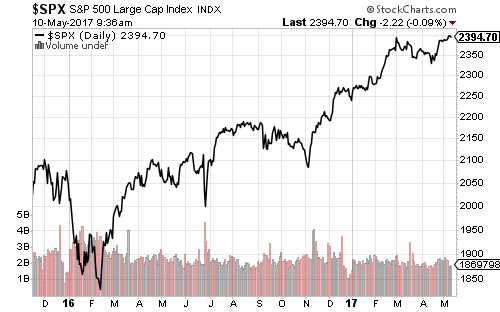

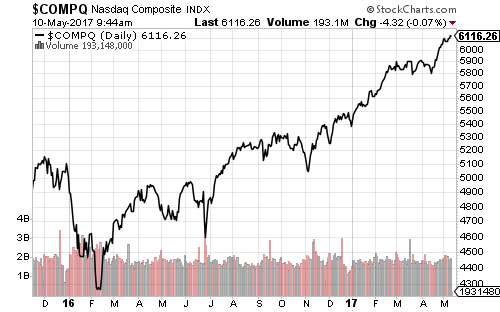

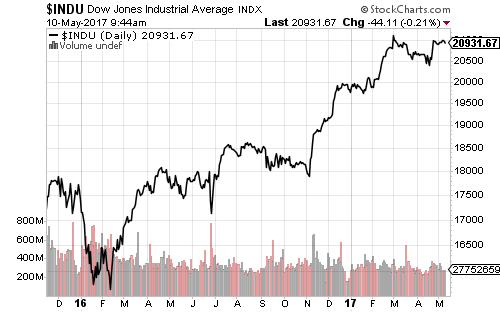

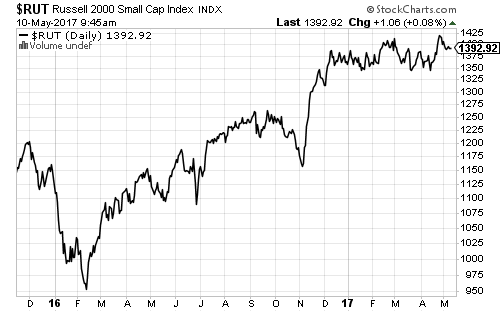

The S&P 500 Index is hovering just below 2400, closing today at 2,339.63. The Nasdaq made a new all-time high on Tuesday, while the Russell 2000 and Dow Jones Industrial Average remain near all-time highs.

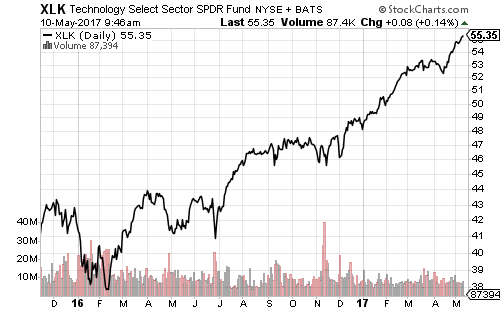

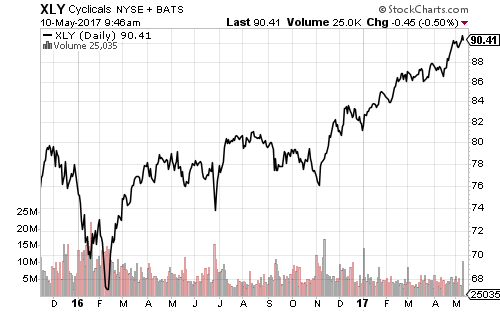

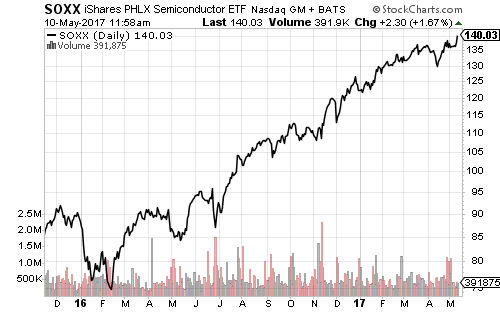

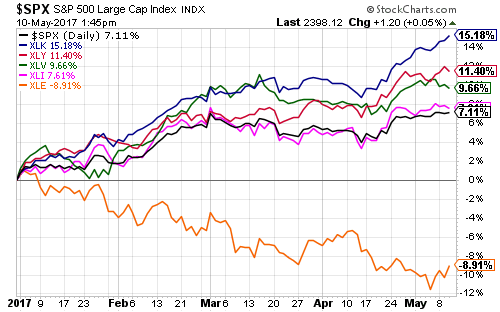

Nvidia (NVDA) beat earnings estimates as semiconductors led the tech sector higher. Consumer cyclicals have also enjoyed recent outperformance among major sectors.

