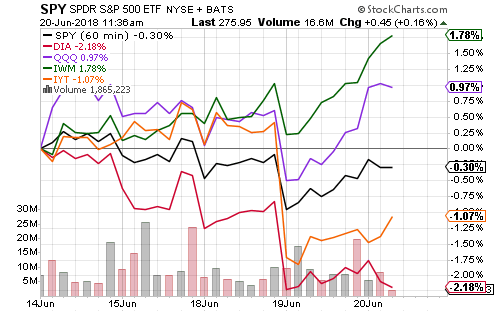

The Russell 2000 and Nasdaq hit new all-time highs in Wednesday trading.

Consumer discretionary led S&P 500 sectors this week. Of the 1.42 percent return through midday on Wednesday, 1.28 percentage points or 90 percent was due solely to gains from Amazon (AMZN) and Netflix (NFLX). The latter stock rose nearly 10 percent on the week. Netflix has gained 15 percent since a judge cleared the way for the AT&T (T) and Time Warner (TWX) merger. Days after the ruling, Comcast (CMCSA) launched a competitive bid for Fox (FOX) assets. Disney (DIS) will launch a rival streaming service next year and it was the likely buyer of Fox’s assets, with Fox scheduling a July shareholder vote on Disney’s offer.

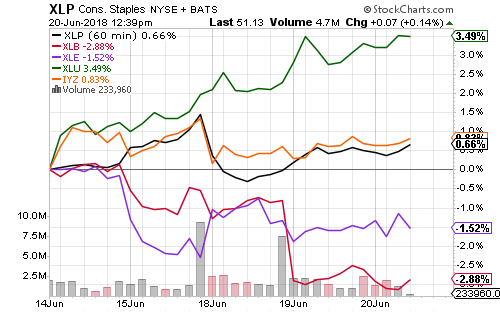

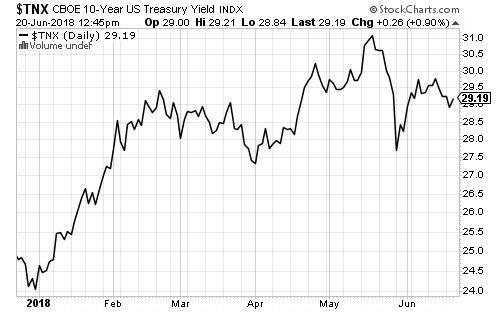

Utilities were the best performing stocks overall as long-term interest rates declined, though they remain down for the year.

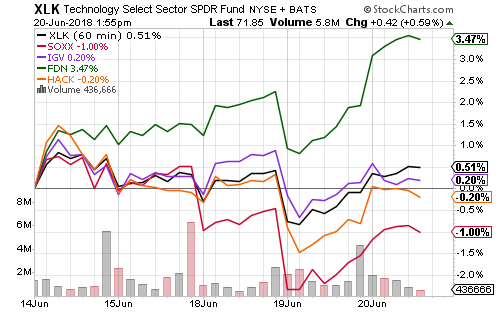

Internet companies led the technology sector this week. Semiconductors were the worst performing sub-sector, hurt by a dip in Intel (INTC) shares. Micron Technology (MU), a top 10 holding in iShares PHLX Semiconductor (SOXX), increased after the bell today.

