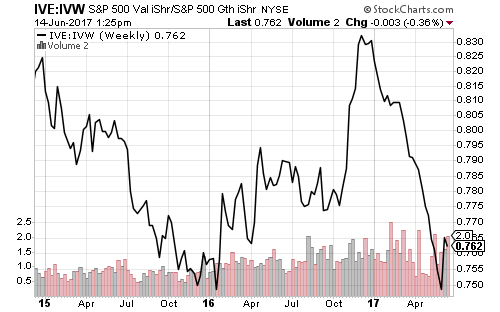

The ratio of value to growth has signaled a possible shift over the past week, as illustrated in the comparison of iShares S&P 500 Value (IVE) to Growth (IVW).

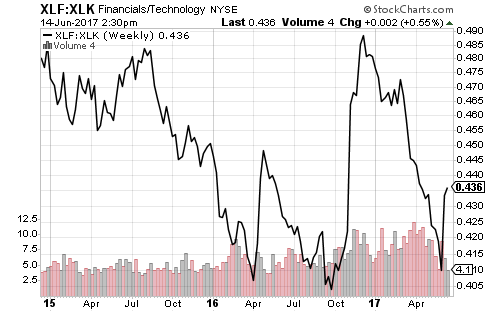

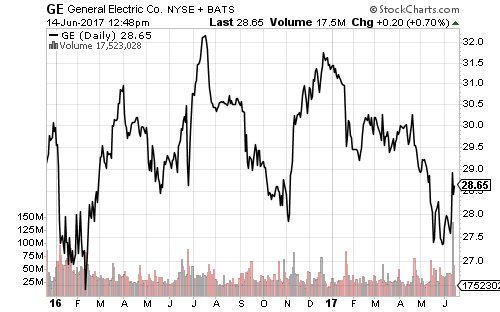

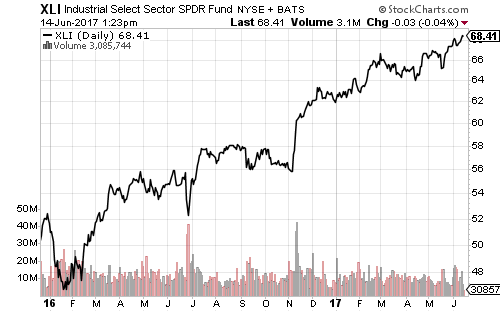

Financial, industrial and healthcare shares advanced through the 2-day tech correction that pulled the Nasdaq 1.80 percent lower. SPDR Financials (XLF) gained 1.9 percent on June 9.

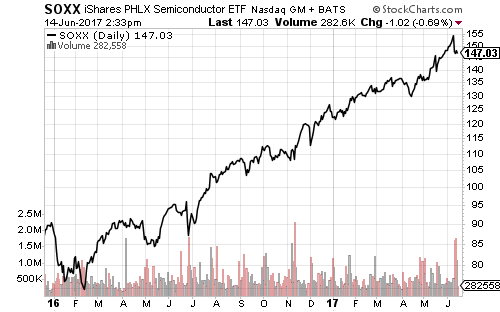

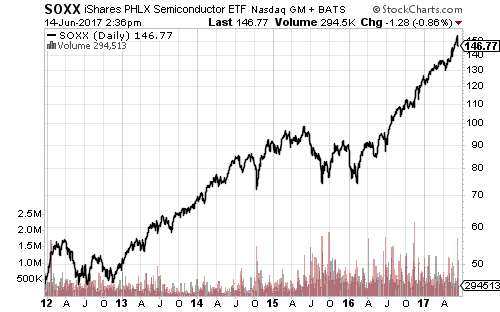

Further sector rotation or a larger pullback in technology is likely. At its peak this year, SPDR Technology (XLK) was up nearly 20 percent, and the iShares PHLX Semiconductor ETF (SOXX) had gained 26 percent. Financials and industrials will outperform tech at least until this pullback is complete. If a major sector rotation is underway, value sectors could assume market leadership for many months.

