The Investor Guide to Vanguard Funds for February is AVAILABLE NOW! Links to the February data files are posted below. Market Perspective: The Rally Continues for Stocks Through February 10, […]

Month: February 2019

ETF & Mutual Fund Watchlist for February 20, 2019

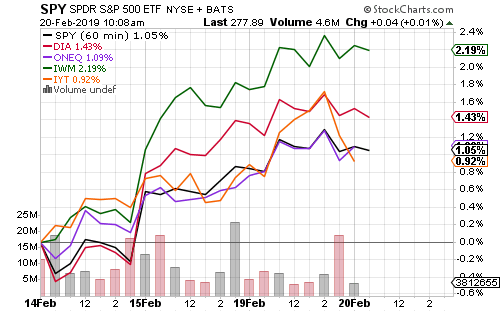

Equities continue to rally, with the Russell 2000 Index leading the way.

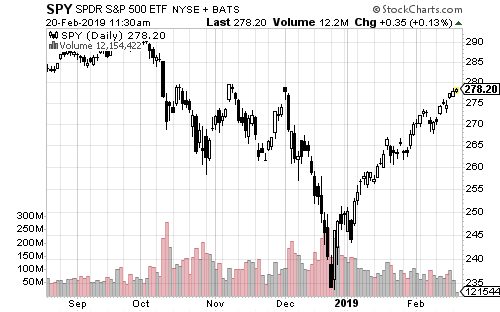

The S&P 500 Index is approaching recent resistance levels. This is the last line of major resistance for the index. We are now only 6 percent away from achieving a new all-time high.

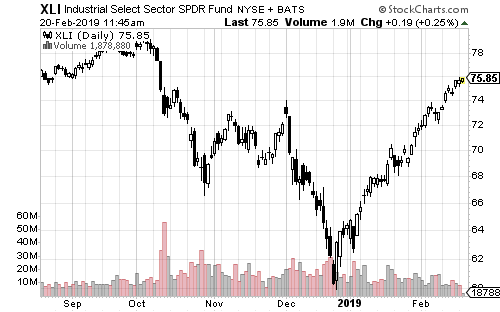

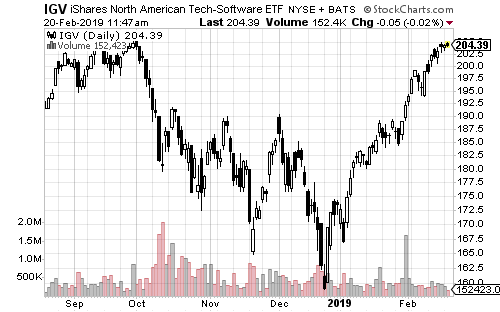

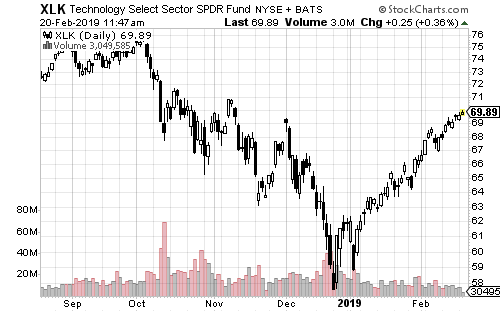

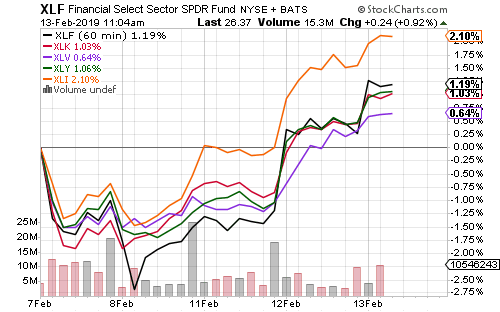

Industrials have already broken resistance levels, as has the software and semiconductor subsectors.