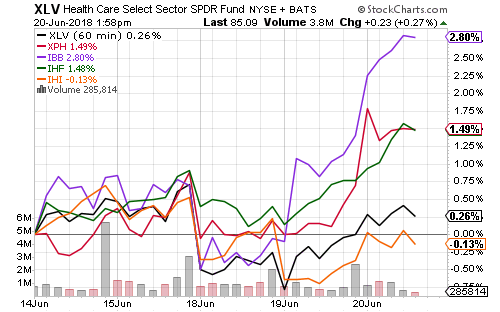

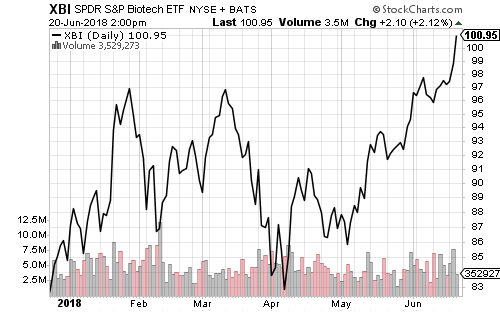

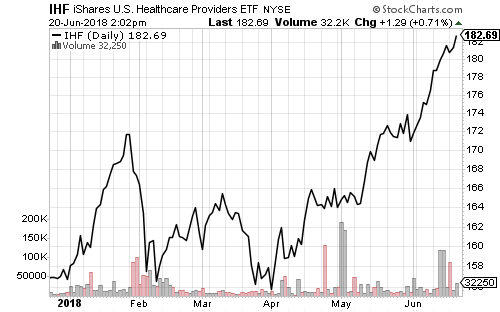

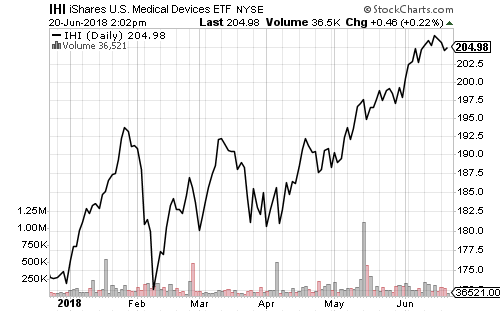

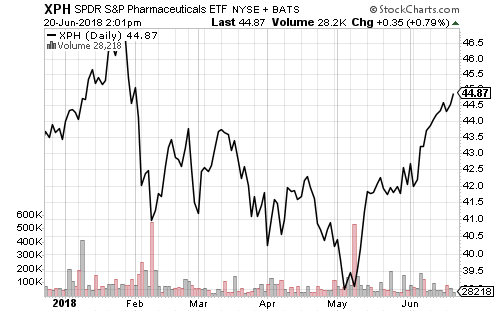

Biotechnology pulled the healthcare sector higher this week, but pharmaceuticals and providers also delivered solid gains. Shares of SPDR S&P Biotech (XBI) broke out to a new all-time high.

