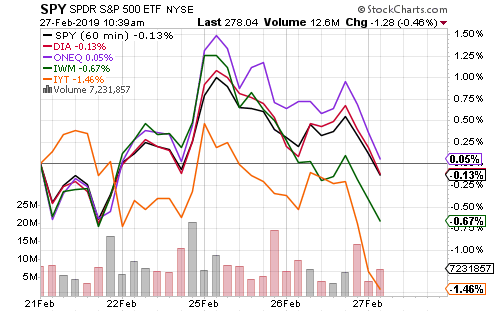

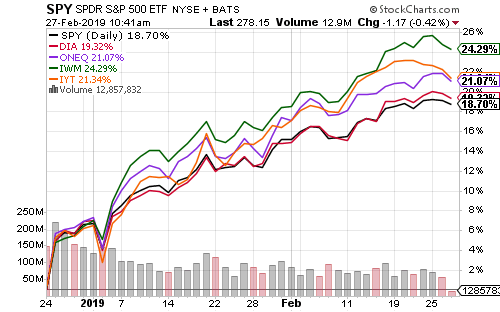

Equities are positioned to achieve a 10th straight week of gains. The Nasdaq was the best performing index over the past week.

Since bottoming in December, the Russell 2000 has rebounded 24 percent.

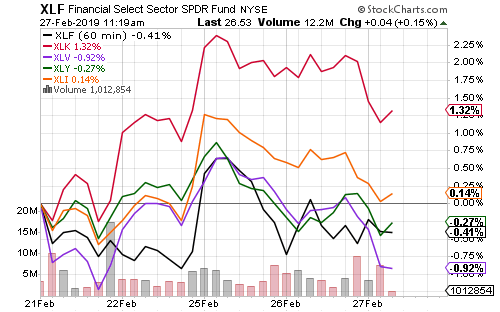

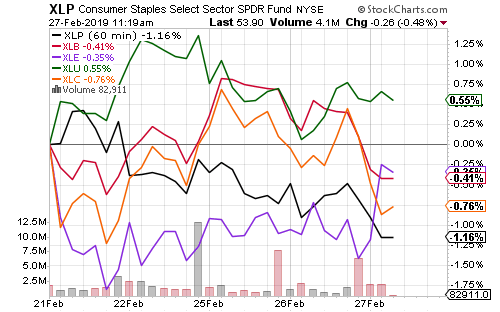

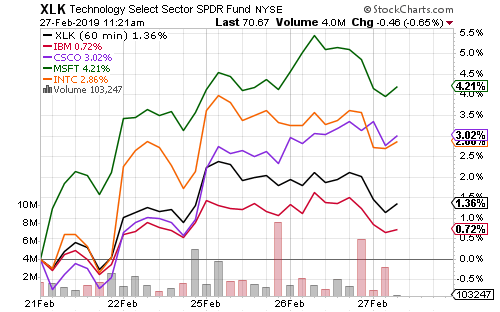

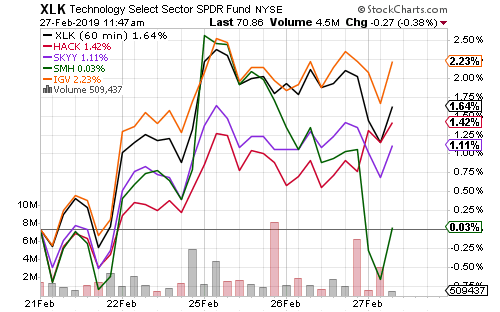

Technology was the best performing sector over the past week. Utilities and industrials have also increased.

Large-cap companies have driven technology gains, including Microsoft (MSFT), Cisco (CSCO), Intel (INTC) and International Business Machines (IBM).

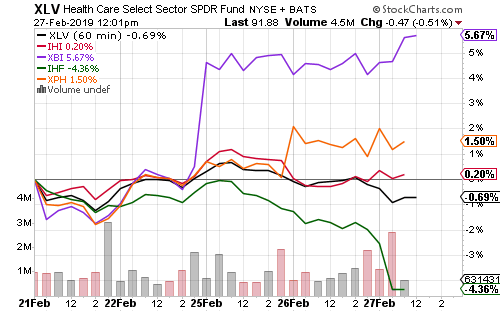

Biotechnology shares jumped after Roche acquired Spark Therapeutics (ONCE) for a 120 percent mark-up. Healthcare providers including UnitedHealth Group (UNH) and Humana (HUM) are down today.

