The Investor Guide to Vanguard Funds for May is NOW AVAILABLE! Links to the May data files are posted below. Market Perspective: Economic Indicators Remain Positive Inflation expectations have held […]

Month: May 2018

Market Perspective for May 21, 2018

Equities rebounded on Monday after weekend trade negotiations between the U.S. and China. Boeing (BA) and Caterpillar (CAT) both jumped on the news. SPDR Industrials (XLI) was by far the best performing sector fund on the day, and the Dow led major indexes.

The consensus forecast for April new home sales is an annualized pace of 678,000, down slightly from March’s 694,000. Existing home sales are also expected to have dipped in April to an annualized pace of 5.5 million. Economists see weekly jobless claims holding steady around 220,000. May consumer sentiment and April durable goods orders will be out later in the week.

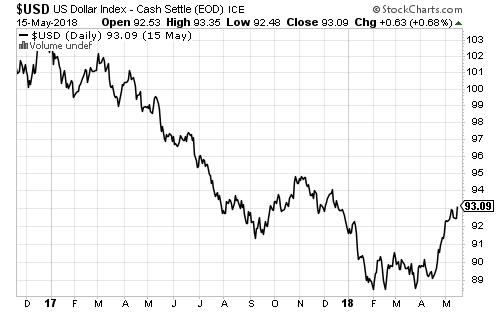

The U.S. Dollar Index advanced in overnight trading before pulling back on Monday. The greenback has risen in four of the past five weeks. The euro was under pressure on Monday as Italy’s new government takes shape. Italian 2-year bond yields rose 500 percent on Monday, from 0.05 percent to 0.25 percent. Over the past two weeks, iShares MSCI Eurozone (EZU) was flat, but iShares MSCI Italy (EWI) has lost 6 percent.

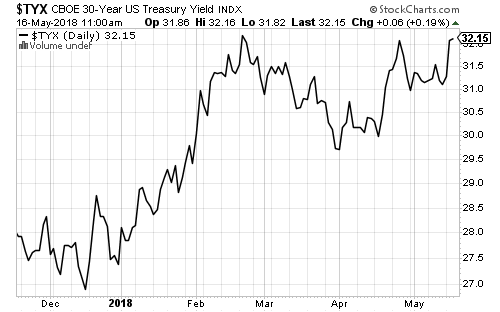

The 10-year and 30-year Treasuries started the week with small gains. Both made new multi-year highs last week. Thompson Bond (THOPX) gained last week and Virtus Seix Floating-Rate High Income (SAMBX) held steady, but most bond funds lost ground.

Retail earnings season is in full swing this week. TJX Companies (TJX), Advance Auto Parts (AAP), AutoZone (AZO), Cracker Barrel (CBRL), Kohl’s (KSS), Lowe’s (LOW), Target (TGT), Tiffany & Co. (TIF), L Brands (LB), Ross Stores (ROSS), Best Buy (BBY) and Foot Locker (FL) are among the many retailers reporting.

Medtronic (MDT), Royal Bank of Canada (RY), Toronto Dominion Bank (TD) Intuit (INTU), Hewlett Packard Enterprise (HPE), Toll Brothers (TOL) and NetApp (NTAP) will also report.

Global Momentum Guide for May 21, 2018

Click Here to view today’s Global Momentum Guide WEEKLY SECTOR MOVERS The Russell 2000 Index gained 1.23 percent last week. The Dow Jones Industrial Average declined 0.46 percent, the […]

Market Perspective for May 18, 2018

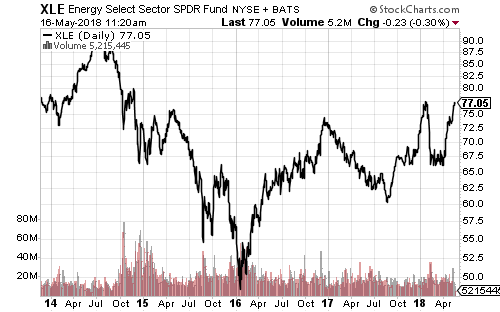

The Russell 2000 led the market this week with a 1.23-percent gain. SPDR Industrials (XLI) advanced 0.83 percent, but SPDR Technology (XLK) lost 1.45 percent. Brent crude oil topped $80 for the first time in years. SPDR Energy (XLE) advanced 1.80 percent.

