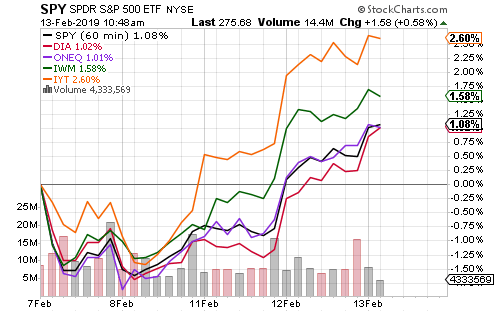

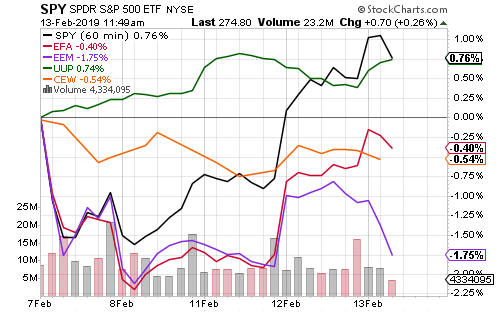

The indexes continue to extend their gains, led by a strong performance in the Russell 2000 Index. A deal to avert a second government shutdown and news that President Xi Jinping was joining trade talks in Beijing helped lift equities.

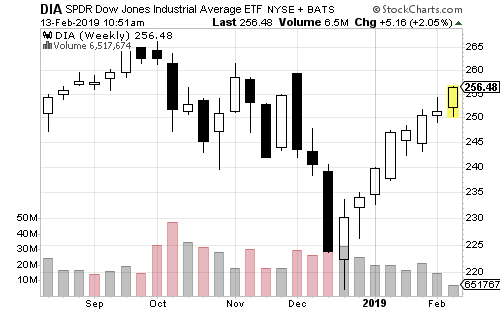

The Dow Industrial Average has achieved gains for eight consecutive weeks. Each of the indexes have similar charts following the correction in the fourth quarter. They are again approaching the highs seen several months ago.

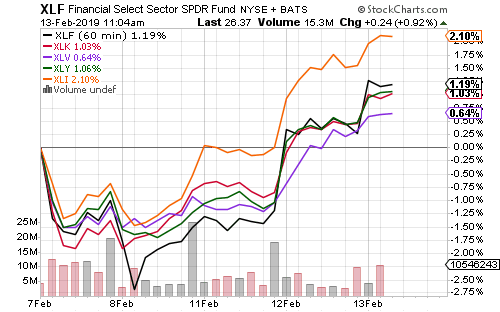

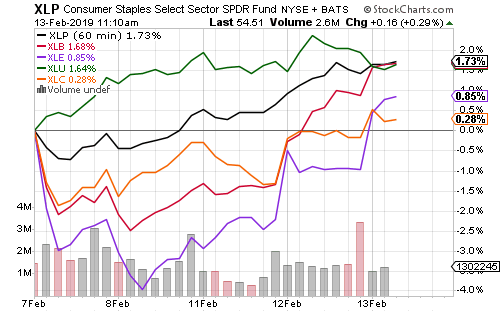

The transportation subsector helped SPDR Industrials (XLI) outperform over the past week. Consumer staples, materials and utilities have also performed well as investors lock in income-paying stocks at attractive yields.

