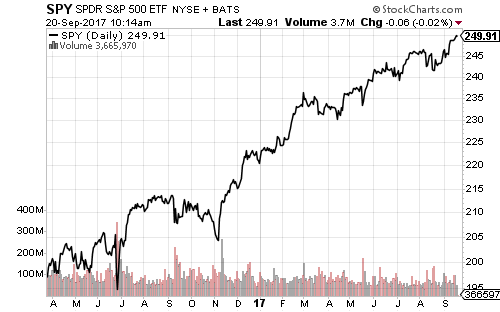

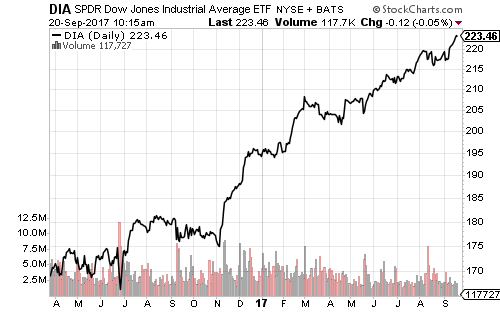

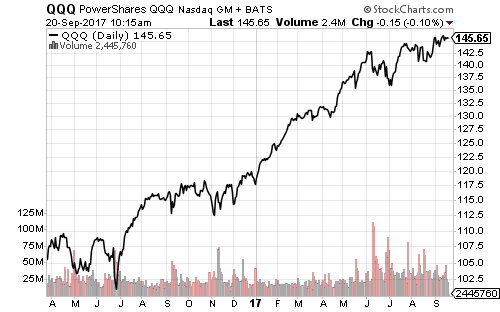

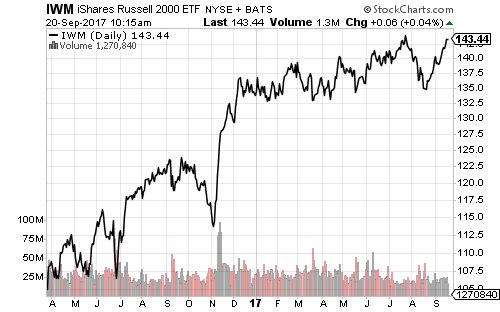

The major indexes hit new all-time highs over the past week, with only the Russell 2000 trailing. iShares Russell 2000 (IWM), however, is just 0.5 percent from joining them.

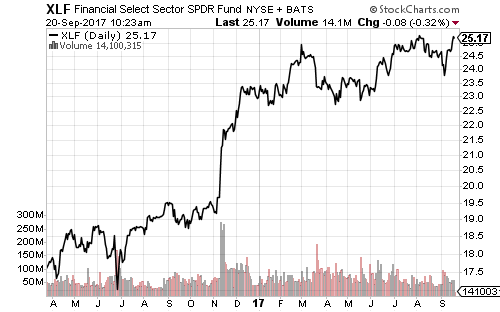

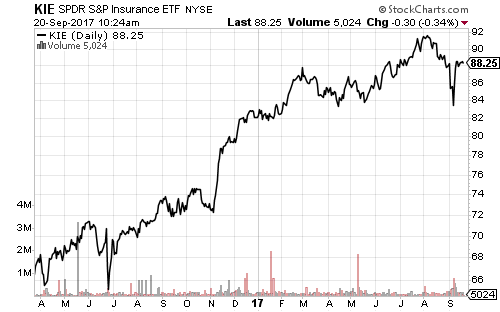

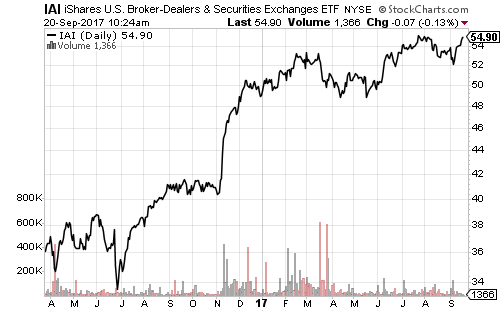

SPDR Financials (XLF) approached its 52-week high set in August this week. Investment banks and brokerages are trading at new highs. The big swing in rate hike expectations over the past month also lifted the sector.

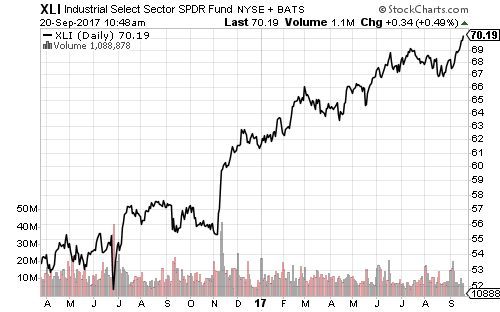

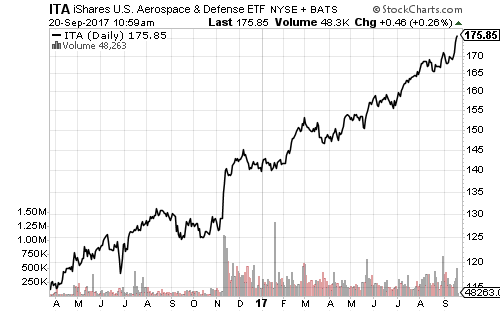

Industrials rallied strongly as merger activity in the defense subsector continued with Northop’s (NOC) offer for missile maker Orbital (OA).

