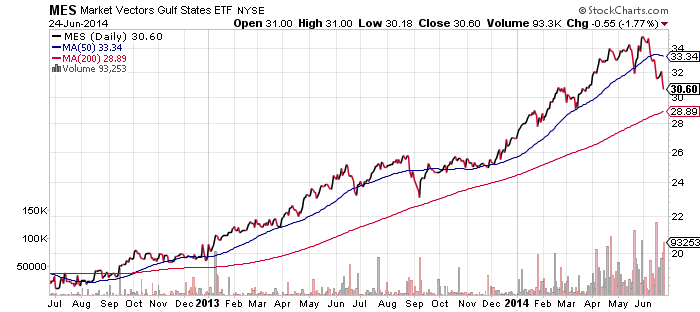

Market Vectors Gulf States (MES)

The Gulf States ETF has plunged in June, down from $35 per share to $30.60 as of Tuesday’s close. The fund is partially feeling the effects of instability in Iraq, but the main culprit is the plunging stock market in Dubai. Although MES has little exposure directly to the Dubai market, its 25 percent plunge since peaking in May has investors in the region rattled. Comparisons between the Dubai stock market over the past few years and Nasdaq in the two years leading up to 2000 makes for a very close match, which has many wondering if this is a bubble bursting.

Despite the fear caused by the Dubai market’s plunge and tensions in Iraq, MES will benefit from higher oil prices and the financial centers in the region are areas of stability. The main question at the moment is whether Dubai is experiencing a correction or a much more significant selloff.

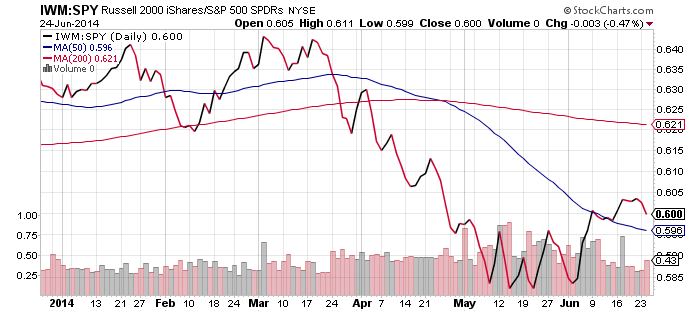

iShares Russell 2000 (IWM)

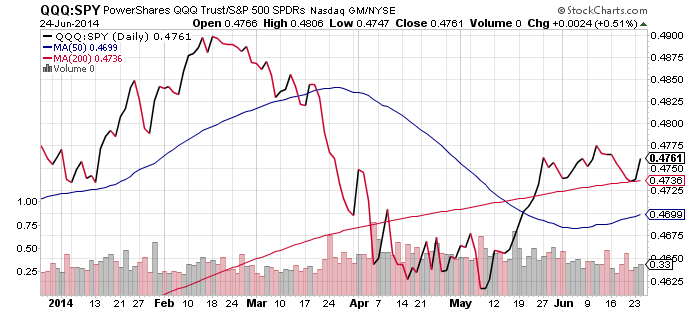

PowerShares QQQ (QQQ)

The two charts below show IWM and QQQ relative to SPDR S&P500 (SPY). Generally, when bullish conditions exist in the market, QQQ and IWM will outperform SPY. That won’t be the case when value leads growth or when large caps lead small caps, as they deliver a good portion of their outperformance during bear markets and pullbacks. We saw this occur in the spring when the Dow Jones Industrial Average was the top performing index.

QQQ is in the better position here, having staged a stronger recovery. However, the relative performance looks good and we should expect to see the Nasdaq and small caps continue to lead the market higher.

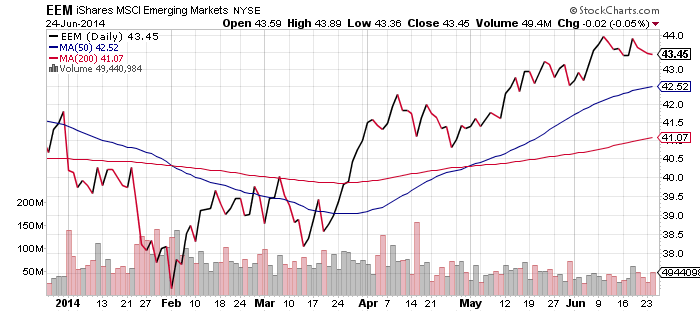

iShares MSCI Emerging Markets (EEM)

Emerging markets still have not significantly broken out, which isn’t atypical for a fund reaching a resistance point. For short-term traders, EEM should be watched closely because it will only take a small rally to break the resistance and push higher.

