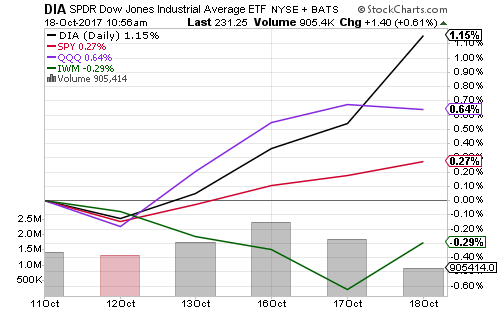

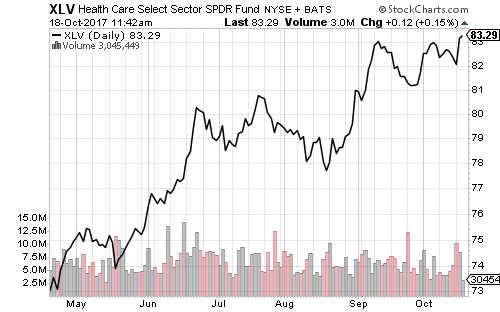

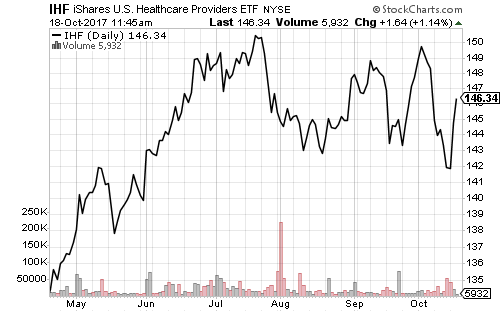

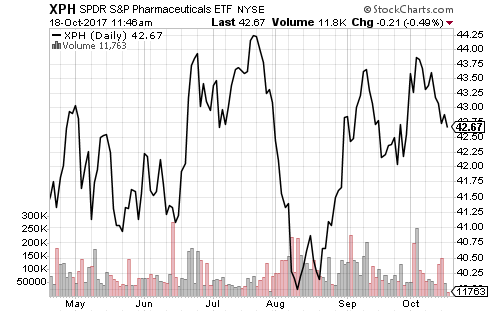

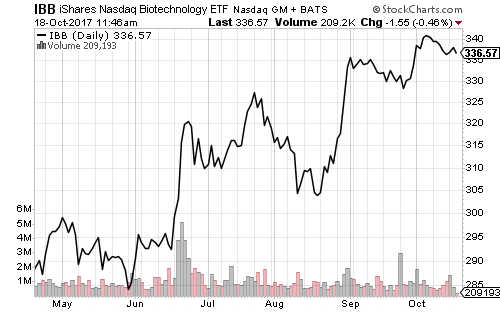

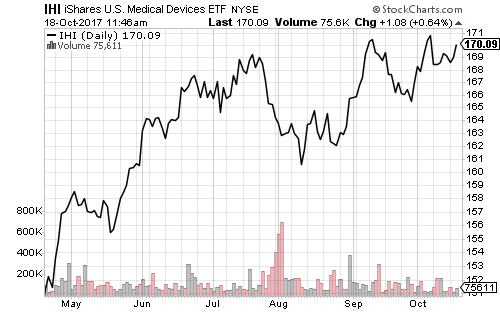

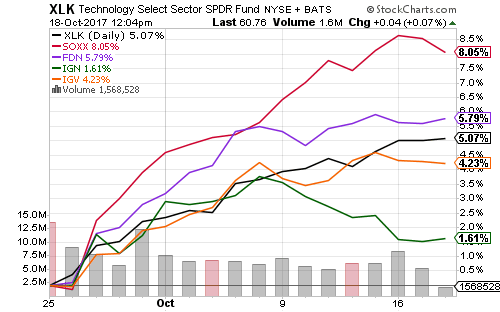

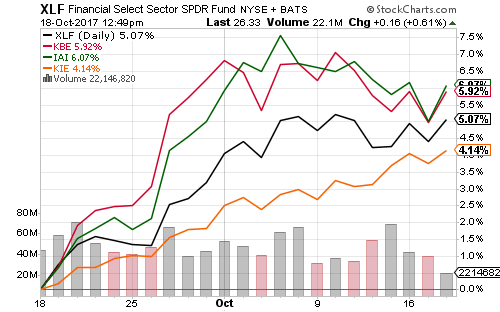

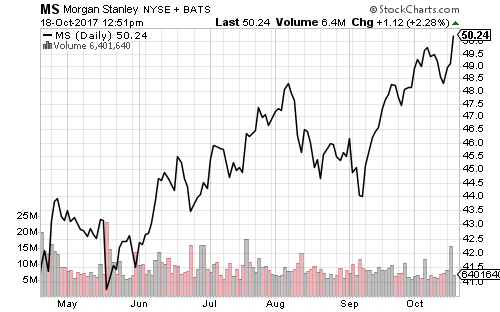

Equities started the week in record territory. Technology, healthcare, financials and materials continued outperforming on Monday.