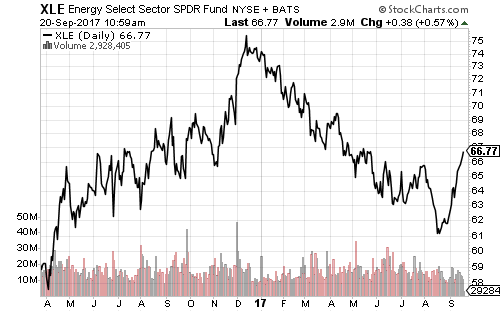

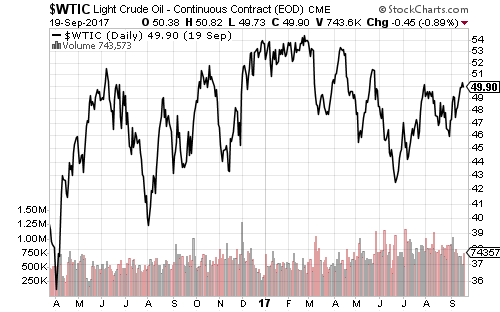

Energy has been in a clear bear market since 2014. It rallied in 2016, but has been in a corrective phase since December. This past week SPDR Energy (XLE) rebounded and broke that downtrend. With West Texas Intermediate crude struggling to hold the $50 level, however, look for energy to correct in the coming week.

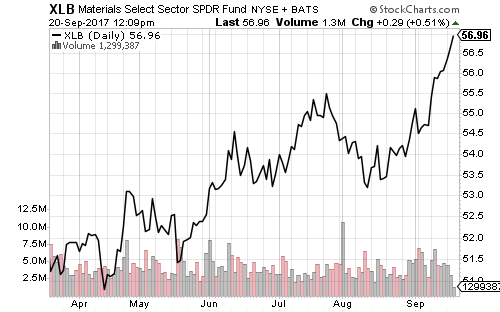

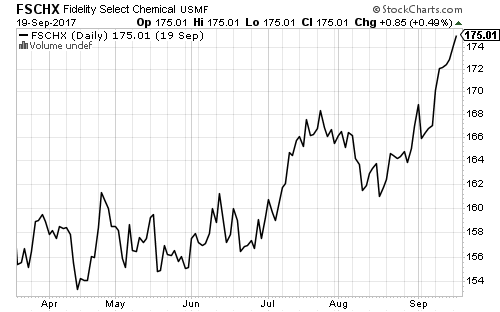

Materials hit a new all-time high last week. Hurricane recovery and rising commodity prices boosted shares. The chemicals subsector is particularly strong right now.