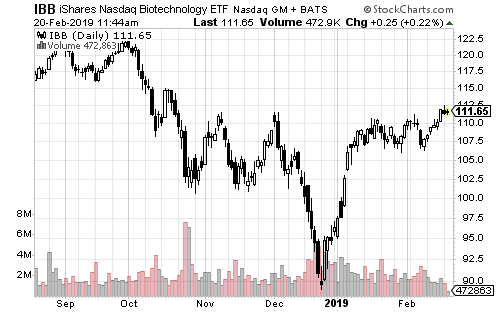

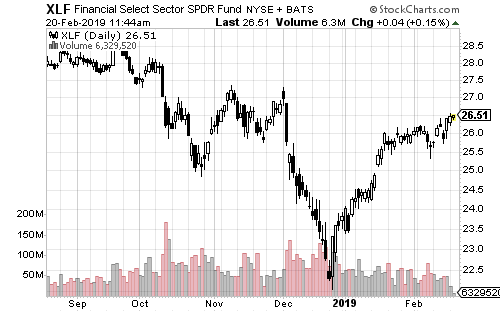

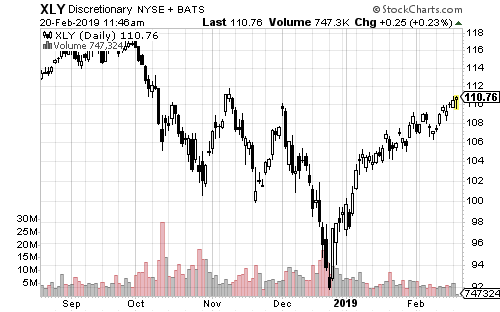

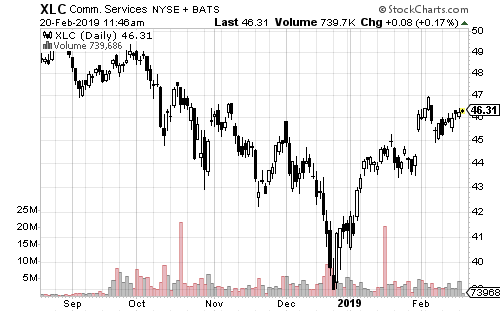

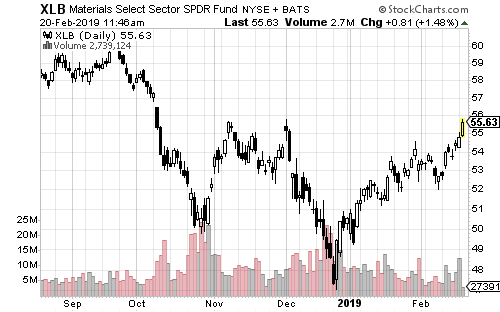

Healthcare, biotechnology, financials, consumer discretionary, communication services, materials and technology are on the cusp of a breakout.

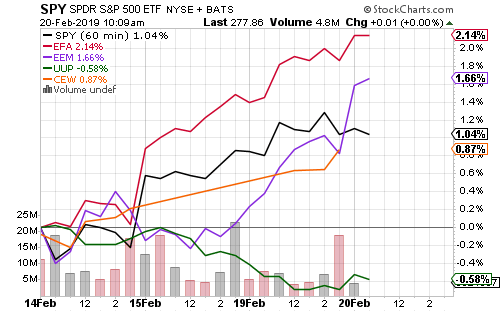

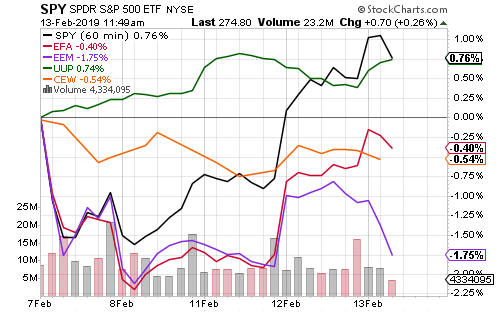

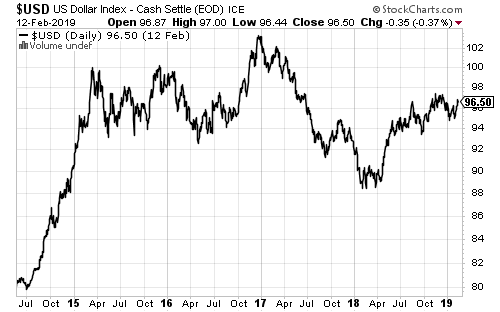

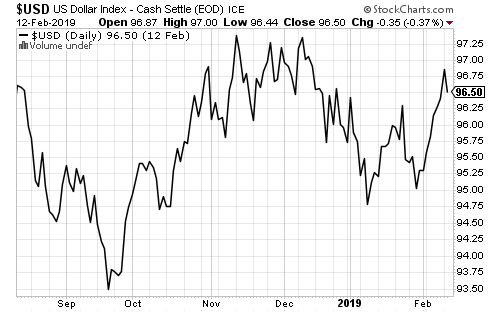

Developed and emerging markets outperformed in part to a weaker U.S. dollar and Chinese credit growth. This will bear watching in the next month as the Chinese Premier indicated no quantitative easing will occur.

