The Chinese yuan fell nearly 2 percent this week, compounding trade tensions and weighing on U.S. stocks. China’s attempts to slow credit growth have led to higher defaults in the bond market.

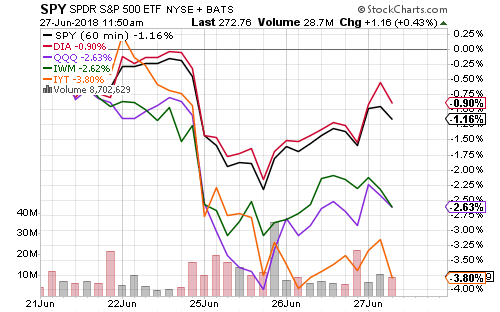

The Dow Jones Industrial Average led the week’s index performance, despite heavy exposure to trade-sensitive companies such as Boeing (BA) and Caterpillar (CAT).

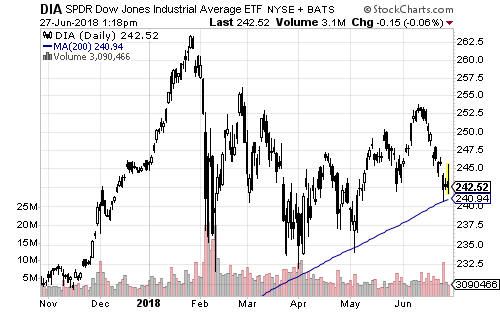

The SPDR DJIA (DIA) bounced off its 200-day moving average this week. It has rebounded at or near this level in April, May and June.

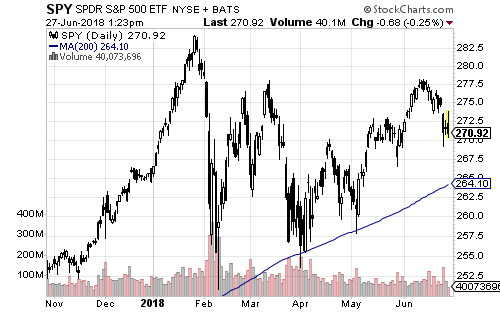

SPDR S&P 500 Index (SPY) has also found strong support at the 200-day MA in 2018.

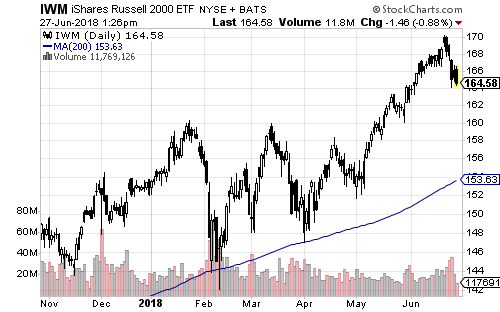

iShares Russell 2000 Index (IWM) remains well above its breakout level of $160.

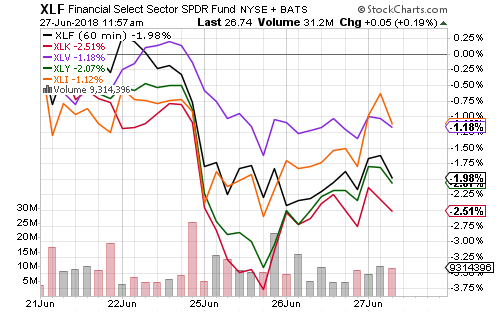

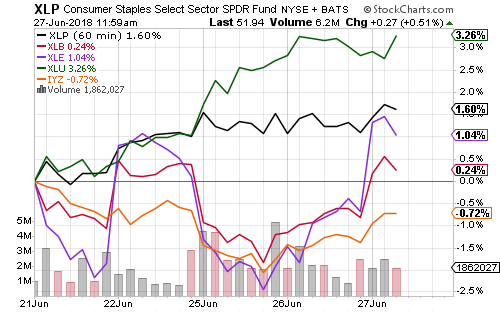

Sector rotation has continued in the domestic market. Smaller sectors have outperformed over the past week. Utilities rebounded 3 percent as long-term interest rates declined and investors bought defensive sectors. Consumer staples, energy, and materials all gained in early Wednesday trading, while technology and consumer discretionary fell as investors rotated into underperforming sectors.

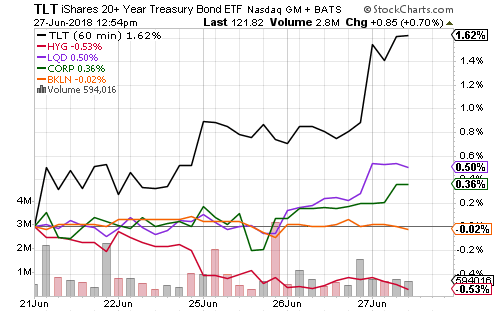

Government, investment-grade and corporate bonds performed well as yields declined. High-yield bonds dipped as credit spreads increased. Floating-rate funds held steady.

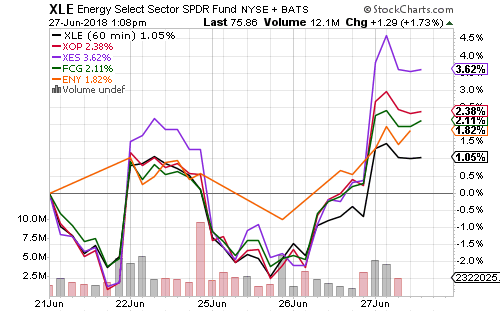

Energy funds rallied strongly this week with explorer, services and natural gas subsectors all gaining. West Texas Intermediate crude pushed towards its 52-week high of $73 a barrel. Brent was still $3 off its 52-week high of $80.

