The February Issue of the ETF Investor Guide is NOW AVAILABLE! Links to the February Data Files have been posted below Market Perspective: Domestic Stocks Continue to Rally The S&P […]

Month: February 2019

ETF & Mutual Fund Watchlist for February 27, 2019

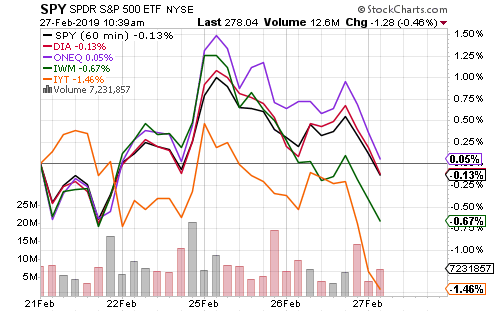

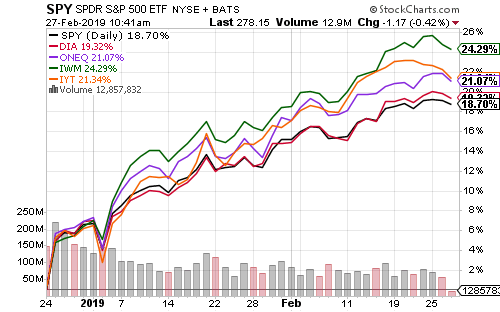

Equities are positioned to achieve a 10th straight week of gains. The Nasdaq was the best performing index over the past week.

Since bottoming in December, the Russell 2000 has rebounded 24 percent.

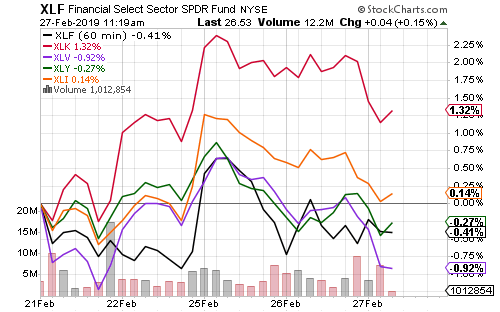

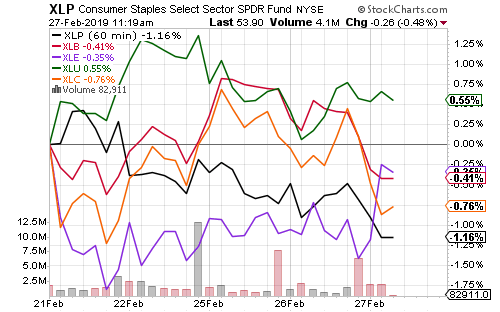

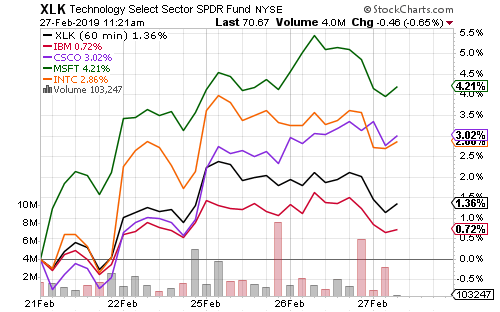

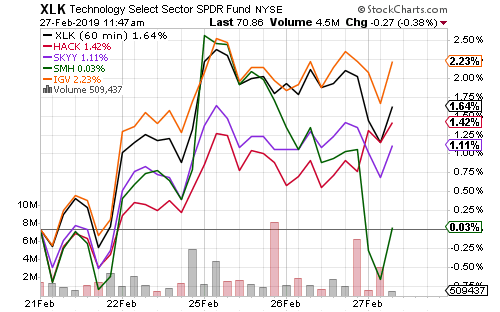

Technology was the best performing sector over the past week. Utilities and industrials have also increased.

Large-cap companies have driven technology gains, including Microsoft (MSFT), Cisco (CSCO), Intel (INTC) and International Business Machines (IBM).