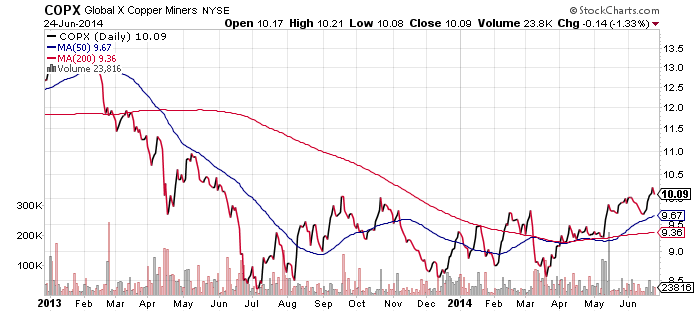

Global X Copper Miners (COPX)

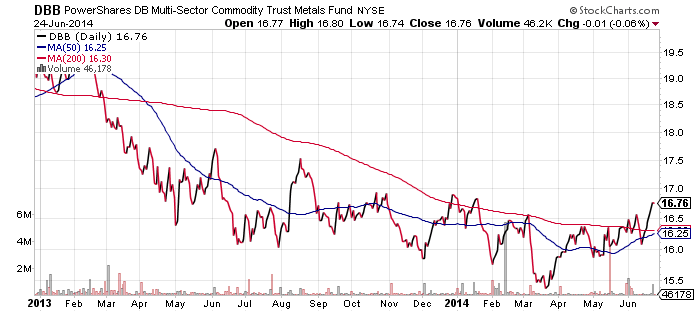

PowerShares DB Base Metals (DBB)

Industrial metals and copper have enjoyed a rally of late. China’s recent port scandal didn’t impact copper significantly and metals prices are rising, despite the slowing of the Chinese economy. Copper imports for May plunged 17 percent in China. Furthermore, the growing port scandal could further dent demand as an estimated one-third of imports are used as loan collateral. For now, many banks have stopped making these types of loans until the situation is resolved.

Given China’s slowing imports, the rally could be another signal of a pickup in inflation. COPX is traded at its highest level in months and a rally of 30 percent could unfold if this is a genuine breakout. For DBB, it’ll take a bigger push before it looks like shares can recover to the $20 level, but that too represents a solid gain of about 20 percent.

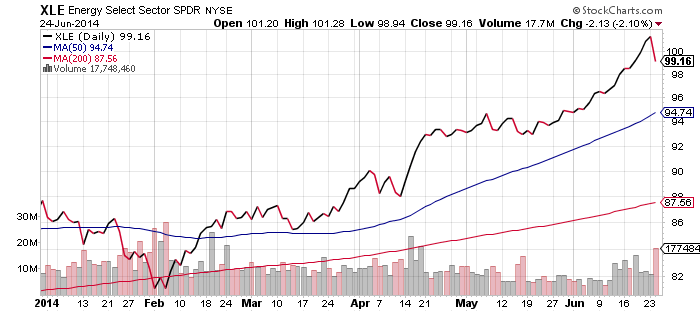

SPDR Energy (XLE)

Energy equities experienced their first pullback after a month of gains. Energy ETFs were down 2 percent on Tuesday, with subsectors down 3 percent or more. SPDR S&P Oil & Gas Exploration & Production (XOP) fell close to 4 percent. First Trust ISE Revere Natural Gas (FCG) slipped 3.5 percent.

Oil prices held firm. Price are off their highs for the week, but still above levels seen two weeks ago. The selling in the equity shares could indicate investors are bearish on the short-term direction of energy prices, but if oil holds up, we should see the energy shares recover and move on to new highs.