The Chinese yuan has rallied after reports said the U.S. government demanded China not offset tariffs with a weaker currency. The bounce in the Chinese yuan lifted emerging market currencies, but it remains to be seen if this is a change in trend or political manipulation amidst trade negotiations.

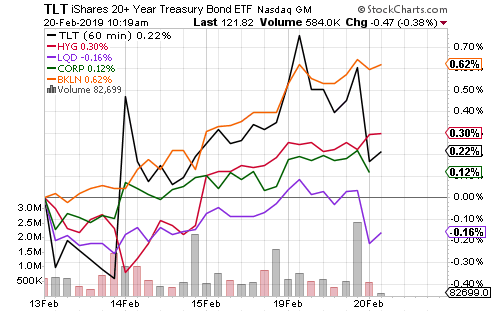

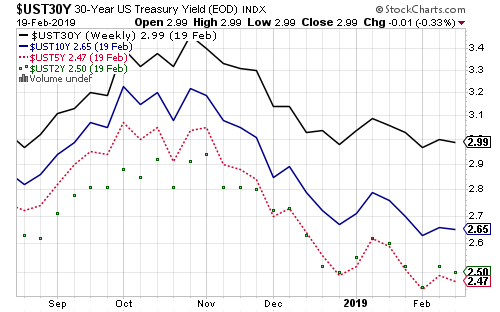

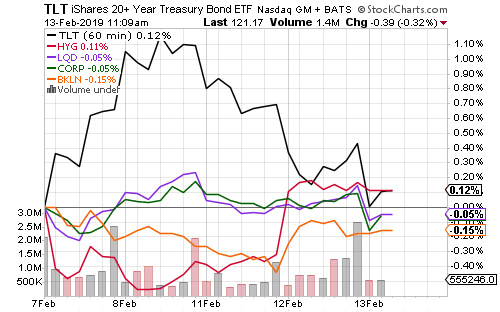

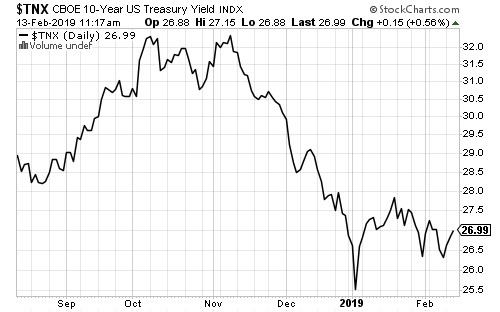

The Federal Reserve eased back on its rate hike forecast for 2019. Bond yields have been falling, lifting all categories of bonds. December interest rate futures show the market overwhelmingly believes the Fed will hold steady this year.

The Fed’s shift in tone has pushed the 5-year Treasury yield below that of the 2-year, an inversion of that part of the yield curve.

Global Momentum Guide for February 18, 2019

Click Here to view today’s Global Momentum Guide WEEKLY SECTOR MOVERS The Russell 2000 Index advanced 4.17 percent last week, the Dow Jones Industrial Average 3.09 percent, the S&P […]

Market Perspective for February 15, 2019

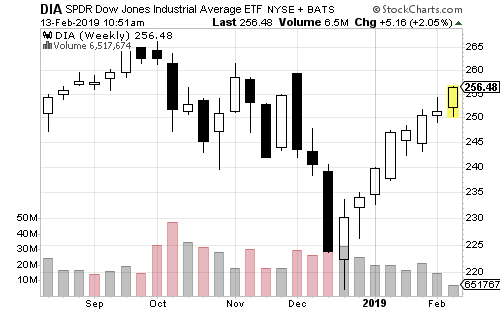

Equity markets extended their rally into an eighth week led by the 4.24-percent gain in the Russell 2000 Index. SPDR Industrials (XLI) and SPDR Healthcare (XLV) were amongst the strongest S&P 500 sectors with returns of 3.59 and 3.25 percent. SPDR Energy (XLE) gained 5.05 percent after crude oil climbed 6 percent.

SPDR S&P 500 (SPY) rose 2.56 percent, slightly behind iShares MSCI EAFE’s (EFA) return of 2.58 percent,

The Nasdaq has now joined the S&P 500 and Dow Jones Industrial Average in trading above its 200-day moving average. The S&P 500 Index has gained 18.1 percent since bottoming on December 24.

The University of Michigan’s consumer sentiment index jumped to 95.5 in February, well above the 91.2 reading in January. Job openings hit 7.3 million in December, more than 800,000 more openings than unemployed Americans. Internet sales fell 3.9 percent.

