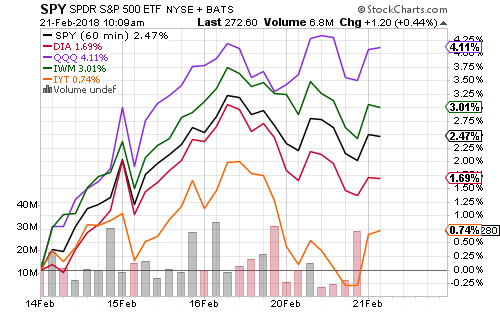

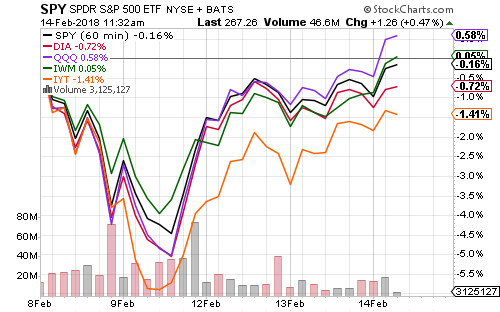

All major indexes gained ground over the past week, with the Nasdaq outperforming the Russell 2000 by almost 1 percent.

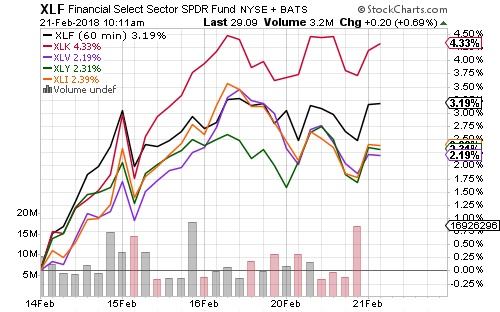

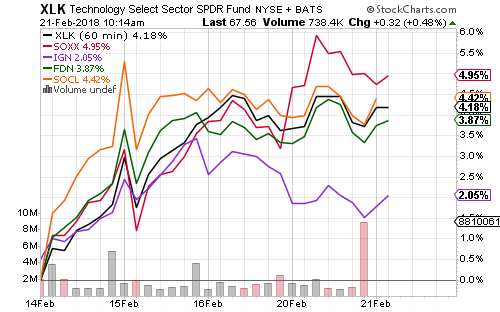

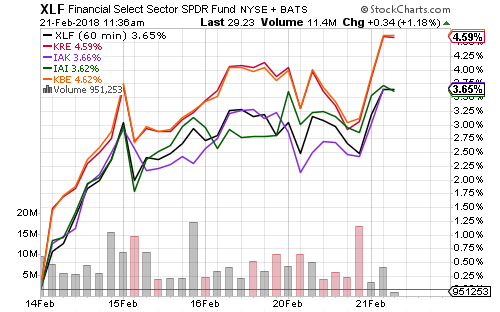

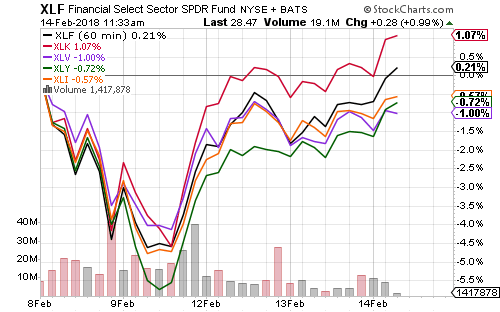

Technology led the week’s performance, followed by financials. Healthcare, consumer discretionary and industrials all had similar returns.

