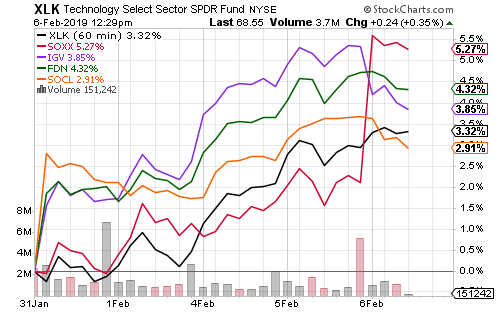

Equities continue to extend their gains. The Nasdaq has outperformed as technology subsectors accelerated.

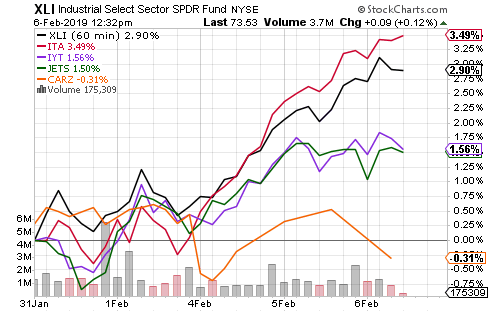

Communication services and industrials have also been market leaders this week.

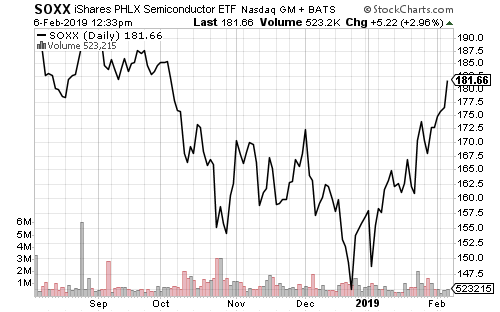

Semiconductors and Internet stocks gained more than 4 percent after solid earnings reports. Semiconductors underperformed in the 4th quarter of 2018 but are now leading the rally.

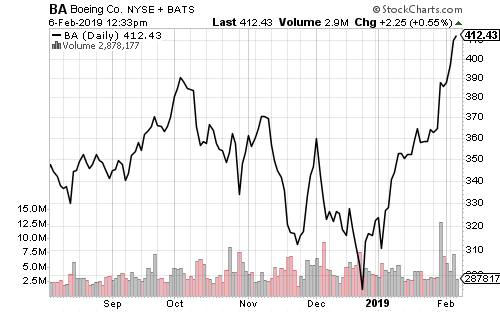

Aerospace and defense lifted the industrial sector with shares of Boeing (BA) rising more than 6 percent. Boeing is now trading at a new all-time high. Transports also achieved solid gains.

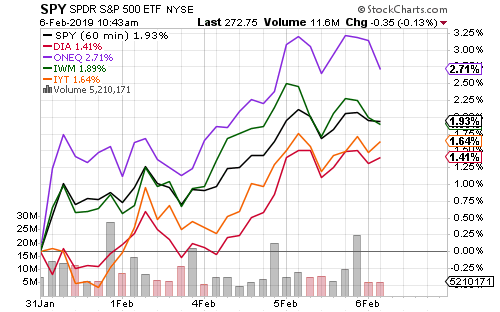

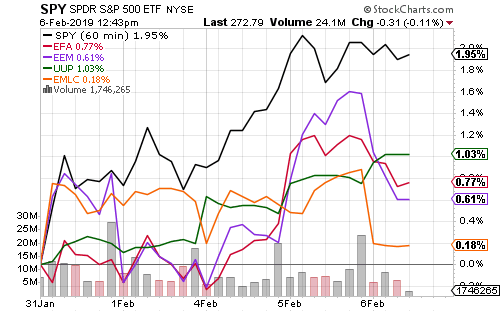

SPDR S&P 500 (SPY) is beating both developed and emerging market funds. The U.S. dollar rallied 1 percent, which has helped domestic stocks.