Healthcare and industrials continue to outpace the S&P 500 Index, while energy has been the worst year-to-date performer by a wide margin.

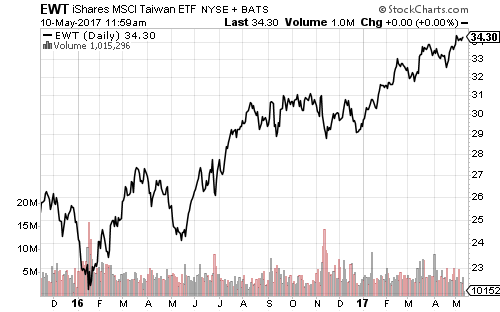

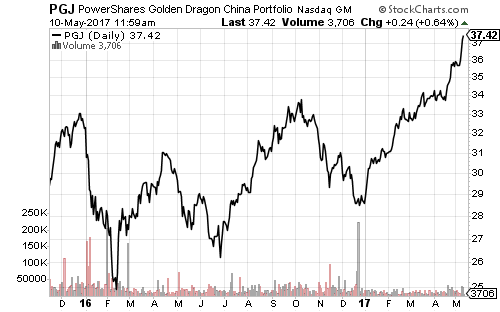

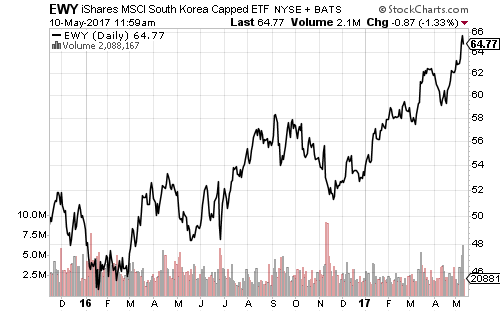

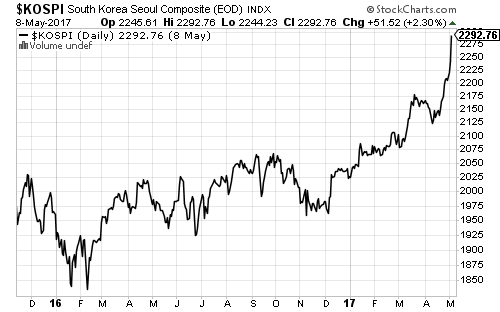

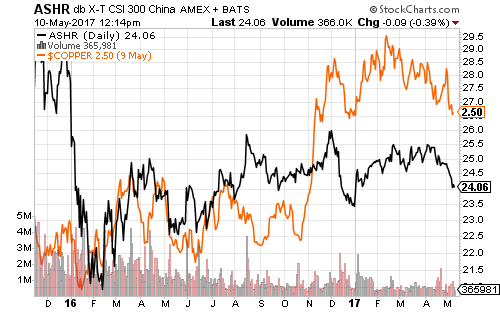

Technology has also lifted emerging markets. Taiwan, South Korea and PowerShares Golden Dragon (PGJ) all have recently hit new all-time highs due to tech overweighting, offsetting weakness in commodities. It’s also notable that the South Korea ETF and the domestic KOSPI are at new all-time highs, despite rising tensions on the Korean peninsula.

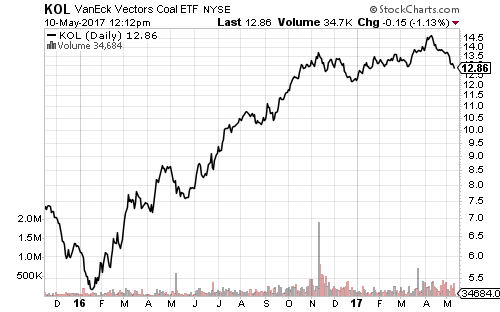

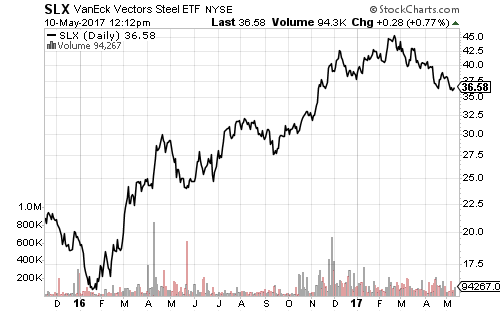

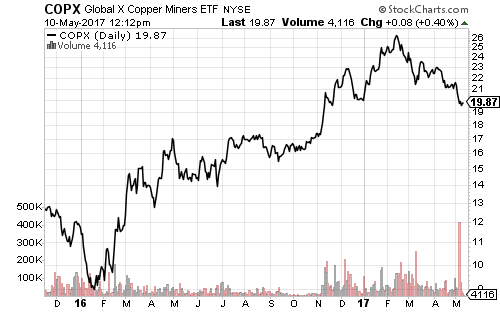

China’s PPI fell 0.4 percent in April, ending the reflation it started a year earlier. Both copper and A-shares are also on the verge of breaking to new 6-month lows.