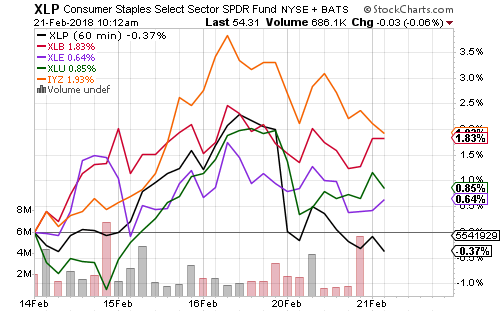

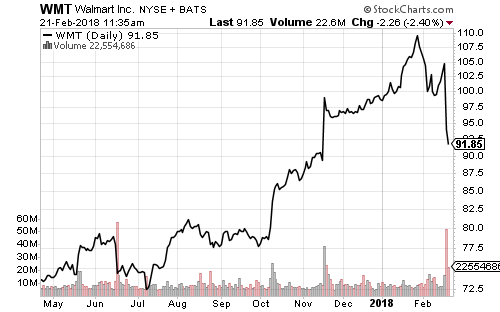

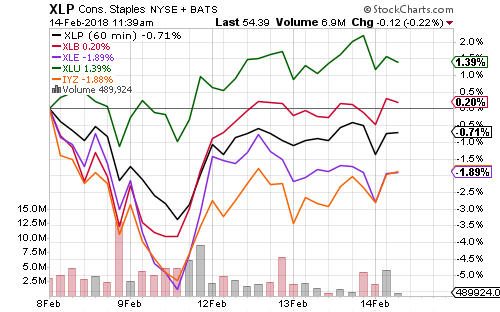

The smaller sectors in the S&P 500 Index underperformed the larger sectors. Wal-Mart’s (WMT) earnings miss sent its shares down 10 percent on Tuesday. WMT is a top component in the consumer staples sector.

Merger activity lifted technology shares this week. Broadcom (BRCM) made a hostile bid for Qualcomm (QCOM) earlier this year, but Qualcomm had already made an offer for NXP Semiconductors (NXPI). This week, Qualcomm upped its bid for NXP in part to fend off Broadcom. The semiconductor ETF was up nearly 5 percent for the week in early Wednesday trading.

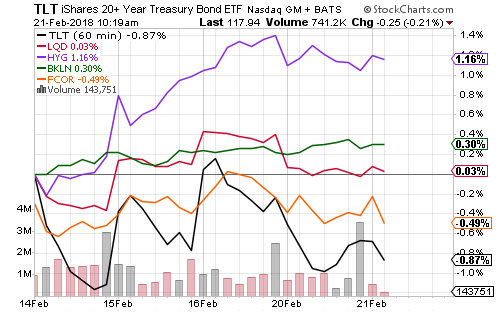

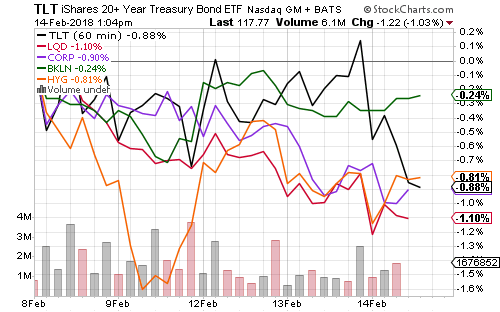

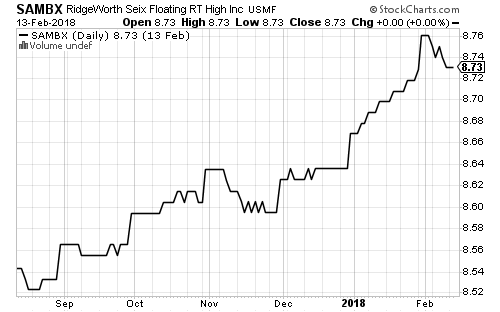

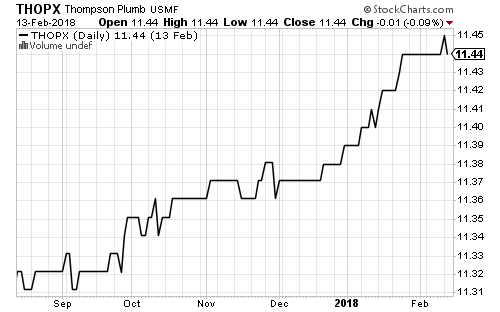

High-yield bonds snapped back this week as credit risk eased. With interest rates steady in over the past week, the dip in credit risk pushed high-yield funds higher. Floating-rate funds such as PowerShares Senior Loan Portfolio (BKLN) continued to perform well.