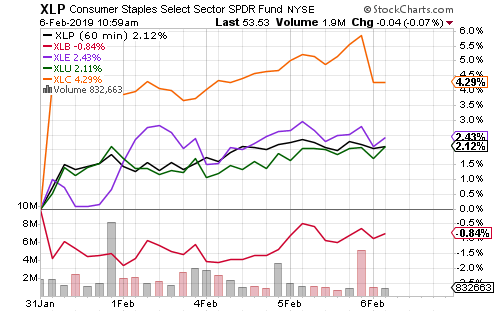

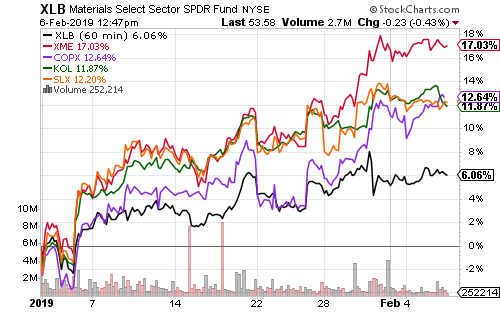

Commodities have also rallied in 2019. SPDR S&P Metals & Mining (XME) has been a strong subsector leader. Copper, steel and coal ETFs are all up double-digits.

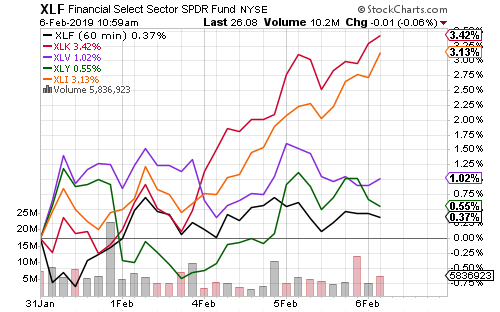

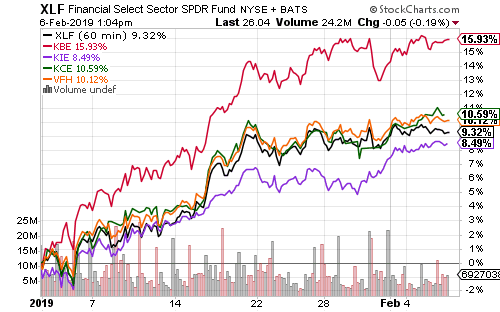

SPDR Financial (XLF) has traded sideways since mid-January. Rising interest rates and widening spreads benefit banks who earn more from lending. Regional banks, insurance and capital markets subsectors have moved on to new highs for 2019.

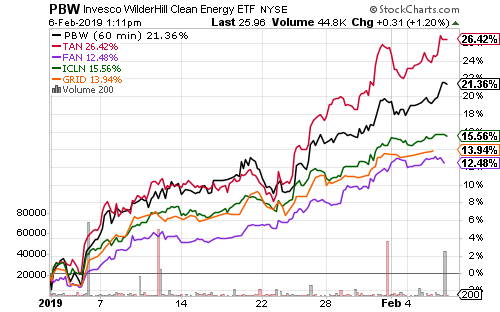

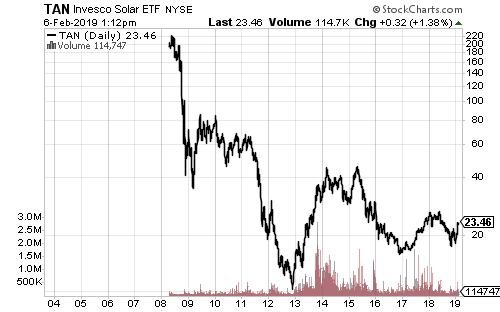

Rebounding energy and technology shares has boosted solar energy stocks. The rest of the clean energy space has also advanced in early 2019. Long-term, the sector remains far below its 2008 high.