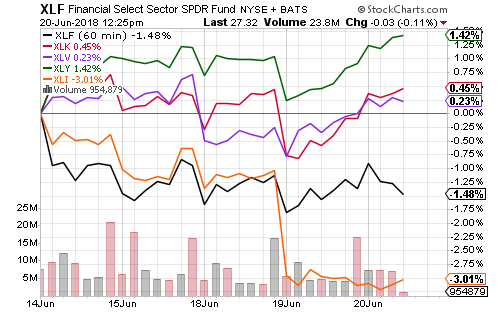

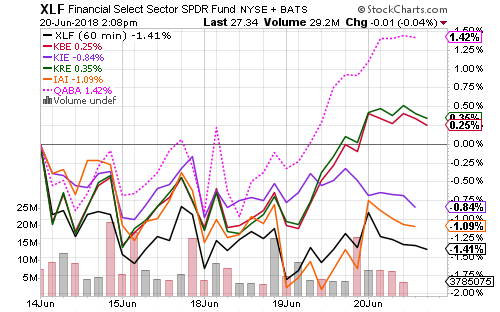

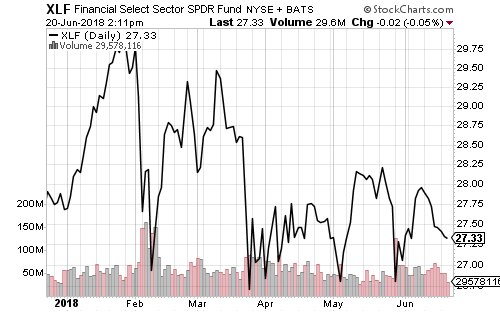

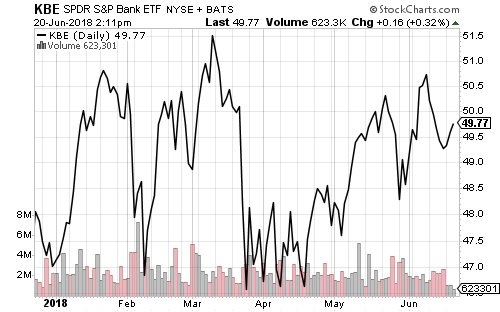

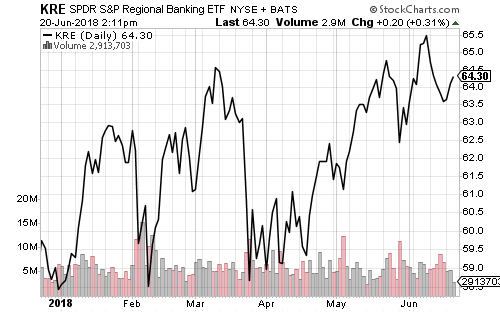

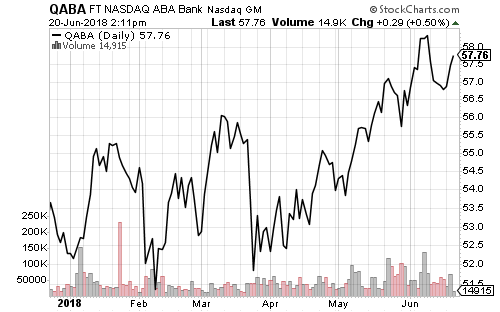

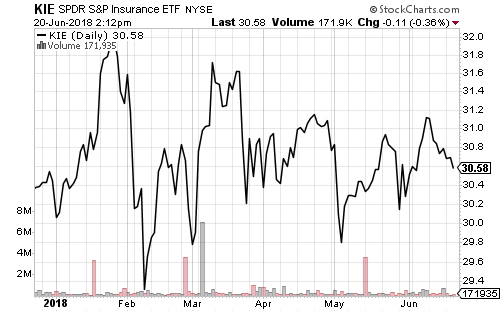

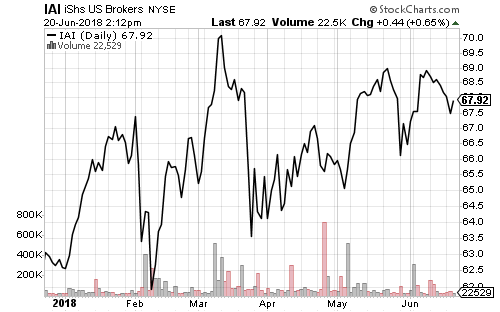

Insurance and investment subsectors have weighed on financials this week, but small banks enjoyed a strong rally. Brokerage and investment companies are trading above their January high, but below their March high.

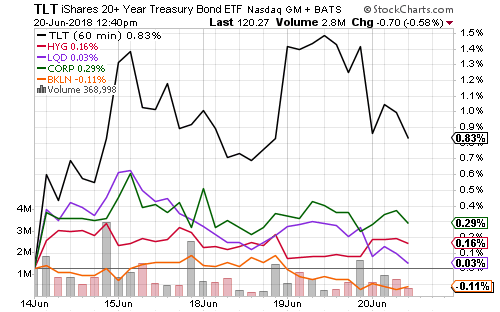

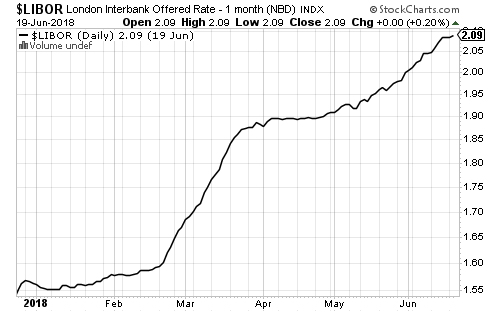

Falling interest rates boosted long-term bonds this week. Floating-rate funds saw a small decline after Libor stabilized. It advanced in the run-up to the rate hike last week and won’t start rising again until we get closer to the September meeting.