Flash manufacturing and service PMIs will be out on Tuesday. Last month, the PMIs came in surprisingly high around the world. September new home sales will be out on Friday. Economists forecast 563,000 homes were sold, in line with August’s number. Jobless claims are expected to rise from last week’s 44-year low of 222,000 up to 233,000. On Friday, the Bureau of Economic Analysis will release the first estimate of third-quarter GDP growth. The Atlanta Federal Reserve’s GDP Now model and economists’ models both anticipate 2.7 percent growth.

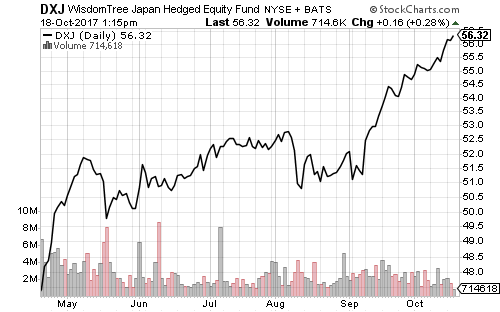

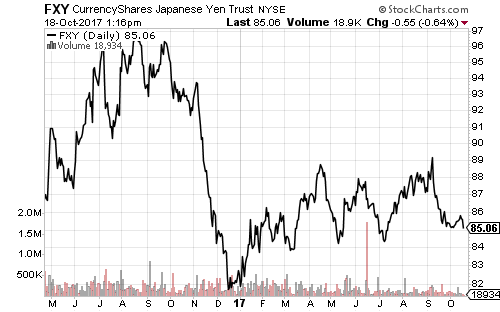

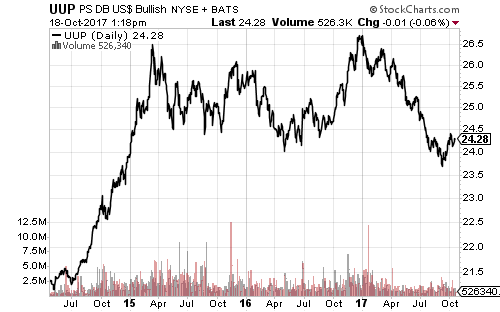

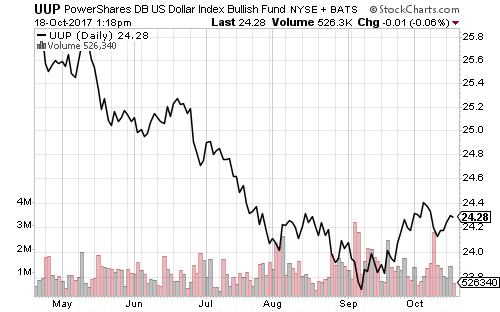

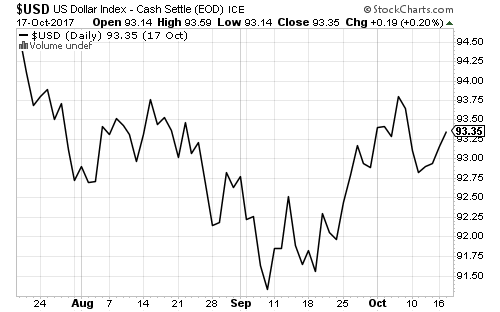

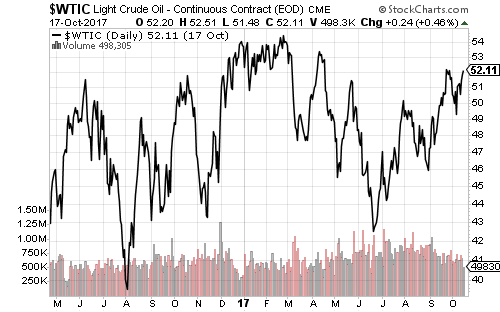

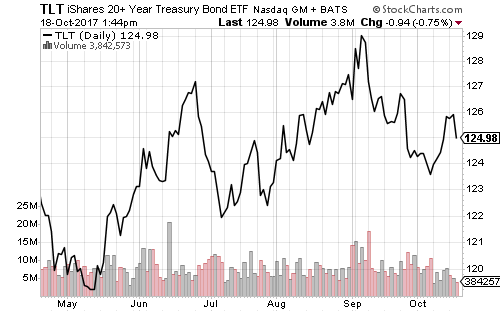

Crude oil opened the week near $52 a barrel. The 10-year Treasury yield held steady at 2.37 percent. The U.S. Dollar Index closed at a new two-month high, aided by the weaker yen.

