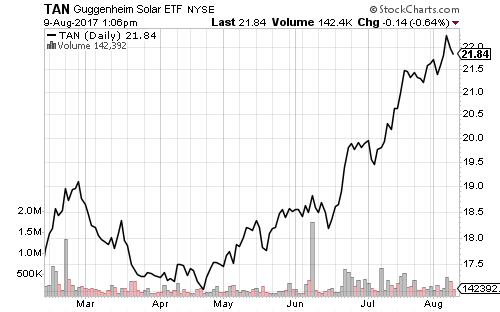

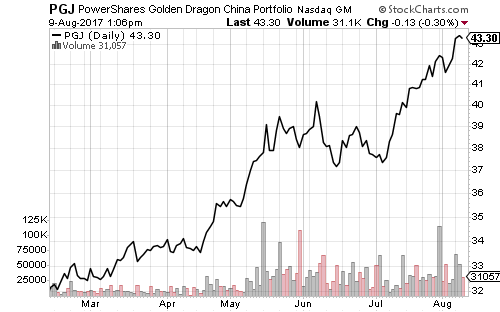

Although technology growth has slowed, sentiment remains healthy in many pockets of the market. Solar and Chinese Internet sub-sectors achieved new 52-week highs in the past week. Caution is still warranted as both are very volatile parts of the market.

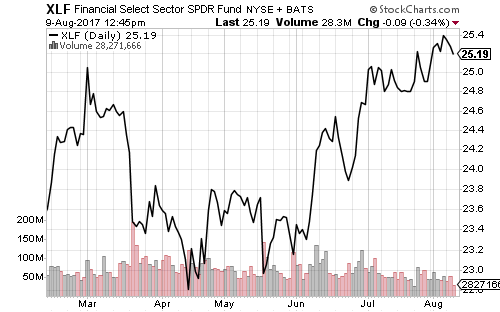

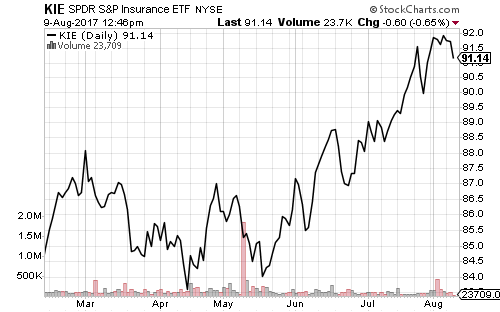

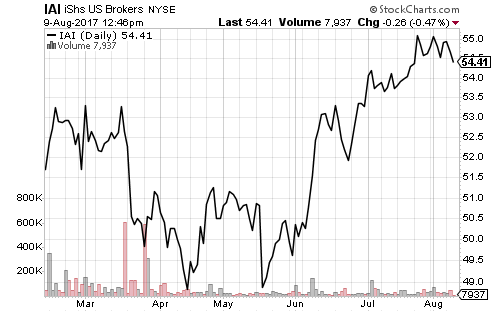

Financials rose to a new 52-week high last week to lead sector performance. Insurers, investment banks and brokerages have powered recent gains.

