SPDR Energy (XLE)

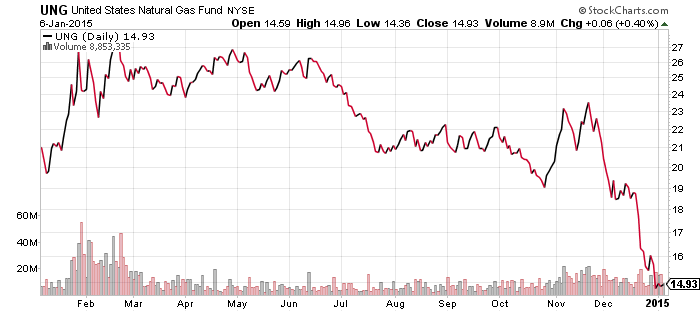

United States Natural Gas (UNG)

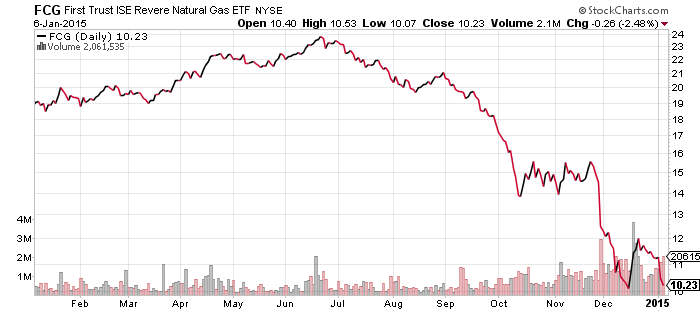

First Trust ISE Revere Natural Gas (FCG)

Another week has passed and we are witnessing another low for crude oil. West Texas Intermediate Crude oil fell to $48 a barrel on Tuesday. Importantly, XLE did not follow crude oil to a new 52-week low, nor did the more volatile subsector service and independent producer ETFs. Investors remain optimistic that oil is bottoming, and they received some evidence substantiating this view on Monday. Bloomberg reported Saudi Arabia reduced its oil price discount for Asian buyers. Asia buys more oil from Saudi Arabia than any other region and with the end of discounts, it is a sign that Saudi Arabia thinks prices have fallen far enough.

Natural gas prices have held near their lows, but FCG has performed modestly better. The outlook for natural gas is a little more optimistic this week given the cold winter air blowing across the United States. Since natural gas is sensitive to local weather conditions, it could decouple from oil, but it will still take an extended period of low temperatures to move the market.

PowerShares U.S. Dollar Index Bullish Fund (UUP)

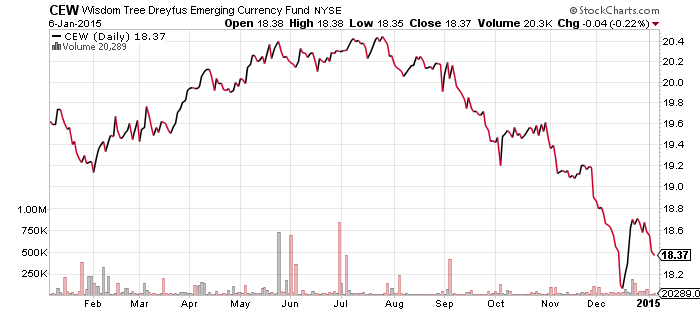

WisdomTree Dreyfus Emerging Currency (CEW)

Global X Greece (GREK)

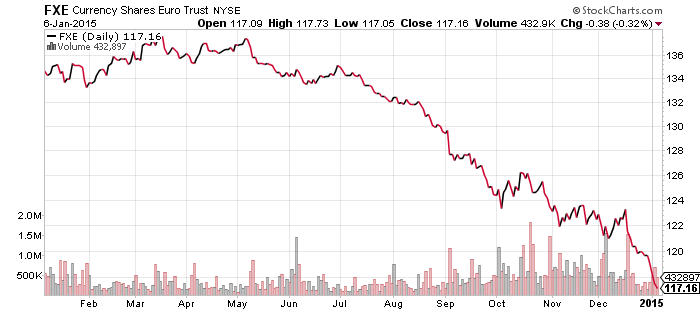

CurrencyShares Euro Trust (FXE)

The Russian ruble sold off again in the past week. It didn’t sink to new lows, nor did CEW which has about 5 percent exposure to the currency. The U.S. Dollar Index climbed to a new record, lifting UUP to a new 52-week high. The greenback’s gains came at the expense of the euro, which slumped to new lows during Wednesday trading. Traders are expecting a quantitative easing program out of Europe and along with a weaker euro, the yield on 5-year German bonds fell below zero. The drop takes the euro back to levels seen in 2006. For technical traders, it has broken the important 2010 lows, opening the way for a move towards parity with the U.S. dollar in the future.