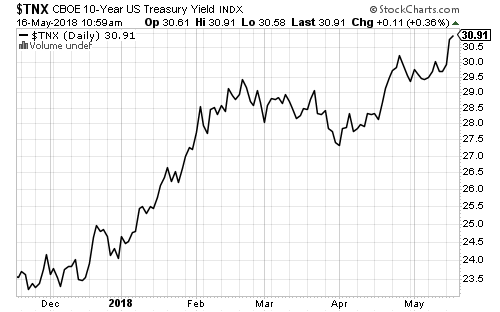

Treasury yields made important technical breakouts over the past week. The 10-year peaked at 3.12 percent and the 30-year 3.25 percent before settling back on Friday. Utilities struggled against long-term interest rates. SPDR Utilities (XLU) fell 2.76 percent.

SPDR S&P Retail (XRT) rallied 2.11 percent this week on strong retail sales and a big earning surprise. The government revised March retail sales higher to 0.8 percent and reported 0.3 percent growth in April. Rising consumer spending buoyed some retail stocks, with Macy’s (M) own management surprised by its strong earnings and sales last quarter. Macy’s gained 14.57 percent on the week. It wasn’t all roses for retail with both Nordstrom (JWN) and JCPenney (JCP) suffering setbacks. Wal-Mart (WMT) beat forecasts due to improving online sales.

Homebuilder confidence climbed in May according to the National Association of Homebuilders. Builders have continued to combat tight labor markets and rising material costs. Housing starts and building permits missed expectations but rose from year-ago levels. Jobless claims rose to 222,000 in the week ended May 12, still close to 40-year lows. Industrial production climbed 0.7 percent in April. Household debt grew 3.8 percent in the first quarter, down from 4.6 percent in the prior quarter.

Boeing (BA) pulled the aerospace and industrial sector higher this week. Shares rallied 2.56 percent after it was rumored China offered a $200 billion reduction in the bilateral trade deficit. China quickly denied the rumor but Boeing shares held their gains.

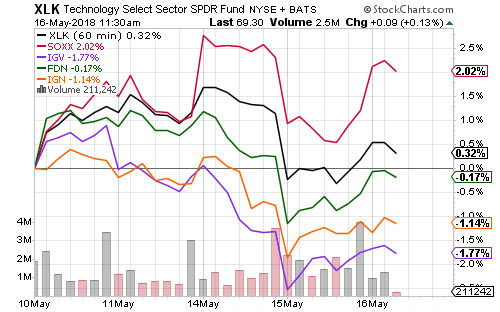

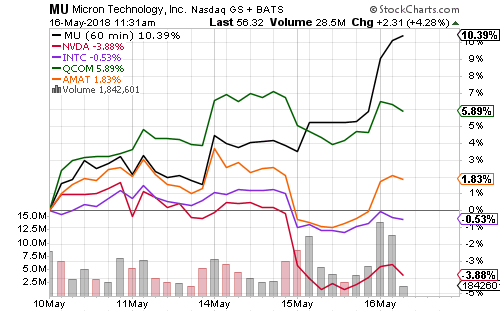

Applied Materials (AMAT) fell 8.25 percent on Friday after reporting earnings. Third-quarter guidance was below expectations. Applied Materials supplies chip and display makers. The company sees softer demand from the smartphone market. Cisco (CSCO) beat earnings, but guidance was in line with estimates. Shares dipped 5.92 percent on the week.

The U.S. Dollar Index climbed another 1 percent this week. It has gained nearly 5 percent since the start of the rally in mid-April. The greenback has risen for five consecutive weeks.

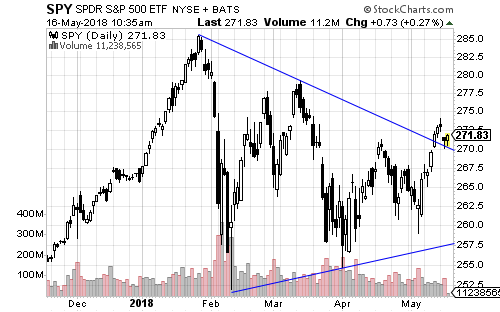

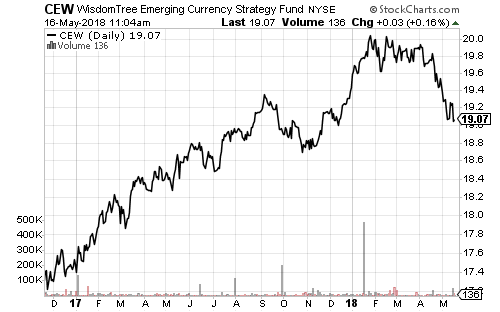

iShares MSCI EAFE (EFA) fell 0.61 percent on the week, nearly matching the SPDR S&P 500’s (SPY) 0.56-percent decline. iShares MSCI Emerging Markets (EEM) fell 2.81 percent as EM currencies remained stressed.