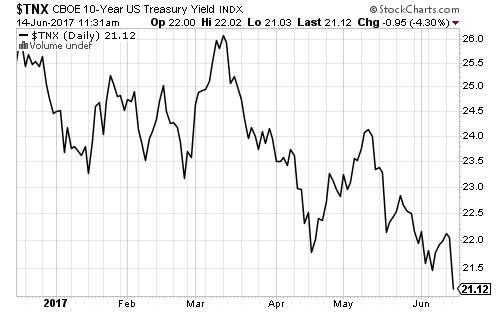

The Federal Reserve hiked interest rates as expected today, though slowing inflation data dampened the odds of another 2017 hike.

Before the Fed announcement, the 10-year Treasury yield broke to a new 2017 low following sluggish retail reports; sales growth ex-autos declined 0.3 percent in May and business inventories fell 0.2 percent in April.

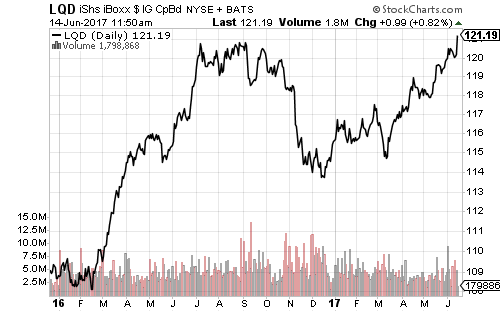

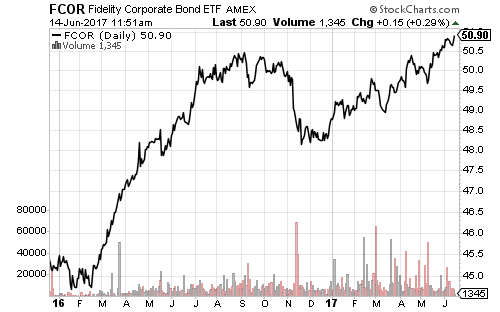

The drop in long-term rates benefited corporate and investment-grade bonds. Both are at new 52-week highs.

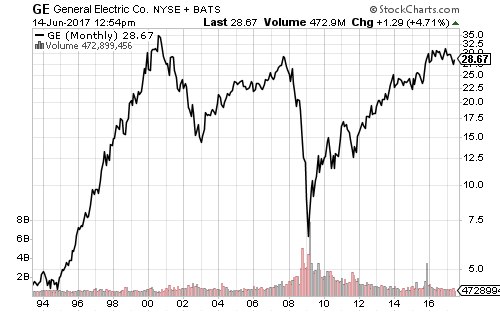

General Electric (GE) shares rallied this week after CEO Jeff Immelt announced his resignation. GE has traded sideways over the past 18 months and is below its all-time high set in 2000. As a major component of the industrial sector, GE accounts for about 8 percent of passive funds such as SPDR Industrials (XLI).

