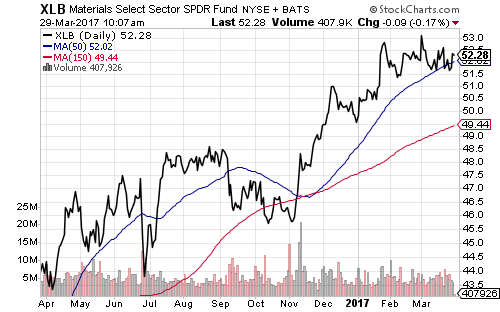

There are pockets of weakness in some commodity and related sectors. iShares U.S. Transportation (IYT) dipped below its 50-day MA. Steel producers and copper miners also slipped below support levels. VanEck Coal (KOL) broke out to a new 52-week high following President Trump’s rollback of anti-coal regulations. The broader materials sector tracked by SPDR Materials (XLB) shows the sector remains in a general uptrend.

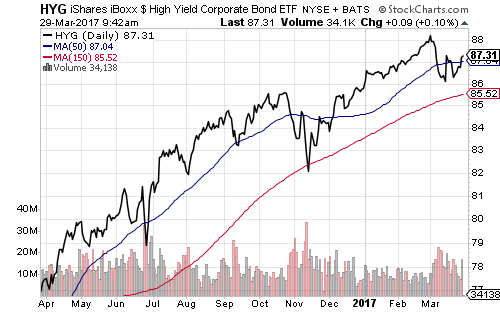

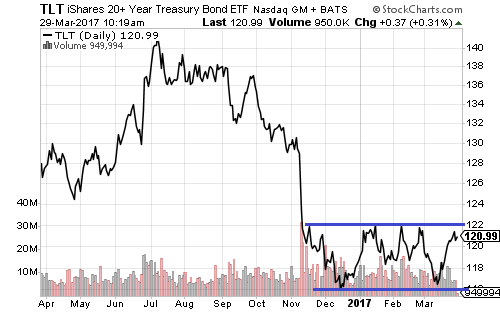

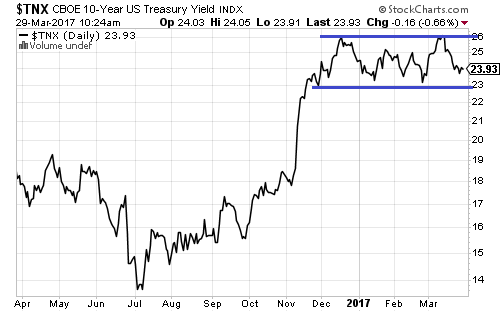

High-yield bonds foreshadowed the recent dip in stocks in early March, but iShares iBoxx High Yield Corporate Bond (HYG) has regained its 50-day MA. Rising interest rates weighed on iShares iBoxx Investment Grade Corporate Bond (LQD). iShares 20+ Year Treasury (TLT) remains in a range between $116 and $122, mirroring the 10-year Treasury yield, which is bouncing between 2.3 and 2.6 percent.