Earnings season was mixed; Nvidia (NVDA) gained 6.16 percent on the week after if delivered positive results and guidance, while chip equipment maker Applied Materials (AMAT) sank 1.71 percent. Pepsi (PEP) climbed 2.56 percent on solid earnings, though Coca-Cola (KO) sank 8.61 percent after it forecast slowing sales growth.

ETF & Mutual Fund Watchlist for February 13, 2019

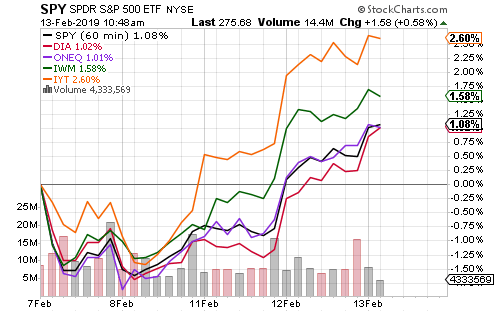

The indexes continue to extend their gains, led by a strong performance in the Russell 2000 Index. A deal to avert a second government shutdown and news that President Xi Jinping was joining trade talks in Beijing helped lift equities.

The Dow Industrial Average has achieved gains for eight consecutive weeks. Each of the indexes have similar charts following the correction in the fourth quarter. They are again approaching the highs seen several months ago.

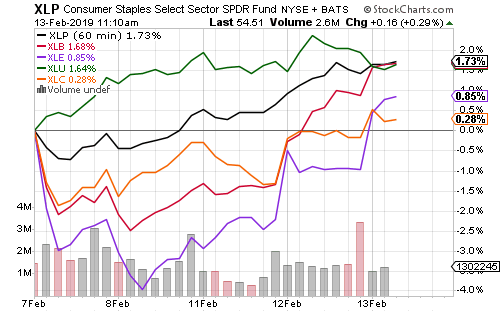

The transportation subsector helped SPDR Industrials (XLI) outperform over the past week. Consumer staples, materials and utilities have also performed well as investors lock in income-paying stocks at attractive yields.

The 10-year Treasury yield moved towards 2.70 percent on Wednesday. Since rebounding a few weeks ago, it has traded in a tight range between 2.80 and 2.63 percent. This is a typical consolidation pattern following the larger move in the fourth quarter.

European industrial production fell to its lowest level since the 2008 financial crisis in December. The European Central Bank still has interest rates below zero and a simulative policy would almost certainly involve a restart of quantitative easing, if not rate cuts deeper into negative territory. This would certainly make the U.S. dollars more attractive.

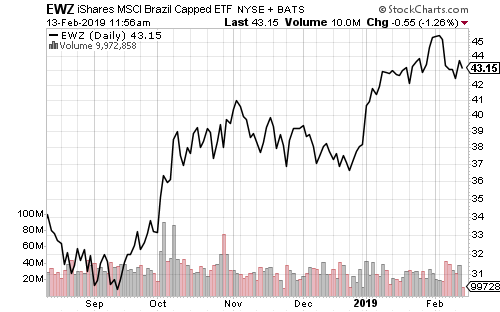

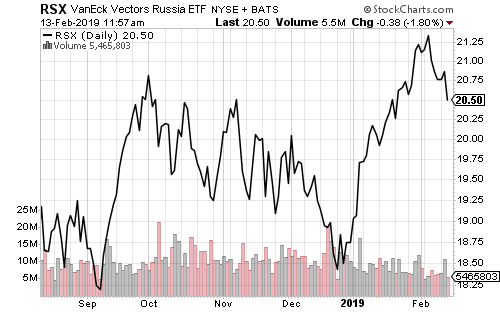

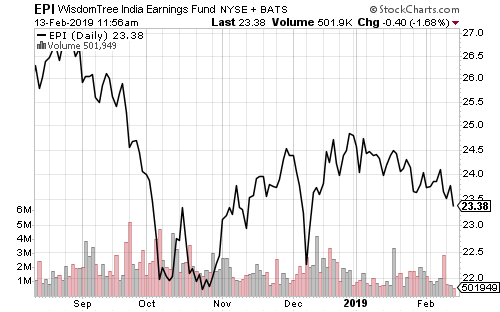

Emerging markets were the weakest performer this week with some pullback in three BRIC markets: Brazil, Russia and India.

A strong dollar creates a powerful headwind for foreign stocks. The rally in emerging market stocks will end if the dollar index breaks above 97.5. With economic difficulties in Europe and China, the odds currently favor a stronger dollar.