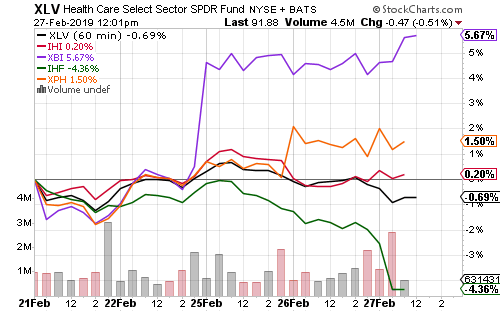

Biotechnology shares jumped after Roche acquired Spark Therapeutics (ONCE) for a 120 percent mark-up. Healthcare providers including UnitedHealth Group (UNH) and Humana (HUM) are down today.

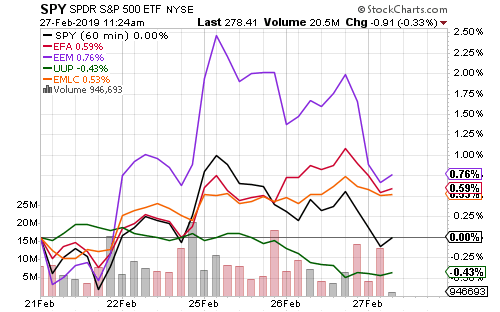

Chinese shares lifted emerging markets due to an anticipated trade deal.

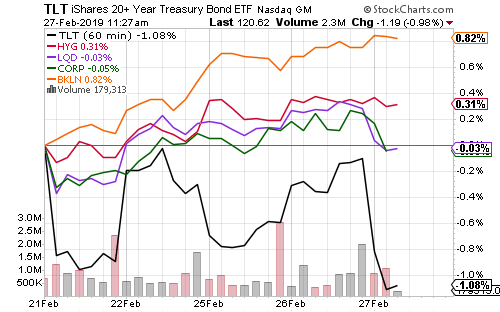

Floating-rate and high yield bonds have outperformed. Investment grade and corporate bonds are flat.

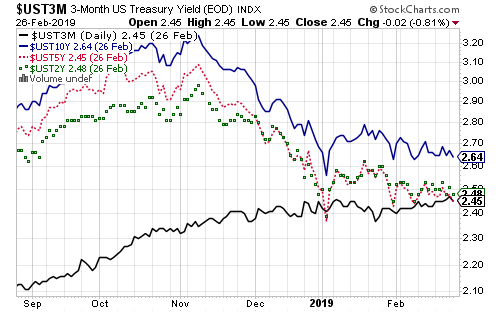

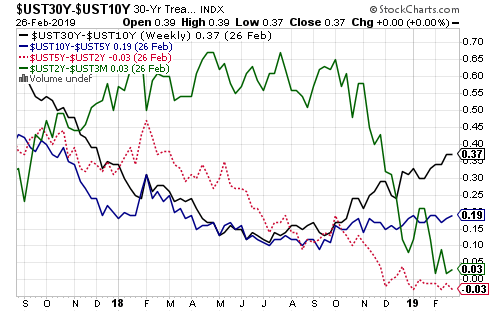

The yield curve has tightened at the short end with the 5-year yield falling below the 2-year yield and the 5-year yield matching the 3-month yield. The spread between the 30-year, 10-year and 5-year yields is widening.

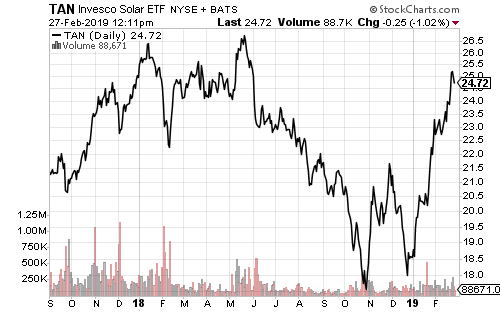

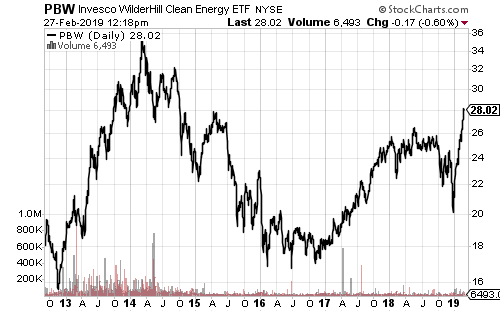

One of the strongest subsectors of the market this year has been solar and clean energy. Invesco Solar (TAN) has rallied near its 52-week high. Invesco WilderHill Clean Energy (PBW) has hit a 4-year high.