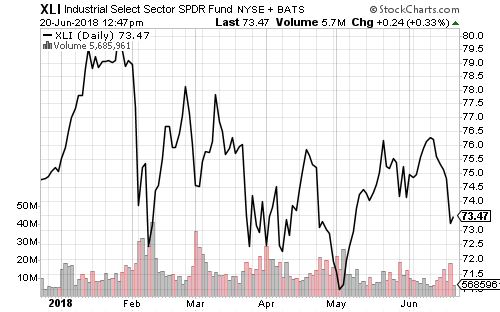

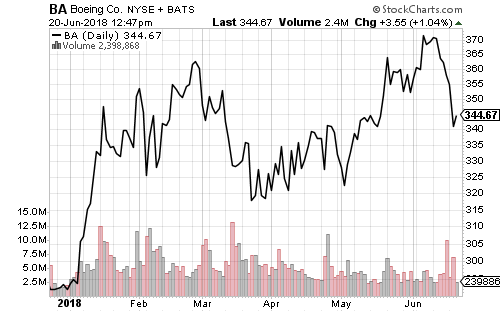

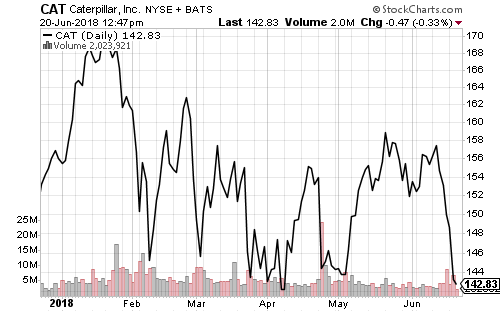

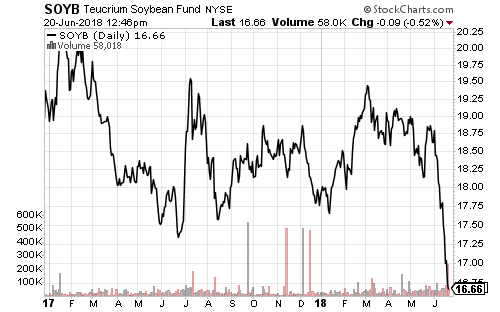

President Trump announced he wants tariffs on $200 billion in Chinese goods this week. Industrials underperformed because investors worry about potential retaliation against firms such as Boeing (BA) and Caterpillar (CAT). The biggest loser was soybeans because it is a major export to China that can be easily substituted.

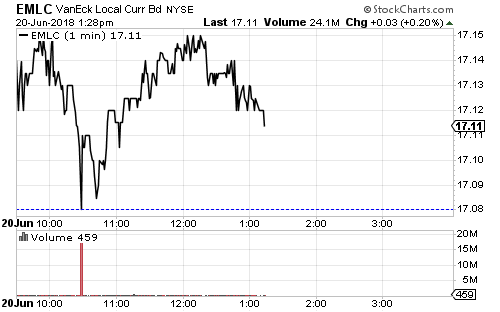

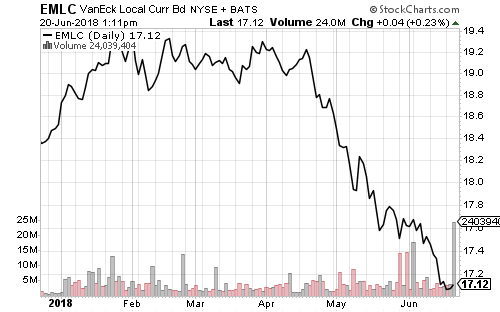

A massive trade in VanEck Emerging Market Local Currency Bond (EMLC) was made today. The trade was more than 6 times the average daily volume over the past three months. While the trade itself is bearish on the surface, it may represent capitulation and potentially a short-term bottom for the asset class. EMLC has been in a constant decline since mid-April.

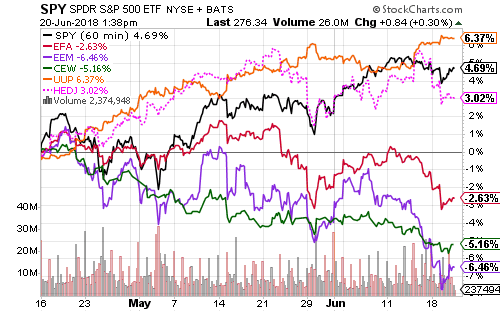

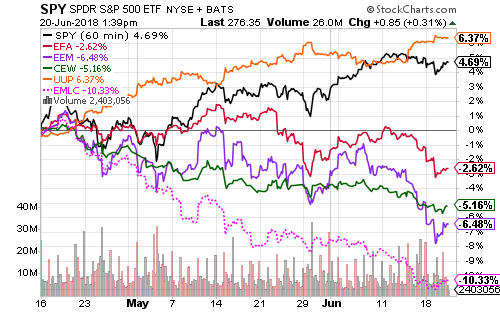

Emerging and developed markets diverged from the U.S. market in mid-April. Since then, Invesco DB U.S. Dollar Index Bullish (UUP) has outperformed along with SPDR S&P 500 (SPY). Developed market funds have suffered due to the weaker dollar. WisdomTree Europe Hedged Equity (HEDJ) trails SPY by less than 2 percent over this period. Emerging market stocks have fared worse, but that’s also largely been the result of weakening currencies. iShares MSCI Emerging Markets (EEM) has underperformed WisdomTree Emerging Currency (CEW) by less than 1.5 percent. Bonds have played the larger role in weakness, with EMLC down 10 percent over this period.