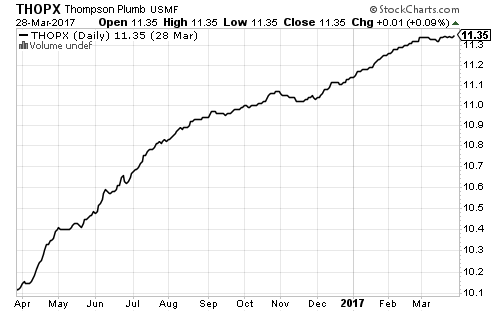

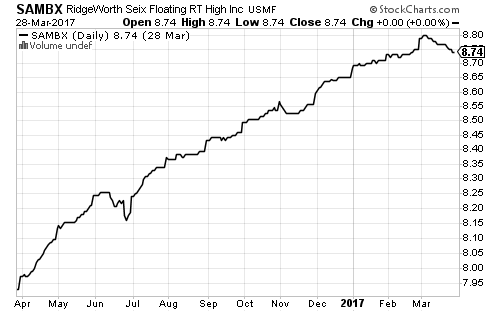

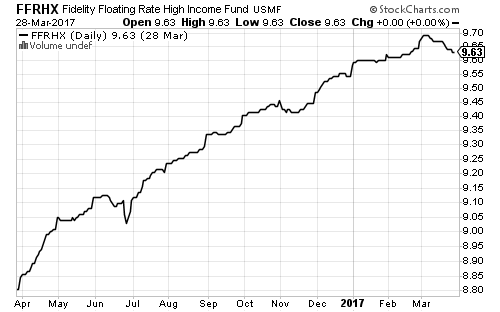

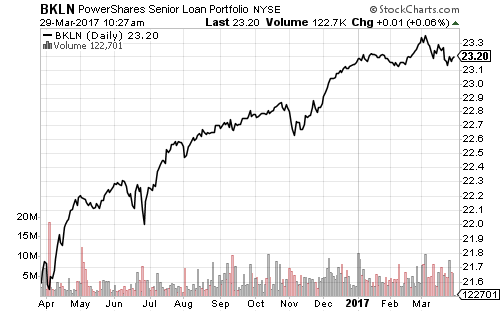

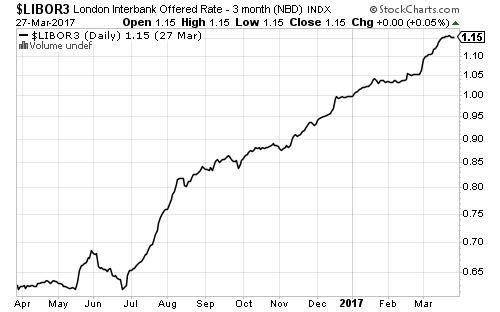

Thompson Bond (THOPX) continues to hold steady despite fluctuations in the bond market. Floating-rate funds eased following the Fed’s rate hike. Market interest rates have steadied over the past few weeks.

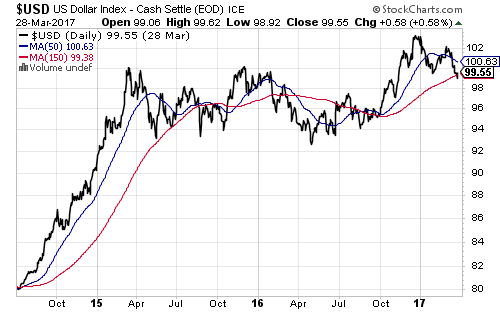

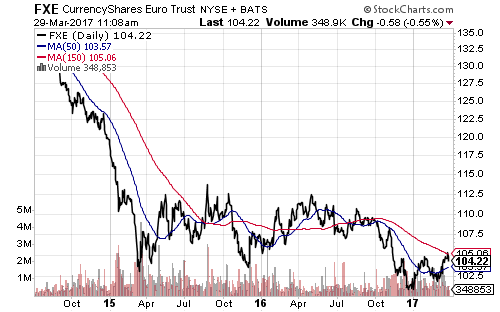

The U.S. Dollar Index fell sharply before quickly recovering. It spent several months below its support line in 2015 and 2016, so a further dip doesn’t threaten the long-term bull market. The euro bumped against its 200-day MA and turned down on Wednesday.

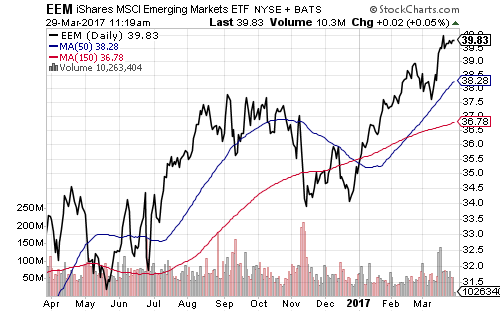

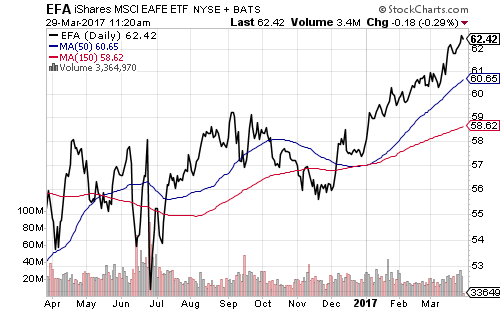

Both emerging and developed markets are well above their moving averages thanks to the weaker dollar this year.

West Texas Intermediate crude oil retook the $49 level today following subdued weekly inventory reports.