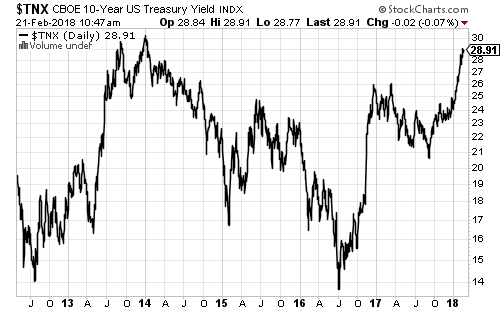

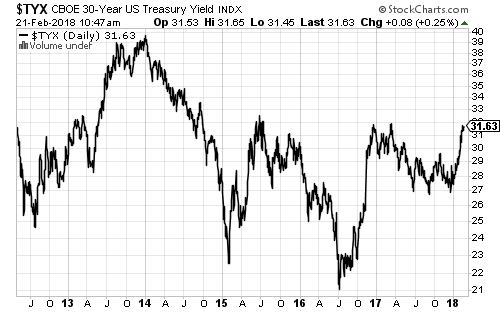

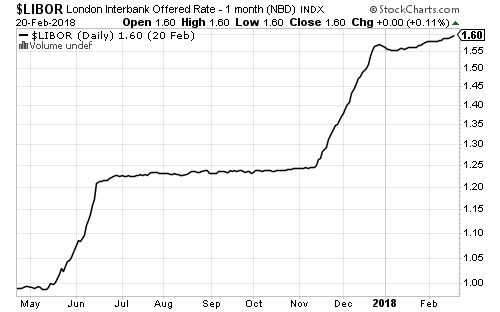

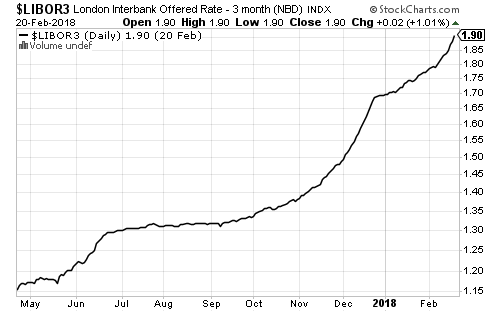

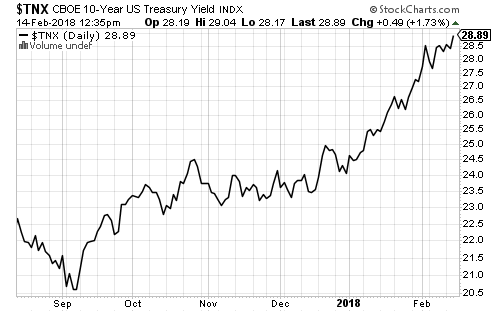

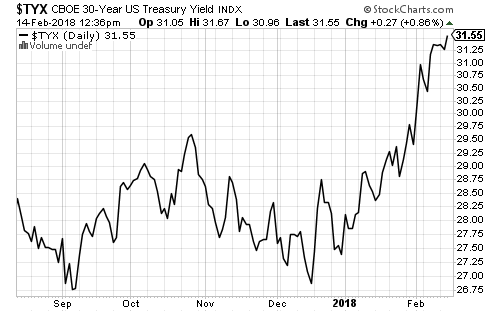

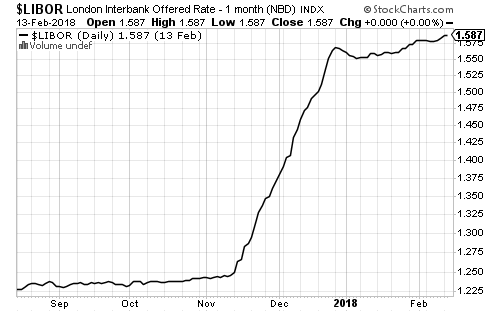

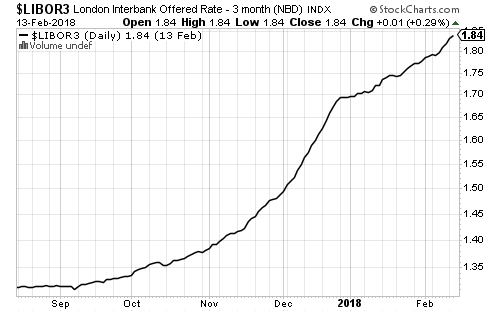

The 10- and 30-year Treasury yields stabilized over the past week. Both remain very close to achieving new multi-year highs. The 5-year yield has already broken out to the upside. The 2-year Treasury yield is back to levels seen in the early 2000s. Libor has already started pricing in a rate hike at the Fed’s March meeting.

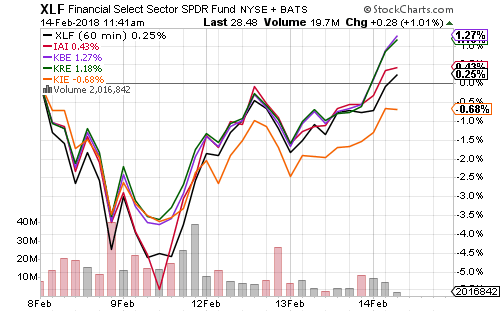

SPDR Bank (KBE) and Regional Banking (KRE) were the best performing subsector funds in the financial sector this week.

