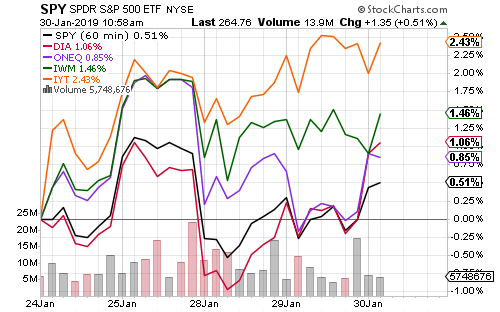

Earnings season has been positive for stocks to begin 2019. Apple (AAPL) and Boeing (BA) were the latest firms to boost the market with better-than-expected results. The economically sensitive Dow Transports has outperformed over the past week, followed by the Russell 2000.

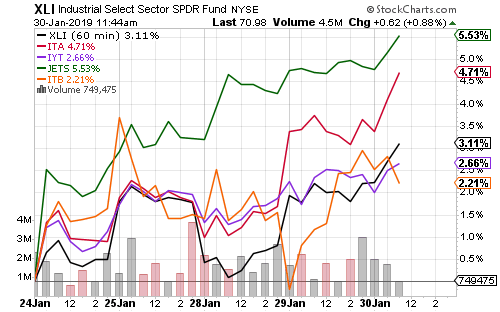

Boeing (BA) was one of several industrial stocks that reported solid earnings this week. Transportation and defense subsectors were also strong. Materials and energy performed well.

Boeing (BA) was one of several industrial stocks that reported solid earnings this week. Transportation and defense subsectors were also strong. Materials and energy performed well.

A drilldown into the industrial subsectors shows airlines, defense and housing all boosting the sector.

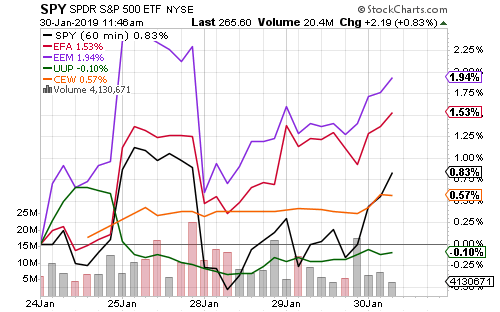

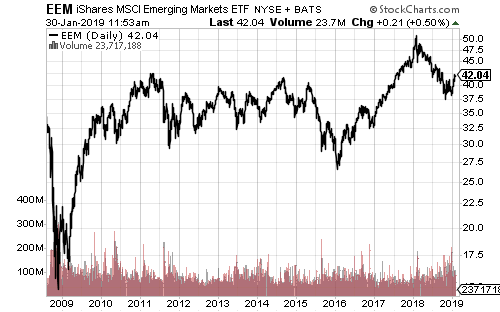

A slightly weaker U.S. dollar helped foreign shares outperform over the past week. Emerging markets rallied with trade talks between China and the U.S. beginning. If there is a trade deal that can rescue the Chinese economy, weaken the U.S. dollar and unleash another inflationary growth cycle, emerging market performance could improve. Without a deal however, the U.S. will potentially impose tariffs on March 2.

A slightly weaker U.S. dollar helped foreign shares outperform over the past week. Emerging markets rallied with trade talks between China and the U.S. beginning. If there is a trade deal that can rescue the Chinese economy, weaken the U.S. dollar and unleash another inflationary growth cycle, emerging market performance could improve. Without a deal however, the U.S. will potentially impose tariffs on March 2.

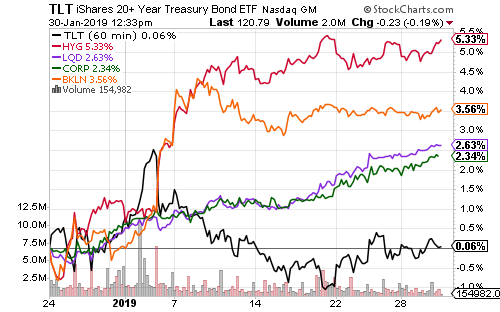

Bonds have rallied along with stocks since the market began to rebound in December. Even long-term treasuries have seen small gains. High-yield bonds have outperformed. Corporate and investment grade bonds have also seen advances over the past few weeks.

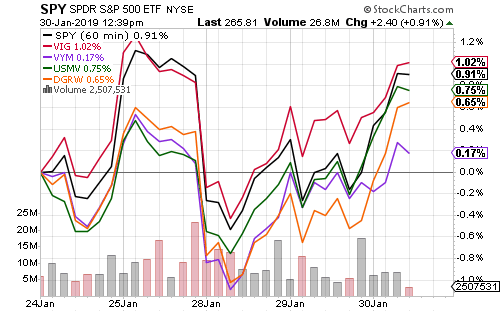

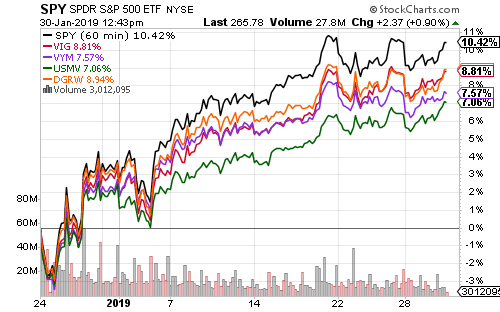

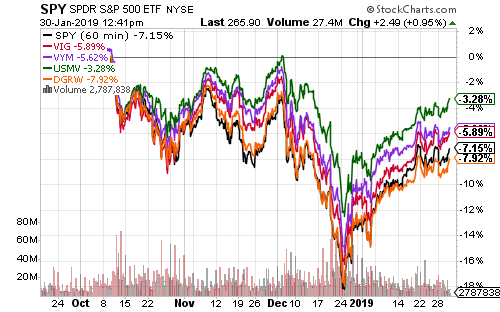

Growth-oriented dividend ETFs including Vanguard Dividend Appreciation (VIG) and WisdomTree U.S. Quality Dividend Growth (DGRW) were strong performers over the past week. iShares Edge MSCI Min Vol USA (USMV) also provided an excellent return. USMV has outperformed the S&P 500 Index going back to September 2018.