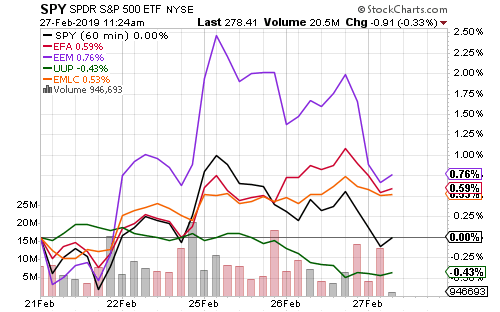

Chinese shares lifted emerging markets due to an anticipated trade deal.

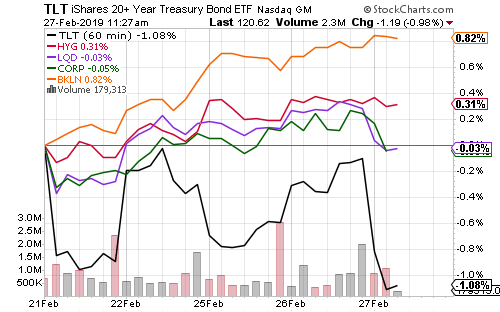

Floating-rate and high yield bonds have outperformed. Investment grade and corporate bonds are flat.

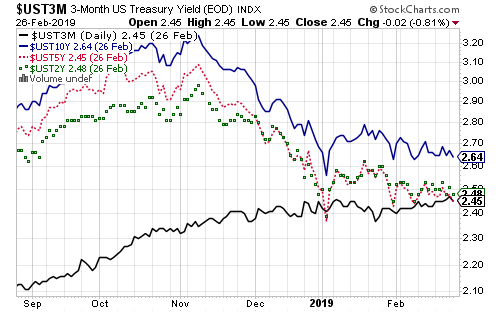

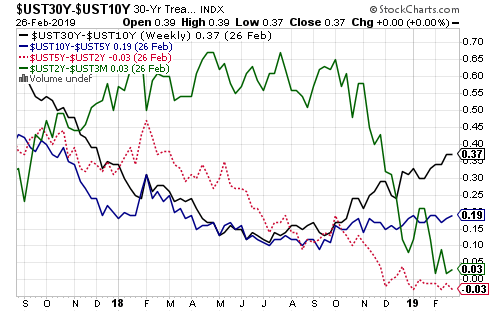

The yield curve has tightened at the short end with the 5-year yield falling below the 2-year yield and the 5-year yield matching the 3-month yield. The spread between the 30-year, 10-year and 5-year yields is widening.

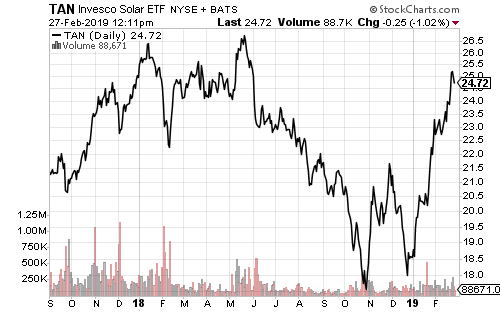

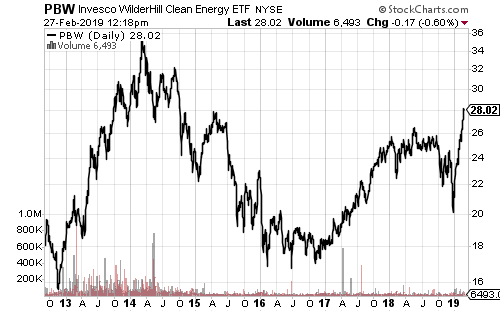

One of the strongest subsectors of the market this year has been solar and clean energy. Invesco Solar (TAN) has rallied near its 52-week high. Invesco WilderHill Clean Energy (PBW) has hit a 4-year high.