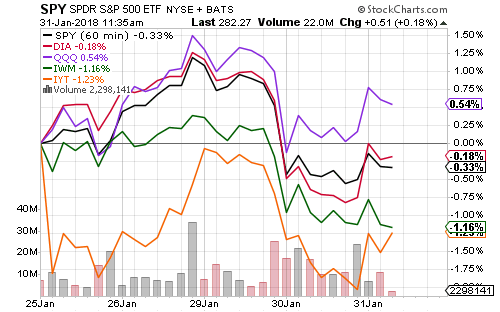

Equities hit new all-time highs in the past week and experienced their first two-day correction in 2018. Major indexes declined on Monday and Tuesday into negative territory before bouncing on Wednesday.

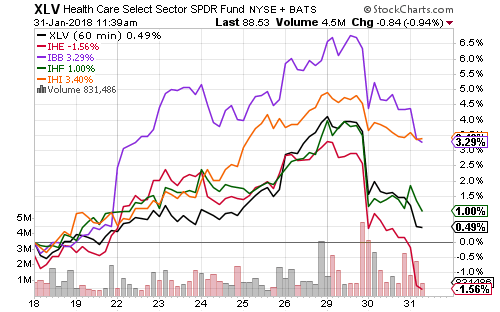

SPDR Healthcare (XLV) rose with the biotechnology rally into the week, but reversed after Amazon (AMZN), J.P. Morgan (JPM) and Berkshire Hathaway (BRK.A) announced a joint healthcare initiative. The new non-profit group will work on reducing healthcare costs for employees.

Within the healthcare sector, medical devices gained on the week, but other subsectors lost ground. The pullback in biotech was modest in comparison to recent gains. Pharma stocks also lost ground.

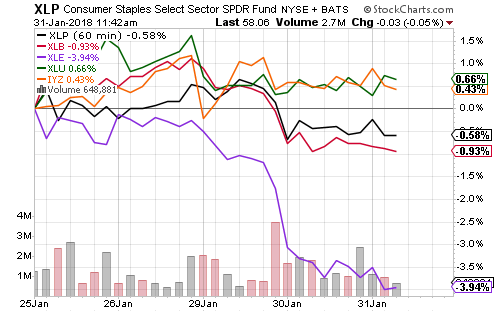

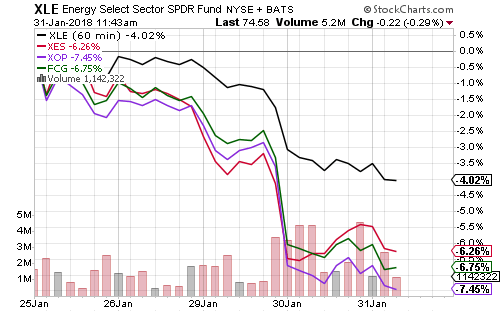

Among the smaller sectors, utilities rebounded despite rising interest rates. The energy sector lagged.

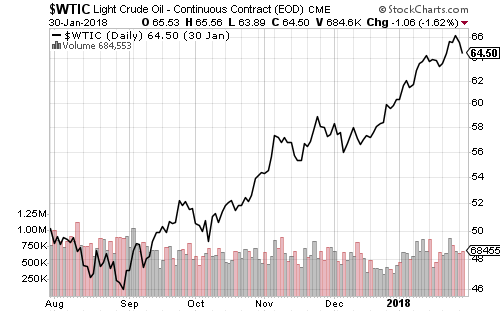

Energy services, natural gas, and explorers have weighed on the broader energy sector over the past week. West Texas Intermediate crude oil fell from a peak above $66 per barrel to $64 on rising U.S. production. America is less than 100,000 barrels away from hitting 10 million barrels per day in output.