ETF & Mutual Fund Watchlist for May 16, 2018

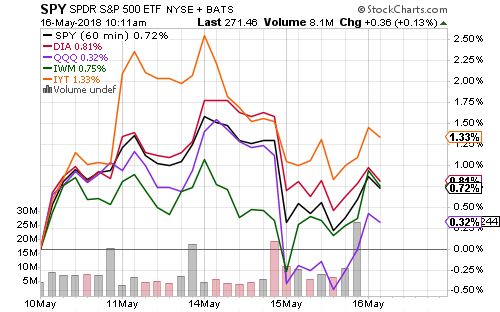

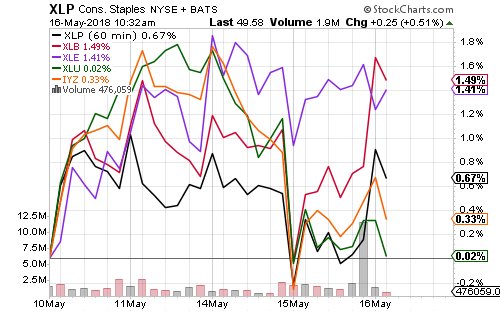

Equities rallied this week. The Dow, S&P 500 and Russell 2000 all saw similar returns, while the Nasdaq gained about half as much.

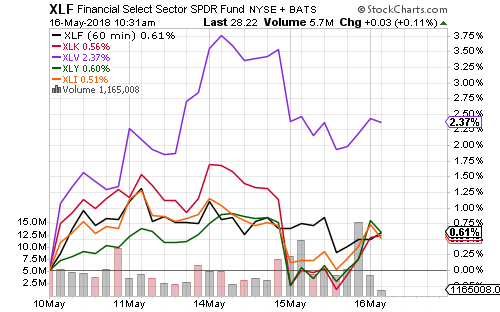

Healthcare was by far the week’s best performing sector, led by pharma.

Micron (MU) and Qualcomm (QCOM) outperformed to boost technology gains on the week.

Materials and Energy were the strongest performers among the smaller S&P 500 sectors. Rate-sensitive sectors such as utilities underperformed.

The S&P 500 breached resistance last Thursday, as we had anticipated. Shares bounced on Monday and Tuesday.

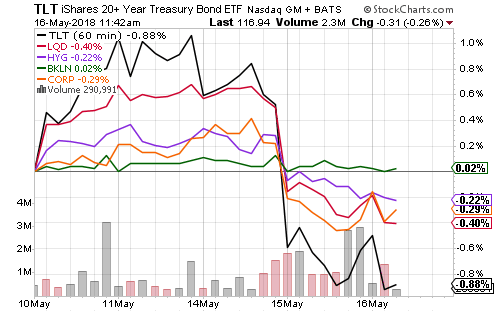

The 10-year Treasury yield broke through the 3.05 percent level watched by technical traders and hit a high of 3.095 percent. The 30-year yield is on the cusp of a breakout.

Bond funds lost ground as interest rates increased. Floating-rate funds held steady and high-yield bonds outperformed. Long-dated treasuries underperformed.

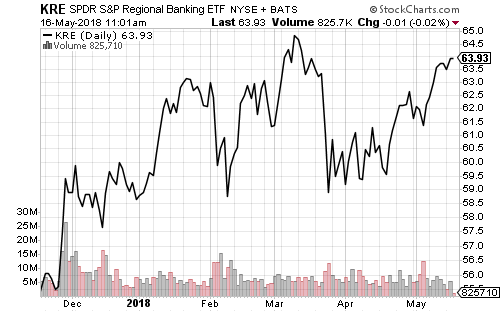

Rate-sensitive stocks fell with higher interest rates, while financials benefited from the rise.

