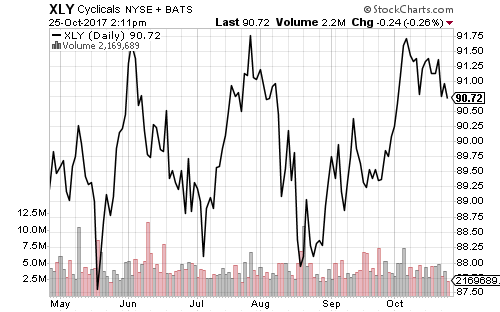

Consumer spending increased faster than expected in September as Americans in hurricane-hit regions replaced damaged vehicles. Personal incomes grew by 0.4 percent, in line with estimates and double August’s growth rate. Core inflation held steady at 0.1 percent growth.

Later this week, several reports for October will be out, including the Conference Board’s consumer confidence index, Chicago PMI, ADP employment report, Markit and ISM manufacturing indexes, motor vehicle sales and the Bureau of Labor Statistic’s employment report. Economists expect several data points to moderate from September’s surge.

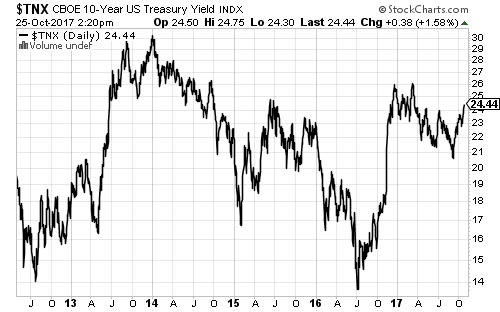

The Federal Reserve will meet on Wednesday. No rate increase is expected, but December rate hike odds are at 98 percent.

This will also be an important week overseas. The European Union will report third-quarter GDP October inflation on Tuesday. Last week, European Central Bank President Mario Draghi’s comments on open-ended quantitative easing sent the euro down versus the dollar. A lower-than-expected inflation number could spark a further decline in the euro. Canada will report August GDP and multiple nations will report manufacturing PMIs.

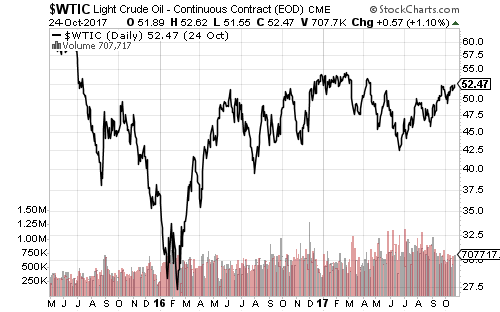

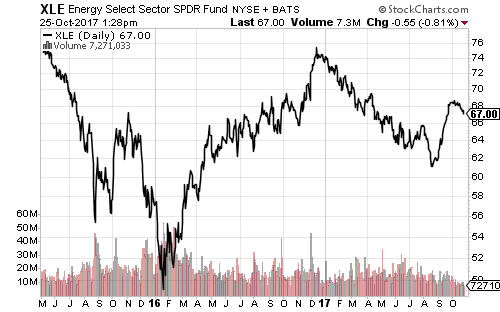

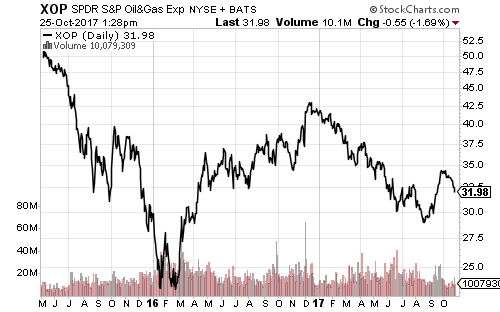

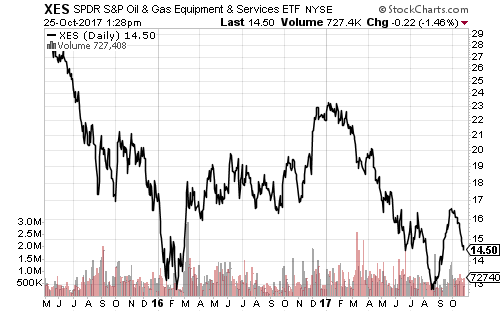

Brent crude crossed $60 a barrel last week. On Monday, West Texas Intermediate crude climbed above $54 a barrel. WTI hasn’t traded above $55 since July 2015. A move above $55 could lift inflation and interest rate expectations.

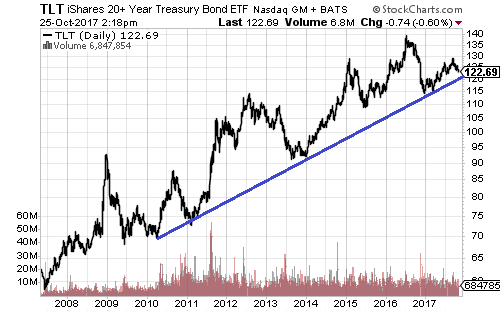

The 10-year Treasury yield traded above 2.4 percent last week, but slipped to 2.3 percent on Monday following inflation data. The U.S. Dollar Index also retreated after rising on four of five days last week.

Telecom funds were hit hard on Monday after Softbank (SFTBY) announced it would drop plans for a Sprint (S) and T-Mobile (TMUS) merger. Softbank owns Sprint. Shares of all three companies fell on the news. Sprint fell more than 10 percent before recovering, T-Mobile more than 5 percent and iShares U.S. Telecommunications (IYZ) slid more than 2 percent. IYZ fell near its 52-week low of $29.31.

Biotech stocks look to rally this week after disappointing earnings. Celgene (CELG) tumbled after missing earnings last week. Gilead Sciences (GILD) beat estimates, but sales of its hepatitis C drug slowed.

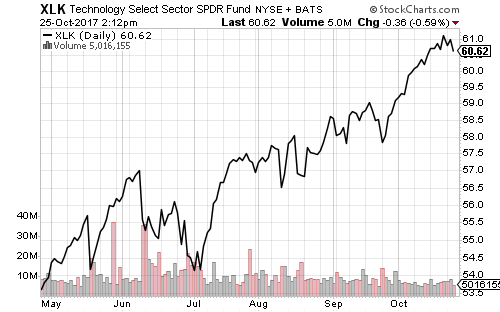

Technology funds will reach for another all-time high this week with Facebook (FB) and Apple (AAPL) earnings on tap. Pharma, consumer staples and utilities will also be in focus this week.

Pfizer (PFE), Mastercard (MA), BP (BP), Aetna (AET) will deliver results on Tuesday. CVS Health (CVS) made an offer for Aetna (AET) last week.

Wednesday brings Facebook (FB), Kraft Heinz (KHC), Qualcomm (QCOM), Allergan (AGN), MetLife (MET), Honda (HMC), Tesla (TSLA), Occidental Petroleum (OXY) and Southern Company (SO).

Apple (AAPL), Alibaba (BABA), Royal Dutch Shell (RDS.A), DowDuPont (DD) and Starbux (SBUX) headline Thursday’s reports.

Duke Energy (DUK) and Moody’s (MCO) deliver results on Friday.