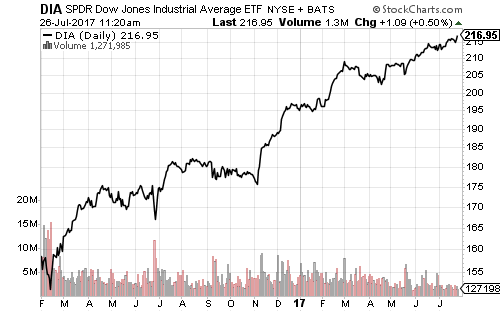

Financials, healthcare and industrials pushed the Dow Jones Industrial Average to another new all-time high on Monday.

Consumer spending, factory orders, construction spending and trade deficit data for June will be released this week. Third-quarter manufacturing and service PMIs from Markit and ISM will also be out over the coming days. Economists anticipate small dips in those surveys. July auto sales are expected to reflect an annualized rise to 16.9 million, up 0.5 million from June. The July employment report will close the week on Friday. The consensus estimate calls for 180,000 new jobs in July and a 0.1-percent drop in the unemployment rate to 4.3 percent.

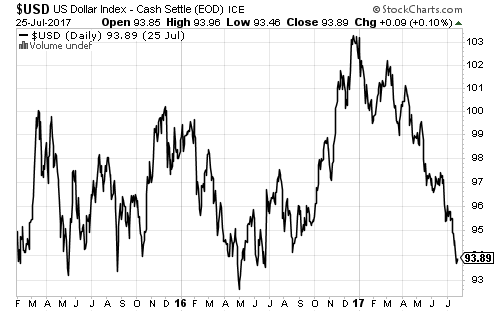

China’s manufacturing PMI slowed in July, but remained above 50, signaling continued expansion. Headline Eurozone inflation matched expectations in July and core CPI was 0.1 percent higher than estimates. The euro gained versus the greenback on the news. The U.S. Dollar Index is flirting with the 93 level and could test its multi-year low this week. On Tuesday, the Eurozone will report second-quarter GDP growth. Economists forecast growth of 2.4 percent year-on-year and 0.6 percent quarter-on-quarter.

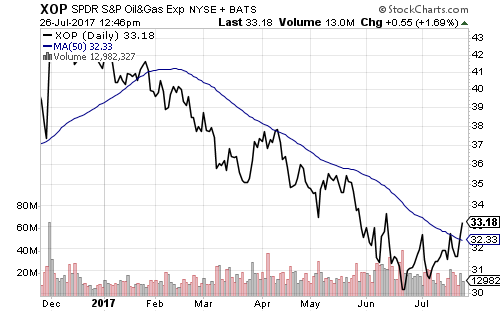

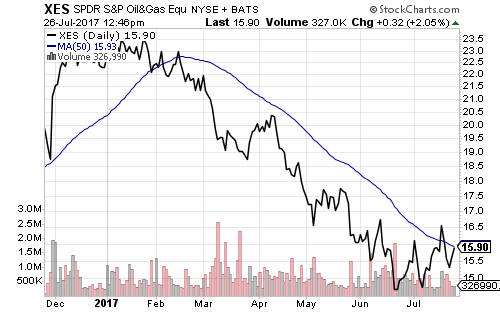

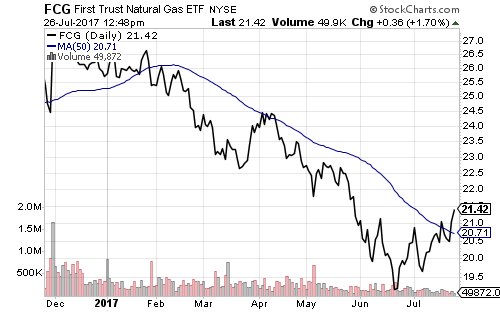

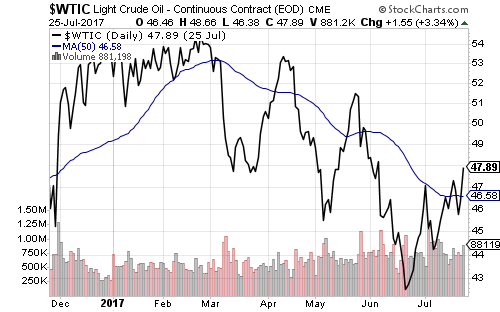

Oil prices climbed near $50 a barrel on rumors of U.S. sanctions against Venezuela’s state-owned oil company following a power grab by the country’s president. Venezuela imports U.S. oil and mixes it with their heavier product to create a mixture suitable for refineries in Asia. The U.S. is also a major importer of Venezuelan heavy crude.

The threat of sanctions has also shifted U.S. importers towards lighter crude produced domestically and heavy crude from Canada. Although traders may push domestic oil prices higher in the short-term, a sustained rise in prices looks unlikely given the preparations by U.S. firms.

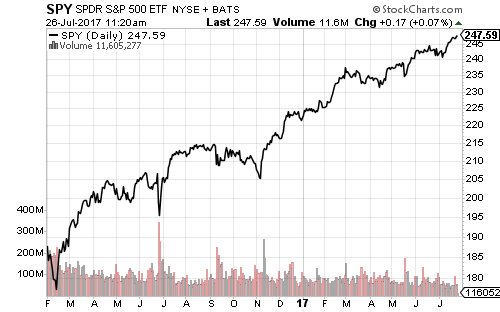

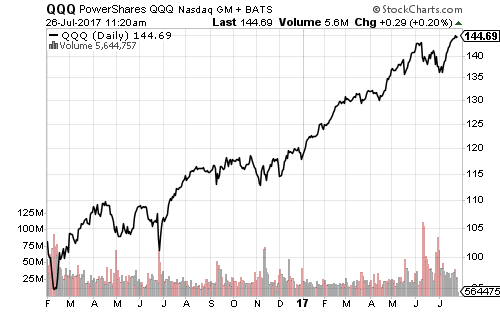

Apple (AAPL) will report earnings after the bell on Tuesday. Analysts forecast $1.57 per-share, though the whisper number is slightly higher at $1.61 per-share. Over the past four quarters, Apple beat earnings by 2.9, 0.6, 4.7 and 4.0 percent, an average of 3.1 percent. Apple is the largest company in the stock market. It makes up 14.6 percent of SPDR Technology (XLK), 11.5 percent of PowerShares QQQ (QQQ), 4.7 percent of SPDR DJIA (DIA) and 3.7 percent of SPDR S&P 500 (SPY). Pfizer (PFE), BP plc (BP) and Sony (SNE) will also report on Tuesday.

On Wednesday, MetLife (MET), Prudential (PRU) American International Group (AIG), Time Warner (YWX), Mondelez (MDLZ) and Tesla (TSLA) will report.

Kraft Heinz (KHC), Allergan (AGN), Enbridge (ENB), Duke Energy (DUK), Regeneron (REGN) and Aetna (AET) will deliver results on Thursday. Friday will be relatively light in terms of market capitalizations. The largest firm reporting will be $44-billion Cigna (CI).