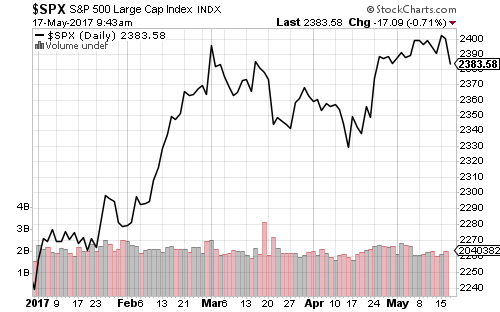

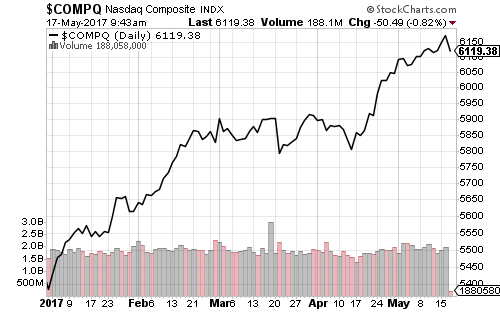

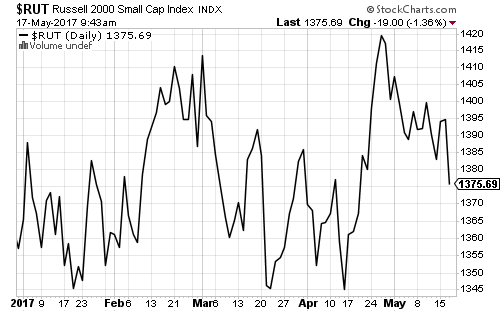

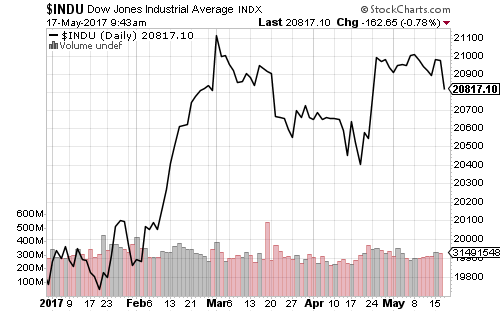

Stocks have recovered nearly all last week’s losses, closing higher across the board on Monday.

U.S. defense shares opened at a new all-time high on Monday after Saudi Arabia and the United States agreed to a $350 billion weapons deal, with $110 billion hitting immediately. iShares U.S. Aerospace & Defense (ITA) gained 0.87 percent on the day.

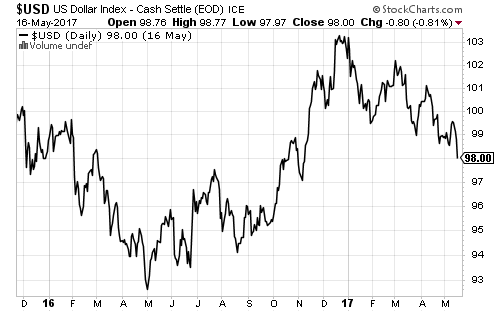

The 10-year Treasury yield opened the week at 2.24 percent. The yield has been in a downtrend since peaking in early March. A break below 2.2 percent would be bullish for bonds. The euro is at $1.12 and could rise as high as $1.15 before hitting stiff resistance.

Flash May PMIs will be out this week. The April Markit and ISM manufacturing surveys were 53.1 and 54.8, respectively. Economists are looking for a small uptick from those figures. The final May PMIs will be released on June 1.

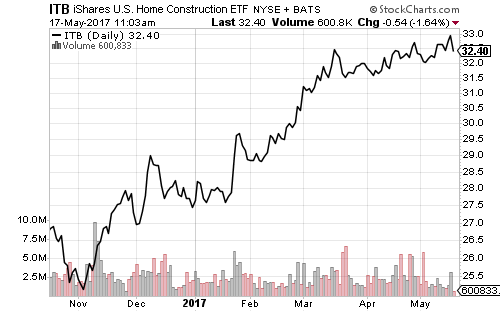

New and existing home sales for April will be available on Tuesday and Wednesday. Economists expect an annualized sales pace of 610,000 new homes and 5.6 million existing homes.

On Wednesday, the last Federal Open Market Committee meeting minutes will be out. Several Fed officials are also scheduled to speak this week. Rate hike odds returned to above 80 percent on Monday.

The first-quarter GDP revision will be released on Friday and growth is expected to climb from 0.7 percent to 0.9 percent. Durable goods and core capital equipment orders for April are also due.

The Bank of Canada will meet on Wednesday, but no rate hike is expected. Japanese CPI is due on Thursday. Britain’s exit from the European Union could be rockier than expected. A bill for U.K. commitments has ballooned to 100 billion euros, according to the EU. Negotiations are scheduled to start on June 19.

Only 5 percent of S&P 500 companies are left to report earnings, including Intuit (INTU), AutoZone (AZO) and Toll Brothers (TOL). Lowe’s (LOW) will report on Wednesday. Analysts are looking for substantial earnings growth of 23 percent. Advance Auto Parts (AAP), Tiffany’s (TIF), and Bank of Montreal (BMO) will also report.

Thursday will be the heaviest day for earnings with Medtronic (MDT), Royal Bank of Canada (RY), Toronto Dominion Bank (TD), Costco Wholesale (COST), Dollar Tree (DLTR), Hormel (HRL), Ulta Beauty (ULTA) and Best Buy (BBY).