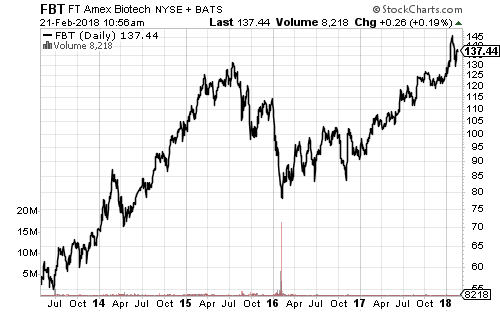

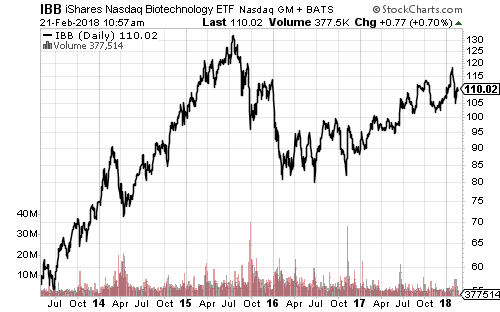

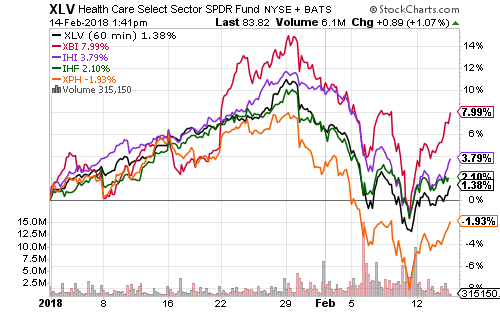

SPDR S&P Biotech (XBI) and FirstTrust NYSE Arca Biotechnology (FBT) briefly reversed earlier breakouts during February selling, but have since climbed higher. Large-cap funds such as iShares Nasdaq Biotechnology (IBB) have yet to exceed 2015 highs.

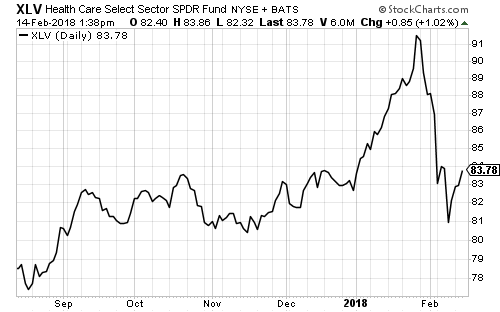

XBI

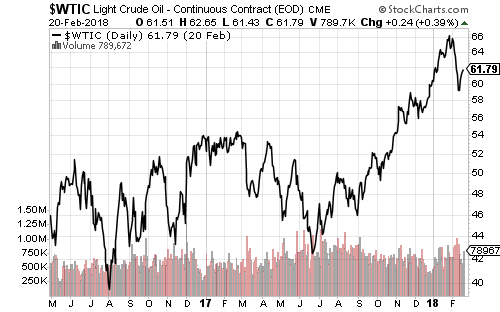

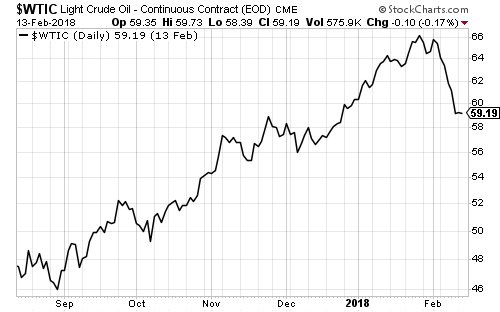

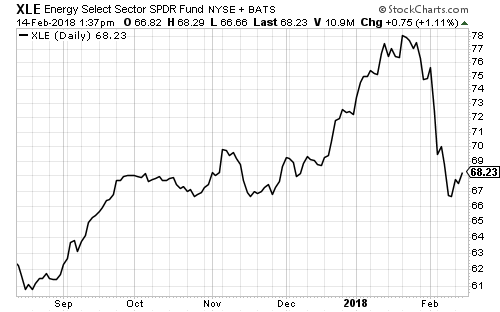

Crude oil has traded above $60 for most of 2018, though it did slide about $8 from peak-to-trough during February.