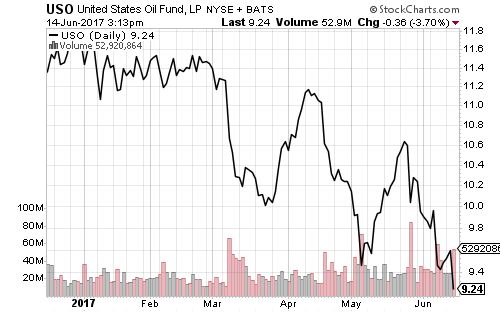

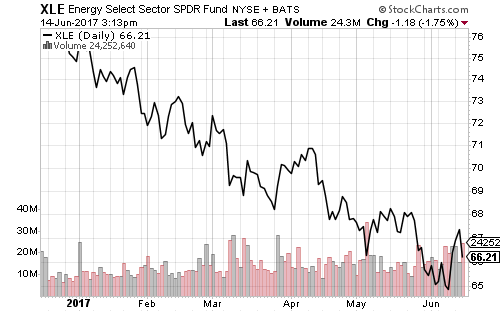

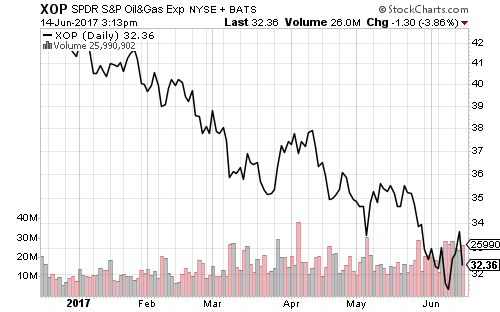

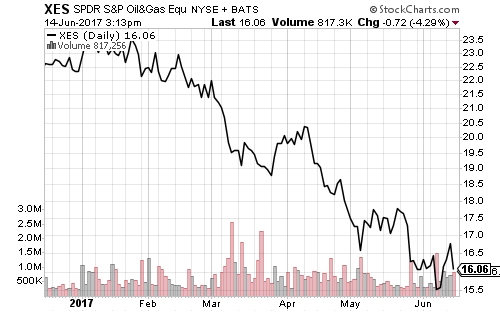

Crude oil prices dipped below $45 a barrel on Wednesday after a build in gasoline inventory. Typically, gasoline inventory falls during the summer driving season, but it rose in 2016 and 2017 is playing out the same way. Oil production also remains high as shale costs keep dropping.

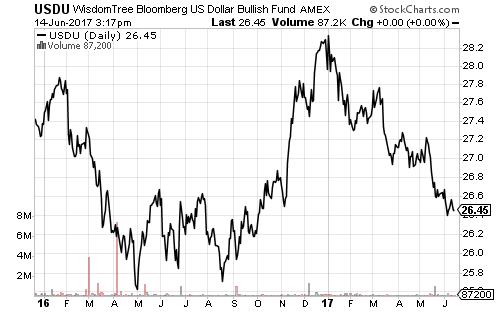

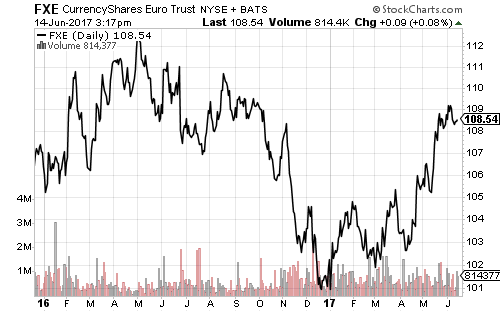

The U.S. dollar rallied after the Fed announcement, which included a plan to reduce its balance sheet by $10 billion a month starting later this year. The Fed will not sell assets, but instead forego the reinvestment of proceeds from maturing bonds. The Fed will also step up the amount by $10 billion every three months until it hits $50 billion. If the Fed starts this process in December 2017, then by December 2018 it will be reducing assets at a rate of $600 billion per-year.

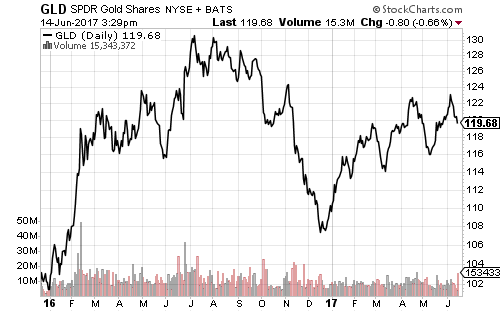

With the Bank of Japan and European Central Bank still engaged in quantitative easing, the Fed’s plan is bullish for the U.S. dollar and bearish for gold. SPDR Gold Shares (GLD) sold off immediately after the Fed’s announcement.