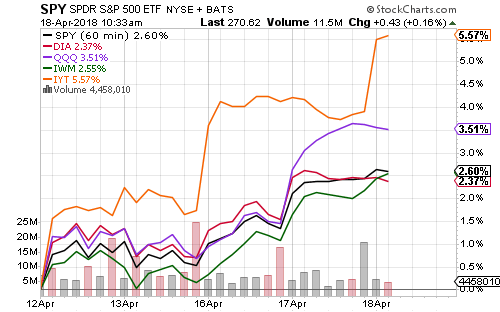

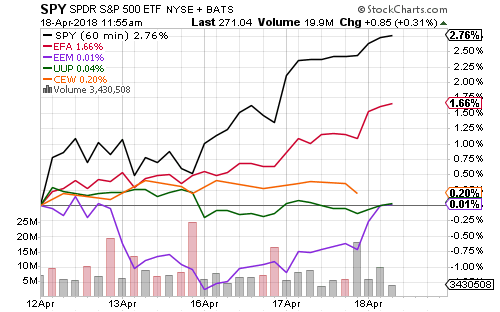

Stocks opened the week mixed. The flash manufacturing and services PMIs strengthened in April. The Markit manufacturing PMI is at its highest in three years. Existing home sales in March were stronger than expected.

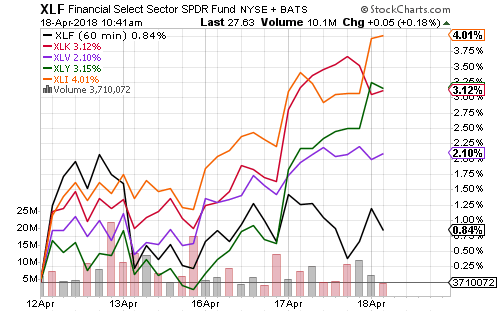

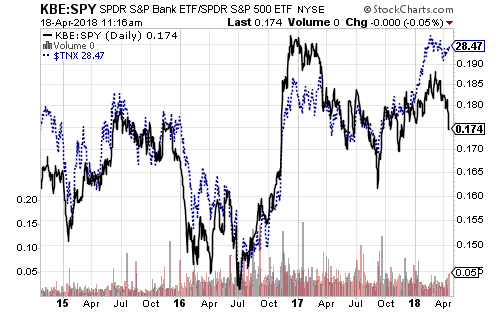

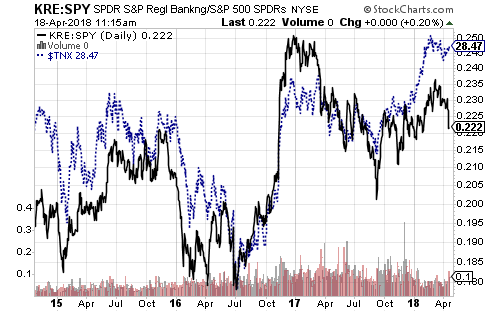

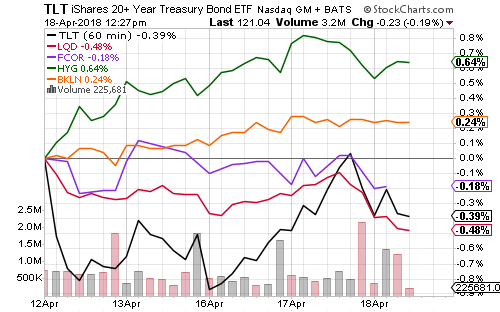

Rising interest rates kept a lid on stocks after the 10-year Treasury yield hit 2.99 percent at noon before pulling back. Financials benefited from higher rates, and banks were among the better performing subsectors on the day.

First-quarter GDP growth will headline the week’s economic data. The New York Fed’s Nowcast model is far more optimistic at 2.9 percent growth as of April 20.

April consumer confidence will also be released this week. Economists forecast a slight decline from March. They see a slight rise in the University of Michigan’s consumer sentiment survey out later in the week. New home sales are expected to have hit an annualized pace of 630,000 in March.

The U.S. Dollar Index and the Bloomberg Dollar Index broke out of downtrends on Monday. Both peaked in December 2016 and have steadily declined as the dollar weakened against the euro, yen and emerging-market currencies.

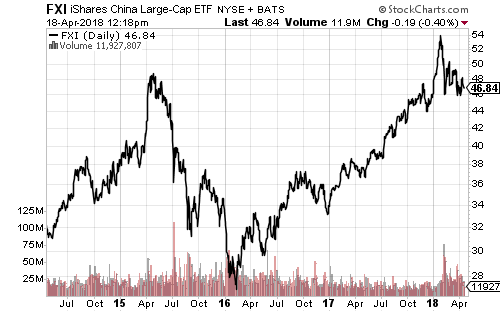

North Korea will freeze nuclear and missile tests as a prelude to negotiations with the United States. China and the United States both spoke positively about a resumption in trade negotiations.

Major technology companies and Dow components will report earnings this week, including Alphabet (GOOGL), Verizon (VZ), 3M (MMM), Coca-Cola (KO), SAP (SAP), Lockheed Martin (LMT), United Technologies (UTX), Texas Instruments (TXN), Caterpillar (CAT), Eli Lilly (LLY), Facebook (FB), Visa (V), AT&T (T), Boeing (BA), Comcast (CMCSA), PayPal (PYPL), Amazon (AMZN), Microsoft (MSFT), Intel (INTC), Royal Dutch Shell (RDS.A), AbbVie (ABBV), Pepsi (PEP) and Amgen (AMGN).

Halliburton (HAL), Chubb (CB), Biogen (BIIB), Travelers Companies (TRV), Sherwin-Williams (SHW), Advanced Micro Devices (AMD), Qualcomm (QCOM), Aflac (AFL), General Dynamics (GD), GlaxoSmithKline (GSK), Northrop Grumman (NOC), Baidu (BIDU), Altria (MO), Union Pacific (UNP), United Parcel Service (UPS), Bristol-Myers (BMY), Starbucks (SBUX), Raytheon (RTN), ConocoPhillips (COP), Time Warner (TWX), Exxon Mobil (XOM) and Chevron (CVX) are also scheduled to report this week.