The euro is short-term oversold and the dollar overbought according to technical indicators, and this would normally be a good sign that a reversal is coming. However, the break to new lows for the euro reverses the outlook. Whereas the euro looked as though it could bounce strongly from its lows given its oversold condition, now that is has broken key support, more short-sellers may enter an already very weak market, pushing the euro lower over the week ahead.

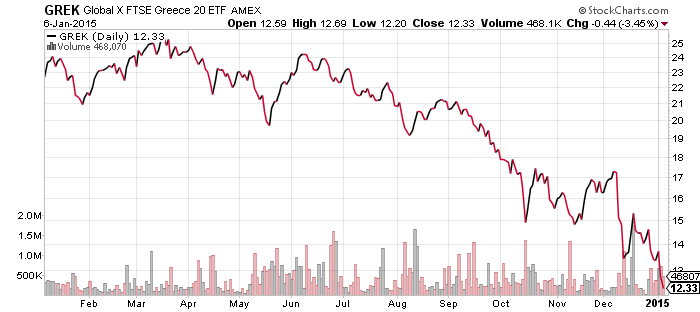

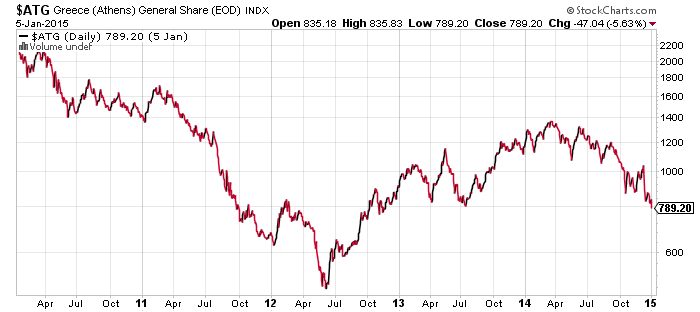

In Greece, the anti-austerity Syriza party still has a lead of about 3 percent in the latest polls. Its lead has narrowed from 4 to 8 percent to 3 to 6 percent recently. Greek stocks have fallen to a new 52-week low, but shares remain well above the lows reached in 2012.

iShares Nasdaq Biotechnology (IBB)

SPDR Healthcare (XLV)

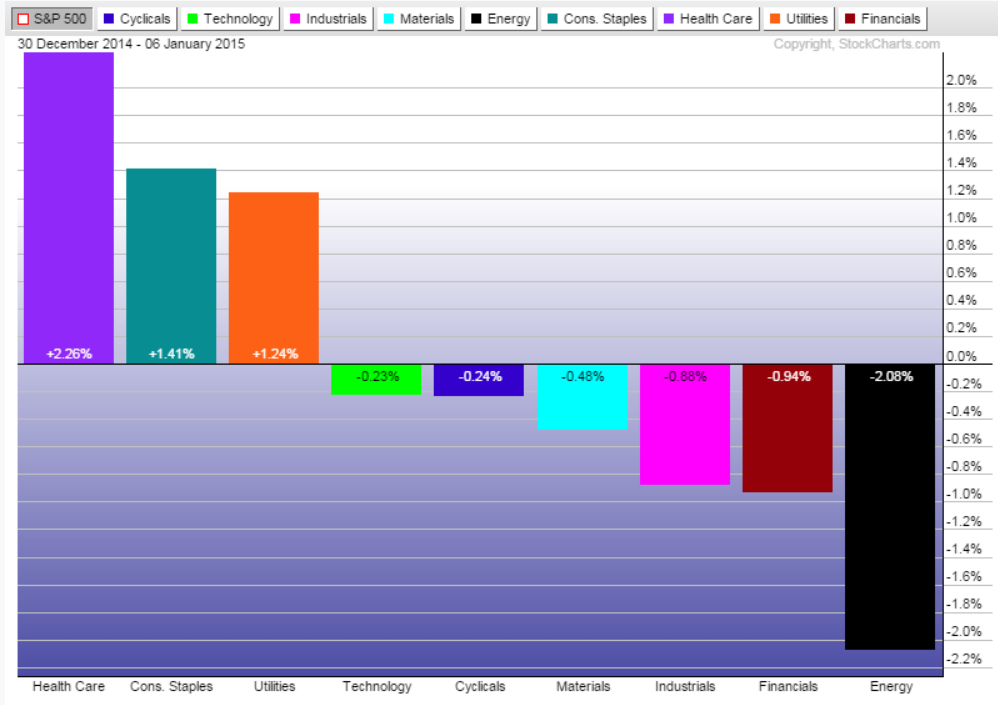

Among the sectors, energy was the worst performer over the past 5 trading days, losing 2.08 percent relative to the S&P 500 Index. Financials have also lagged as investors worry about interest rates in 2015; higher rates are good for banks, but the drop in oil prices could allow the Fed to delay rate hikes.

The top performing sectors were the “defensive” sectors of healthcare, consumer staples and utilities.