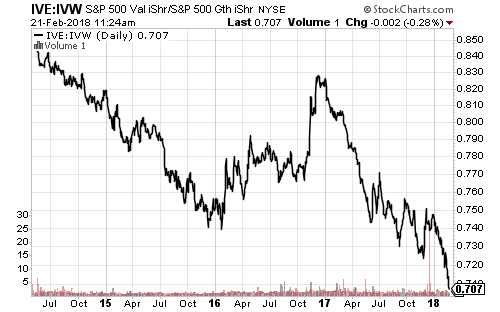

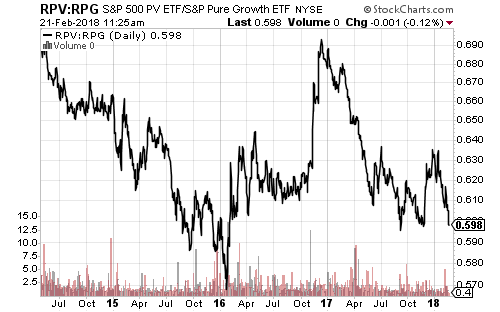

Strength in technology contributed to relative weakness in value versus growth funds this year.

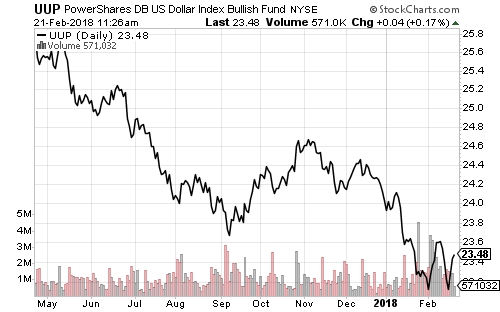

The U.S. Dollar Index has triple-bottomed in the past month in intraday trading. PowerShares U.S. Dollar Index Bullish (UUP) needs to climb above the recent high of $23.60 to stage a larger rally.

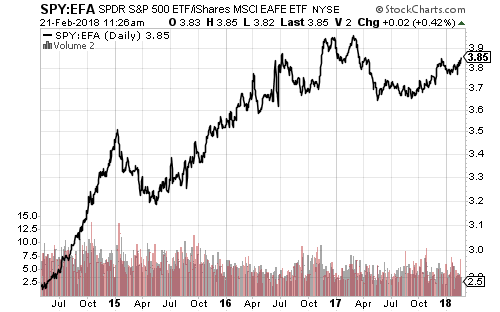

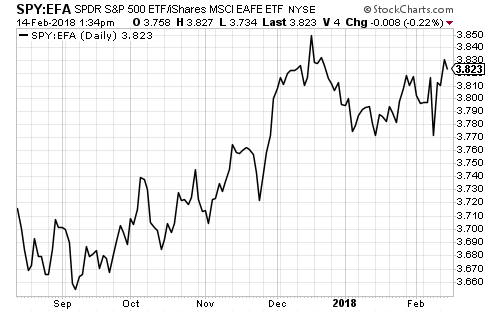

With the U.S. dollar stabilizing, the outlook for foreign stocks is dimming. The S&P 500 is trading at a new 2018 high versus the MSCI EAFE and it could easily exceed the 2017 multi-year high if the U.S. dollar achieves even a modestly bullish rally.

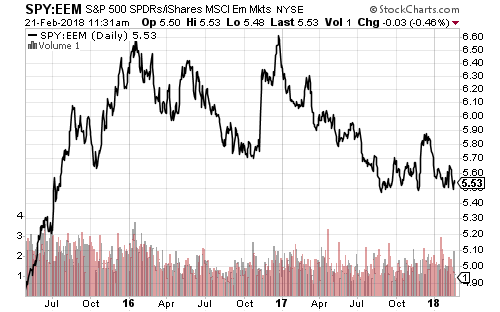

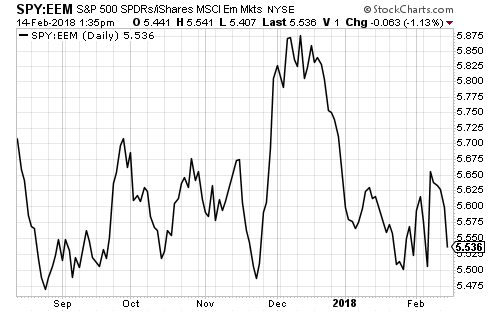

Although emerging markets are outperforming developed markets, they still haven’t broken out to a new relative high versus the S&P 500 Index. EEM has failed to breakout versus SPY multiple times over the past six months. A downside breakout in this ratio would be very bullish for emerging markets.