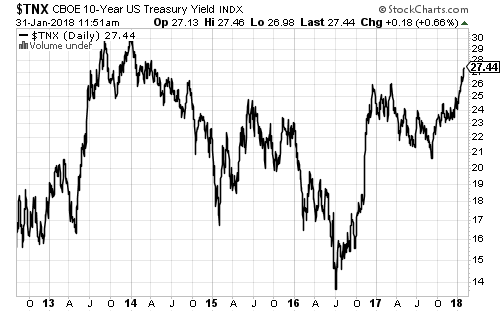

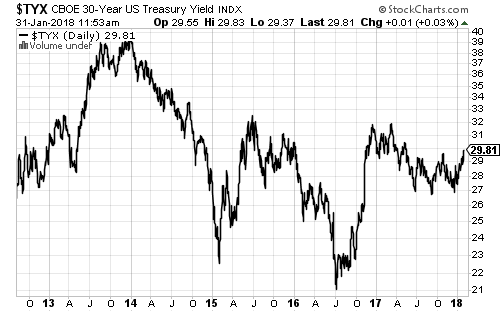

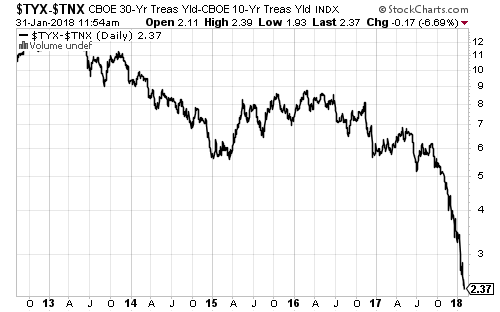

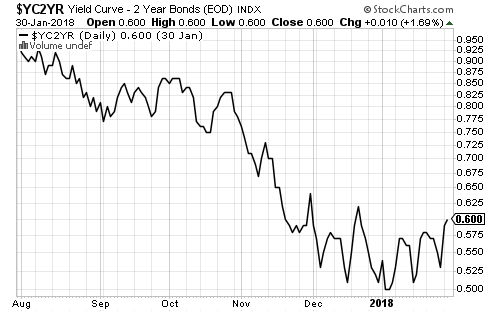

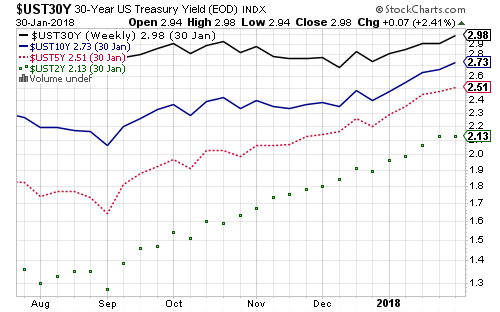

The 10-year Treasury yield climbed above 2.7 percent this week. The 30-year Treasury rallied towards 3.0 percent. The spread between the 10-year and 30-year has collapsed over the past five months from 0.6 percent to 0.2 percent. The spread between the 2-year and 10-year Treasury yield stopped tightening at the start of 2018 as the 2-year Treasury yield leveled off.

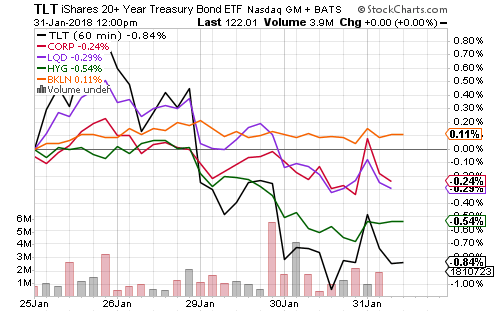

High-yield, short duration such as Virtus Seix Floating-Rate High Income (SAMBX) and Thompson Bond (THOPX) are the only bonds gaining ground amid rising interest rates. Long-duration treasuries fell significantly, followed by high-yield bonds with intermediate and long duration.