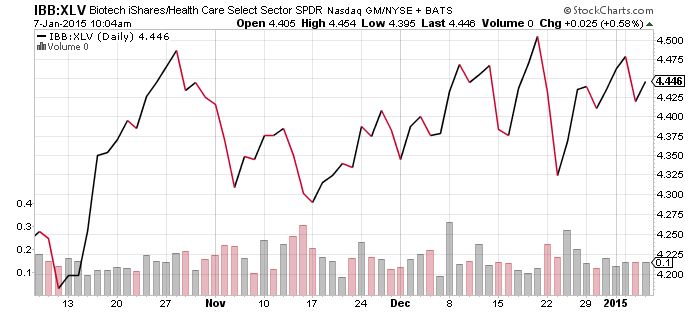

Among healthcare subsectors, biotechnology remains the best performing, along with medical devices. The new Republican Congress may try to repeal the medical device tax portion of the Affordable Care Act in the new session. At the other end are healthcare providers, who may face pressure in the first half of the year ahead of the Supreme Court decision on the federal subsidies portion of the Affordable Care Act.

Among financial subsectors, banks and regional banks are the worst performing, while insurance has been the best so far in 2015.

iShares Russell 2000 (IWM)

SPDR S&P Midcap 400 (MDY)

SPDR S&P 500 (SPY)

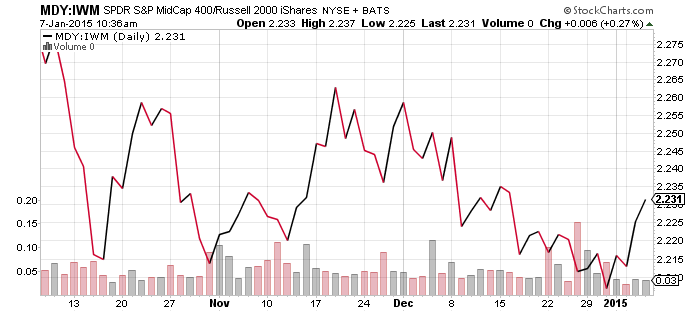

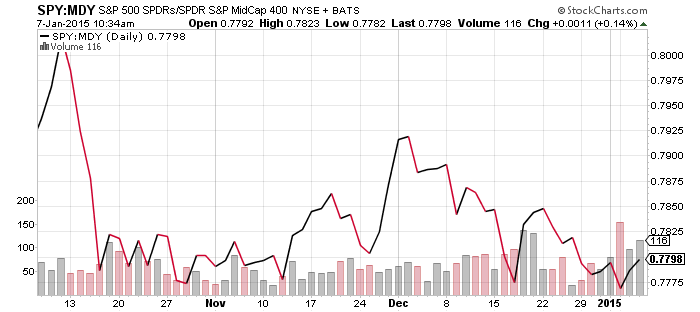

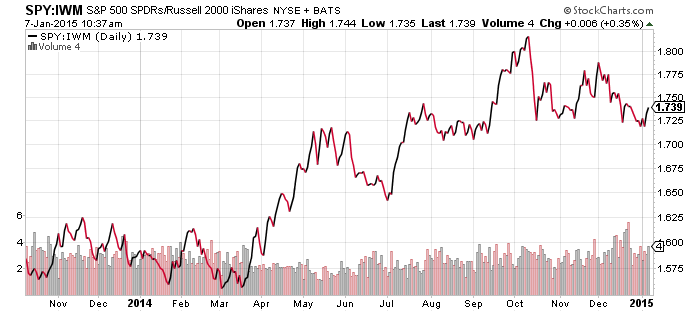

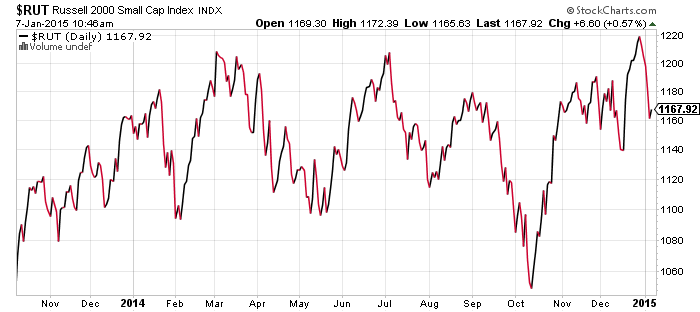

Due to market weakness in early 2015, large caps have outperformed mid caps and small caps. If the broader market continues to slide in the coming days or weeks, investors will be given the chance to pick up small caps at favorable prices. The key level to watch over the next week is the 1160 and potentially, the 1140 level. The 1160 level was a support level over the past two months, with 1140 serving as the low. Stocks would need to drop about 2.5 percent from here to break that low. If a break occurs, it may be possible to buy small caps at a 5 to 10 percent discount from current prices.