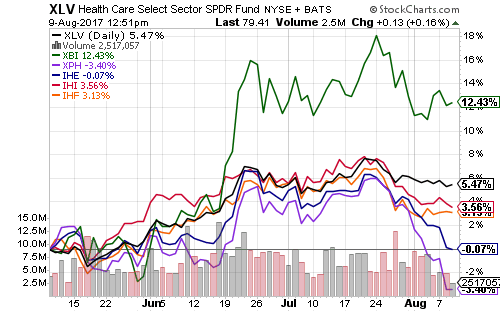

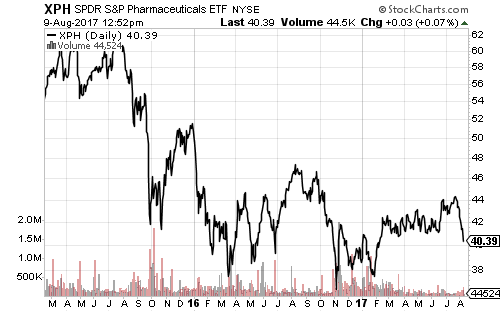

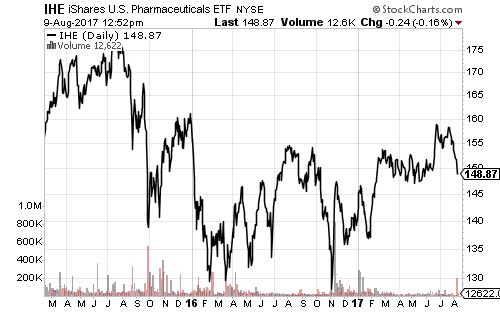

Pharmaceutical shares have weighed on the healthcare sector in the past couple of weeks. Teva (TEVA) is struggling to pay off debt incurred with its 2016 acquisition of Allergan’s (AGN) generic business. TEVA lowered earnings guidance and cut its dividend 75 percent. Shares have fallen 45 percent over the past two weeks. Our outlook on the broader healthcare sector remains positive and will likely perform very well over the coming months.

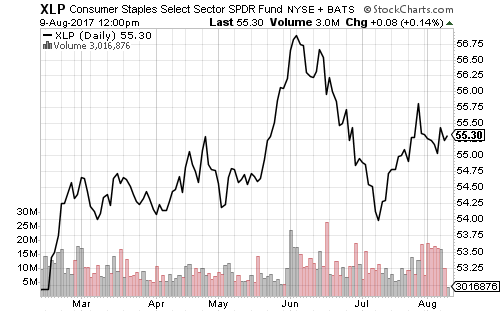

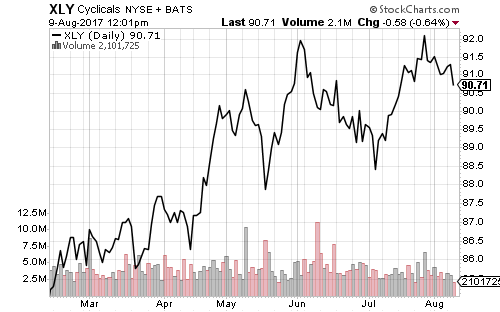

Consumer staples outperformed the market last week, while consumer discretionary shares fell. Disney (DIS) announced plans to sever ties with Netflix (NFLX) and launch its own streaming video service. Shares of Disney were down 3.88 percent on the day, Netflix fell 1.45 percent. Disney accounts for 6.0 percent of SPDR Consumer Discretionary (XLY) and Netflix is 2.9 percent.