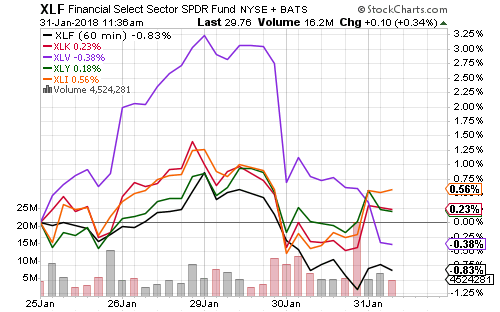

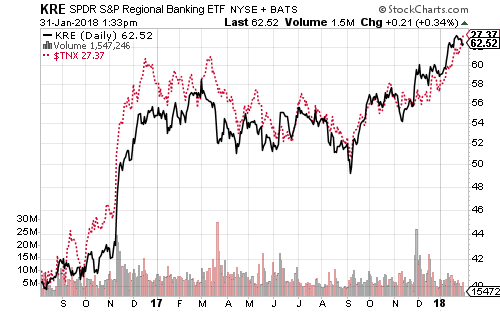

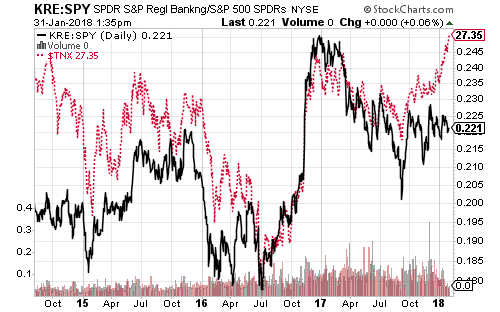

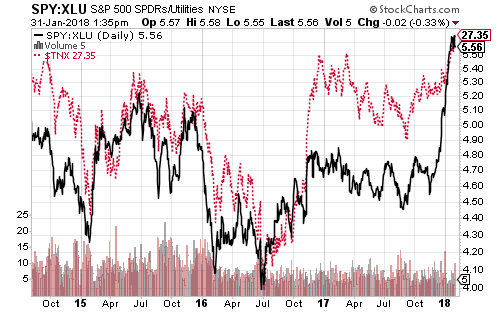

Rising interest rates remain bullish for the financial sector. SPDR S&P Regional Banking (KRE) moves almost in lockstep with the 10-year Treasury yield. Banking shares have room to run because they haven’t outperformed the S&P 500 as much as expected given the rise in rates. In contrast, the utilities sector has caught up to the rate hike. (The utilities relative price chart is inverted, with the outperformance of SPY versus XLU.)

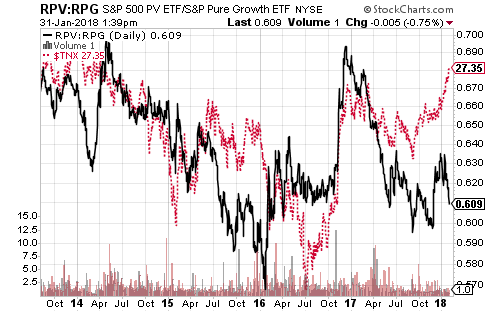

Value stocks also have room to catch-up with higher interest rates. The financial sector has been a market performer. Energy, materials, and the transportation subsector of industrials have lagged over the past few weeks.