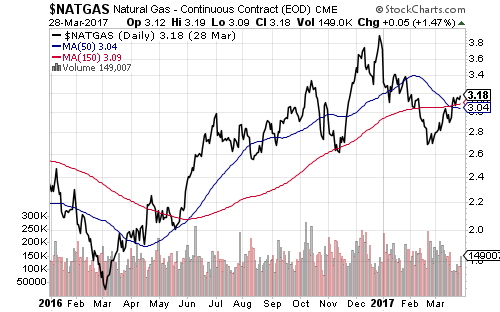

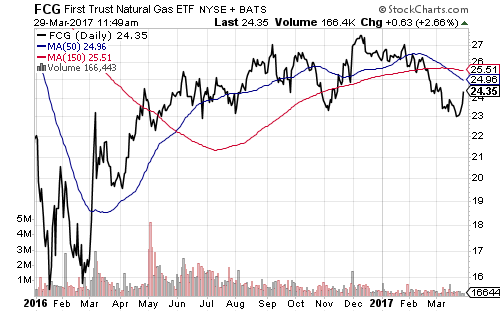

Natural gas continues to perform better than oil, but natural gas equities have underperformed the broader energy sector in 2017.

Healthcare was a strong performer over the past week, due to the failure to repeal the Affordable Care Act.

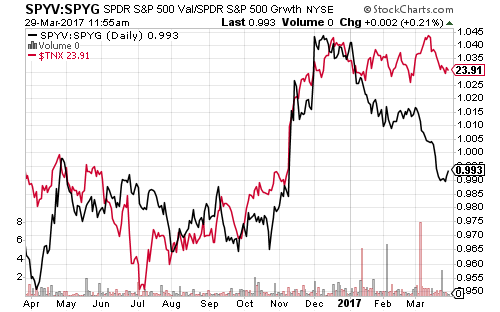

Value stocks outperformed growth by a solid margin in 2016. At the start of 2017, the trend towards higher rates paused as investors rotated out of value and back into growth.

ETF Investor Guide for March 2017

The March Issue of the ETF Investor Guide is NOW AVAILABLE! Links to the March Data Files have been posted below. Market Perspective: Reconsider Bond Allocations in Light of Rate Hikes […]

Market Perspective for March 27, 2017

Healthcare and consumer discretionary opened the week on a strong note, while the broader market pulled back in response to gridlock over proposed healthcare reform. Pharmaceuticals gained more than 1 percent on Monday as Celgene (CELG) and AstraZeneca (AZN) both rallied strongly. On Monday, the Chinese government approved AstraZeneca’s lung cancer drug Tagrisso for sale.

Economic data will be light this week. On Tuesday, the February advance trade in goods is forecast to show a $65.5 billion deficit, improving from $69.2 billion in January. January’s Case-Schiller Home Price Index is expected to hold steady at 5.6 percent growth. The consensus says the Conference Board’s Consumer Confidence for March will ease to 114, down slightly from 114.8 in February. February pending home sales data will be available on Wednesday. Economists are looking for a 2.4 percent increase, reversing the 2.8 percent dip in January.

The third and final estimate of 2016 fourth quarter GDP will be out on Thursday. Economists predict the estimate will improve from 1.9 to 2.0 percent.

The Federal Reserve’s preferred inflation measure, core personal consumption expenditures (PCE), is due out on Friday. The consensus predicts PCE inflation rose 1.7 percent year-on-year, and 0.2 percent month-on-month. The University of Michigan Consumer Sentiment survey will also be out. It is expected to hold steady at 97.6.

Interest rates may test short-term support this week. The four-month low for the 10-year Treasury yield is 2.31 percent. On Monday, the 10-year Treasury yield traded at 2.37 percent. This support level has been tested and held three times in 2017. The U.S. dollar continued to consolidate on Monday. The failure of the GOP’s healthcare reform bill dealt a short-term blow to tax reform optimism.

A few companies are scheduled to report earnings in the interim period this week. Analysts expect Carnival (CCL) will report earnings of $0.35 per share on Tuesday, down from $0.39 cents last year. On Wednesday, the consensus calls for earnings of $1.01 per share at lululemon (LULU) and $0.54 at Paychex (PAYX), both up from year-ago levels. On Friday, analysts are looking for a loss of $0.04 at Blackberry (BBRY), 2 cents better than last year.

Global Momentum Guide for March 27, 2017

Click Here to view today’s Guide WEEKLY SECTOR PERSPECTIVE The MSCI EAFE fell 0.07 percent last week. The Nasdaq slipped 1.22 percent, the S&P 500 Index 1.44 percent, the Dow […]