Rising interest rates boosted the U.S. dollar again in the past week. In the near-term a pullback in the dollar seems likely. The next target for a larger bullish move is the 95 level that served as resistance in November.

Emerging-market currency losses have weighed on emerging market stock funds. iShares MSCI Emerging Markets (EEM) has support in the $45-$46 range.

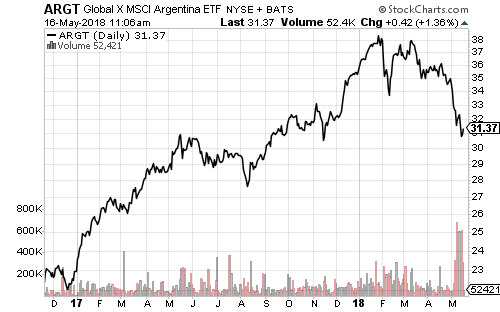

Turkey and Argentina are at the center of emerging-market weakness. In Argentina, a $30 billion IMF bailout failed to stop the peso’s decline.

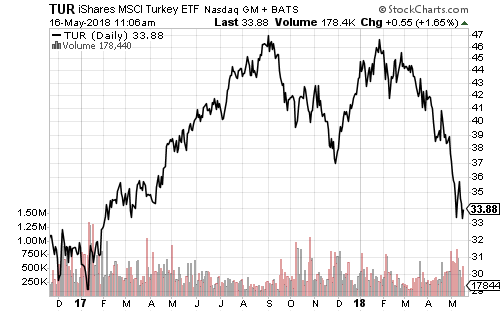

In Turkey, President Erdogan said he will take control of monetary policy after elections in June. The central bank chief wants to raise interest rates to combat inflation. Erdogan wants to cut interest rates. Unlike Argentina, Turkey is a major political player in the Middle East and many European banks are exposed to its economy.

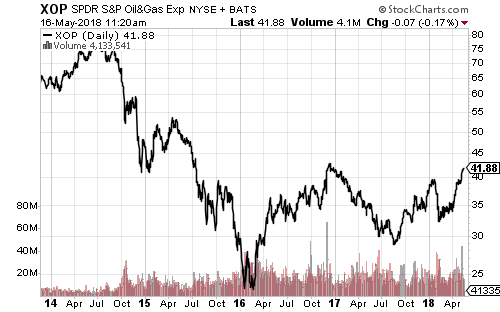

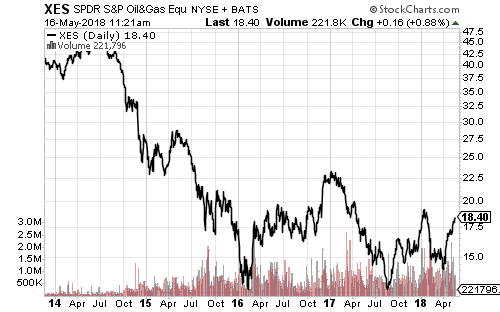

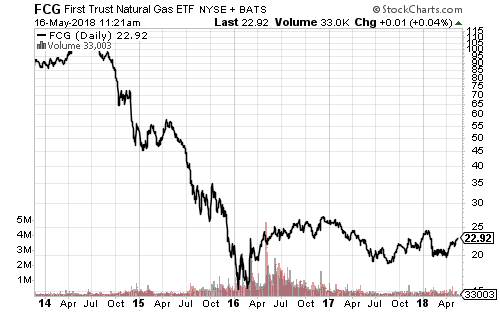

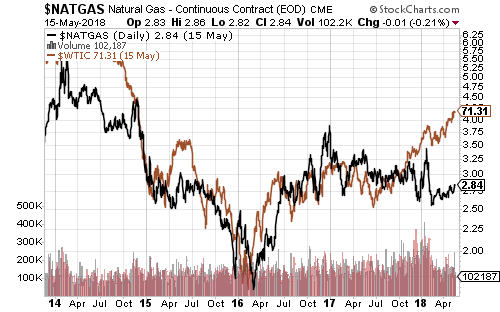

Energy stocks rallied this week. SPDR Energy (XLE) is near a 52-week high and could hit a 4-year high. The exploration and services ETFs (XOP and XES) remain relatively depressed. Natural gas producers are still 50 percent below where they were 3 years ago. While natural gas prices are still trading the same as 3 years ago. It will take a sustained rally towards $4 to revive the sector.