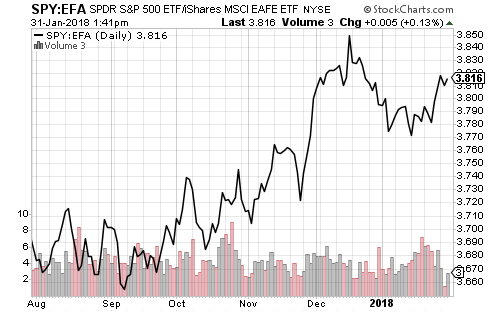

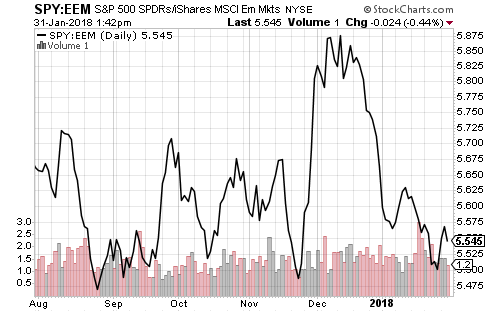

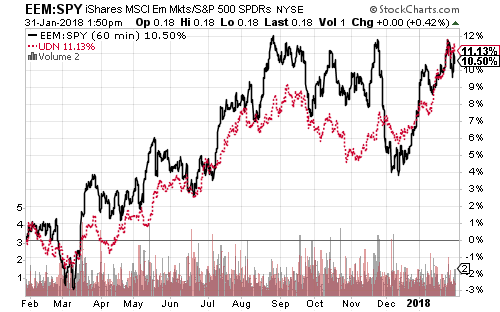

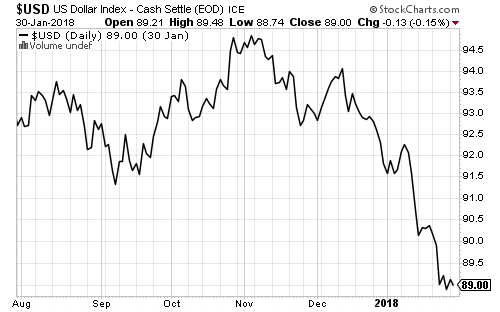

Despite a weaker U.S. dollar, SPDR S&P 500 (SPY) gained ground on iShares MSCI EAFE (EFA) in the past week. Over the past year, iShares Emerging Markets (EEM) outperformed SPY by roughly the same amount as PowerShares DB U.S. Dollar Index Bearish (UDN) gained.

The relative performance of SPY versus EEM looks like it might put in a triple-bottom. The bounces in September and late November both coincided with bounces in the U.S. dollar.

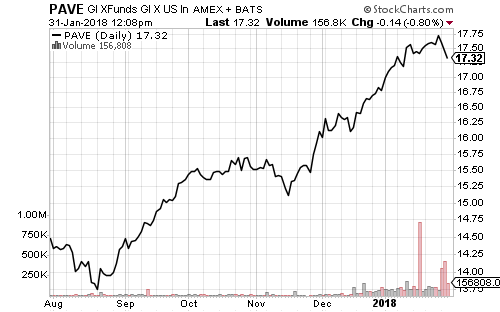

President Trump called for $1.5 trillion in infrastructure spending in his State of the Union speech on Tuesday. As expected, traders sold the news, sending the only pure-play infrastructure ETF down on Wednesday.

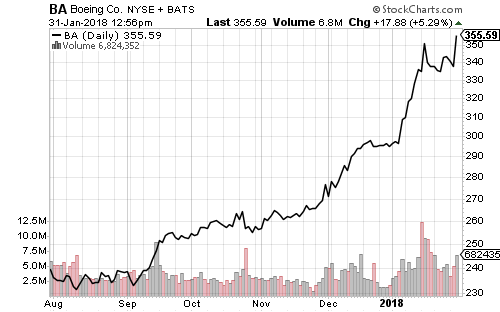

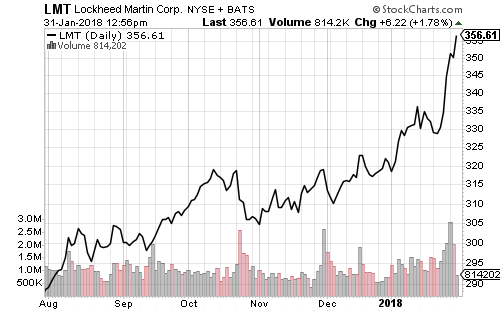

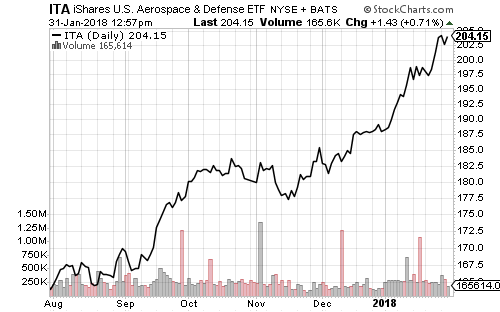

Boeing (BA) and Lockheed (LMT) lifted the defense sector this week with strong earnings. Boeing (BA) beat fourth-quarter estimates by 6 percent, but nearly doubled earnings with tax benefits included. The firm’s backlog hit $488 billion and guidance was positive.

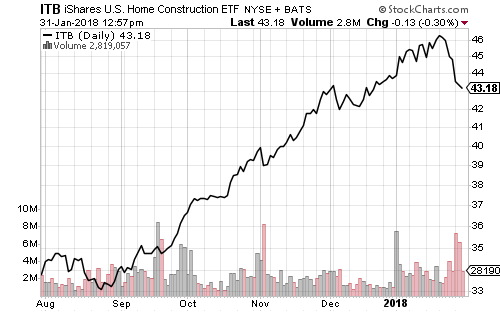

Higher interest rates dented homebuilder shares. The sector lost ground for six consecutive days through Tuesday. Short-term traders may be behind the move though, since the housing market typically doesn’t peak until the Federal Reserve’s rate hike cycle nears its end.