Later this week, the Bank of Canada and European Central Bank will make policy decisions. The ECB could announce a start date for tapering quantitative easing. An October announcement was widely expected two months ago, but a delay until December is possible.

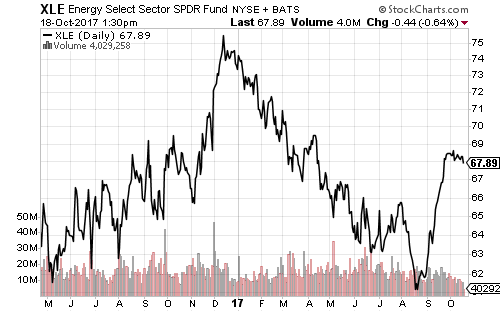

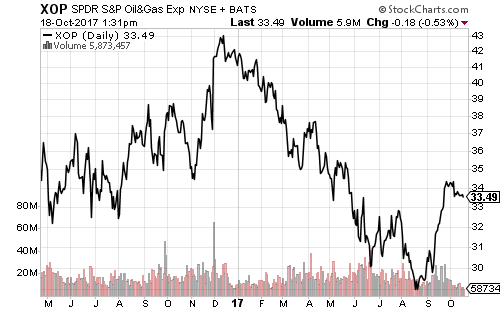

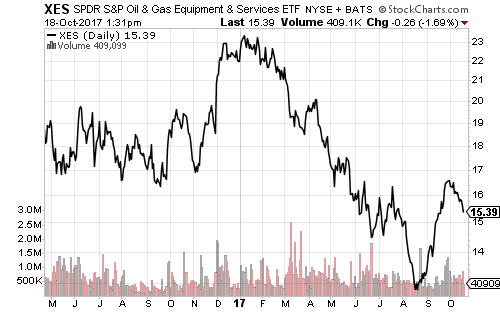

After reporting earnings on Monday, shares of Illinois Tool Works (ITW) rallied and Halliburton (HAL) fell. As a major component in energy funds, the dip in Halliburton weighed on the sector. Illinois Tool Works lifted the industrial sector, but renewed selling in General Electric (GE) offset it. GE reversed Friday’s gain and fell to a new 52-week closing low.

Major components in defense, telecom, pharma, technology, consumer, biotech, energy and industrial funds will report this week. The bulk of iShares U.S. Aerospace & Defense (ITA) will report.

3M (MMM), AT&T (T), McDonald’s (MCD), Novartis (NVS), Eli Lilley (LLY), United Technologies (UTX), Lockheed (LMT), Texas Instruments (TXN), Caterpillar (CAT), Biogen (BIIB) and General Motors (GM) will report on Tuesday.

Wednesday brings Visa (V), Coca-Cola (KO), Boeing (BA), Amgen (AMGN), GlaxoSmithKline (GSK), Walgreens (WBA), General Dynamics (GD) and Northrop Grumman (NOC).

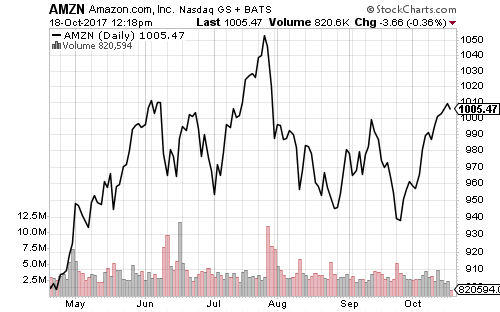

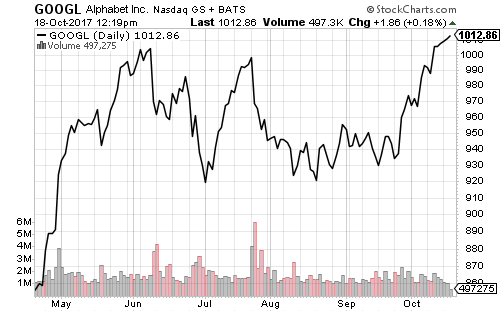

Alphabet (GOOGL), Microsoft (MSFT), Amazon (AMZN) and Intel (INTC) will headline Thursday’s reports, along with Anheuser-Busch Inbev (BUD), Comcast (CMCSA), Altria (MO), Gilead Sciences (GILD), Bristol-Myers Squibb (BMY), Celgene (CELG) and United Parcel Service (UPS).

The week will close out with the major integrated oil producers. Exxon Mobil (XOM), Chevron (CVX), Total SA (TOT), Phillips 66 (PSX), AbbVie (ABBV), Colgate-Palmolive (CL) and Simon Property Group (SPG) are on Friday’s reporting schedule.