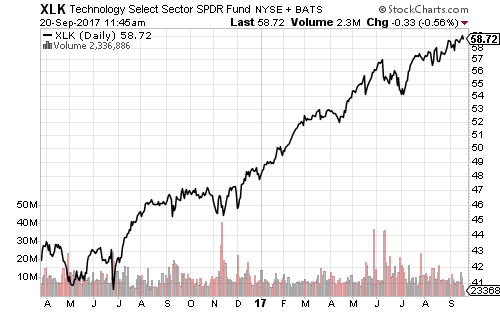

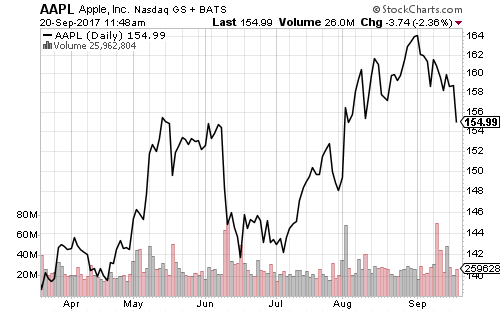

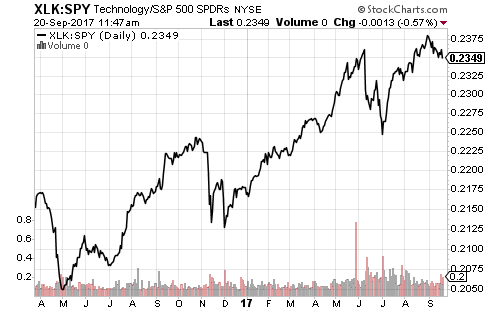

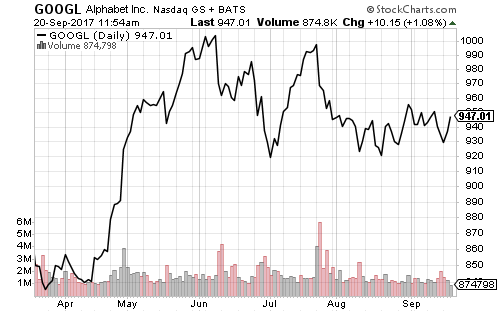

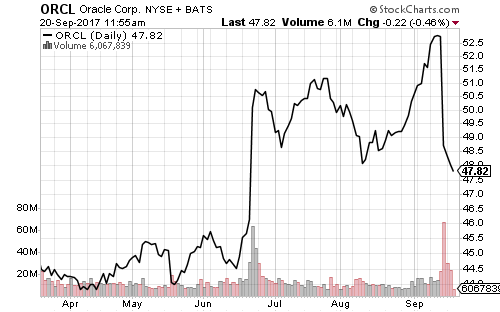

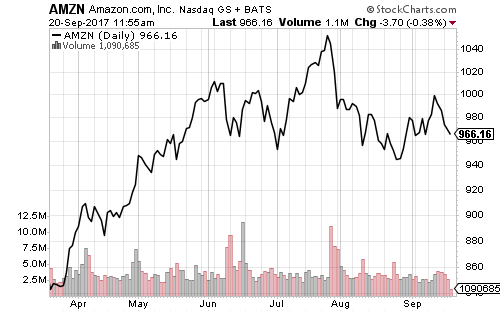

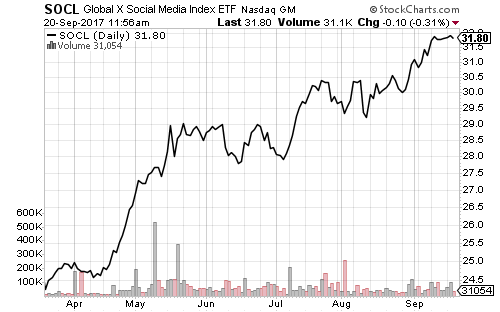

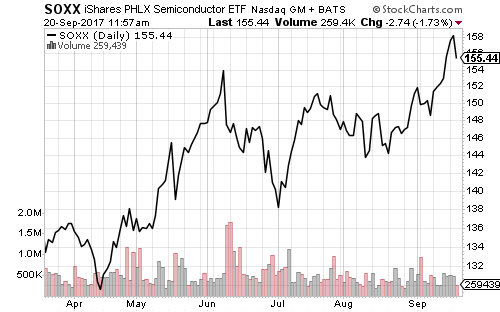

Although SPDR Technology (XLK) also hit a new all-time high this past week, Apple (AAPL) peaked ahead of the iPhone8 and iPhone X unveiling. Slower pre-orders for iPhone 8 and some other issues have since hit the stock. The third chart below shows XLK relative to SPDR S&P 500 (SPY). Shares of Google (GOOGL) remain in a corrective phase and shares of Oracle (ORCL) fell on disappointing earnings guidance last week. Social media and semiconductors have been the best performing subsectors over the past week.