Market Perspective for February 25, 2019

The Nasdaq led Monday with a gain of 0.36 percent. SPDR Technology (XLK) climbed 0.48 percent. Industrials and material sectors extended their strong performances, with SPDR Industrial (XLI) adding 0.39 percent. SPDR Materials (XLB) advanced 0.65 percent.

Merger and acquisition activity boosted the biotechnology sectors. Roche offered $4.8 billion for Spark Therapeutics (ONCE), more than 120 percent higher than its closing price on Friday. SPDR S&P Biotech (XBI) rallied 4.42 percent.

December housing starts, building permits and January pending home sales will be released this week. The Conference Board will report February consumer confidence, which is expected to increase. The first and second estimate of first quarter GDP will be out on Thursday. Economics forecast 2 percent growth. Manufacturing PMIs will be out on Friday, along with the University of Michigan’s consumer sentiment survey.

Interest rates edged higher on Monday. The 10-year Treasury yield closed at 2.67 percent. High-yield, floating-rate and corporate bonds edged higher on the day.

iShares China Large Cap (FXI) gained 1.97 percent and Deutsche X-Trackers CSI 300 A-Share (ASHR) popped 6.27 percent. iShares MSCI Emerging Markets (EEM) added 1.09 percent.

Retail earnings season kicks into high gear this week with Home Depot (HD), Lowe’s (LOW), Autozone (AZO), Best Buy (BBY), Gap Inc. (GPS), L Brands (L), Foot Locker (FL), Macy’s (M) among the big names reporting. Express Scripts (ESRX), EOG Resources (EOG), Booking Holdings (BKNG), American Tower (AMT), Campbell Soup (CPB), Anheuser-Busch (BUD), Autodesk (ADSK), Ambev (ABEV) will also deliver quarterly results this week.

Global Momentum Guide for February 25, 2019

Click Here to view today’s Global Momentum Guide WEEKLY SECTOR MOVERS The MSCI EAFE climbed 1.58 percent last week, the Russell 2000 Index 1.33 percent, the Nasdaq 0.74 percent, […]

Market Perspective for February 22, 2019

Equities rallied for their ninth-straight week. The Russell 2000 Index climbed 1.24 percent to lead the major indexes. Among the larger S&P 500 sectors, SPDR Technology (XLK) increased 1.45 percent. SPDR Materials (XLB) and SPDR Utilities (XLU) saw gains of 2.35 and 2.41 percent.

Weekly jobless claims declined to 216,000. Durable goods orders for December increased 1.2 percent. Existing home sales hit an annualized pace of 4.94 million in January, down from 5.00 million in December. Homebuilder confidence index rose from 58 to 62. Housing could benefit from falling interest rates with the 30-year mortgage falling to an average of 4.35 percent last week.

China reported credit growth equivalent to 5 percent of GDP in January. iShares China Large Cap (FXI), made up of Chinese shares listed in Hong Kong, climbed 3.52 percent on the week. Deutsche X-trackers CSI 300 China A-Shares (ASHR) advanced 5.67 percent.

International funds outperformed this week thanks in part to a weaker U.S. dollar. iShares MSCI Emerging Markets (EEM) advanced 2.28 percent and iShares MSCI EAFE (EFA) 0.79 percent. The U.S. Dollar Index declined 0.30 percent.

Berkshire Hathaway (BRK.A) declined due to its exposure to Kraft Heinz (KHC). An analyst at Barclays cut his earnings forecast in half in the wake of the company’s miss and dividend cut. Berkshire owns 27 percent of Kraft.

Wal-Mart (WMT), DISH Network (DISH), and Medtronic (MDT) were among firms beating earnings estimates this week. CVS Health (CVS) disappointed investors.