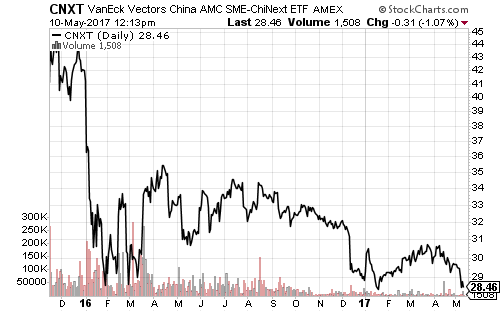

The tech-heavy small-cap index (CNXT) already broke to a new 18-month low. Bond issuance is also down significantly for corporations and local governments. Mortgage lending was down sharply in April in Beijing, the city with the most stringent real estate restrictions. Beijing’s policies are expected to roll out nationally over the next few months. Copper, coal, steel, iron ore and other industrial commodities will follow A shares lower.

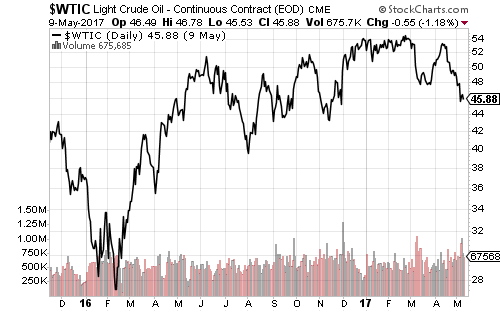

Oil rebounded on Wednesday after big drops in inventory. U.S. oil imports dropped as domestic production satisfied a larger share of domestic demand.

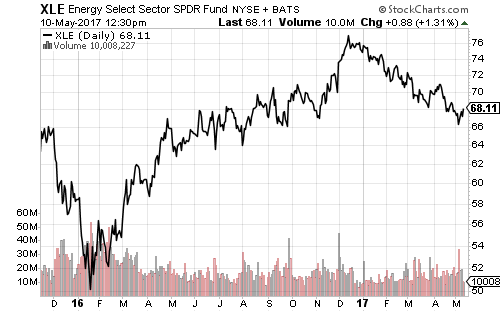

Although crude prices fell sharply over the past month, the February uptrend is still intact. Energy shares also bounced after bottoming last Thursday.

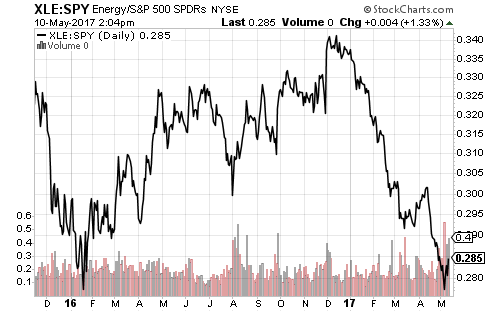

Relative to SPDR S&P 500 (SPY), XLE matched its 2016 lows last week. Energy should improve its relative performance in the weeks ahead as value investors test the waters.

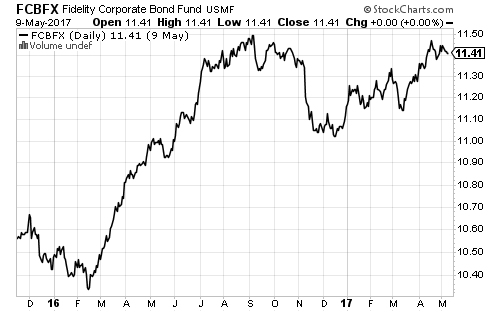

Fidelity Corporate Bond (FCBFX) is near its 52-week high. FCBFX is also higher than it was in February.