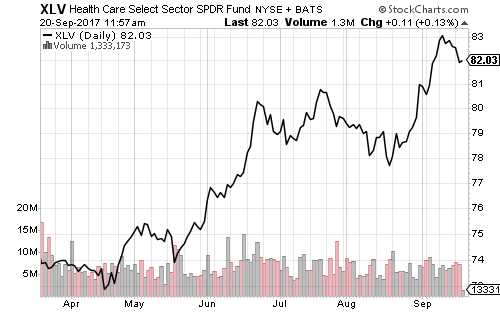

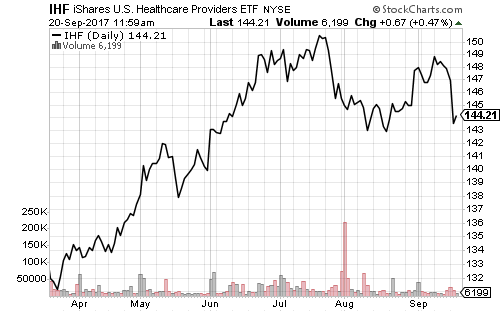

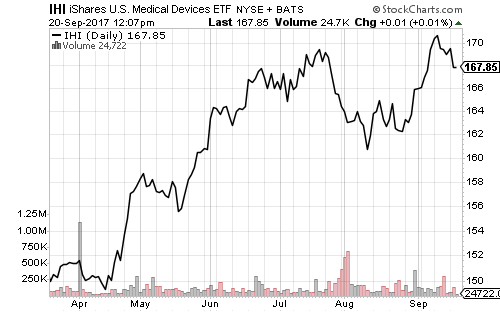

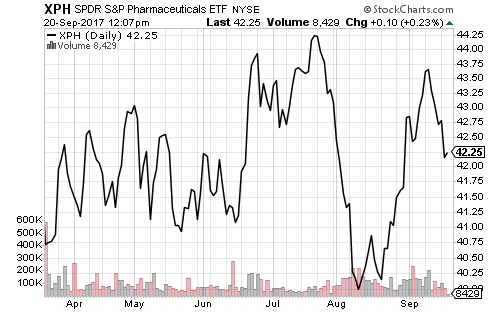

Senate Republicans resurrected healthcare reform this week. A new bill will take federal money raised under the Affordable Care Act and give it to states as block grants. States must use the money on healthcare, but can deviate from ACA rules. The news caught the market by surprise and traders sold healthcare providers amid increased uncertainty. The latest count shows the bill is short by two votes. Three GOP Senators voted against the prior bill. Reports say two of them are undecided.

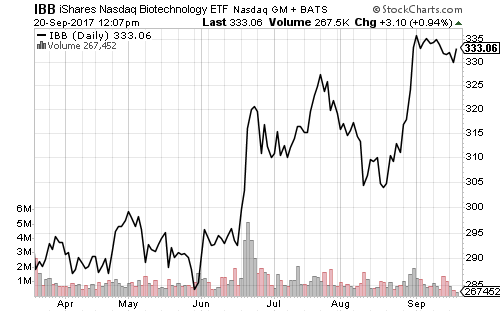

Biotech has emerged as the strongest subsector in healthcare this month.

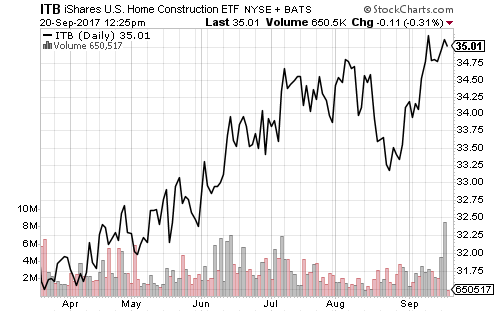

A rise in building permits and better-than-expected housing starts in August fueled heavy buying of homebuilder shares. iShares U.S. Home Construction’s (ITB) volume spiked to its highest level since the November election. The prior one-day high was in July 2016 during the post-Brexit rally.

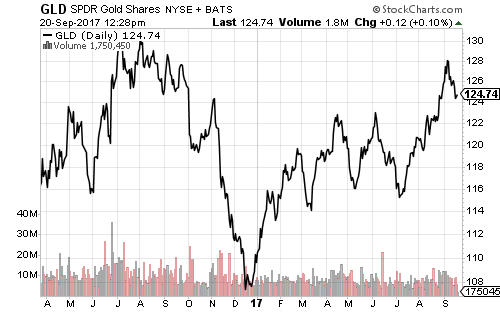

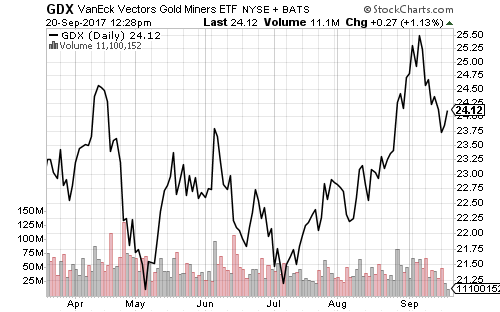

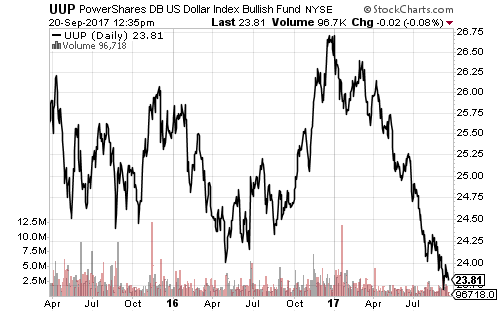

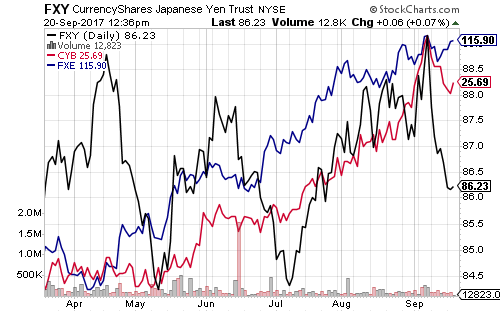

Gold and gold mining both sold off in September. The Japanese yen and Chinese yuan also weakened in September. The euro is near its 52-week high.