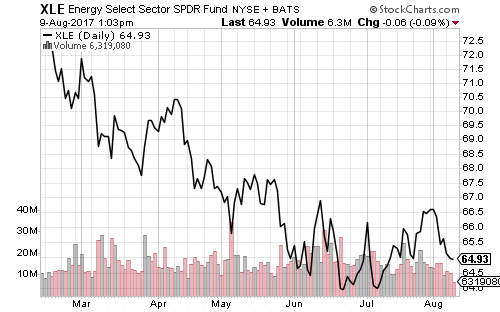

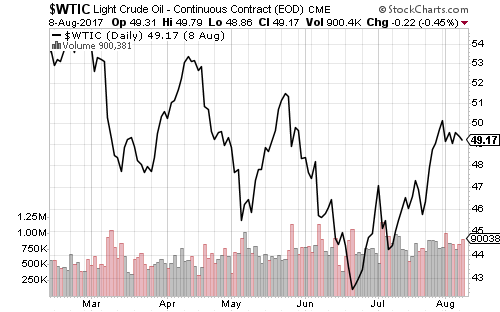

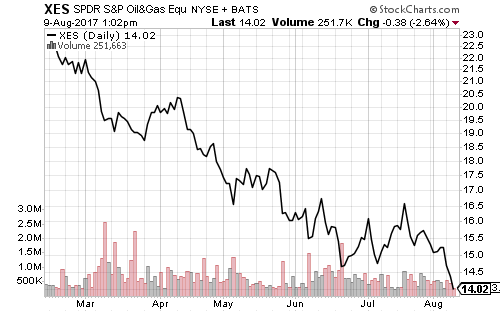

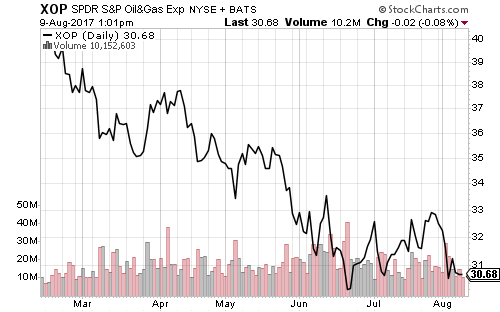

Crude oil may have peaked after briefly trading above $50 a barrel. Oil service stocks (XES) are at a new 52-week low. As well, independent explorers and producers (XOP) are approaching a 52-week low.

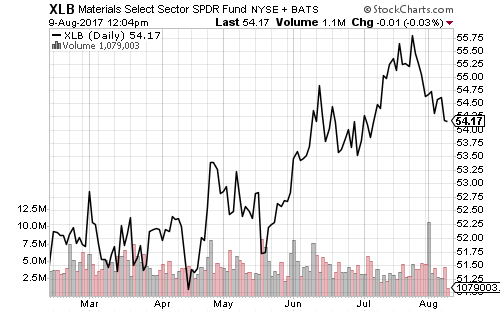

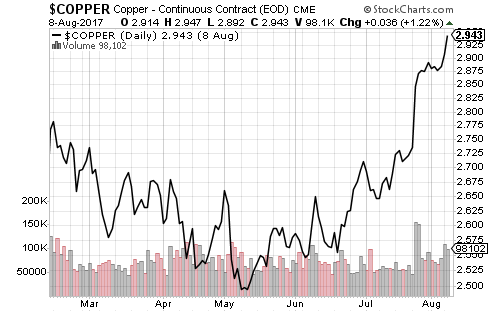

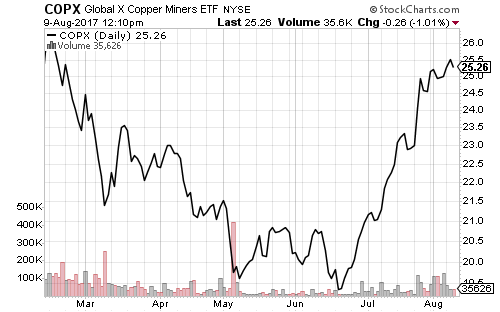

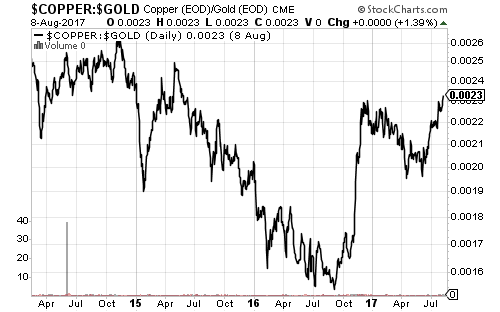

Copper is trading at a two-year high, the rest of the materials sector has slowed COPX’s ascent. The copper gold ratio broke out to a new high in the past week.

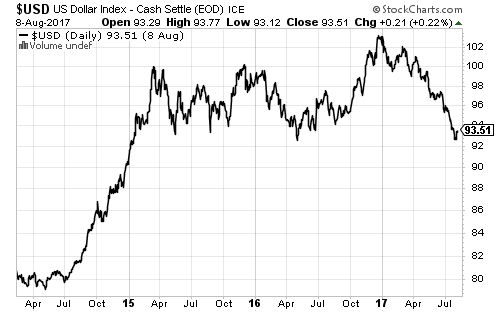

The U.S. Dollar Index rallied sharply on Friday following the strong July employment report.

The euro is the largest component in the U.S. Dollar Index. It broke out of a 2 ½ year trading range in the past month, signaling a potential breakdown in the dollar.