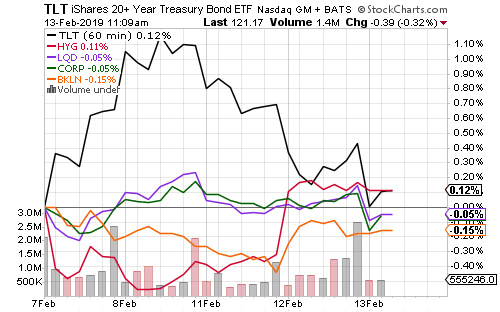

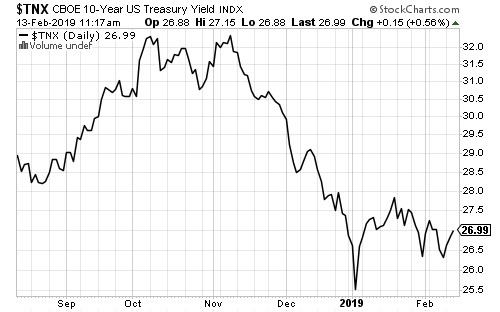

The 10-year Treasury yield moved towards 2.70 percent on Wednesday. Since rebounding a few weeks ago, it has traded in a tight range between 2.80 and 2.63 percent. This is a typical consolidation pattern following the larger move in the fourth quarter.

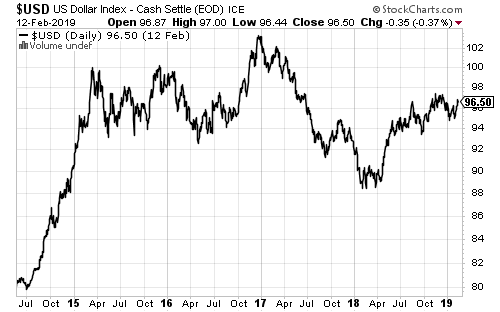

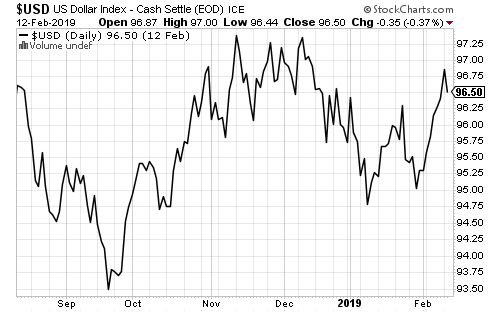

European industrial production fell to its lowest level since the 2008 financial crisis in December. The European Central Bank still has interest rates below zero and a simulative policy would almost certainly involve a restart of quantitative easing, if not rate cuts deeper into negative territory. This would certainly make the U.S. dollars more attractive.

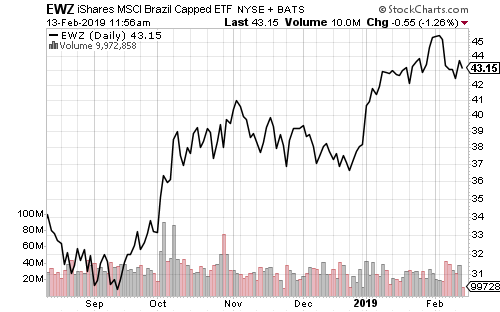

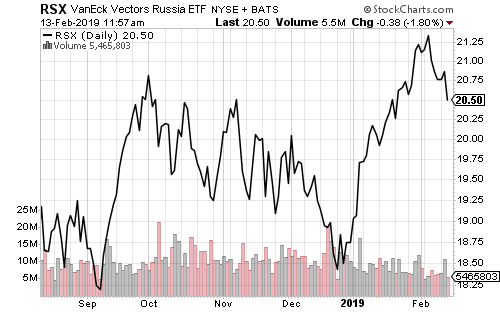

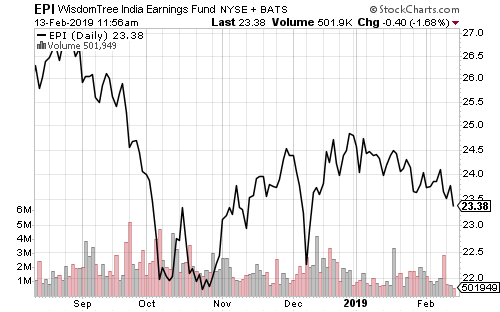

Emerging markets were the weakest performer this week with some pullback in three BRIC markets: Brazil, Russia and India.

A strong dollar creates a powerful headwind for foreign stocks. The rally in emerging market stocks will end if the dollar index breaks above 97.5. With economic difficulties in Europe and China, the odds currently favor a stronger dollar.