The week ahead will include major earnings reports, economic data, and a Federal Open Market Committee (FOMC) meeting. The Federal Reserve will meet on Tuesday and Wednesday this week. No rate hike is expected this month.

Core inflation as measured by personal consumption expenditures (PCE) hit 1.9 percent in March. The headline number was 2.0 percent. The Fed’s target range for inflation is 2 to 3 percent.

April manufacturing PMIs, auto sales and March construction spending will be released on May 1st. Auto sales were strong in March, hitting an annualized pace of 17.5 million vehicles. Last week’s flash PMIs indicated strengthening in the manufacturing sector. Service PMIs are due later in the week. The big economic data point will be Friday’s April employment report. The consensus forecast calls for 194,000 new jobs and a drop in the unemployment rate to 4.0 percent.

Eurozone GDP will be out on Wednesday. Economists expect 2.5 percent growth year-on-year. They also forecast 1.3 and 0.9 percent headline and core inflation for the Eurozone.

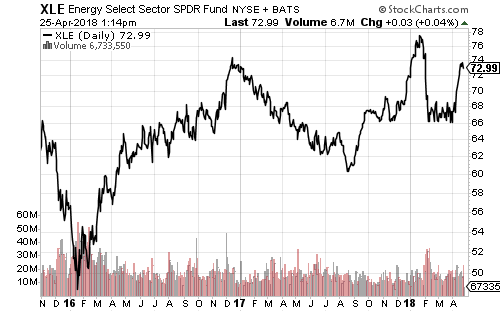

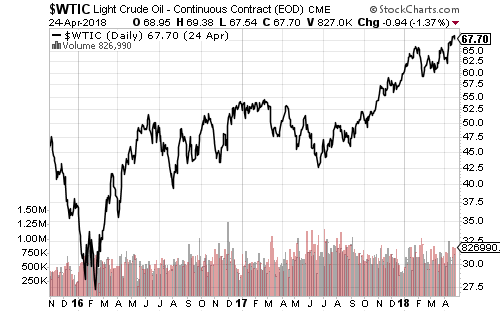

Crude oil climbed past $69 a barrel as geopolitical tensions escalated between Israel and Iran. Energy was the best performing sector in Monday trading.

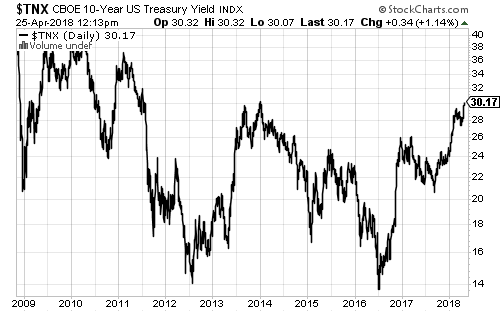

The 10-year Treasury yield continued its consolidation after cracking 3 percent last week. It finished Monday trading at 2.94 percent.

McDonald’s (MCD) kicked off this week with a strong earnings report. It delivered $1.67 per-share last quarter, up 20 cents from last year and 7 cents ahead of estimates. Shares rallied on Monday and the Dow outperformed the other major indexes. Analysts are looking for $2.69 per share from Apple (AAPL) after the bell on Tuesday. The company is expected to announce a large dividend increase or share buyback plan given the changes in tax laws.

Allergan (AGN), Pfizer (PFE), Merck (MRK), BP (BP), Gilead Sciences (GILD), Mondelez (MDLZ), Mastercard (MA), CVS Health (CVS), Kraft Heinz (KHC), Estee Lauder (EL), MetLife (MET), Tesla (TSLA), Southern Company (SO), Prudential Financial (PRU), Express Scripts (ESRX), Zoetis (ZTS), DowDuPont (DWDP), Alibaba (BABA), Celgene (CELG) and Cboe Global Markets (CBOE) will also report this week.