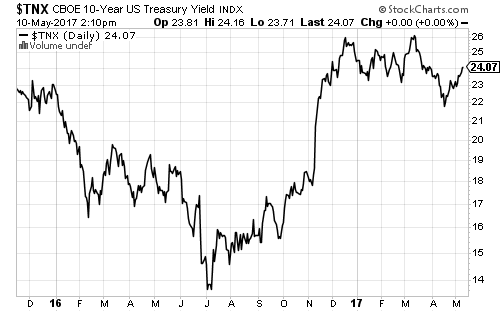

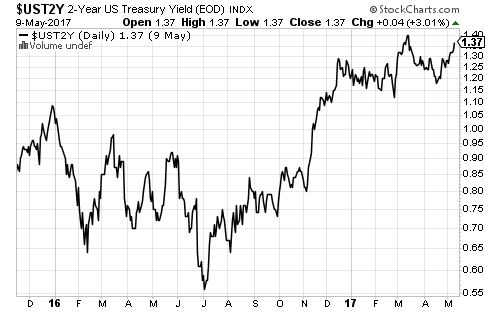

Vanguard Short Term Corporate Bond (VCSH) hit a new 52-week high in April, but it has moved slightly lower as rate hike expectations increased. The 2-year Treasury yield is approaching its highest level since 2009.

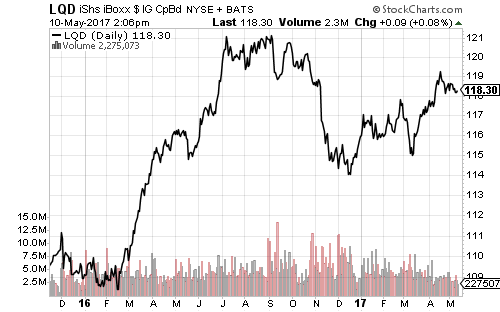

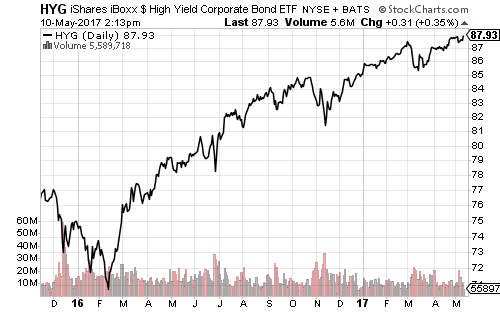

Finally, high-yield bonds are back at a new all-time high.

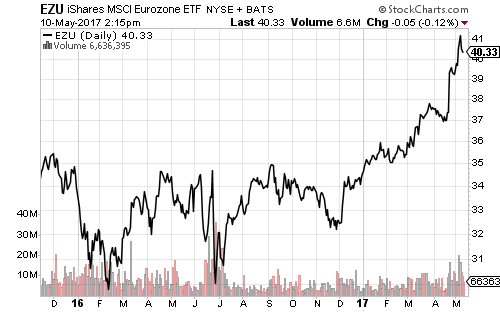

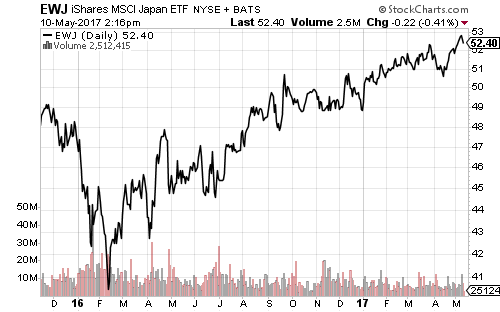

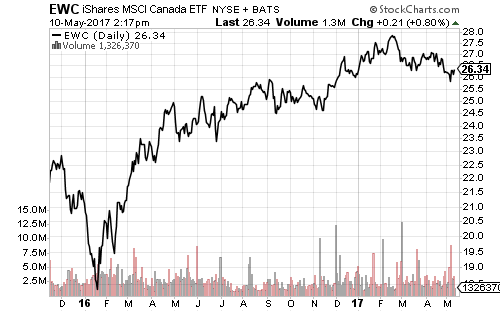

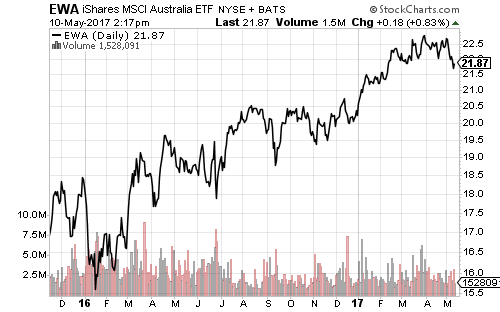

The sharp rally in Eurozone markets following the French election should consolidate in the weeks ahead. Japanese markets are trading near a 52-week high. Canada and Australia are showing some relative weakness as the slowdown in China hits commodities markets.