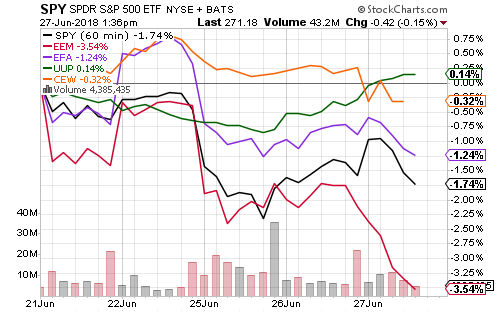

The U.S. dollar gained this week. SPDR S&P 500 (SPY) and MSCI EAFE (EFA) performed similarly, while emerging markets remained weak.

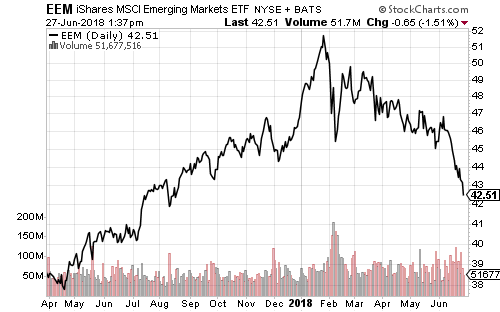

iShares MSCI Emerging Markets (EEM) is nearing its 52-week low of $40.

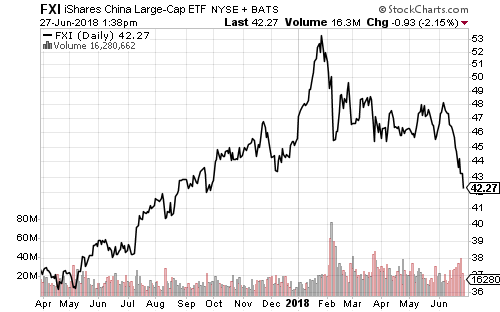

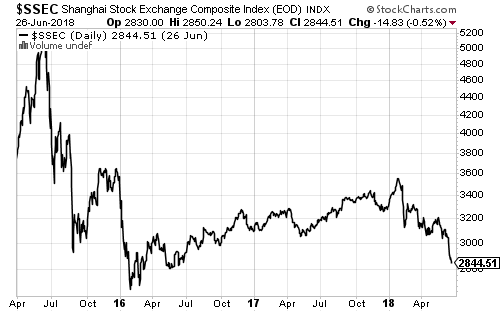

China is driving emerging markets lower. China’s mainland A-share market is approaching its post-2015 low. It is down more than 20 percent on the year.

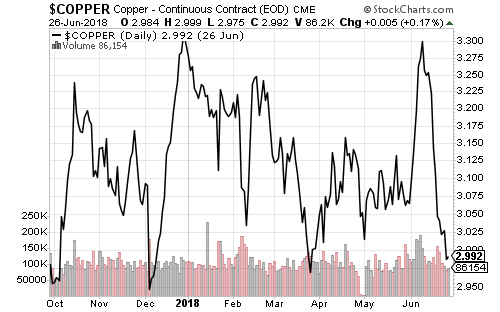

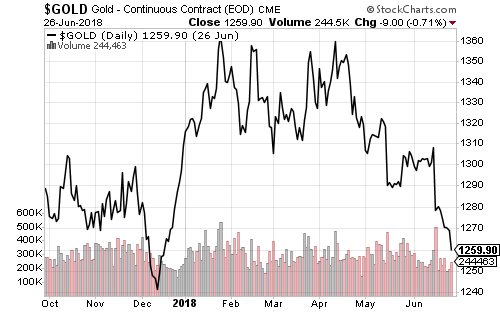

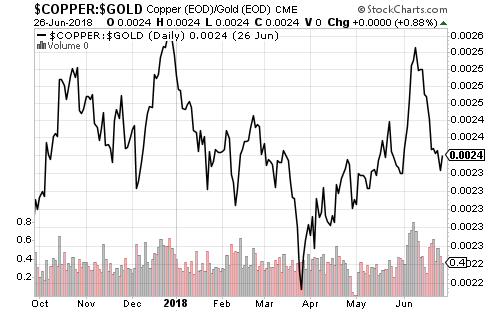

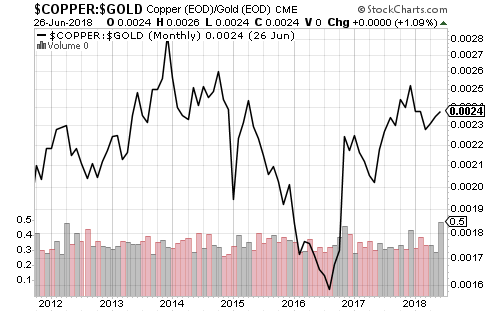

Copper and gold prices have fallen with the rising U.S. dollar. The copper/gold ratio has dipped based on conditions in China, but it has remained in an uptrend since the 2016 low. This comports with economist forecasts for U.S. second-quarter GDP growth, currently at 3.5 percent.