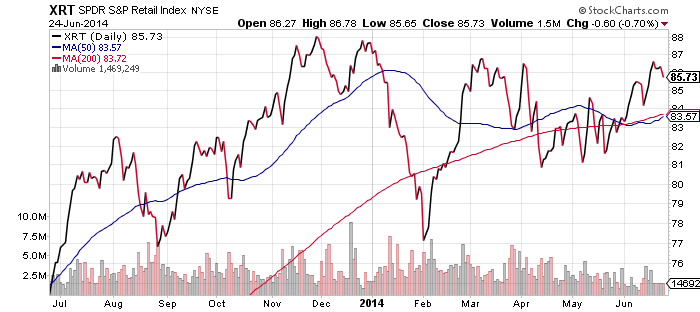

SPDR Retail (XRT)

The S&P 500 sector that suffered the most thus far in 2014 is consumer discretionary. Moreover, retail took a hit right at the start of the year when high expectations for the Christmas sales season were not met. Retail made a near-term bottom right about the same time as small caps bottomed in late May. Since then it has staged a solid rally and sits within 3 percent of its 52-week high.

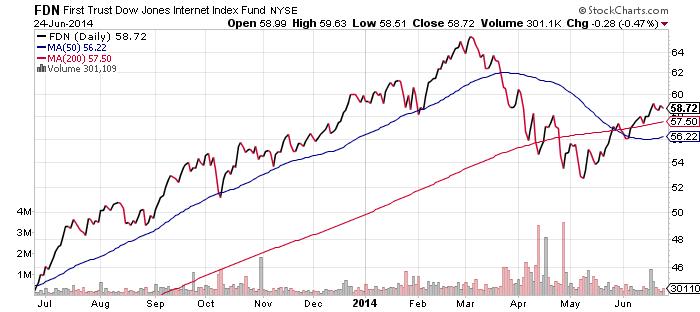

First Trust Dow Jones Internet (FDN)

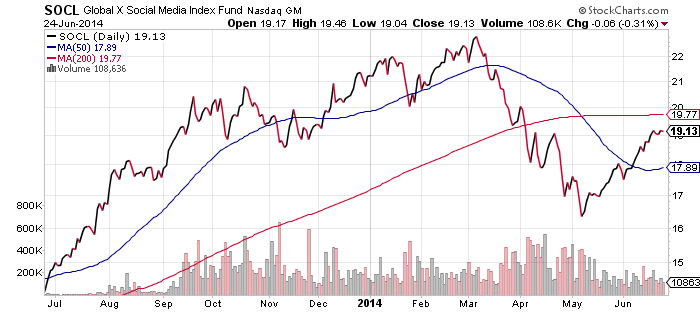

On Tuesday, the Dow and S&P 500 fell about 0.6 percent each, while the Russell 2000 was down more than 1 percent. The Nasdaq was the best performer due to strength in Internet names, losing only 0.47 percent. Unlike other beaten down sectors, the recovery in FDN has been very steady. Global X Social Media (SOCL) also displays the same steady recovery pattern.

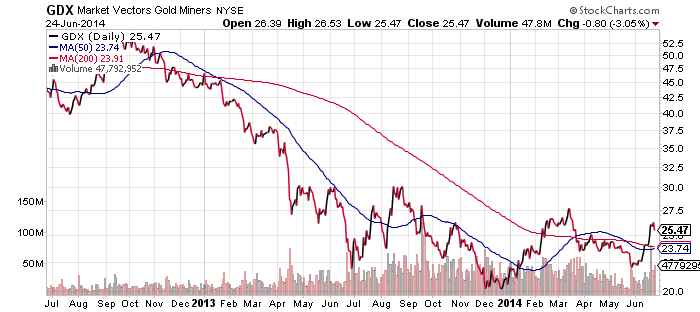

Market Vectors Gold Miners (GDX)

Investors piled into gold mining shares in June, sending GDX up nearly 20 percent from late May levels. As the longer term chart shows, the mining shares are still in a downtrend, even if they have done better this year.

It would take a move above $30 to get the bulls exited and open up the potential for much larger gains. Currently, breaking that resistance level would require another gain of about 20 percent. As with emerging markets and industrial metals discussed above, breaking resistance presents a lot of upside.